Help me...

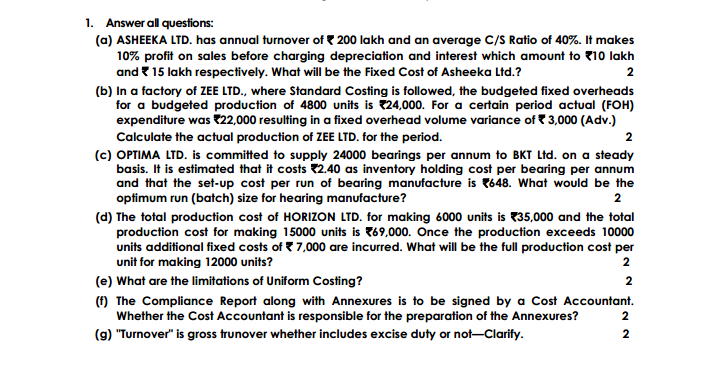

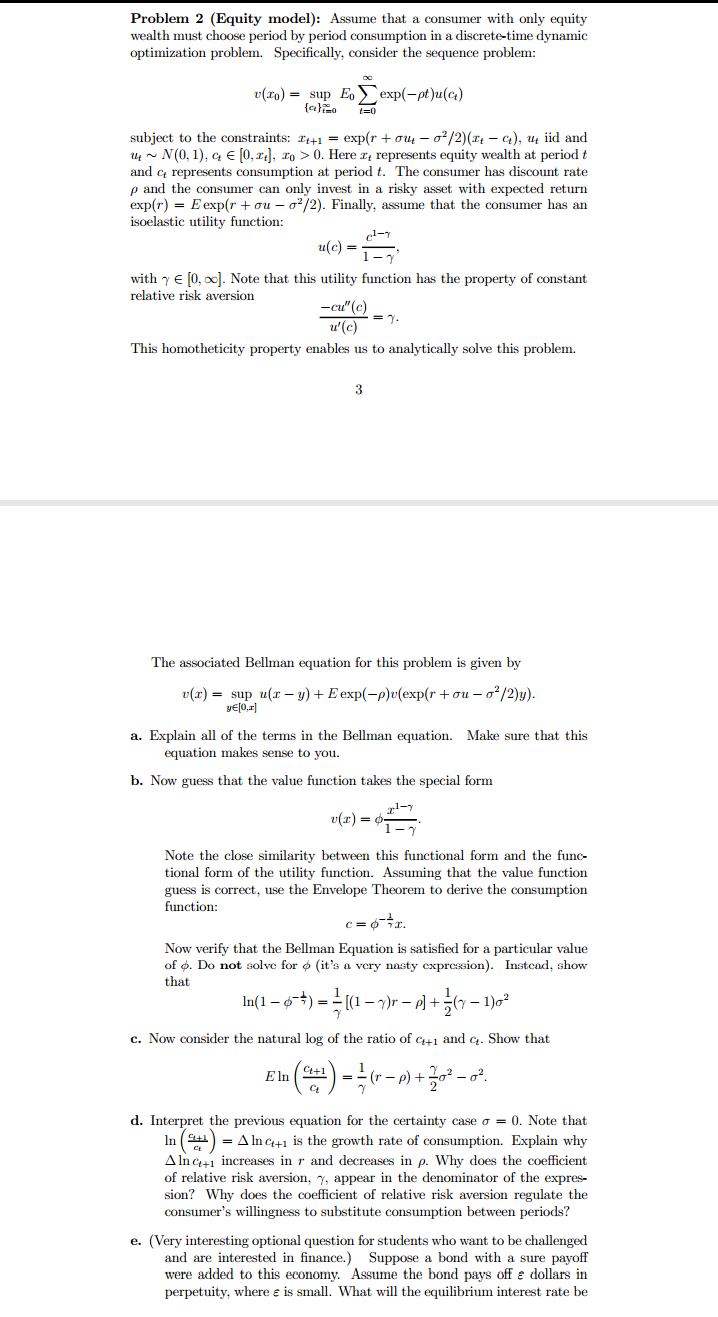

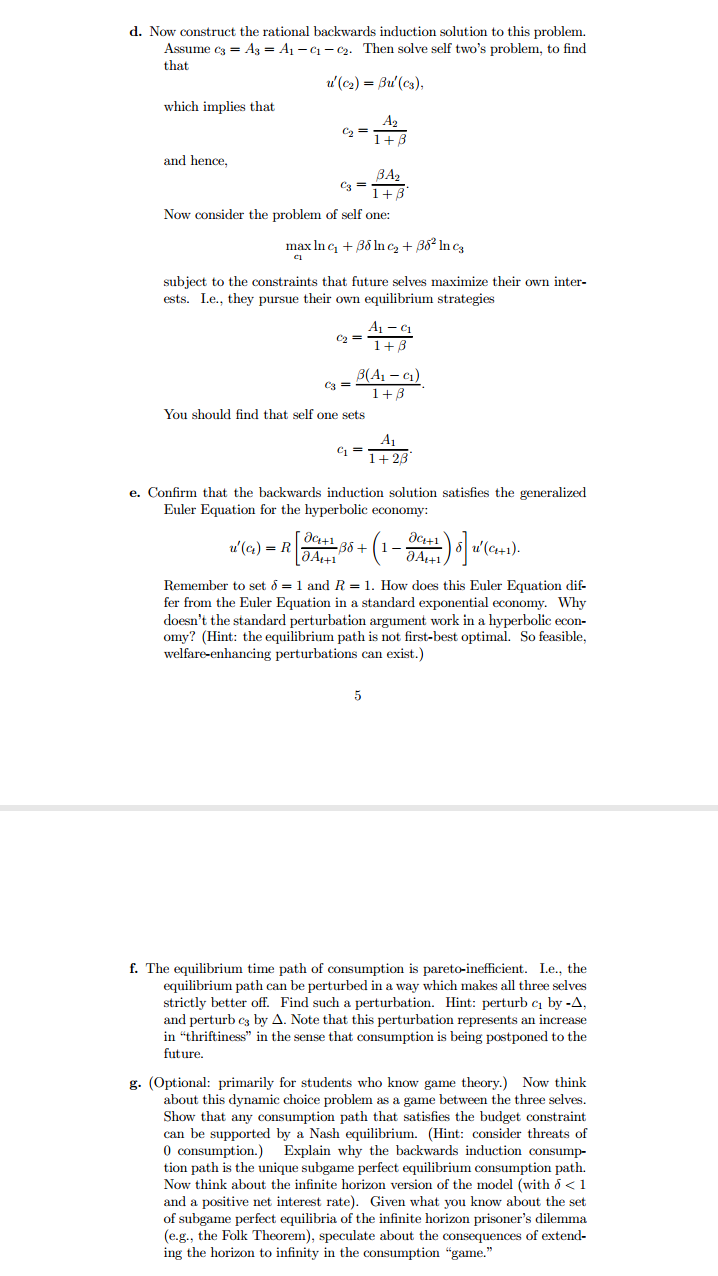

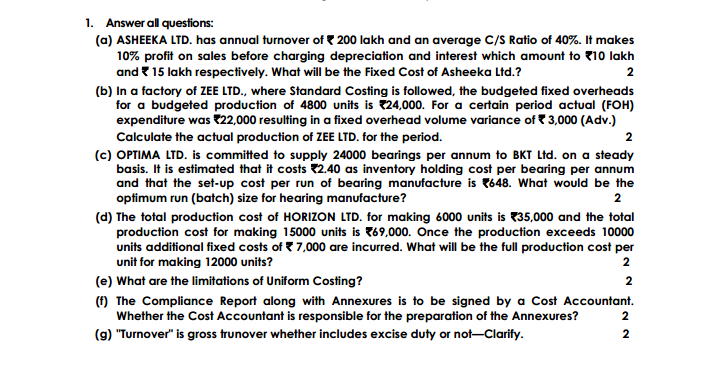

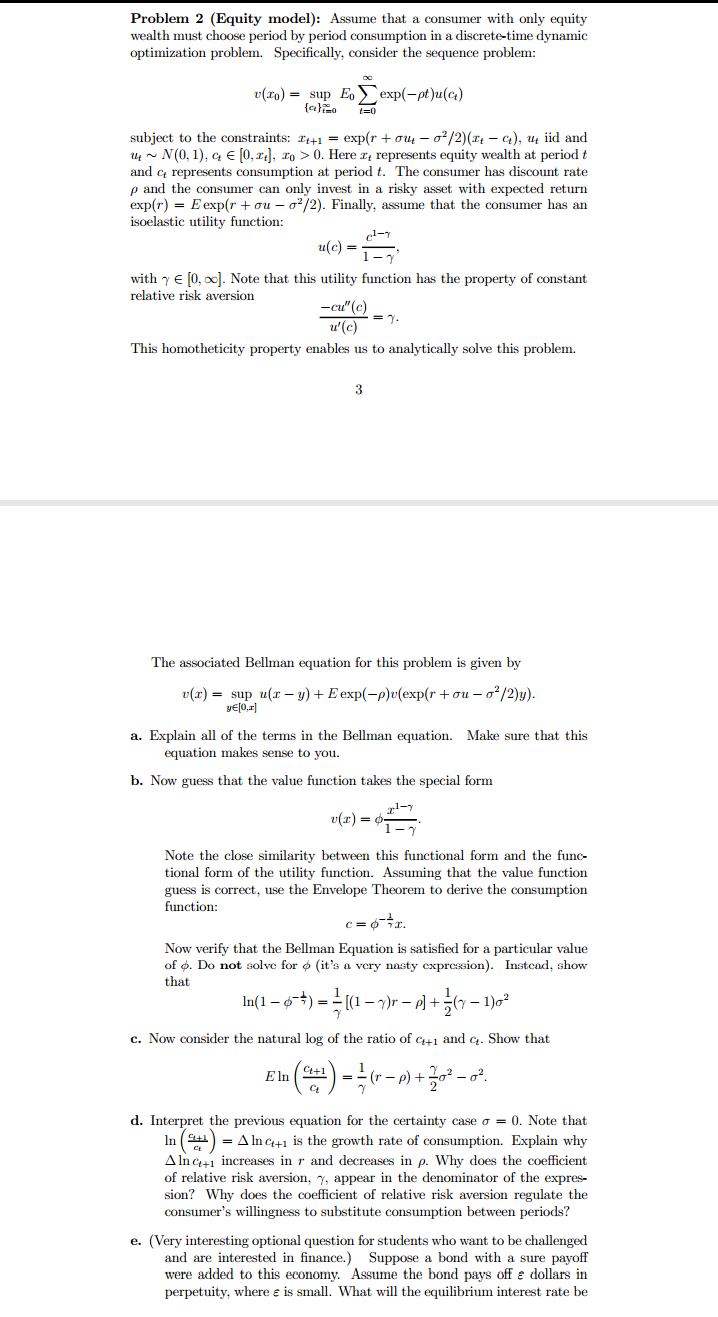

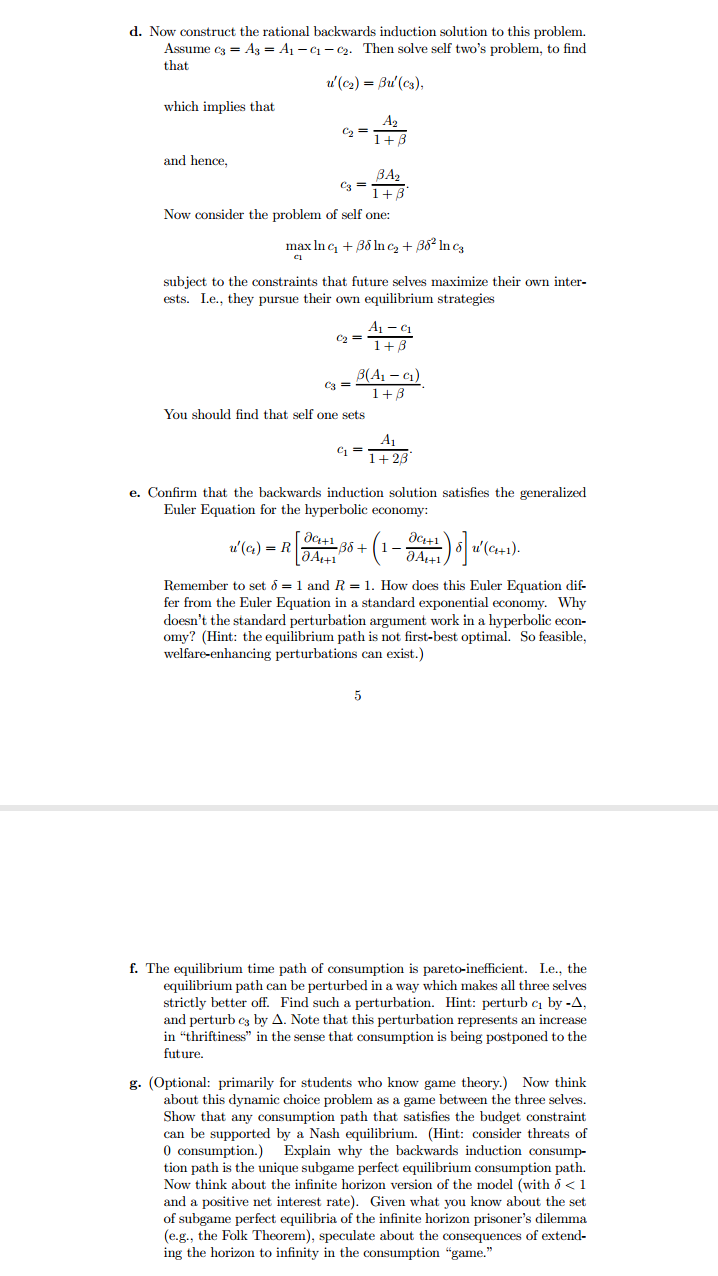

1. Answer all questions: (a) ASHEEKA LTD. has annual turnover of exp(-pt)u(c.) 1= 0 subject to the constraints: It+1 = exp(r + out -o'/2)(1 - G), up iid and the ~ N(0, 1), G E [0, If], To > 0. Here I, represents equity wealth at period t and & represents consumption at period t. The consumer has discount rate p and the consumer can only invest in a risky asset with expected return exp(r) = Eexp(r + ou - o'/2). Finally, assume that the consumer has an isoelastic utility function: u(c ) = _ with y E [0, co]. Note that this utility function has the property of constant relative risk aversion -cu"(c) u'(c) = 7. This homotheticity property enables us to analytically solve this problem. The associated Bellman equation for this problem is given by v(x) = sup u(x - y) + Eexp(-p)v(exp(r tou - o'/2)y). BE[o,x] a. Explain all of the terms in the Bellman equation. Make sure that this equation makes sense to you. b. Now guess that the value function takes the special form Note the close similarity between this functional form and the func- tional form of the utility function. Assuming that the value function guess is correct, use the Envelope Theorem to derive the consumption function: