Help me answer these please i need to prepare. show work please. What exactly do you need to help answer this study guide?

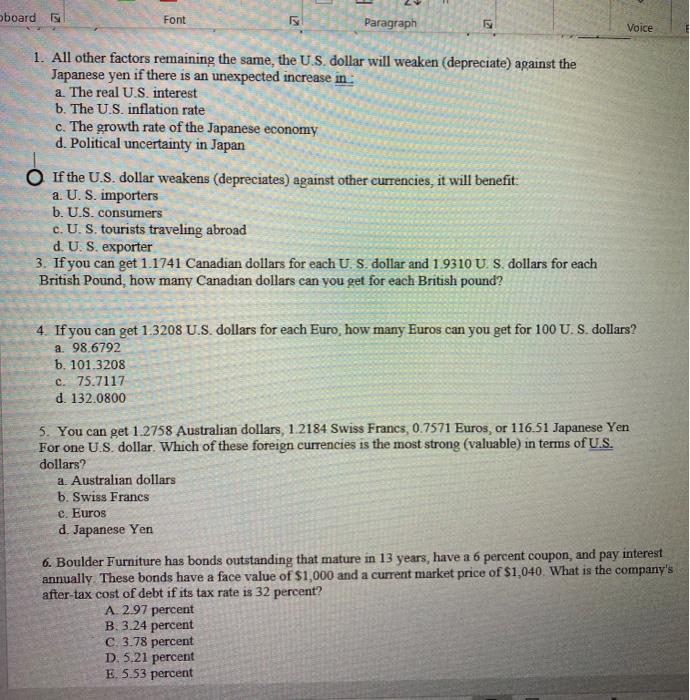

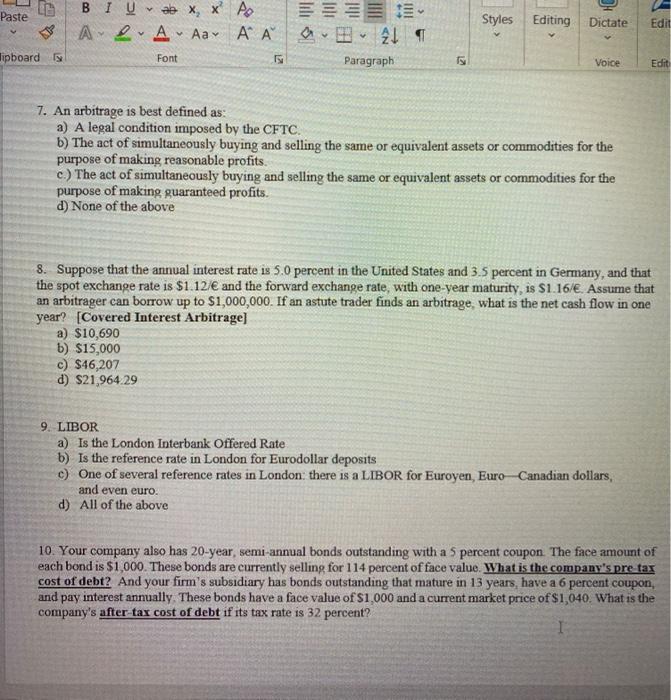

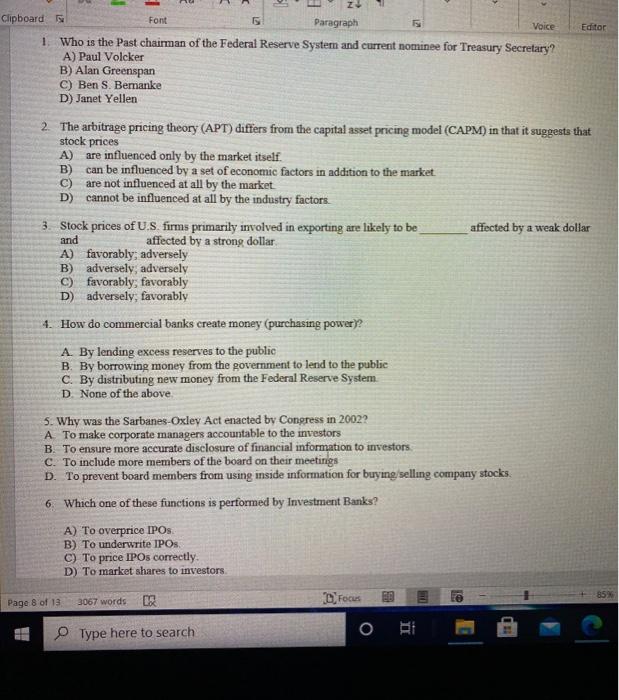

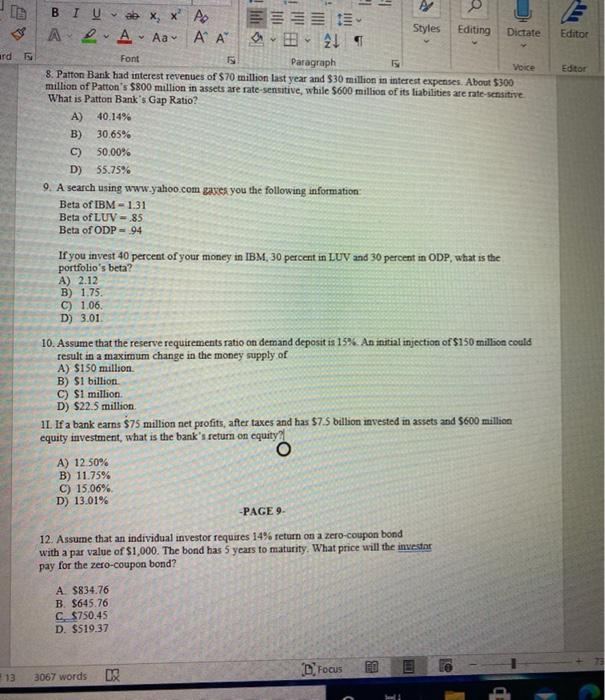

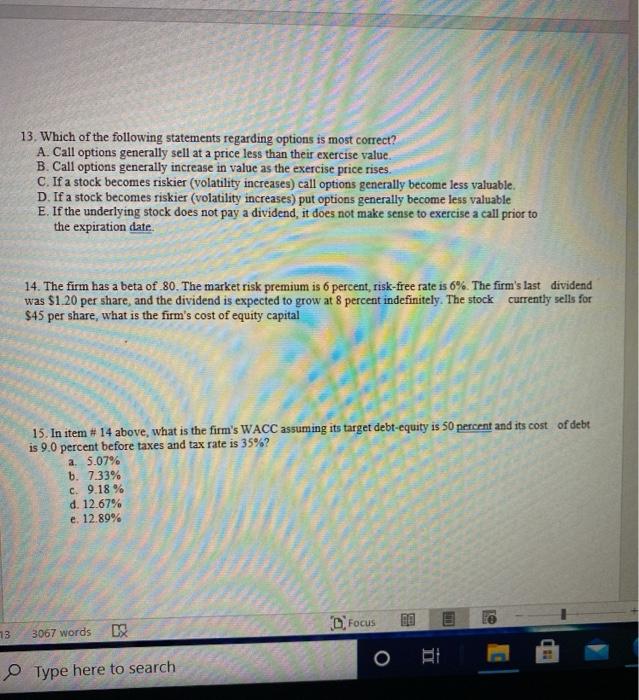

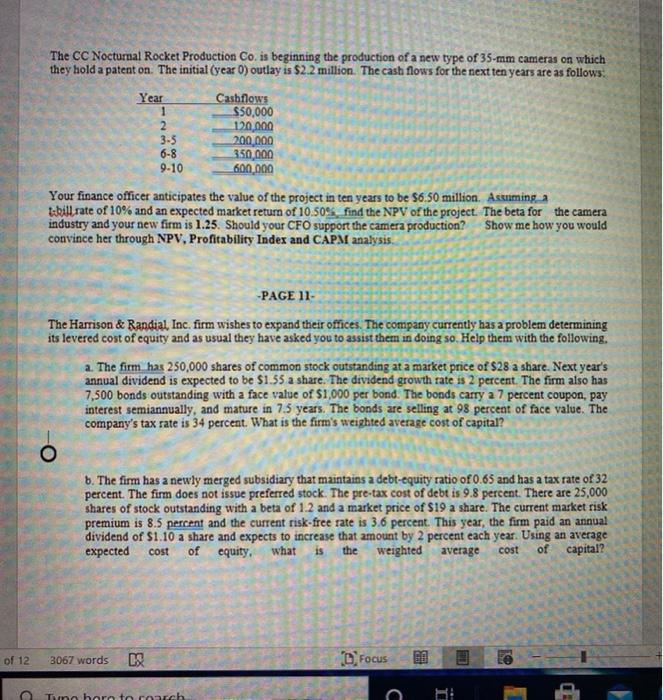

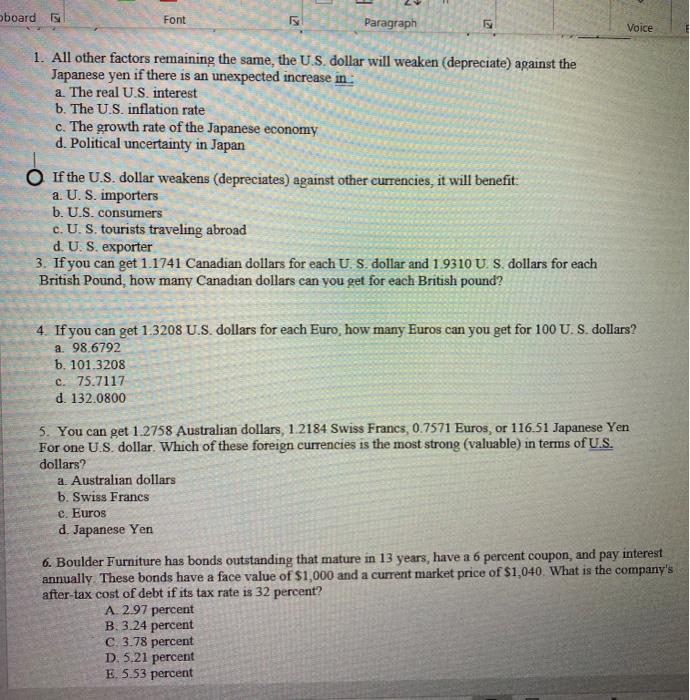

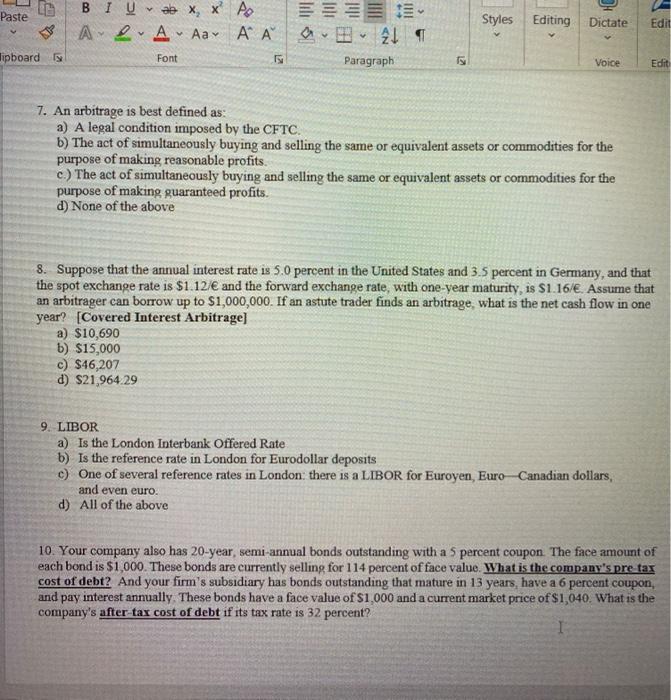

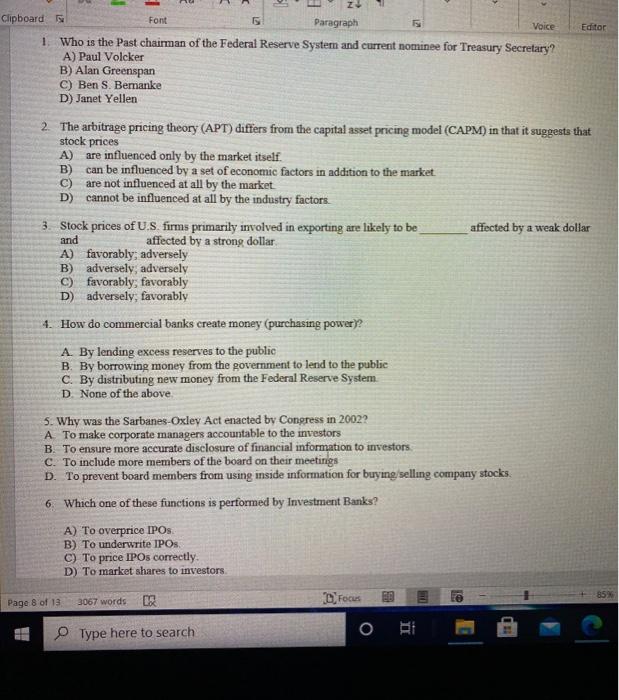

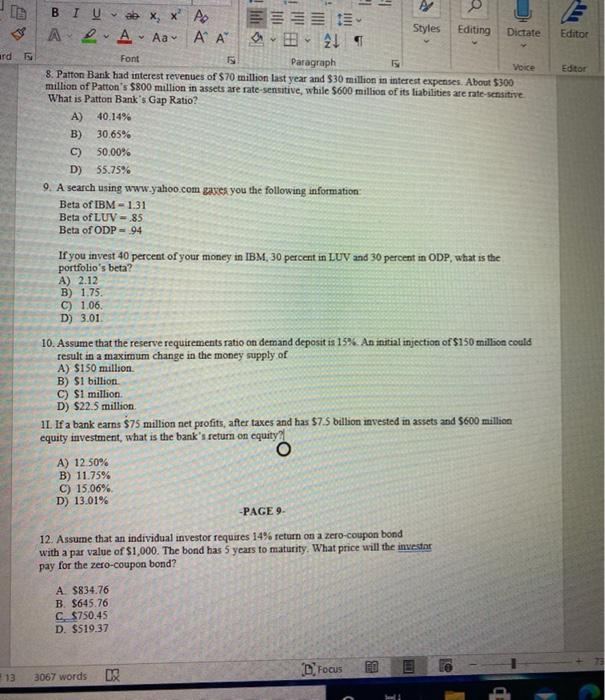

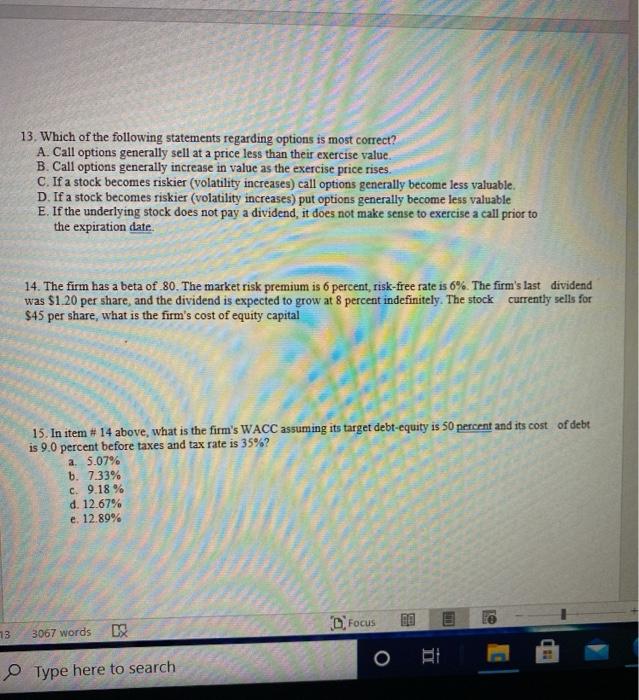

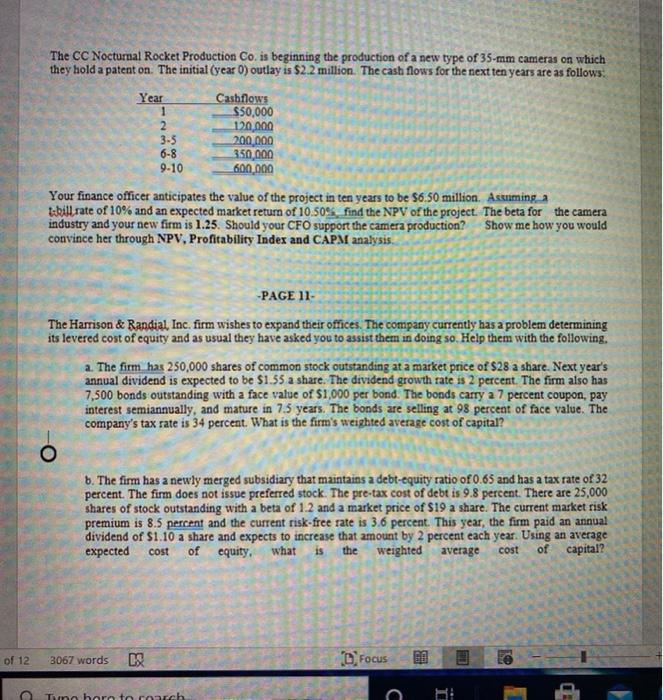

board Font Paragraph Voice 1. All other factors remaining the same, the U.S. dollar will weaken (depreciate) against the Japanese yen if there is an unexpected increase in: a. The real U.S. interest b. The U.S. inflation rate c. The growth rate of the Japanese economy d. Political uncertainty in Japan If the U.S. dollar weakens (depreciates) against other currencies, it will benefit: a. U.S. importers b. U.S. consumers c. U.S. tourists traveling abroad d. U.S. exporter 3. If you can get 1.1741 Canadian dollars for each U. S. dollar and 19310 U. S dollars for each British Pound, how many Canadian dollars can you get for each British pound? 4. If you can get 1.3208 U.S. dollars for each Euro, how many Euros can you get for 100 U. S. dollars? a. 98.6792 b. 101.3208 c. 75.7117 d. 132.0800 5. You can get 1.2758 Australian dollars, 1.2184 Swiss Francs, 0.7571 Euros, or 116.51 Japanese Yen For one U.S. dollar. Which of these foreign currencies is the most strong (valuable) in