Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help help please You work for Bluth Company, a constant growth firm which recently paid a dividend of $2.55. Bluth just announced it is investing

help help please

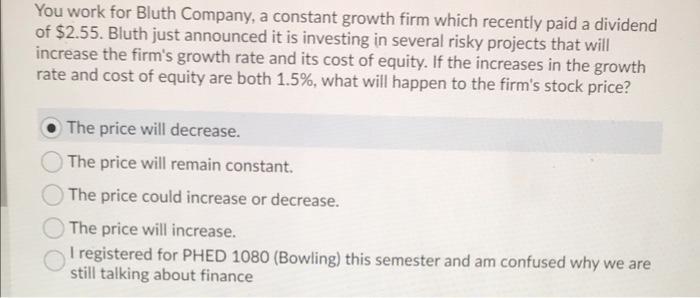

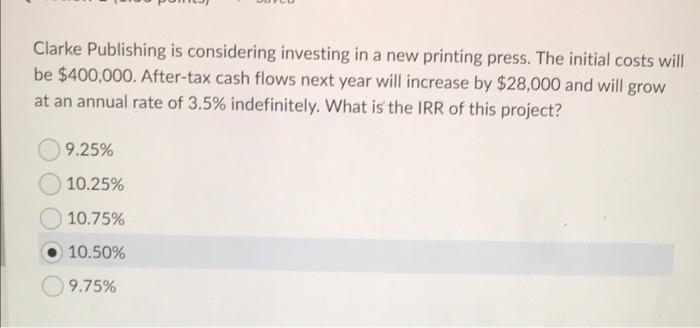

You work for Bluth Company, a constant growth firm which recently paid a dividend of $2.55. Bluth just announced it is investing in several risky projects that will increase the firm's growth rate and its cost of equity. If the increases in the growth rate and cost of equity are both 1.5%, what will happen to the firm's stock price? The price will decrease. The price will remain constant. The price could increase or decrease. The price will increase. I registered for PHED 1080 (Bowling) this semester and am confused why we are still talking about finance Clarke Publishing is considering investing in a new printing press. The initial costs will be $400,000. After-tax cash flows next year will increase by $28,000 and will grow at an annual rate of 3.5% indefinitely. What is the IRR of this project? 9.25% 10.25% 10.75% 10.50% 9.75%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started