c=0-ir. Now verify that the Bellman Equation is satisfied for a particular value of p. Do not solve for $ (it's a very nasty expression). Instead, show that In(1 - $ 4) = =[(1 - 4)r -p]+ =(7-1)02 c. Now consider the natural log of the ratio of C+1 and c. Show that Eln ("+1 ) = 1(r -p) + 302 -02. d. Interpret the previous equation for the certainty case o = 0. Note that In Eth ) = A Inc+1 is the growth rate of consumption. Explain why Alnot+1 increases in r and decreases in p. Why does the coefficient of relative risk aversion, 7, appear in the denominator of the expres- sion? Why does the coefficient of relative risk aversion regulate the consumer's willingness to substitute consumption between periods? e. (Very interesting optional question for students who want to be challenged and are interested in finance.) Suppose a bond with a sure payoff were added to this economy. Assume the bond pays off & dollars in perpetuity, where & is small. What will the equilibrium interest rate beProblem 3 (True/False/Uncertain): I often give T/F/U questions on exams. Such questions are short and enable me to cover a lot of different topics quickly. That way the coverage of the exam is diversified, rather than being concentrated on one or two long questions. T/F/U questions focus on the key ideas and force you to demonstrate a conceptual understanding. These questions are graded on the quality of your explanation (not on the one-word answer