terms of U.S. dollars? a. Australian dollars b. Swiss Francs e. Euros d. Japanese Yen 6. Boulder Furniture has bonds outstanding that mature in 13 years, have a 6 percent coupon, and pay interest annually. These bonds have a face value of $1,000 and a current market price of $1,040. What is the company's after-tax cost of debt if its tax rate is 32 percent? A. 2.97 percent B. 3.24 percent C.3.78 percent D. 5.21 percent E. 5.53 percent Paste BIU ab X, XA A A Aa A A Styles Editing Dictate Edit DE AL Paragraph lipboard Font Voice Edit 7. An arbitrage is best defined as: a) A legal condition imposed by the CFTC. b) The act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making reasonable profits. c.) The act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making guaranteed profits. d) None of the above 8. Suppose that the annual interest rate is 5.0 percent in the United States and 3.5 percent in Germany, and that the spot exchange rate is $1.12/ and the forward exchange rate, with one-year maturity, is $1.16/. Assume that an arbitrager can borrow up to $1,000,000. If an astute trader finds an arbitrage, what is the net cash flow in one year? [Covered Interest Arbitrage] a) $10,690 b) $15,000 c) $46,207 d) $21,964.29 9. LIBOR a) Is the London Interbank Offered Rate b) is the reference rate in London for Eurodollar deposits c) One of several reference rates in London: there is a LIBOR for Euroyen, Euro Canadian dollars, and even euro. d) All of the above 10. Your company also has 20-year, semi-annual bonds outstanding with a 5 percent coupon The face amount of each bond is $1,000 