HELP! It keeps saying that my question is INCOMPLETE... what is missing?

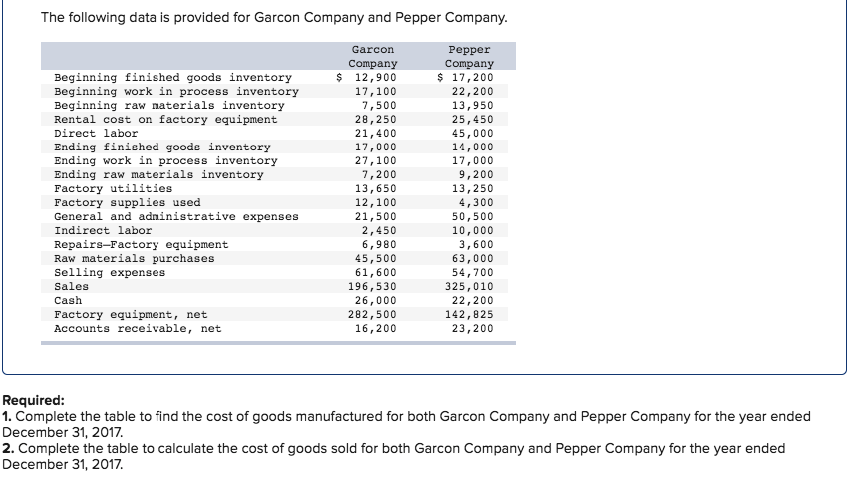

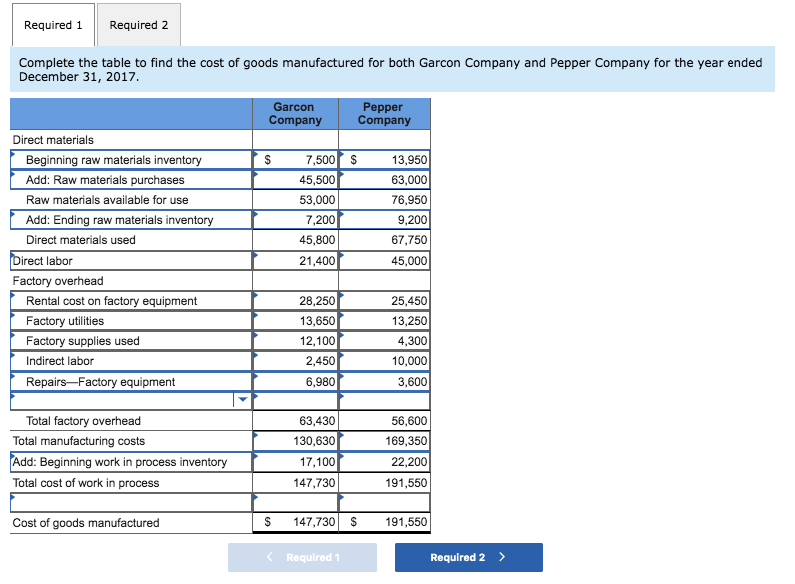

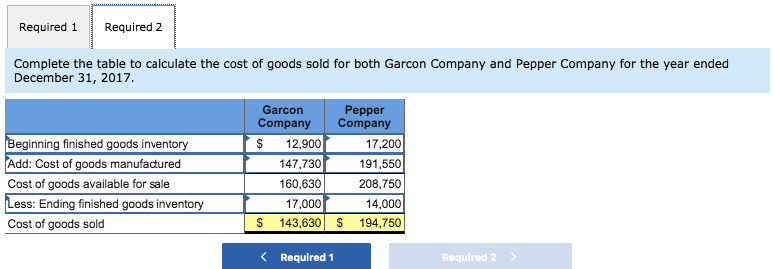

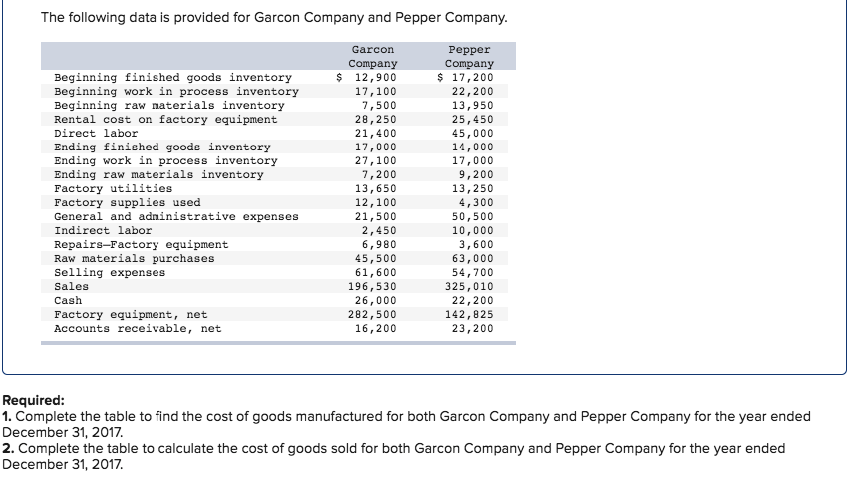

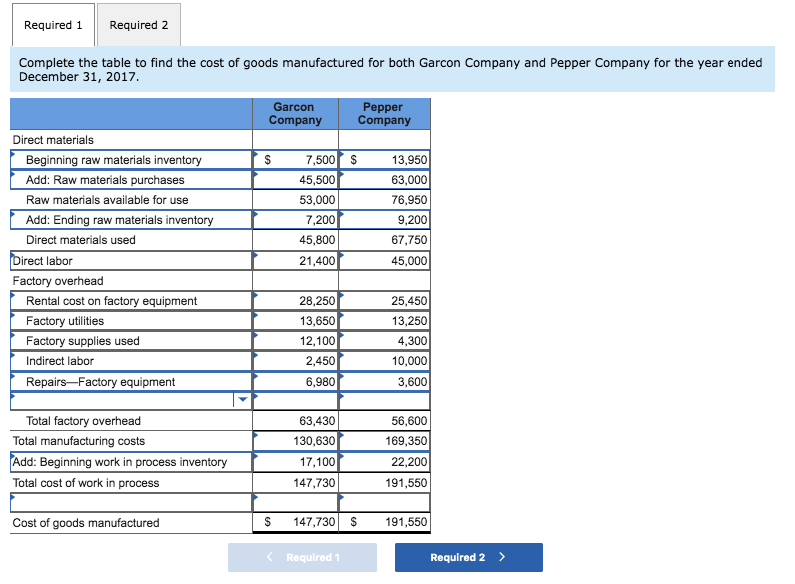

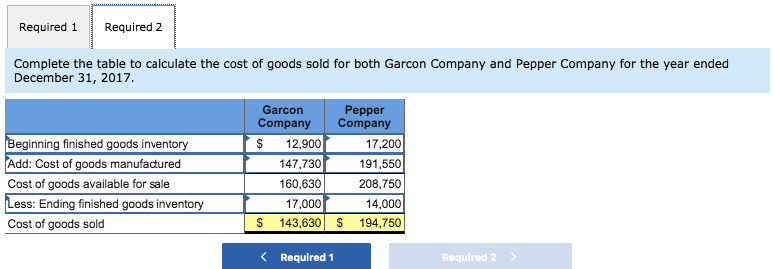

The following data is provided for Garcon Company and Pepper Company. Beginning finished goods inventory Beginning work in process inventory Beginning raw naterials inventory Rental cost on factory equipment Direct labor Ending finished goode inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used General and adninistrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 12,900 17,100 7,500 28, 250 21,400 17,000 27,100 7,200 13,650 12,100 21,500 2,450 6,980 45,500 61,600 196,530 26,000 282,500 16, 200 Pepper Company $ 17,200 22,200 13,950 25,450 45,000 14,000 17,000 9, 200 13,250 4,300 50,500 10,000 3,600 63,000 54,700 325,010 22,200 142,825 23,200 Required: 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2017 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2017 Required 1 Required 2 Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2017. Garcon Company Pepper Company $ Direct materials Beginning raw materials inventory Add: Raw materials purchases Raw materials available for use Add: Ending raw materials inventory Direct materials used Direct labor Factory overhead Rental cost on factory equipment Factory utilities Factory supplies used Indirect labor Repairs-Factory equipment 7,500 $ 45,500 53,000 7,200 45,800 21,400 13,950 63,000 76,950 9,200 67,750 45,000 28,250 13,650 12,100 2,450 6,980 25,450 13,250 4,300 10,000 3,600 Total factory overhead Total manufacturing costs Add: Beginning work in process inventory Total cost of work in process 63,430 130,630 17,100 147,730 56,600 169,350 22,200 191,550 Cost of goods manufactured $ 147,730 $ 191,550 Required 1 Required 2 > Required 1 Required 2 Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2017. Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold Garcon Company $ 12,900 147,730 160,630 17,000 $ 143,630 Pepper Company 17,200 191,550 208,750 14,000 $ 194,750