itself). So explain each answer. You may or may not want to use formal/rigorous mathematical proof to support your answer. However, when a statement is false, you'll get full credit only if you provide a counter-example. a. All supremum sequence problems have a unique value-function solution. (Hint: this is true. Why?) b. If the flow payoff function is bounded, then there exists a unique bounded solution to the Bellman Equation. c. Let v(.) be a solution to a Bellman Equation for some dynamic optimiza tion problem. If the flow payoff function, F(, .), is unbounded, then it is always possible to find a feasible sequence of actions such that lim B"v(In) 0. 7-+0 Hint: this is false. Can you generate a counterexample? In other words, can you generate an example for which the flow payoff function is unbounded, but it is impossible to generate a feasible sequence of actions such that lim,-x. "v(2,) #0. d. In the growth problem (problem 1), for any & > 0, there exists a value of T, such that Ke 7. Hint: this is true. e. In the growth problem (problem 1), lim,- "v(r,) 5 0.d. Now construct the rational backwards induction solution to this problem. Assume c3 = As = Al - C1 - C2. Then solve self two's problem, to find that 1/' (c2) = Bu'(cs), which implies that C2 = I + B and hence, BA2 C3 1 + B Now consider the problem of self one: max Ing, + Bo Inc2 + Bo' In ca subject to the constraints that future selves maximize their own