HELP!! Complete Problem 3-5 from page 152/153. Re-type the Adjusted Trial Balance for Excell Company using proper formatting and formulas. Follow the instructions in the problem to make adjustments and create a Classified Balance Sheet for Excell Company. You MUST use Cell referencing to create the balance sheet. Also you must use formulas and formatting. You make the decision if you want to put both on one worksheet or two different worksheets.

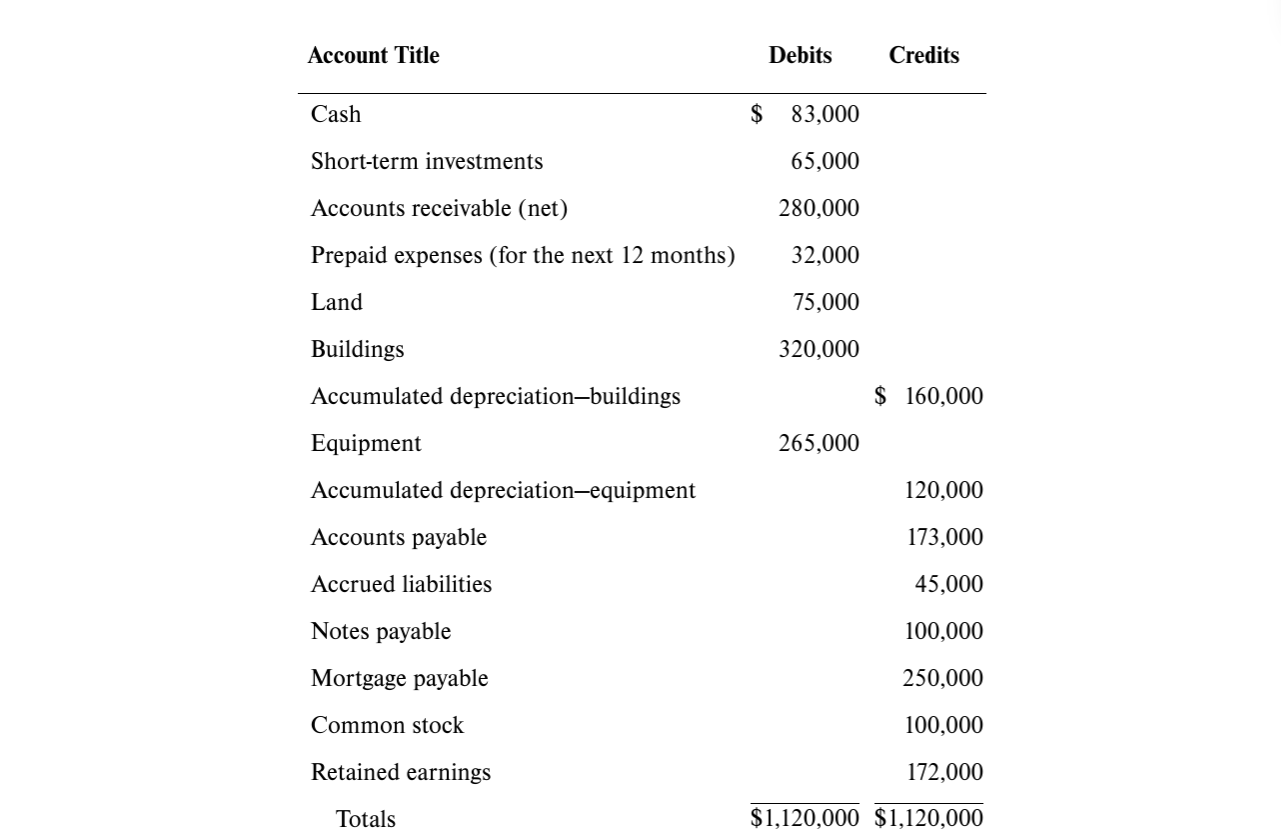

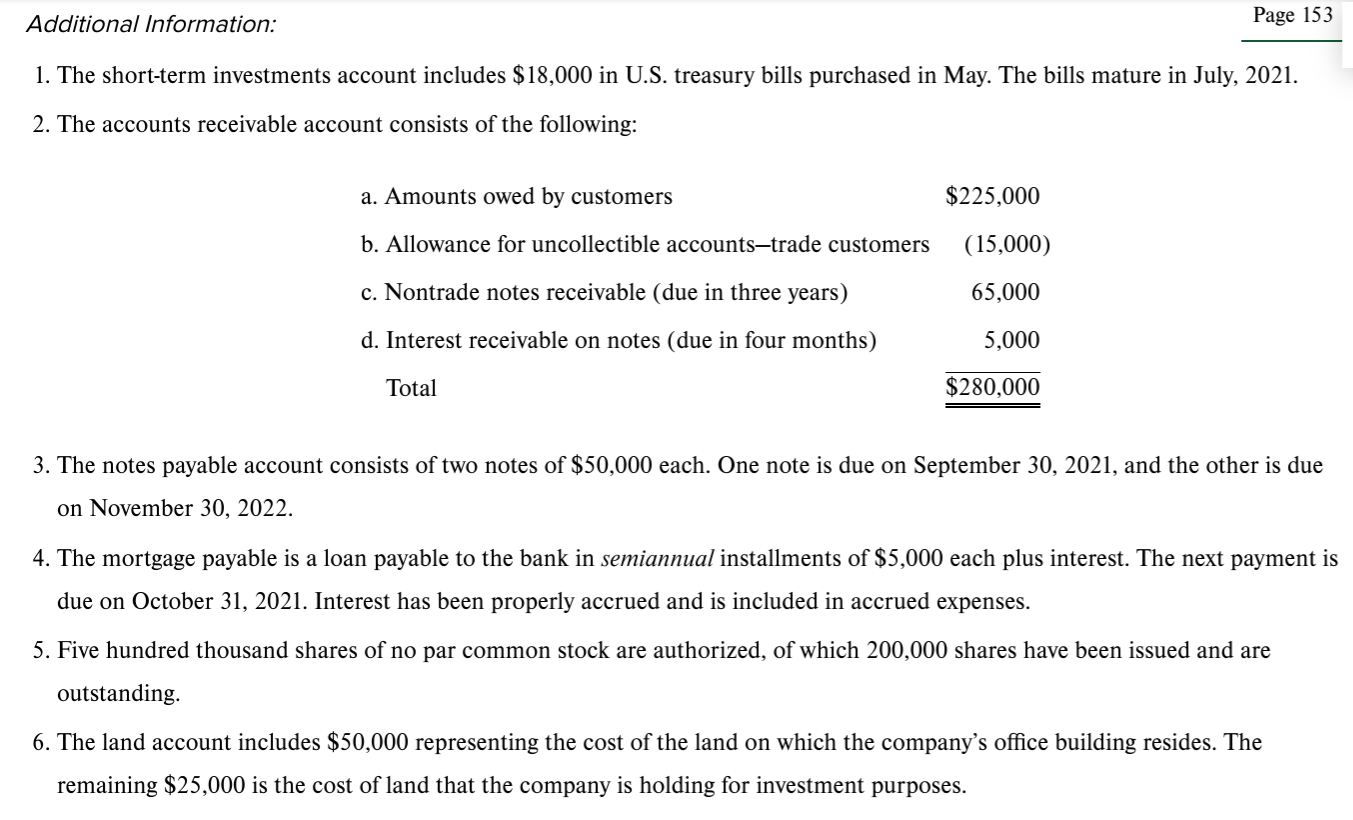

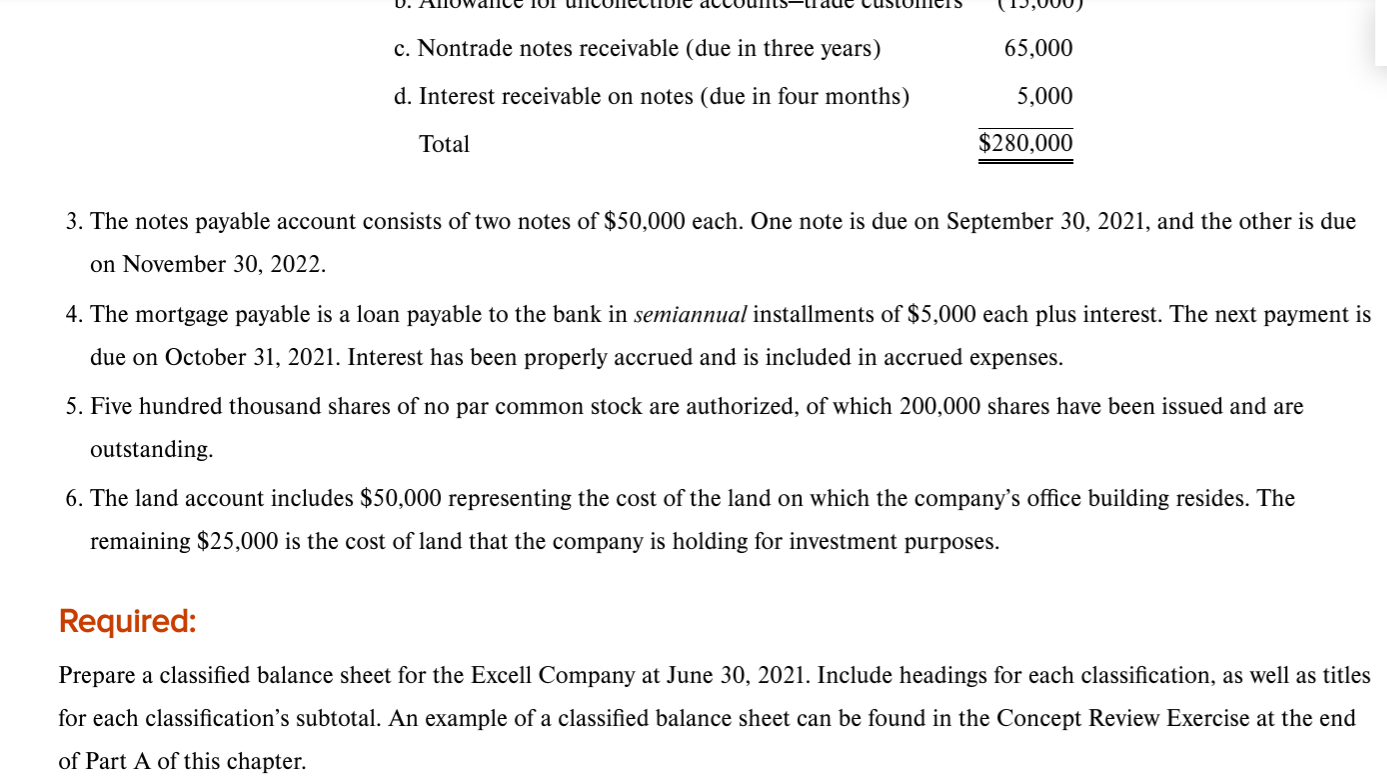

