Help format into excel, accounting

Help format into excel, accounting

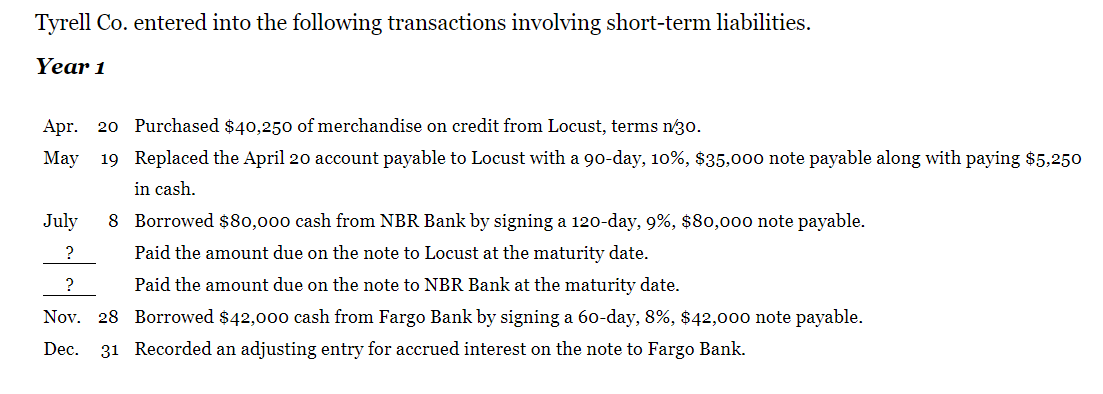

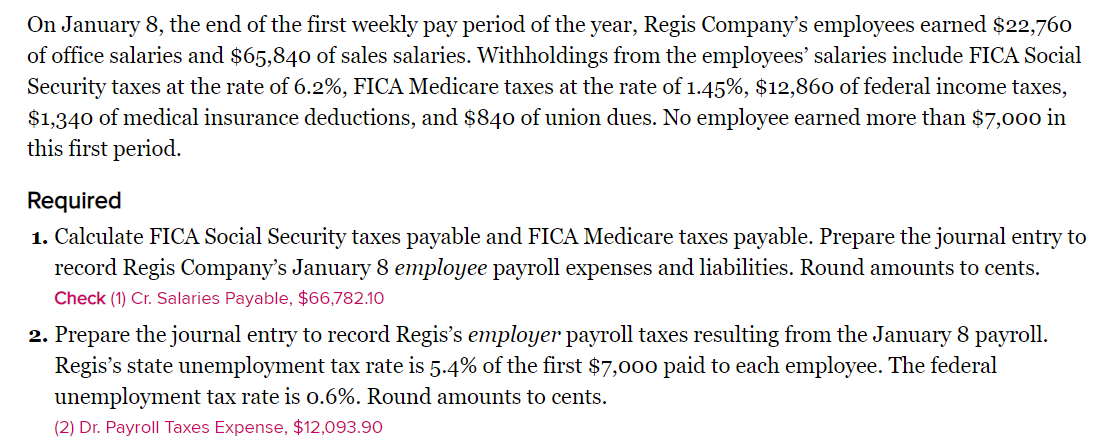

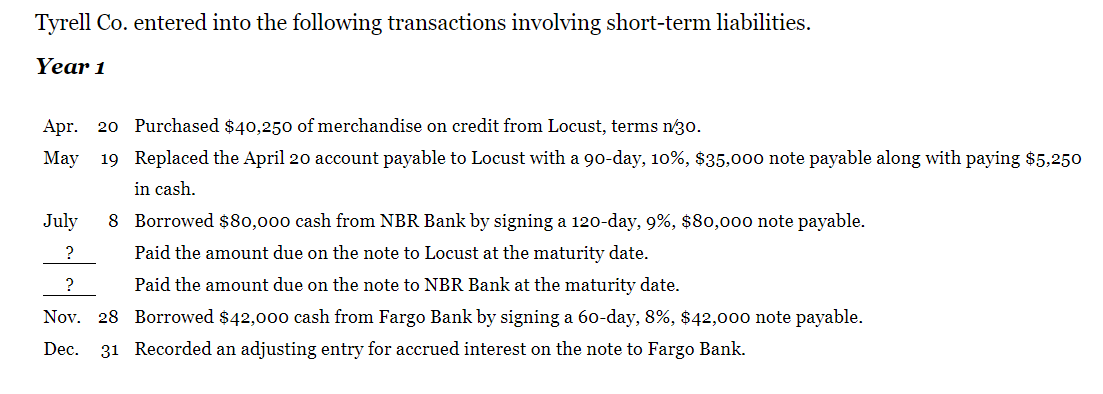

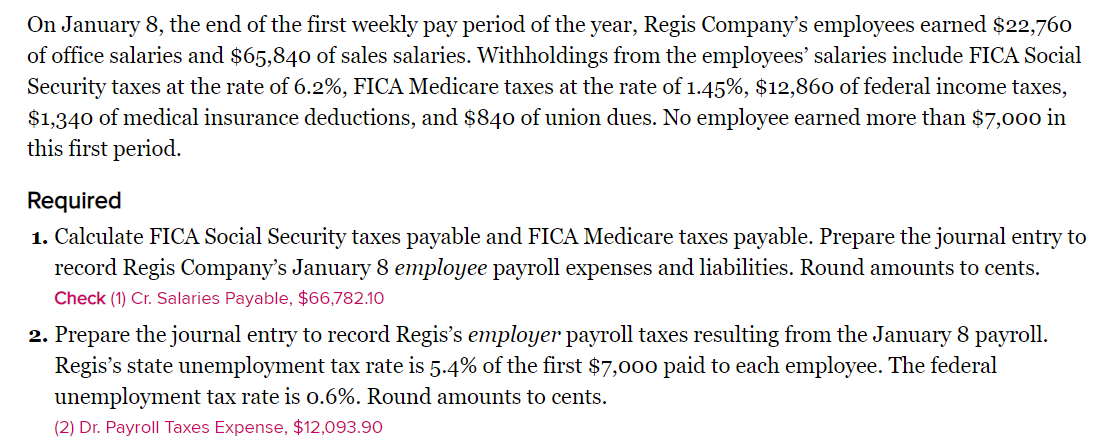

Tyrell Co. entered into the following transactions involving short-term liabilities. Year 1 Apr. 20 Purchased $40,250 of merchandise on credit from Locust, terms n30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 10%, $35,000 note payable along with paying $5,250 in cash. July 8 Borrowed $80,000 cash from NBR Bank by signing a 120-day, 9%, $80,000 note payable. ? Paid the amount due on the note to Locust at the maturity date. ? Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $42,000 cash from Fargo Bank by signing a 60-day, 8%, $42,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. On January 8, the end of the first weekly pay period of the year, Regis Company's employees earned $22,760 of office salaries and $65,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $12,860 of federal income taxes, $1,340 of medical insurance deductions, and $840 of union dues. No employee earned more than $7,000 in this first period. Required 1. Calculate FICA Social Security taxes payable and FICA Medicare taxes payable. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. Round amounts to cents. Check (1) Cr. Salaries Payable, $66,782.10 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. Round amounts to cents. (2) Dr. Payroll Taxes Expense, $12,093.90 Tyrell Co. entered into the following transactions involving short-term liabilities. Year 1 Apr. 20 Purchased $40,250 of merchandise on credit from Locust, terms n30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 10%, $35,000 note payable along with paying $5,250 in cash. July 8 Borrowed $80,000 cash from NBR Bank by signing a 120-day, 9%, $80,000 note payable. ? Paid the amount due on the note to Locust at the maturity date. ? Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $42,000 cash from Fargo Bank by signing a 60-day, 8%, $42,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. On January 8, the end of the first weekly pay period of the year, Regis Company's employees earned $22,760 of office salaries and $65,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $12,860 of federal income taxes, $1,340 of medical insurance deductions, and $840 of union dues. No employee earned more than $7,000 in this first period. Required 1. Calculate FICA Social Security taxes payable and FICA Medicare taxes payable. Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. Round amounts to cents. Check (1) Cr. Salaries Payable, $66,782.10 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. Round amounts to cents. (2) Dr. Payroll Taxes Expense, $12,093.90

Help format into excel, accounting

Help format into excel, accounting