inter- ests. Le., they pursue their own equilibrium strategies 02 = Al - Ci 1 + B B(A1 - (1) 1 + 3 You should find that self one sets e. Confirm that the backwards induction solution satisfies the generalized Euler Equation for the hyperbolic economy: u' (c ) = R aAll + ( 1 - 89 ) 8) 2 ( C41 ). Remember to set o = 1 and R = 1. How does this Euler Equation dif- fer from the Euler Equation in a standard exponential economy. Why doesn't the standard perturbation argument work in a hyperbolic econ- omy? (Hint: the equilibrium path is not first-best optimal. So feasible, welfare-enhancing perturbations can exist.) 5 f. The equilibrium time path of consumption is pareto-inefficient. Le., the equilibrium path can be perturbed in a way which makes all three selves strictly better off. Find such a perturbation. Hint: perturb q by -A, and perturb cy by A. Note that this perturbation represents an increase in "thriftiness" in the sense that consumption is being postponed to the future. g. (Optional: primarily for students who know game theory.) Now think about this dynamic choice problem as a game between the three selves. Show that any consumption path that satisfies the budget constraint can be supported by a Nash equilibrium. (Hint: consider threats of 0 consumption.) Explain why the backwards induction consump- tion path is the unique subgame perfect equilibrium consumption path. Now think about the infinite horizon version of the model (with o