Answered step by step

Verified Expert Solution

Question

1 Approved Answer

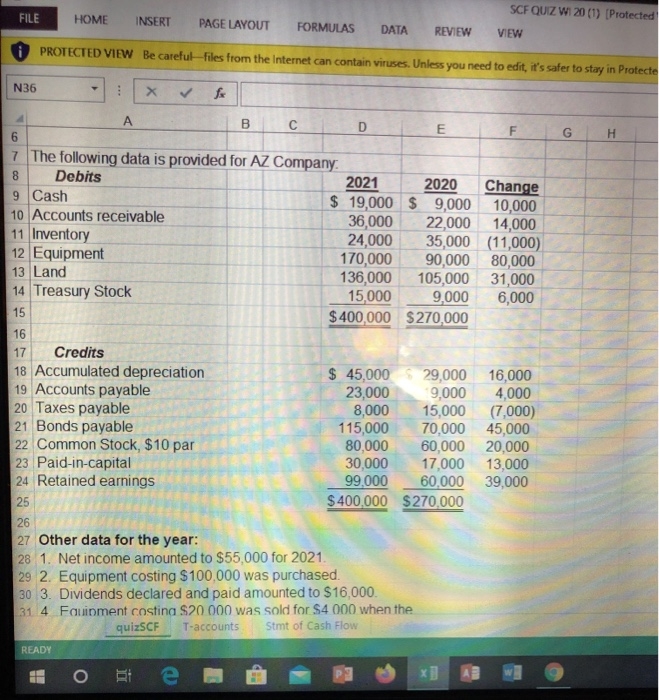

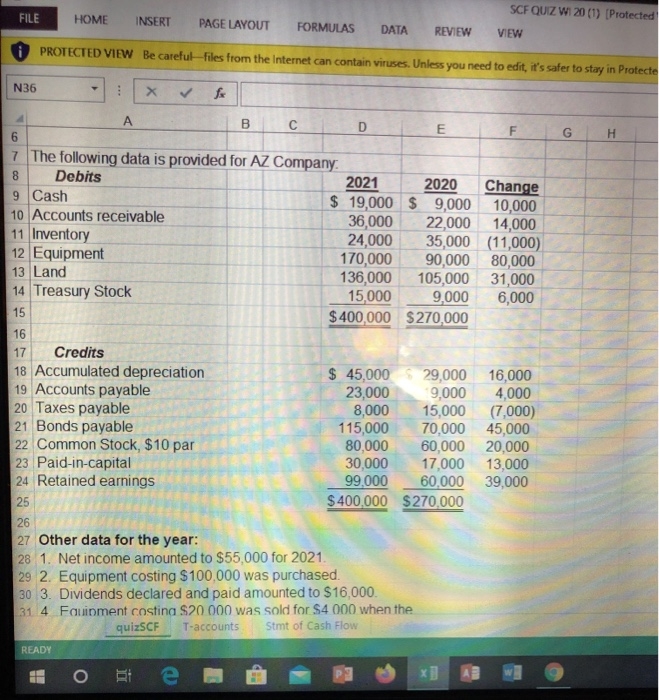

help,, FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW SCF QUIZ W 20 (1) [Protected VIEW PROTECTED VIEW Be careful-files from the Internet can contain

