help me answer question no. 7,8,9 asap please! thanks a lot!

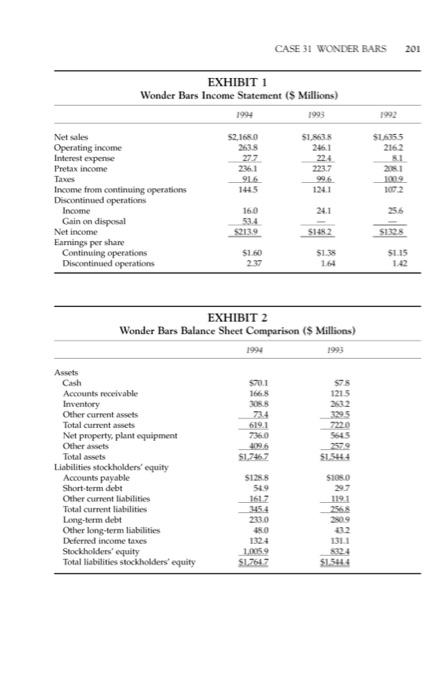

CASE 31 WONDER BARS COST OF CAPITAL OR REQUIRED RETURN All rational investors want to invest in securities (or projects that are expected to yield a return greater than their cost of capital. For the chief financial officer (CFO) of a company, the procedure for determining where to invest is a three step process. The first step is finding the expected return on the securities (or projects) in which the firm may be interested. The second step is the determina- tion of the firm's cost of capital. The final step is selecting those securities for projects) whose expected return is greater than the firm's cost of capital. In real- ity neither of the first two steps precedes the other as the CFO may calculate the firm's cost of capital on an annual, a semiannual, or even a quarterly basis, depending on changes in the capital markets. The calculated cost of capital may then be compared to the expected returns of the various securities and capital projects available. HISTORY OF WONDER BARS Wonder Bars (WB) was founded in 1896 by Earle Greymore as a manufacturer of quality chocolate candy. As with most food companies established in the United States in that period, WB started as a modest manufacturer of a single product that was sold locally. Later, if successful, those firms expanded their sales efforts to state, regional, national, and sometimes even to international areas. Wonder Bars was one of the successful companies. Greymore's first product was a chocolate bar that sold for two cents. The bar, known as the Wonder Bar, soon became famous for its quality and fine taste. Greymore expanded production to meet the rising demand for the Wonder Bar, but growth never exceeded cash avail able to pay for the expansion. Two of the basic tenets on which Greymore founded and ran WB were to make a quality chocolate bar and not to go into debt. These PART VI CAPITAL STRUCTURE tenets were considered almost sacrosanct, and Greymore believed they were the reasons for his success while many other food companies failed. By 1936, when Greymore turned the reins of his company over to his son, John, WB had grown into a respected and well-known $2.5-million regional chocolate firm. It had survived the Great Depression, according to Earle Greymore, because the firm still produced a quality product and, above all, had no debt. John Greymore followed the principles laid down by his father, and in the next 30 years WB grew to a national firm with 5125 million in sales. Although WB had purchased a confectionery candy firm, over 90 percent of the sales were from chocolate candy. Significantly only 5 percent of the firm's capital structure was in long-term debt, the debt needed to purchase the con- fectionery candy firm In 1967, when John's son Earl became president of WB, the family still owned all the stock of the firm and the board of directors was made up entirely of fam- ily members. However, in 1971 the company was forced into going public because of two circumstances. The first was the need to raise cash to pay estate taxes following the death of John Greymore. The second came from the increas- ing awareness that the firm needed to modernize its plants to compete with other food companies, which were slowly taking market share from WB with better quality candy products and higher profits from their automated, modern equipment By the early 1980s the firm had completed its modernization, improving the quality of its products and reducing operating expenses. However, the firm was totally dependent on the chocolate and confectionery business and its man- agers were beginning to realize that diversification into other lines of the food business might be necessary for WB to survive in the increasingly competitive business environment. In addition, some family members were beginning to question the financial practices of the firm and the effects those practices had on the stock price. They noticed that throughout the 1970s, many of the old-line family food businesses were purchased by larger, publicly held firms run by managers who were not majority shareholders of the firm. More importantly they noticed that the returns on the shares sold seemed much higher than the returns they were receiving from their stock. During the early 1980s, WB did expand into the pasta business through the purchase of three family-owned firms and by 1989 had an 18 percent market share of the $1 billion U.S. pasta business. Salem financed the purchase of these businesses through two bond issues. Long-term debt, however, was never more than 20 percent of total assets. Sam Wendover Sam Wendover, the chief financial officer (CFO) of WB, was hired in 1988 with specific instructions to improve the return on the financial resources of the firm. Wendover's background included four years as the cash manager of a large cor- poration with sales in excess of $9 billion. He was a graduate of an MBA pro- gram that is nationally known for its emphasis on financial management. 