Help me do an executive summary for Colgate-Palmolive Company's segments and NCI's. I have included some info for assistance.

2.What are the requirements/rules for disclosures in the two areas of segments and NCIs to include the history and development of the specific rules (#s), key points etc. of segment and NCI reporting and disclosure requirements.

3. What and how Colgate-Palmolive Company has disclosed relating to these two items (and only these items), and

4. How's the effectiveness / overall meaningfulness of Colgate-Palmolive's disclosures relating to only segments and NCIs and the disclosure rules themselves

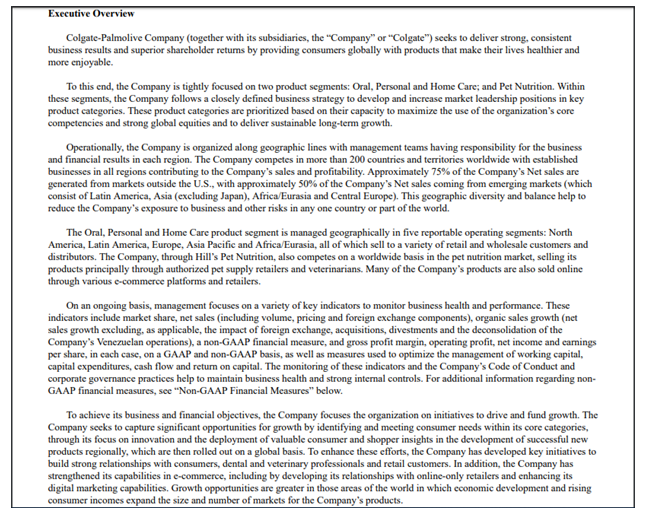

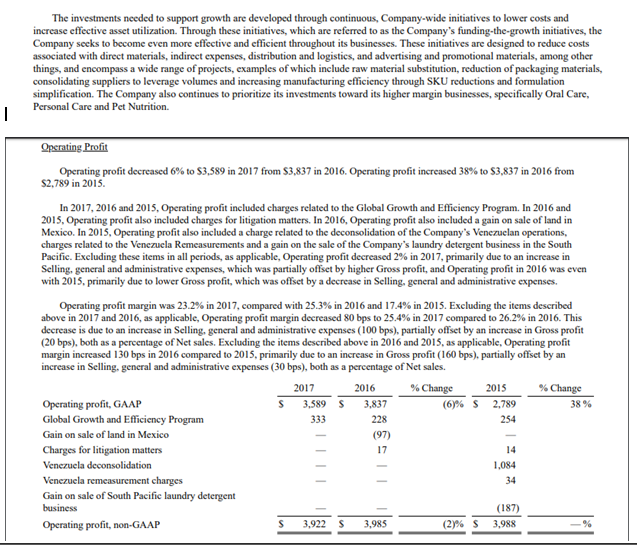