help,,

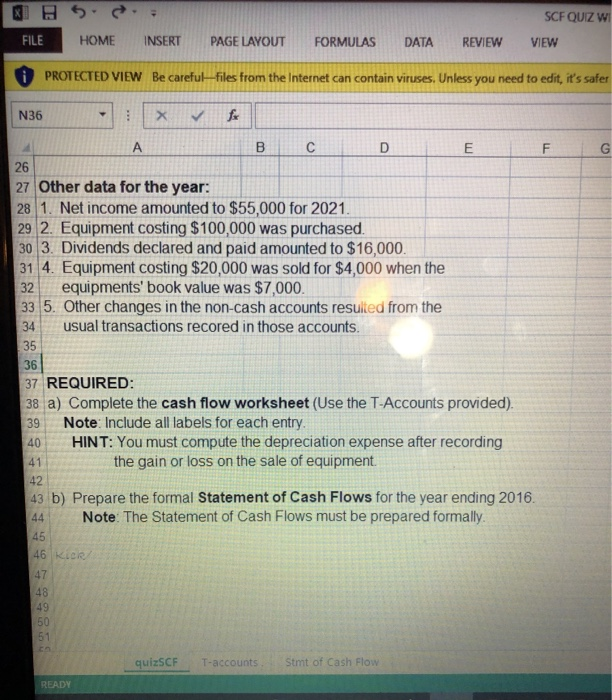

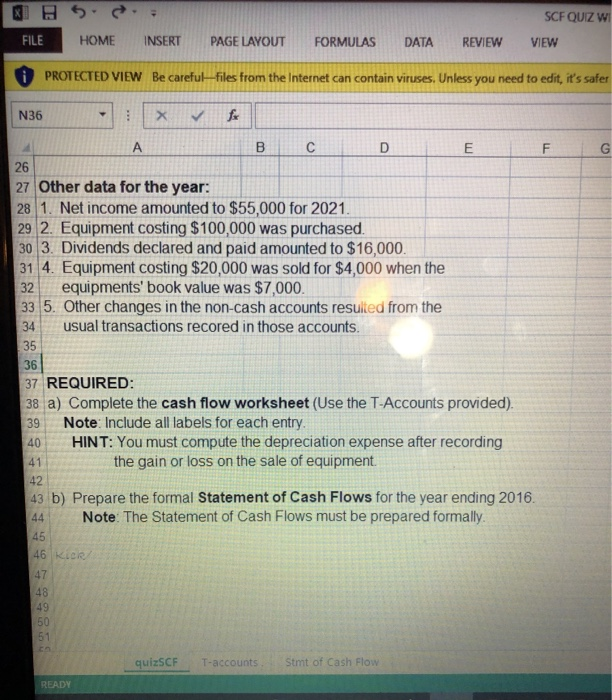

FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW SCF QUIZ W 20 (1) [Protected VIEW PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit it's safer to stay in Protecte N36 : * fa BC D 7 The following data is provided for AZ Company 8 Debits 2021 2020 9 Cash $ 19,000 $ 9,000 10 Accounts receivable 36,000 22,000 11 Inventory 24,000 35,000 12 Equipment 170,000 90,000 13 Land 136,000 105,000 14 Treasury Stock 15,000 9,000 $ 400,000 $270,000 Change 10,000 14,000 (11,000) 80,000 31,000 6,000 16,000 4,000 (7,000) 45,000 20,000 13,000 39,000 17 Credits 18 Accumulated depreciation $ 45,000 29,000 19 Accounts payable 23,000 9,000 20 Taxes payable 8,000 15,000 21 Bonds payable 115,000 70,000 22 Common Stock, $10 par 80,000 60,000 23 Paid-in-capital 30,000 17,000 24 Retained earnings 99,000 60,000 $400,000 $270,000 26 27 Other data for the year: 28 1. Net income amounted to $55,000 for 2021. 29 2. Equipment costing $100,000 was purchased. 30 3. Dividends declared and paid amounted to $16,000. 31 4 Fauipment costina $20.000 was sold for $4 000 when the quizSCF T-accounts Stmt of Cash Flow READY 25 5. HOME SCF QUIZ WI VIEW FILE INSERT PAGE LAYOUT FORMULAS DATA REVIEW N PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit, it's safer N36X for A B C D 27 Other data for the year: 28 1. Net income amounted to $55,000 for 2021. 29 2. Equipment costing $100,000 was purchased. 30 3. Dividends declared and paid amounted to $16,000. 31 4. Equipment costing $20,000 was sold for $4,000 when the 32 equipments' book value was $7,000. 33 5. Other changes in the non-cash accounts resulted from the usual transactions recored in those accounts. 34 35 37 REQUIRED: 38 a) Complete the cash flow worksheet (Use the T-Accounts provided). 39 Note: Include all labels for each entry. 40 HINT: You must compute the depreciation expense after recording 41 the gain or loss on the sale of equipment. 43 b) Prepare the formal Statement of Cash Flows for the year ending 2016. 44 Note: The Statement of Cash Flows must be prepared formally. 46 KCR quizSCF T-accounts Stmt of Cash Flow READY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started