Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help find the total purchases, interest, new balance due, minimum payment, available credit, due date. The following terms apply: The credit limit is $3,000. The

Help find the total purchases, interest, new balance due, minimum payment, available credit, due date.

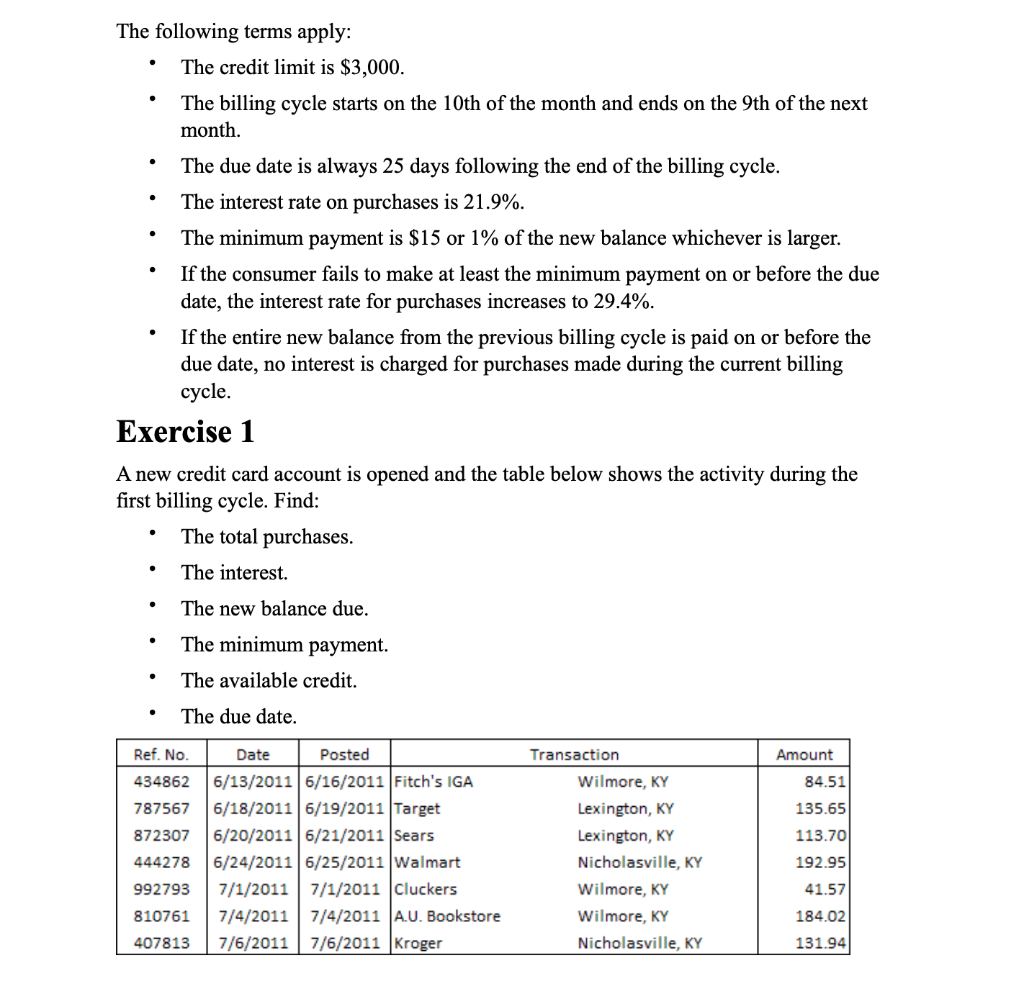

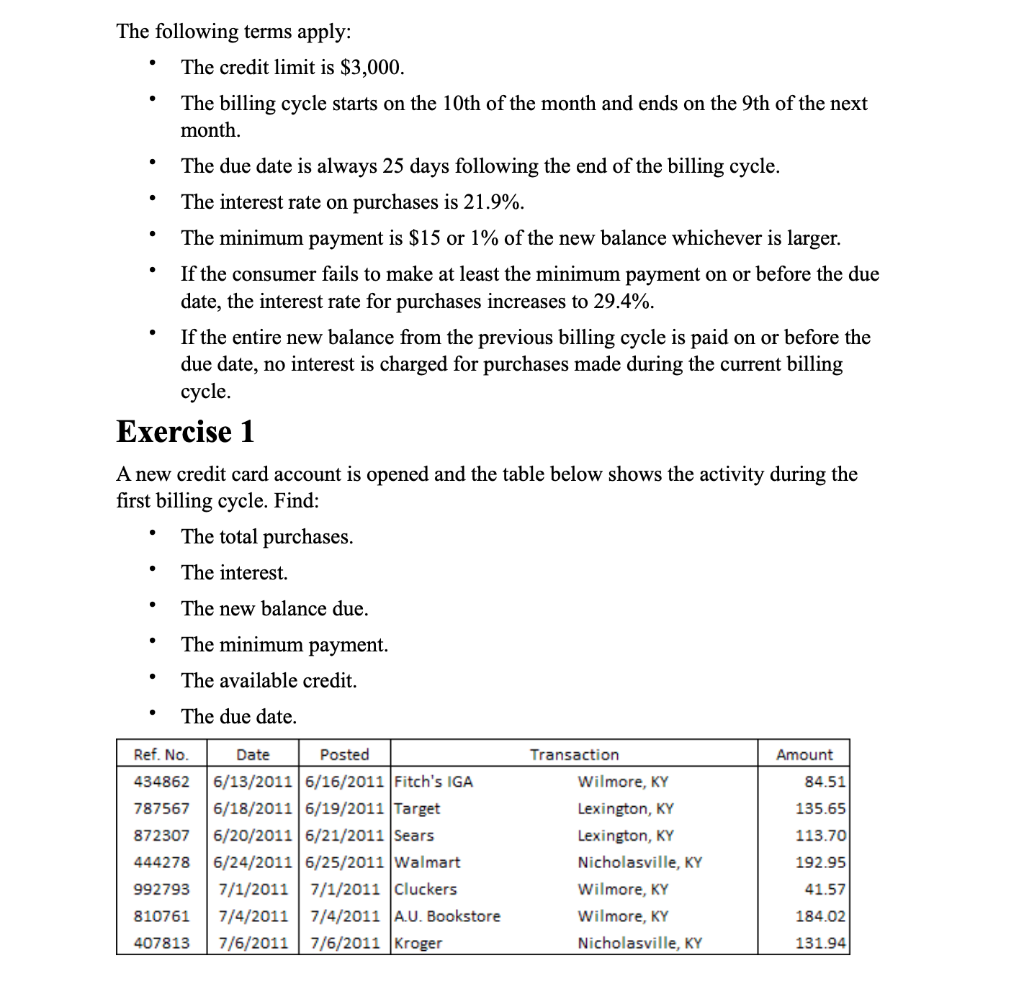

The following terms apply: The credit limit is $3,000. The billing cycle starts on the 10th of the month and ends on the 9th of the next month. The due date is always 25 days following the end of the billing cycle. The interest rate on purchases is 21.9%. The minimum payment is $15 or 1% of the new balance whichever is larger. If the consumer fails to make at least the minimum payment on or before the due date, the interest rate for purchases increases to 29.4%. If the entire new balance from the previous billing cycle is paid on or before the due date, no interest is charged for purchases made during the current billing cycle. Exercise 1 A new credit card account is opened and the table below shows the activity during the first billing cycle. Find: The total purchases. The interest. The new balance due. The minimum payment. The available credit. The due date. Ref. No. Amount 434862 84.51 135.65 787567 872307 Date Posted 6/13/2011 6/16/2011 Fitch's IGA 6/18/2011 6/19/2011 Target 6/20/2011 6/21/2011 Sears 6/24/2011 6/25/2011 Walmart 7/1/2011 7/1/2011 Cluckers 7/4/2011 7/4/2011 A.U. Bookstore 7/6/2011 7/6/2011 Kroger Transaction Wilmore, KY Lexington, KY Lexington, KY Nicholasville, KY Wilmore, KY Wilmore, KY Nicholasville, KY 113.70 192.95 41.57 444278 992793 810761 407813 184.02 131.94 The following terms apply: The credit limit is $3,000. The billing cycle starts on the 10th of the month and ends on the 9th of the next month. The due date is always 25 days following