These bonds are currently selling for 114 percent of face value. What is the company's pre tar cost of debt? And your firm's subsidiary has bonds outstanding that mature in 13 years, have a 6 percent coupon, and pay interest annually. These bonds have a face value of $1.000 and a current market price of $1,040. What is the company's after tar cost of debt if its tax rate is 32 percent? 1 Editor Z Clipboard Font Paragraph Voice 1. Who is the Past chairman of the Federal Reserve System and current nominee for Treasury Secretary? A) Paul Volcker B) Alan Greenspan C) Ben S. Bemanke D) Janet Yellen 2. The arbitrage pricing theory (APT) differs from the capital asset pricing model (CAPM) in that it suggests that stock prices A) are influenced only by the market itself. B) can be influenced by a set of economic factors in addition to the market c) are not influenced at all by the market D) cannot be influenced at all by the industry factors 3. Stock prices of U.S.firms primarily involved in exporting are likely to be affected by a weak dollar and affected by a strong dollar A) favorably, adversely B) adversely, adversely C) favorably, favorably D) adversely, favorably 4. How do commercial banks create money (purchasing power)? A. By lending excess reserves to the public B. By borrowing money from the government to lend to the public C. By distributing new money from the Federal Reserve System D None of the above 5. Why was the Sarbanes-Oxley Act enacted by Congress in 20022 A To make corporate managers accountable to the investors B. To ensure more accurate disclosure of financial information