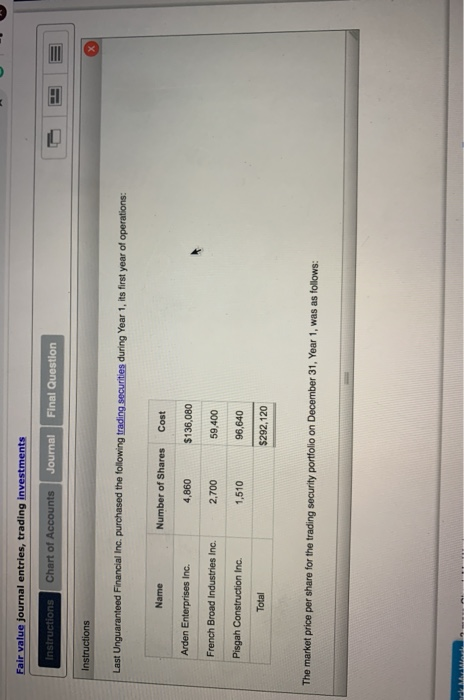

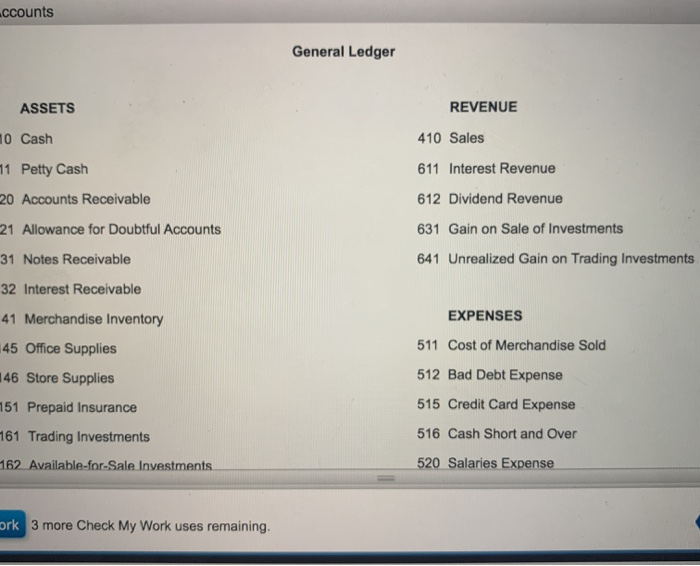

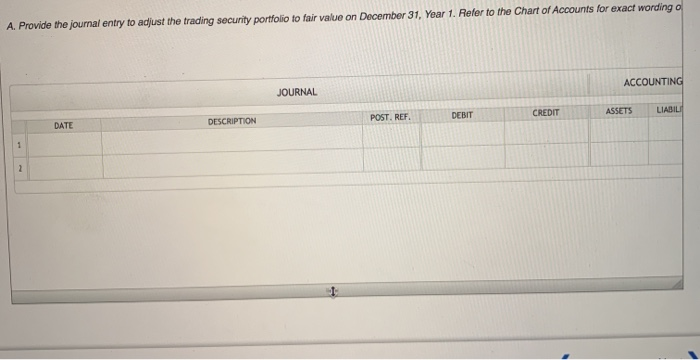

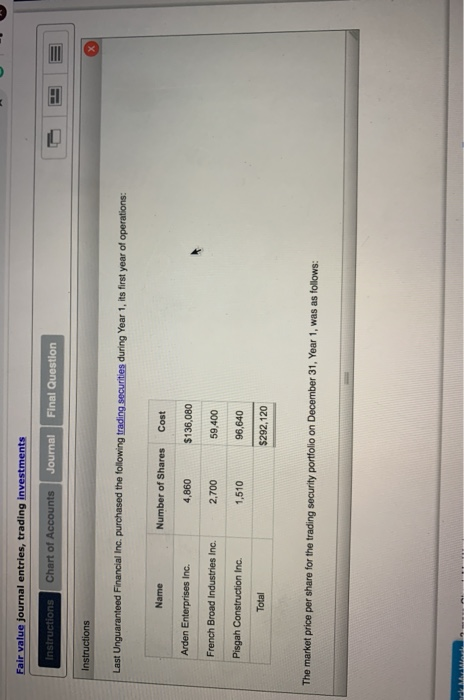

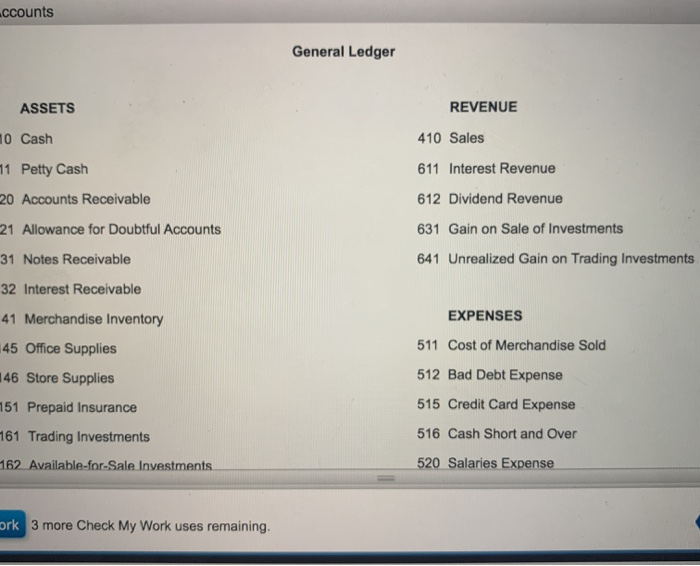

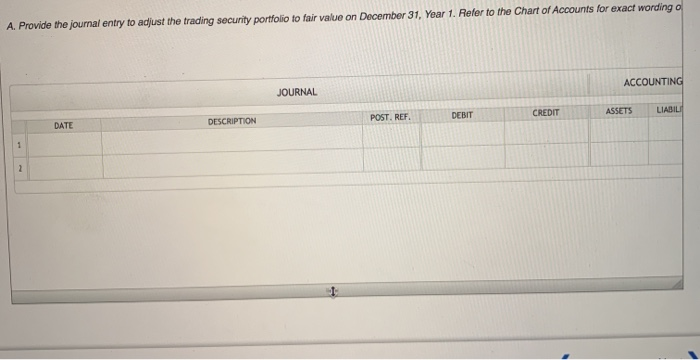

Fair value journal entries, trading investments Instructions Chart of Accounts Journal Final Question Instructions Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1, its first year of operations: Name Number of Shares Cost Arden Enterprises Inc. 4,860 $136,080 French Broad Industries Inc. 2,700 59,400 Pisgah Construction Inc. 1,510 96,640 Total $292,120 The market price per share for the trading security portfolio on December 31, Year 1, was as follows: SMALL TIT ccounts General Ledger REVENUE 410 Sales 611 Interest Revenue 612 Dividend Revenue 631 Gain on Sale of Investments 641 Unrealized Gain on Trading Investments ASSETS 10 Cash 71 Petty Cash 20 Accounts Receivable 21 Allowance for Doubtful Accounts 31 Notes Receivable 32 Interest Receivable 41 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 761 Trading Investments EXPENSES 511 Cost of Merchandise Sold 512 Bad Debt Expense 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 162 Available-for-Sale Investments ork 3 more Check My Work uses remaining. A. Provide the journal entry to adjust the trading security portfolio to fair value on December 31, Year 1. Refer to the Chart of Accounts for exact wording of JOURNAL ACCOUNTING DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILE Final Question B. Assume the market prices of the portfolio were the same on December 31, Year 2, as they were on December 31, Year 1. What would be the journal entry to adjust the portfolio to fair value? Dr Unrealized Gain on Trading Investments Cr.Valuation Allowance for Trading Investments Dr Valuation Allowance for Trading Investments Cr. Unrealized Gain on Trading Investments Dr Unrealized Loss on Trading Investments Cr.Valuation Allowance for Trading Investments No entry aang investments Instructions Chart of Accounts Journal Final Question Instructions Total $292,120 The market price per share for the trading security portfolio on December 31, Year 1, was as follows: Market Price per Share, Dec. 31, Year 1 Arden Enterprises Inc. $35 French Broad Industries Inc. Pisgah Construction Inc. Required: A. Provide the journal entry to adjust the trading security portfolio to fair value on December 31, Year 1. Refer the Chart of Accounts for exact wording of account titles. B. Assume the market prices of the portfolio were the same on December 31, Year 2, as they were on December 31, Year 1. What would be the journal entry to adjust the portfolio to fair value