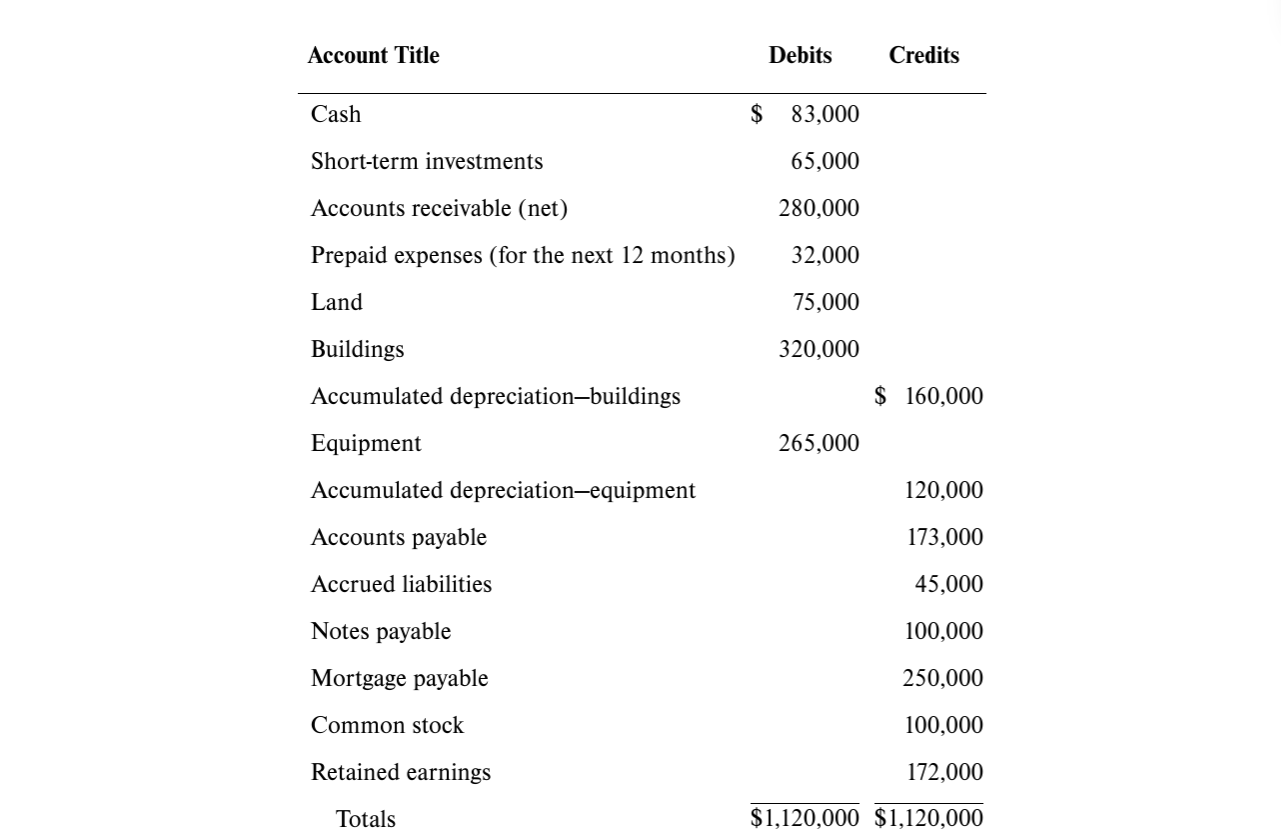

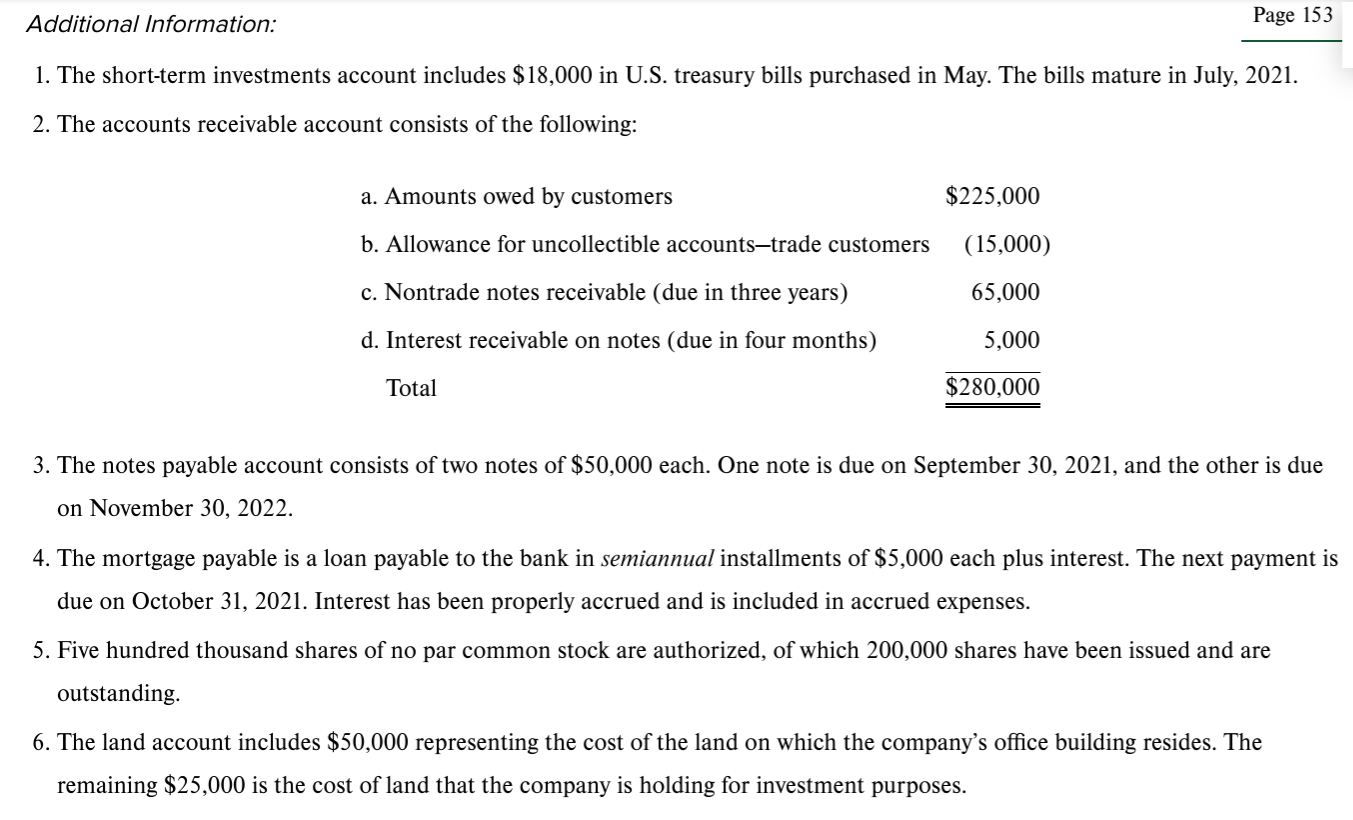

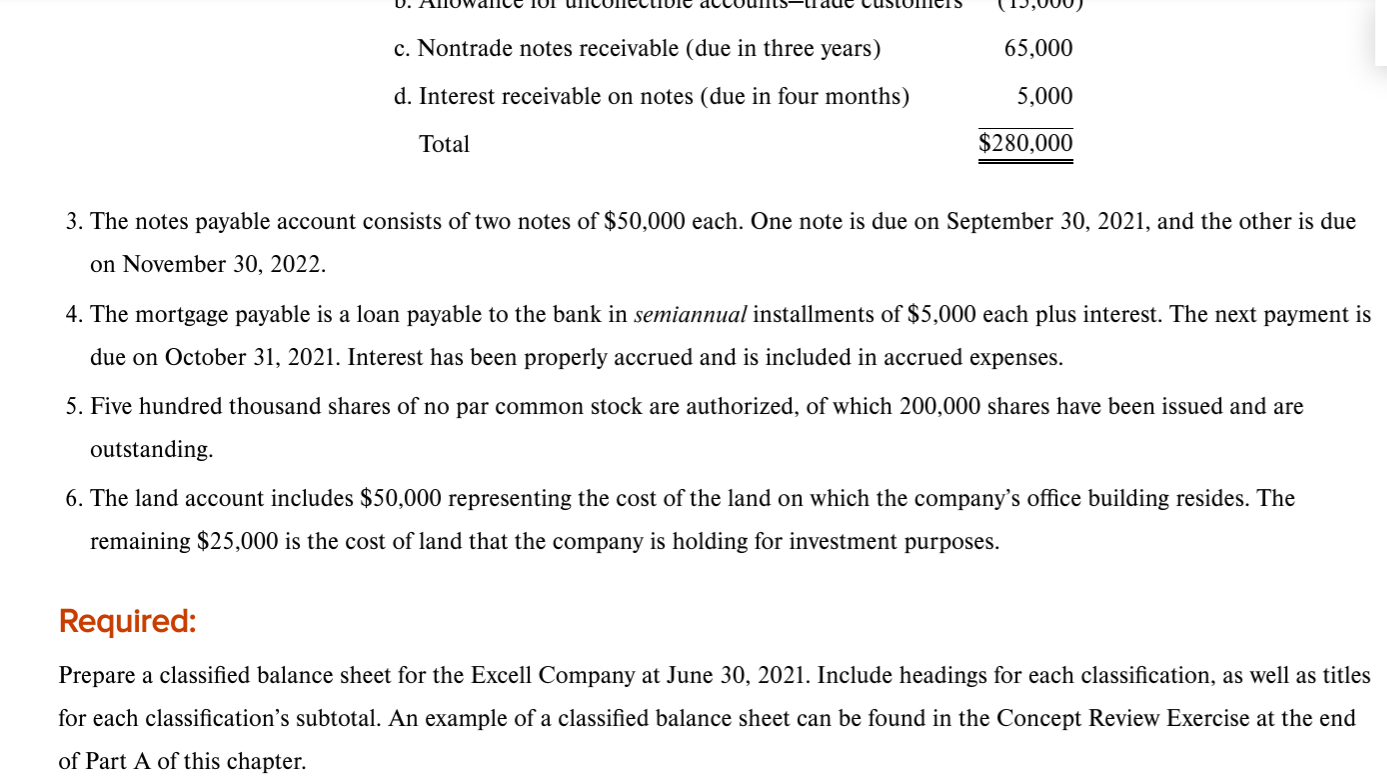

Account Title Debits Credits Cash $ 83,000 Short-term investments 65,000 280,000 Accounts receivable (net) Prepaid expenses (for the next 12 months) 32,000 Land 75,000 320,000 Buildings Accumulated depreciation-buildings $ 160,000 265,000 Equipment Accumulated depreciation-equipment Accounts payable 120,000 173,000 Accrued liabilities 45,000 Notes payable 100,000 Mortgage payable 250,000 Common stock 100,000 Retained earnings 172,000 Totals $1,120,000 $1,120,000 