the end of the billing cycle. The interest rate on purchases is 21.9%. The minimum payment is $15 or 1% of the new balance whichever is larger. If the consumer fails to make at least the minimum payment on or before the due date, the interest rate for purchases increases to 29.4%. If the entire new balance from the previous billing cycle is paid on or before the due date, no interest is charged for purchases made during the current billing cycle. Exercise 1 A new credit card account is opened and the table below shows the activity during the first billing cycle. Find: The total purchases. The interest. The new balance due. The minimum payment. The available credit. The due date. Ref. No. Amount 434862 84.51 135.65 787567 872307 Date Posted 6/13/2011 6/16/2011 Fitch's IGA 6/18/2011 6/19/2011 Target 6/20/2011 6/21/2011 Sears 6/24/2011 6/25/2011 Walmart 7/1/2011 7/1/2011 Cluckers 7/4/2011 7/4/2011 A.U. Bookstore 7/6/2011 7/6/2011 Kroger Transaction Wilmore, KY Lexington, KY Lexington, KY Nicholasville, KY Wilmore, KY Wilmore, KY Nicholasville, KY 113.70 192.95 41.57 444278 992793 810761 407813 184.02 131.94 The following terms apply: The credit limit is $3,000. The billing cycle starts on the 10th of the month and ends on the 9th of the next month. The due date is always 25 days following the end of the billing cycle. The interest rate on purchases is 21.9%. The minimum payment is $15 or 1% of the new balance whichever is larger. If the consumer fails to make at least the minimum payment on or before the due date, the interest rate for purchases increases to 29.4%. If the entire new balance from the previous billing cycle is paid on or before the due date, no interest is charged for purchases made during the current billing cycle. Exercise 1 A new credit card account is opened and the table below shows the activity during the first billing cycle. Find: The total