199 CASE 31 WONDER BARS Wendover saw the job as CFO of WB as an outstanding opportunity to affect the financial decision making of a firm in transition from family ownership to one that was becoming a multibillion dollar, publicly held firm. This Monday morning, Wendover had just walked into his office at 7:40 to find a note stuck on his computer's video monitor to call Earl Greymore, the CEO of Wonder Bars. The posting of the note was unusual in that most intra- office memos were sent via the electronic mail system, by then very few of WB's top executive managers ever used their computers for this or any other pur- pose. Greymore, however, was making a real effort to bring WB into the mod- em era, insisting that the computers be installed and that all managers below the level of the executive officers take in-house training on how to use them. He also had many of the top executives attend financial seminars sponsored by the Wharton School. Wendover had suggested the seminars to Greymore as a vehi- cle to help these executives understand some of the changes he thought were necessary to improve Wonder Bars' financial performance. Wendover called Greymore, who asked him to come up to his office. In the next 30 minutes Wendover learned that WB was considering the purchase of Sonzoni Foods, a pasta producer with annual sales in excess of S100 million, for $85 million. Before a decision could be made, Greymore wanted the answers to three financial questions from Wendover. First, what was the expected return from this proposed purchase? Second, what was Wonder Bars' cost of capital? Finally, what was Wendover's recommendation on how the purchase could be financed? Financial Information Wendover reviewed the WB financial data. (See Exhibits 1 and 2.) The average outstanding balance of short-term, interest-bearing debt in 1994 was $76,132,000 and the weighted average interest rate was 8.2 percent. Domestic borrowing under lines of credit and commercial paper was used to fund seasonal working capital requirements and provide interim financing for business acquisitions. Maximum short-term borrowings at any month were $372,400,000. WB had two long-term, AA+ rated bonds outstanding. The first was an 8.25 percent sinking fund debenture due in 12 years. This debenture is traded on the New York Stock Exchange and closed Friday at 91%. Of the original S150 million issue, $133 million is still outstanding. The second issue was for $100 million and had a coupon interest rate of 9.375 percent. The entire issue was sold in 1990 in a private placement to two life insurance companies, and the issue will mature in 2020. Wendover then called WB's investment banker and learned that the banker was highly confident that Wonder Bars could issue up to $100 million of new debt at the current return on WB's outstanding long- term debt. Like many other family-controlled but publicly held businesses, WB has two classes of common stock: Common Stock and Class B stock. The Common Stock has one vote per share and the Class B stock (held or controlled by family mem- bers) has 10 votes per share. However, the Common Stock, voting separately as PART VI CAPITAL STRUCTURE a class, is entitled to elect one-sixth of the board of directors. With respect to dividend rights, the common stock is entitled to cash dividends that are 10 percent higher than those declared and paid on the Class B Stock. There are a total of 75 million shares of common stock and 10 million of Class B Stock out- standing. The current price of both the common stock and Class B Stock is $35 and its beta is 0.95. The common stock and Class B Stock generally vote together without regard to class on matters submitted to stockholders, The growth rate of net income, earnings per share, dividends, and common stock prices are given in Exhibit 3 and have averaged about 14 percent a year over the last five years. Some of this growth rate is the result of an aggressive repurchase of the firm's common stock. Over the past three years the firm has repurchased over 5 million common stock shares. Finally, Wendover looked up the capitalization ratio for other firms in the food industry. (See Exhibit 4.) As he expected, WB had a much lower debt ratio than almost all other companies in the industry group Sam Wendover wrote down the additional information that he thought he needed before starting to work. The current Treasury Bill rate was 5.0 percent and the return on the S&P 500 has averaged 12 percent over the past 10 years. Salem's current combined federal and state income tax rate is 40 percent. The beta for Sonzoni Food was 0.90, almost the same as Wonder Bars. QUESTIONS 1. What is WB's capital structure? 2. What is WB's before-tax cost of long-term debt? 3. What is the firm's cost of equity? 4. Calculate the cost of capital for WB. 5. If Wonder Bar uses book value rather than market value to determine its capital structure, what is the impact of the cost of capital on its budgeting decisions? 6. Which is superior, using the book value or the market value of the firm's cap- ital in the determination of the cost of capital? Why? 7. Wendover apparently believes that WB's cost of capital can be used as the hurdle rate for the required return to evaluate the acquisition of Sonzoni Foods. Under what conditions, if any, is this appropriate? 8. How can the firm raise $85 million for the acquisition without changing the present capital structure? 9. Assuming an expected net income in 1995 of $182 million, how would you suggest that the firm finance the acquisition? CASE 31 WONDER BARS 201 EXHIBIT 1 Wonder Bars Income Statement ($ Millions) 1994 1993 1992 SLAS 2162 52.168.0 2615 277 2361 916 145 51,863 246.1 224 223.7 21 1009 1002 1241 Net sales Operating income Interest expertise Pretax income Taxes Income from continuing operations Discontinued operations Income Gain on disposal Net income Eaming per share Continuing operations Discontinued operations 24.1 256 16.0 53.4 S2139 51482 SIS S10 237 SL15 1.42 164 EXHIBIT 2 Wonder Bars Balance Sheet Comparison (s Millions) 1991 1993 5701 1668 30. 734 6191 7360 S78 1215 222 3295 7220 2579 $15.4 S12467 Assets Cash Accounts receivable Inventory Other current assets Total current assets Net property, plant equipment Others Total assets Liabilities stockholders' equity Accounts payable Short-term debt Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Deferred income taxes Stockholders' equity Total liabilities stockholders' equity SIOSO 297 SIS 59 1612 45.4 233.0 RO 1324 19 SL7647 1191 2568 200 22 1311 $324 SI564