Additional Information: Page 153 1. The short-term investments account includes $18,000 in U.S. treasury bills purchased in May. The bills mature in July, 2021. 2. The accounts receivable account consists of the following: a. Amounts owed by customers $225,000 b. Allowance for uncollectible accounts-trade customers (15,000) 65,000 c. Nontrade notes receivable (due in three years) d. Interest receivable on notes (due in four months) 5,000 Total $280,000 3. The notes payable account consists of two notes of $50,000 each. One note is due on September 30, 2021, and the other is due on November 30, 2022. 4. The mortgage payable is a loan payable to the bank in semiannual installments of $5,000 each plus interest. The next payment is due on October 31, 2021. Interest has been properly accrued and is included in accrued expenses. 5. Five hundred thousand shares of no par common stock are authorized, of which 200,000 shares have been issued and are outstanding. 6. The land account includes $50,000 representing the cost of the land on which the company's office building resides. The remaining $25,000 is the cost of land that the company is holding for investment purposes. 65,000 c. Nontrade notes receivable (due in three years) d. Interest receivable on notes (due in four months) 5,000 Total $280,000 3. The notes payable account consists of two notes of $50,000 each. One note is due on September 30, 2021, and the other is due on November 30, 2022. 4. The mortgage payable is a loan payable to the bank in semiannual installments of $5,000 each plus interest. The next payment is due on October 31, 2021. Interest has been properly accrued and is included in accrued expenses. 5. Five hundred thousand shares of no par common stock are authorized, of which 200,000 shares have been issued and are outstanding. 6. The land account includes $50,000 representing the cost of the land on which the company's office building resides. The remaining $25,000 is the cost of land that the company is holding for investment purposes. Required: Prepare a classified balance sheet for the Excell Company at June 30, 2021. Include headings for each classification, as well as titles for each classification's subtotal. An example of a classified balance sheet can be found in the Concept Review Exercise at the end of Part A of this chapter