to investors C. To include more members of the board on their meetings D. To prevent board members from using inside information for buying/selling company stocks 6. Which one of these functions is performed by Investment Banks? A) To overprice IPOs B) To underwrite IPOs C) To price IPOs correctly. D) To market shares to investors Page 8 of 13 3067 words Focus Type here to search HE Editor ard Editor BIUX, X A EE Styles Editing Dictate Aa AA 211 Font Paragraph Voice 8. Patton Bank had interest revenues of $ 70 million last year and $30 million in interest expenses. About $300 million of Patton's $800 million in assets are rate-sensitive, while $600 million of its liabilities are rate-sensitive What is Patton Bank's Gap Ratio? A) 40.14% B) 30,65% C) 50.00% D) 55.75% 9. A search using www.yahoo.com gaxes you the following information Beta of IBM-1.31 Beta of LUV -85 Beta of ODP - 94 If you invest 40 percent of your money in IBM, 30 percent in LUV and 30 percent in ODP, what is the portfolio's beta? A) 2.12 B) 1.75. C) 1.06. D) 3.01 10. Assume that the reserve requirements ratio on demand deposit is 15%. An initial injection of $150 million could result in a maximum change in the money supply of A) $150 million B) S1 billion C) $1 million D) $22.5 million 11. If a bank earns $75 million net profits, after taxes and has $7.5 billion invested in assets and 5600 million equity investment, what is the bank's retum on equity A) 12.50% B) 11.75% C) 15.06% D) 13.01% -PAGE 9 12. Assume that an individual investor requires 14% return on a zero-coupon bond with a par value of $1,000. The bond has 5 