Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help d and e please Problem 1 On January 1, Year 1, G and L form a limited partnership to acquire and operate a rental

help d and e please

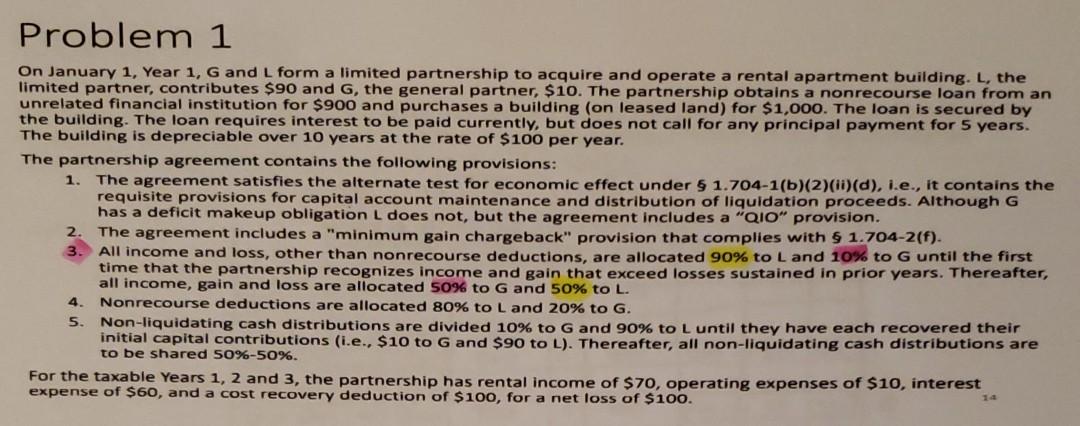

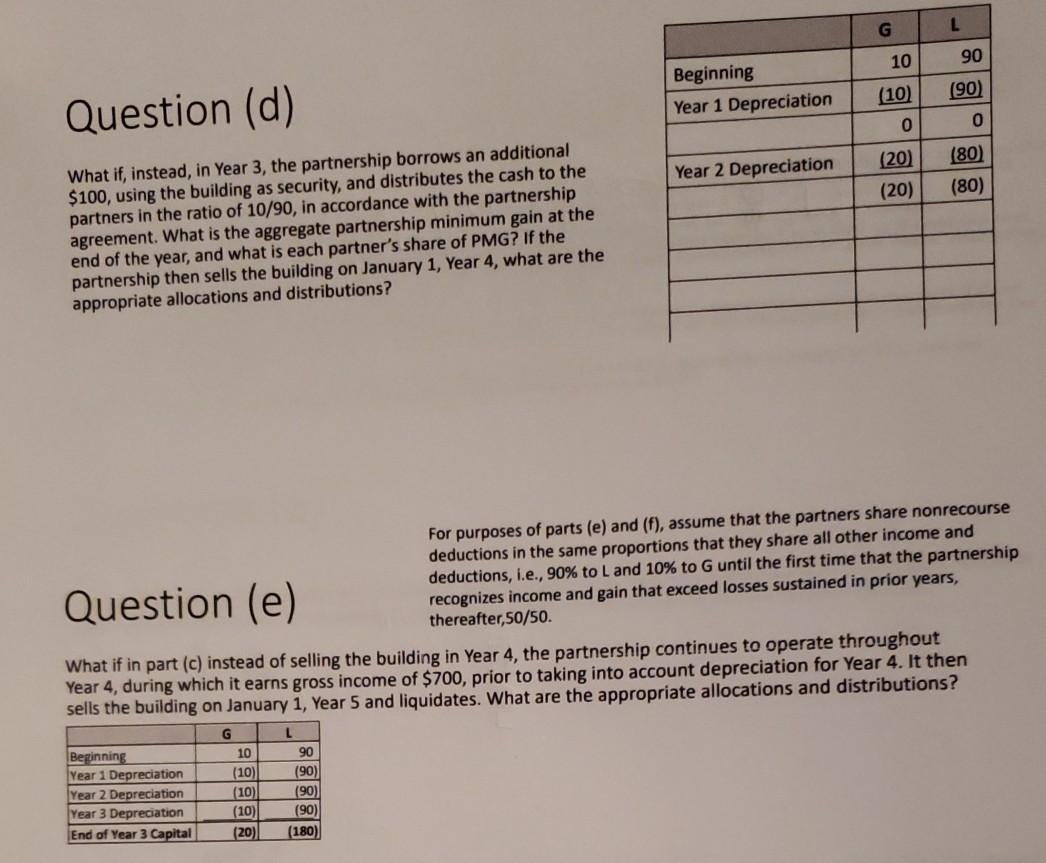

Problem 1 On January 1, Year 1, G and L form a limited partnership to acquire and operate a rental apartment building. L, the limited partner, contributes $90 and G, the general partner, $10. The partnership obtains a nonrecourse loan from an unrelated financial institution for $900 and purchases a building (on leased land) for $1,000. The loan is secured by the building. The loan requires interest to be paid currently, but does not call for any principal payment for 5 years. The building is depreciable over 10 years at the rate of $100 per year. The partnership agreement contains the following provisions: 1. The agreement satisfies the alternate test for economic effect under 5 1.704-1(b)(2)(1)(d), i.e., it contains the requisite provisions for capital account maintenance and distribution of liquidation proceeds. Although G has a deficit makeup obligation L does not, but the agreement includes a "QIO" provision. The agreement includes a "minimum gain chargeback" provision that complies with $ 1.704-2(f). 3. All income and loss, other than nonrecourse deductions, are allocated 90% to L and 10% to G until the first time that the partnership recognizes income and gain that exceed losses sustained in prior years. Thereafter, all income, gain and loss are allocated 5096 to G and 50% to L. 4. Nonrecourse deductions are allocated 80% to Land 20% to G. Non-liquidating cash distributions are divided 10% to G and 90% to L until they have each recovered their initial capital contributions (i.e., $10 to G and $90 to L). Thereafter, all non-liquidating cash distributions are to be shared 50%-50%. For the taxable Years 1, 2 and 3, the partnership has rental income of $70, operating expenses of $10, interest expense of $60, and a cost recovery deduction of $100, for a net loss of $100. 5. G L 10 90 Beginning Year 1 Depreciation (10) Question (d) (90) 0 0 Year 2 Depreciation (20) (20) (80) (80) What if, instead, in Year 3, the partnership borrows an additional $100, using the building as security, and distributes the cash to the partners in the ratio of 10/90, in accordance with the partnership agreement. What is the aggregate partnership minimum gain at the end of the year, and what is each partner's share of PMG? If the partnership then sells the building on January 1, Year 4, what are the appropriate allocations and distributions? Question (e) For purposes of parts (e) and (f), assume that the partners share nonrecourse deductions in the same proportions that they share all other income and deductions, i.e., 90% to L and 10% to G until the first time that the partnership recognizes income and gain that exceed losses sustained in prior years, thereafter,50/50. What if in part (c) instead of selling the building in Year 4, the partnership continues to operate throughout Year 4, during which it earns gross income of $700, prior to taking into account depreciation for Year 4. It then sells the building on January 1, Year 5 and liquidates. What are the appropriate allocations and distributions? Beginning Year 1 Depreciation Year 2 Depreciation Year 3 Depreciation End of Year 3 Capital 10 (10) (10) (10) (20) L 90 (90) (90) (90) (180)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started