purchases. The interest. The new balance due. The minimum payment. The available credit. The due date. Ref. No. Amount 434862 84.51 135.65 787567 872307 Date Posted 6/13/2011 6/16/2011 Fitch's IGA 6/18/2011 6/19/2011 Target 6/20/2011 6/21/2011 Sears 6/24/2011 6/25/2011 Walmart 7/1/2011 7/1/2011 Cluckers 7/4/2011 7/4/2011 A.U. Bookstore 7/6/2011 7/6/2011 Kroger Transaction Wilmore, KY Lexington, KY Lexington, KY Nicholasville, KY Wilmore, KY Wilmore, KY Nicholasville, KY 113.70 192.95 41.57 444278 992793 810761 407813 184.02 131.94 The following terms apply: The credit limit is $3,000. The billing cycle starts on the 10th of the month and ends on the 9th of the next month. The due date is always 25 days following the end of the billing cycle. The interest rate on purchases is 21.9%. The minimum payment is $15 or 1% of the new balance whichever is larger. If the consumer fails to make at least the minimum payment on or before the due date, the interest rate for purchases increases to 29.4%. If the entire new balance from the previous billing cycle is paid on or before the due date, no interest is charged for purchases made during the current billing cycle. Exercise 1 A new credit card account is opened and the table below shows the activity during the first billing cycle. Find: The total purchases. The interest. The new balance due. The minimum payment. The available credit. The due date. Ref. No. Amount 434862 84.51 135.65 787567 872307 Date Posted 6/13/2011 6/16/2011 Fitch's IGA 6/18/2011 6/19/2011 Target 6/20/2011 6/21/2011 Sears 6/24/2011 6/25/2011 Walmart 7/1/2011 7/1/2011 Cluckers 7/4/2011 7/4/2011 A.U. Bookstore 7/6/2011 7/6/2011 Kroger Transaction Wilmore, KY Lexington, KY Lexington, KY Nicholasville, KY Wilmore, KY Wilmore, KY Nicholasville, KY 113.70 192.95 41.57 444278 992793 810761 407813 184.02 131.94Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started