years to maturity. What price will the investor pay for the zero-coupon bond? A $834.76 B $645.76 $750.45 D. $519.37 D. Focus 13 DX 3067 words 13. Which of the following statements regarding options is most correct? A. Call options generally sell at a price less than their exercise value. B. Call options generally increase in value as the exercise price rises. C. If a stock becomes riskier (volatility increases) call options generally become less valuable. D. If a stock becomes riskier (volatility increases) put options generally become less valuable E. If the underlying stock does not pay a dividend, it does not make sense to exercise a call prior to the expiration date 14. The firm has a beta of 80. The market risk premium is 6 percent, risk-free rate is 6%. The firm's last dividend was $1.20 per share, and the dividend is expected to grow at 8 percent indefinitely. The stock currently sells for $45 per share, what is the firm's cost of equity capital 15. In item # 14 above, what is the firm's WACC assuming its target debt-equity is 50 percent and its cost of debt is 9.0 percent before taxes and tax rate is 35%? a. 5.07% b. 7.33% c. 9.18% d. 12.67% e. 12.89% 13 D Focus DS 3067 words Type here to search The CC Nocturnal Rocket Production Co. is beginning the production of a new type of 35-mm cameras on which they hold a patent on. The initial (year 0) outlay is $2.2 million. The cash flows for the next ten years are as follows: Year Cashflows 1 $50,000 2 120,000 3-5 200,000 6-8 350,000 9-10 600.000 Your finance officer anticipates the value of the project in ten years to be $6.50 