Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP I finished the first part of this question but I'm confused about how to get these answers for 3 and 4 in Excel .

HELP I finished the first part of this question but I'm confused about how to get these answers for 3 and 4 in Excel.

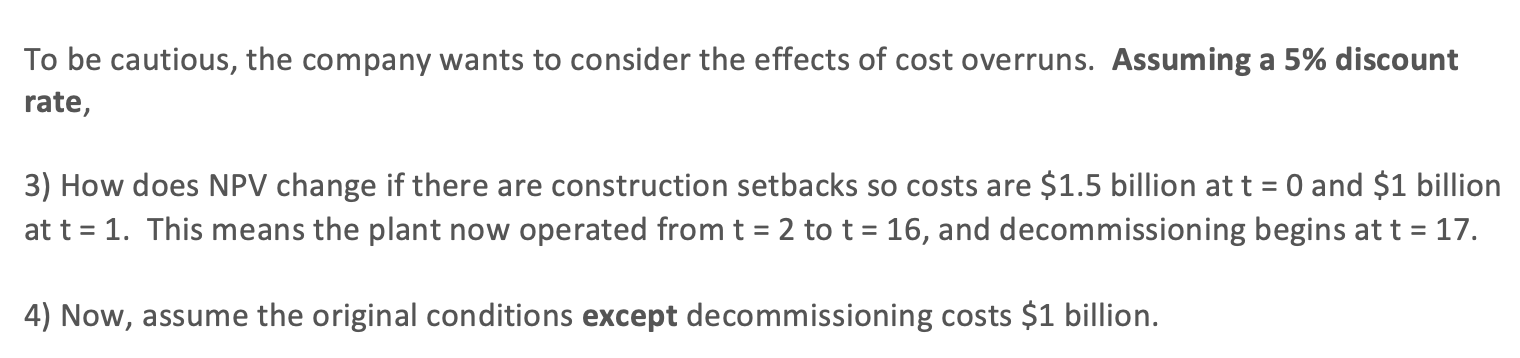

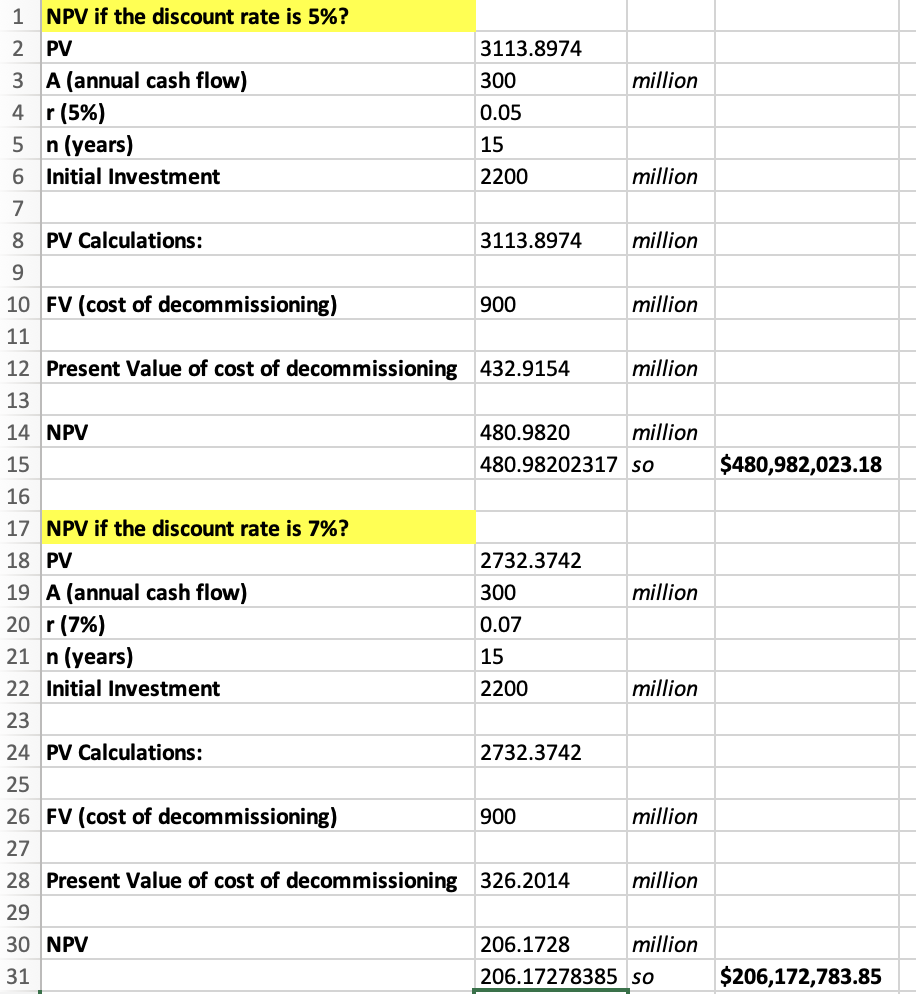

To be cautious, the company wants to consider the effects of cost overruns. Assuming a 5% discount rate, 3) How does NPV change if there are construction setbacks so costs are $1.5 billion at t=0 and $1 billion at t=1. This means the plant now operated from t=2 to t=16, and decommissioning begins at t=17. 4) Now, assume the original conditions except decommissioning costs $1 billion. \begin{tabular}{|c|c|c|c|c|} \hline 1 & NPV if the discount rate is 5% ? & & & \\ \hline 2 & PV & 3113.8974 & & \\ \hline 3 & A (annual cash flow) & 300 & million & \\ \hline 4 & r (5\%) & 0.05 & & \\ \hline 5 & n (years) & 15 & & \\ \hline 6 & Initial Investment & 2200 & million & \\ \hline 7 & & & & \\ \hline 8 & PV Calculations: & 3113.8974 & million & \\ \hline 9 & & & & \\ \hline 10 & FV (cost of decommissioning) & 900 & million & \\ \hline 11 & & & & \\ \hline 12 & Present Value of cost of decommissioning & 432.9154 & million & \\ \hline 13 & & & & \\ \hline 14 & NPV & 480.9820 & million & \\ \hline 15 & & 480.98202317 & so & $480,982,023.18 \\ \hline 16 & & & & \\ \hline 17 & NPV if the discount rate is 7% ? & & & \\ \hline 18 & PV & 2732.3742 & & \\ \hline 19 & A (annual cash flow) & 300 & million & \\ \hline 20 & r (7\%) & 0.07 & & \\ \hline 21 & n (years) & 15 & & \\ \hline 22 & Initial Investment & 2200 & million & \\ \hline 23 & & & & \\ \hline 24 & PV Calculations: & 2732.3742 & & \\ \hline 25 & & & & \\ \hline 26 & FV (cost of decommissioning) & 900 & million & \\ \hline 27 & & & & \\ \hline 28 & Present Value of cost of decommissioning & 326.2014 & million & \\ \hline 29 & & & & \\ \hline 30 & NPV & 206.1728 & million & \\ \hline 31 & & 206.17278385 & so & $206,172,783.85 \\ \hline \end{tabular}

