Answered step by step

Verified Expert Solution

Question

1 Approved Answer

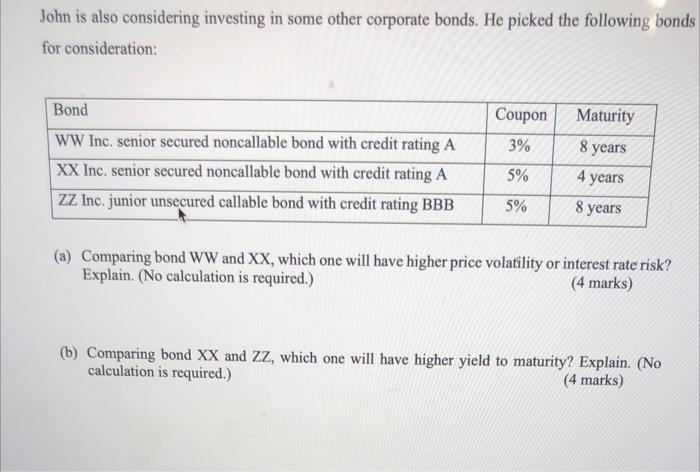

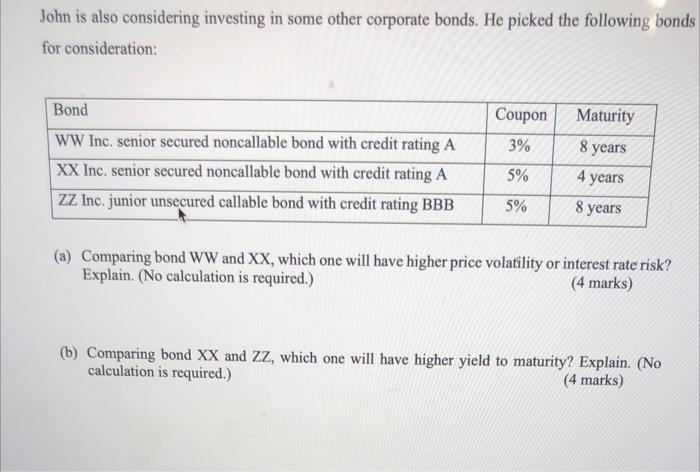

help John is also considering investing in some other corporate bonds. He picked the following bonds for consideration: Bond Coupon Maturity 3% 8 years WW

help

John is also considering investing in some other corporate bonds. He picked the following bonds for consideration: Bond Coupon Maturity 3% 8 years WW Inc. senior secured noncallable bond with credit rating A XX Inc, senior secured noncallable bond with credit rating A ZZ Inc. junior unsecured callable bond with credit rating BBB 5% 4 years 5% 8 years (a) Comparing bond WW and XX, which one will have higher price volatility or interest rate risk? Explain. (No calculation is required.) (4 marks) (b) Comparing bond XX and ZZ, which one will have higher yield to maturity? Explain. (No calculation is required.) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started