Answered step by step

Verified Expert Solution

Question

1 Approved Answer

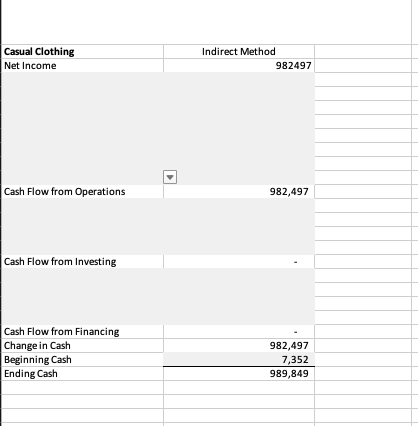

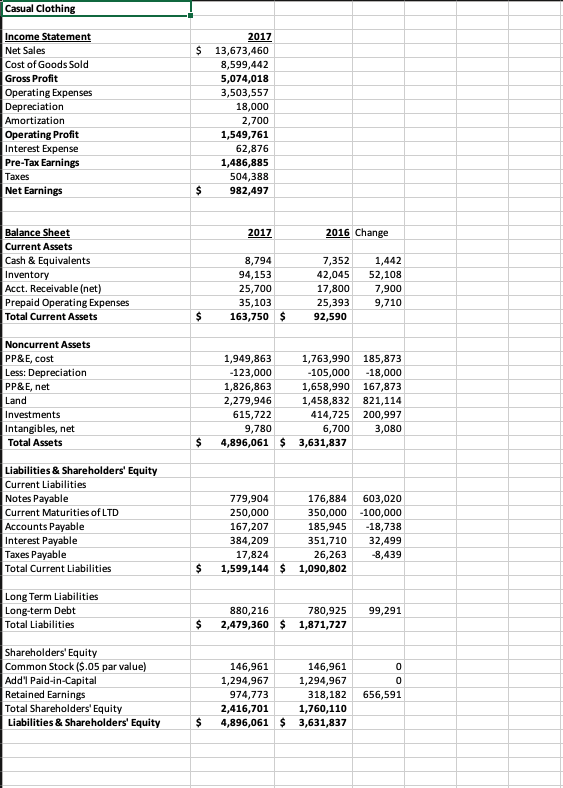

Help complete the following Indirect cash flow statement using the balance sheet and Income statement provided. fill in the gray squares on the indirect income

Help complete the following Indirect cash flow statement using the balance sheet and Income statement provided. fill in the gray squares on the indirect income statement

Casual Clothing Net Income Indirect Method 982497 Cash Flow from Operations 982,497 Cash Flow from Investing Cash Flow from Financing Change in Cash Beginning Cash Ending Cash 982,497 7,352 989,849 Casual Clothing $ Income Statement Net Sales Cost of Goods Sold Gross Profit Operating Expenses Depreciation Amortization Operating Profit Interest Expense Pre-Tax Earnings Taxes Net Earnings 2017 13,673,460 8,599,442 5,074,018 3,503,557 18,000 2,700 1,549,761 62,876 1,486,885 504,388 982,497 $ 2017 2016 Change Balance Sheet Current Assets Cash & Equivalents Inventory Acct. Receivable (net) Prepaid Operating Expenses Total Current Assets 8,794 94,153 25,700 35,103 163,750 $ 7,352 42,045 17,800 25,393 92,590 1,442 52,108 7,900 9,710 $ Noncurrent Assets PP&E, cost Less: Depreciation PP&E, net Land Investments Intangibles, net Total Assets 1,949,863 1,763,990 185,873 -123,000 -105,000 -18,000 1,826,863 1,658,990 167,873 2,279,946 1,458,832 821,114 615,722 414,725 200,997 9,780 6,700 3,080 4,896,061 $ 3,631,837 $ Liabilities & Shareholders' Equity Current Liabilities Notes Payable Current Maturities of LTD Accounts Payable Interest Payable Taxes Payable Total Current Liabilities Long Term Liabilities Long-term Debt Total Liabilities 779,904 176,884 603,020 250,000 350,000 -100,000 167,207 185,945 -18,738 384,209 351,710 32,499 17,824 26,263 -8,439 1,599,144 $ 1,090,802 $ 99,291 880,216 780,925 2,479,360 $ 1,871,727 $ Shareholders' Equity Common Stock ($.05 par value) Add'l Paid-in-Capital Retained Earnings Total Shareholders' Equity Liabilities & Shareholders' Equity 146,961 146,961 1,294,967 1,294,967 974,773 318,182 2,416,701 1,760,110 4,896,061 $ 3,631,837 0 0 656,591 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started