To be cautious, the company wants to consider the effects of cost overruns. Assuming a 5% discount rate, 3) How does NPV change if there are construction setbacks so costs are $1.5 billion at t=0 and $1 billion at t=1. This means the plant now operated from t=2 to t=16, and decommissioning begins at t=17. 4) Now, assume the original conditions except decommissioning costs $1 billion. \begin{tabular}{|c|c|c|c|c|} \hline 1 & NPV if the discount rate is 5% ? & & & \\ \hline 2 & PV & 3113.8974 & & \\ \hline 3 & A (annual cash flow) & 300 & million & \\ \hline 4 & r (5\%) & 0.05 & & \\ \hline 5 & n (years) & 15 & & \\ \hline 6 & Initial Investment & 2200 & million & \\ \hline 7 & & & & \\ \hline 8 & PV Calculations: & 3113.8974 & million & \\ \hline 9 & & & & \\ \hline 10 & FV (cost of decommissioning) & 900 & million & \\ \hline 11 & & & & \\ \hline 12 & Present Value of cost of decommissioning & 432.9154 & million & \\ \hline 13 & & & & \\ \hline 14 & NPV & 480.9820 & million & \\ \hline 15 & & 480.98202317 & so & $480,982,023.18 \\ \hline 16 & & & & \\ \hline 17 & NPV if the discount rate is 7% ? & & & \\ \hline 18 & PV & 2732.3742 & & \\ \hline 19 & A (annual cash flow) & 300 & million & \\ \hline 20 & r (7\%) & 0.07 & & \\ \hline 21 & n (years) & 15 & & \\ \hline 22 & Initial Investment & 2200 & million & \\ \hline 23 & & & & \\ \hline 24 & PV Calculations: & 2732.3742 & & \\ \hline 25 & & & & \\ \hline 26 & FV (cost of decommissioning) & 900 & million & \\ \hline 27 & & & & \\ \hline 28 & Present Value of cost of decommissioning & 326.2014 & million & \\ \hline 29 & & & & \\ \hline 30 & NPV & 206.1728 & million & \\ \hline 31 & & 206.17278385 & so & $206,172,783.85 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started