million. Assuming a t-bill rate of 10% and an expected market return of 10.50% find the NPV of the project. The beta for the camera industry and your new firm is 1.25. Should your CFO support the camera production? Show me how you would convince her through NPV, Profitability Index and CAPM analysis. -PAGE 11- The Harrison & Randial, Inc. firm wishes to expand their offices. The company currently has a problem determining its levered cost of cquity and as usual they have asked you to assist them in doing so. Help them with the following. The firm has 250,000 shares of common stock outstanding at a market price of $28 a share. Next year's annual dividend is expected to be $1.55 a share. The dividend growth rate is 2 percent. The firm also has 7,500 bonds outstanding with a face value of $1,000 per bond. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98 percent of face value. The company's tax rate is 34 percent. What is the firm's weighted average cost of capital? O b. The firm has a newly merged subsidiary that maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The firm does not issue preferred stock. The pre-tax cost of debt is 9.8 percent. There are 25,000 shares of stock outstanding with a beta of 1.2 and a market price of $19 a share. The current market risk premium is 8.5 percent and the current risk-free rate is 3.6 percent. This year, the firm paid an annual dividend of $1.10 a share and expects to increase that amount by 2 percent each year. Using an average expected cost equity, weighted average of capital? of what is the cost of 12 3067 words BE D) Focus L c Ba baron ranh