Answered step by step

Verified Expert Solution

Question

1 Approved Answer

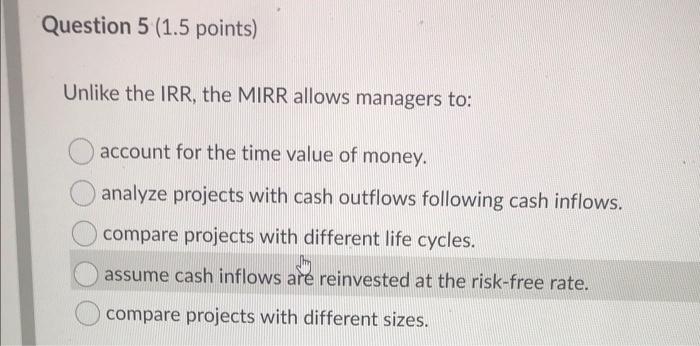

help help please help ASAP HELP Question 5 (1.5 points) Unlike the IRR, the MIRR allows managers to: account for the time value of money.

help help please help ASAP HELP

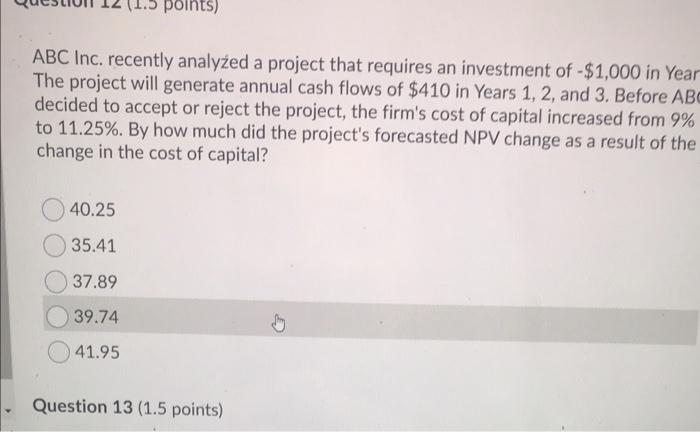

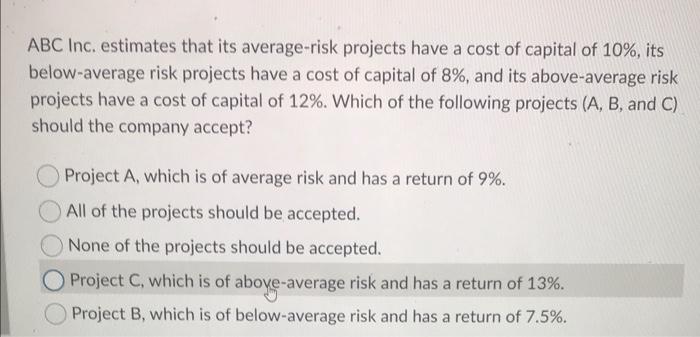

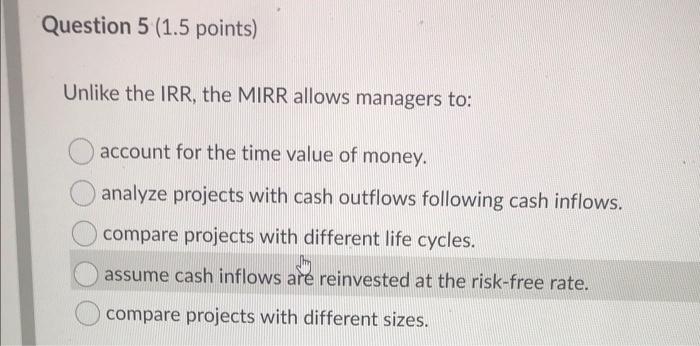

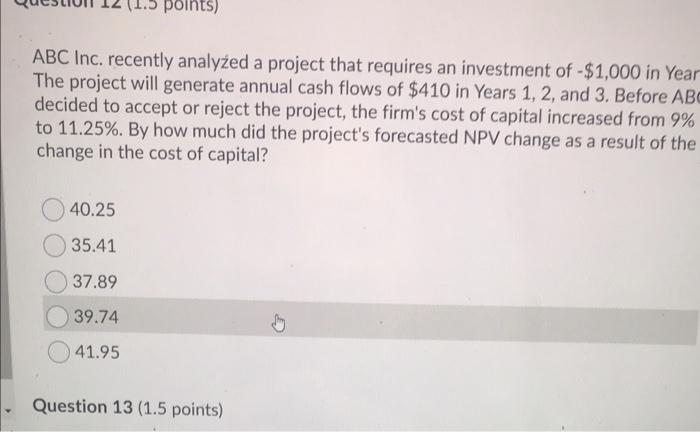

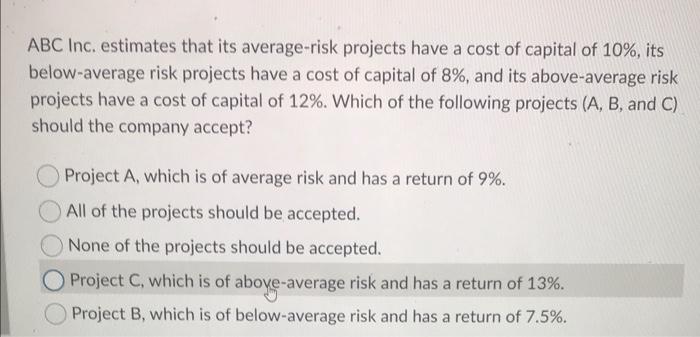

Question 5 (1.5 points) Unlike the IRR, the MIRR allows managers to: account for the time value of money. analyze projects with cash outflows following cash inflows. compare projects with different life cycles. assume cash inflows are reinvested at the risk-free rate. compare projects with different sizes. points) ABC Inc. recently analyzed a project that requires an investment of - $1,000 in Year The project will generate annual cash flows of $410 in Years 1, 2, and 3. Before ABC decided to accept or reject the project, the firm's cost of capital increased from 9% to 11.25%. By how much did the project's forecasted NPV change as a result of the change in the cost of capital? 40.25 35.41 37.89 39.74 By 41.95 Question 13(1.5 points) ABC Inc. estimates that its average-risk projects have a cost of capital of 10%, its below-average risk projects have a cost of capital of 8%, and its above-average risk projects have a cost of capital of 12%. Which of the following projects (A, B, and C) should the company accept? Project A, which is of average risk and has a return of 9%. All of the projects should be accepted. None of the projects should be accepted. O Project C, which is of aboye-average risk and has a return of 13%. Project B, which is of below-average risk and has a return of 7.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started