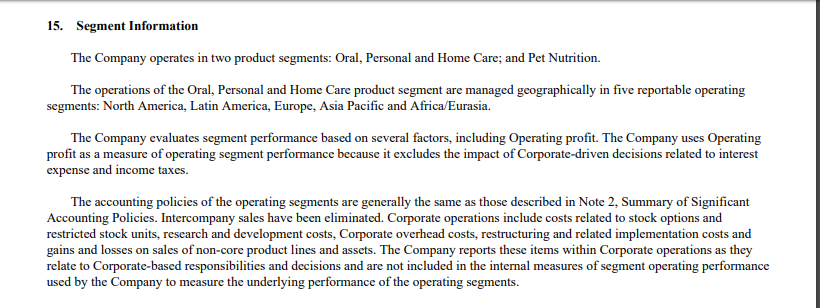

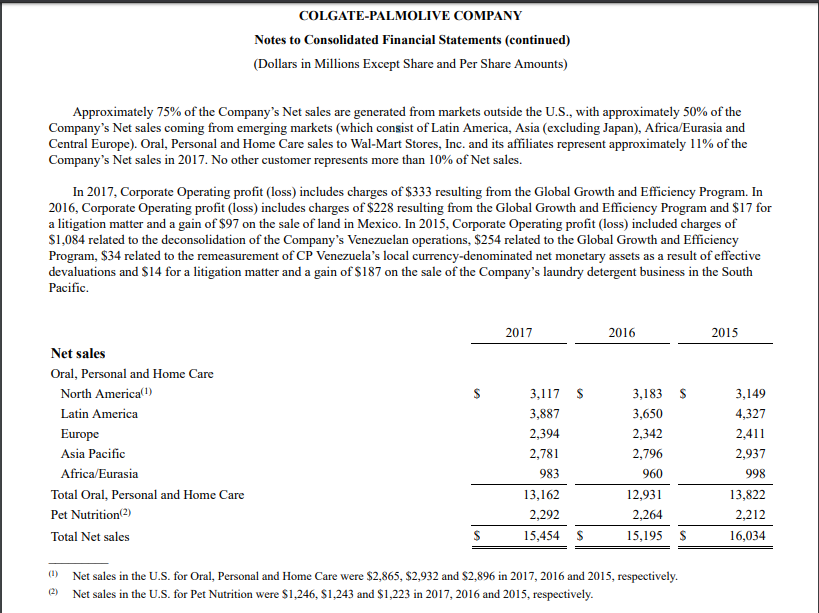

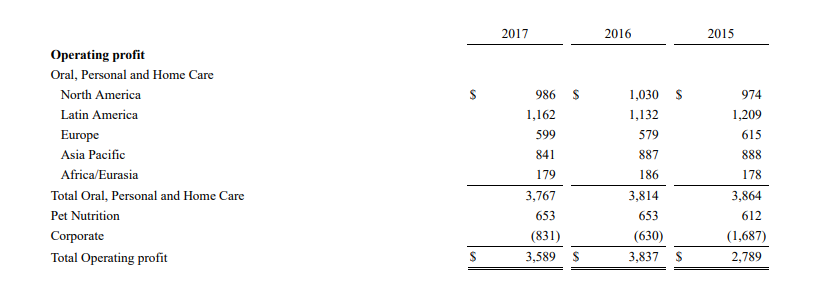

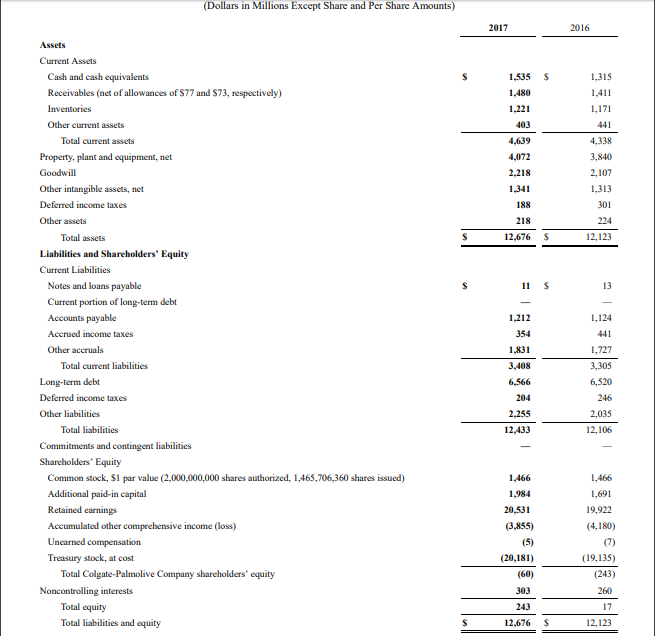

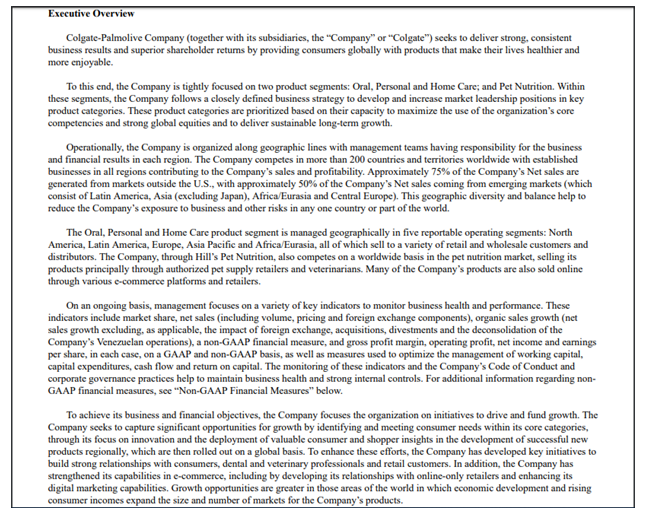

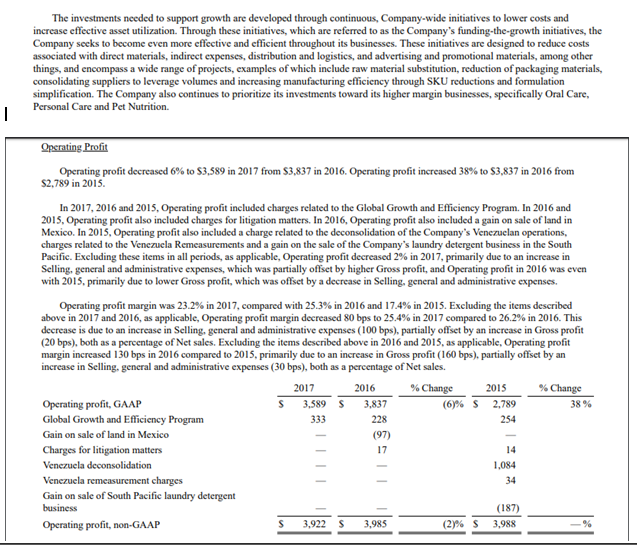

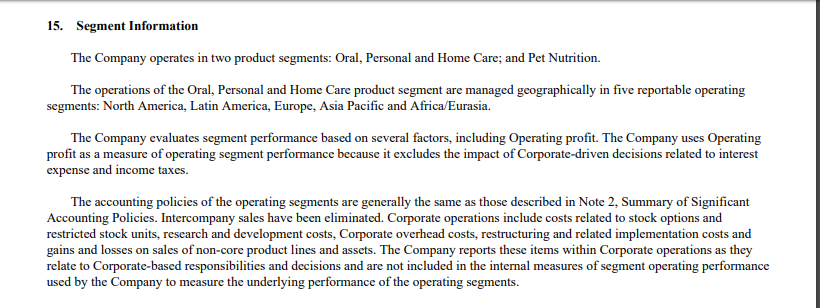

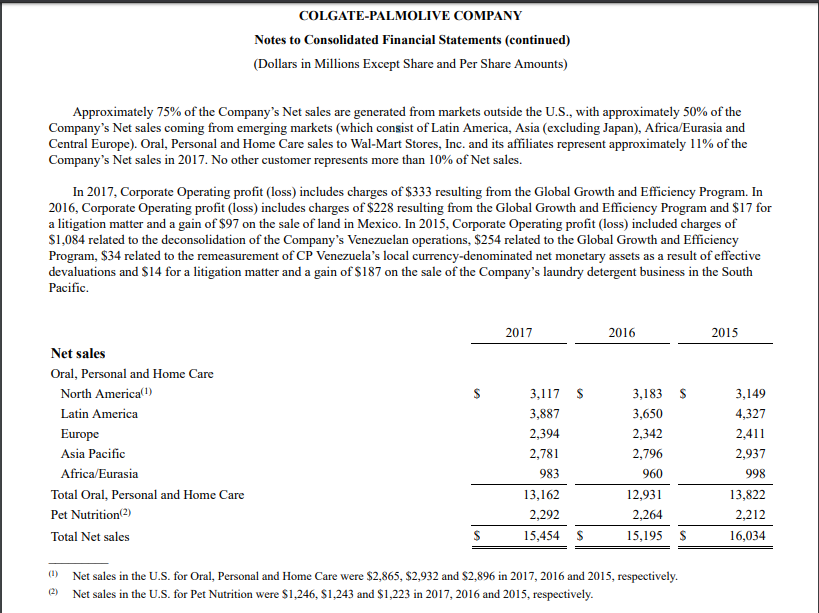

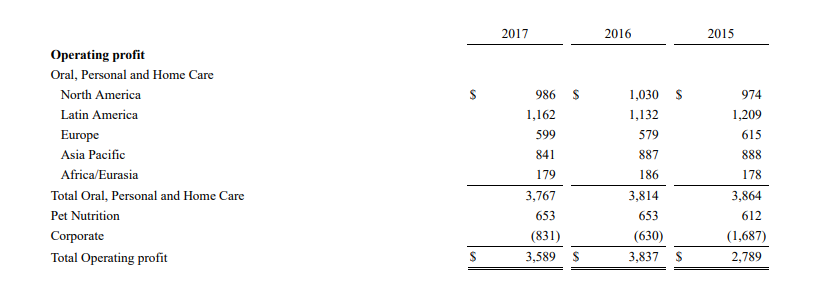

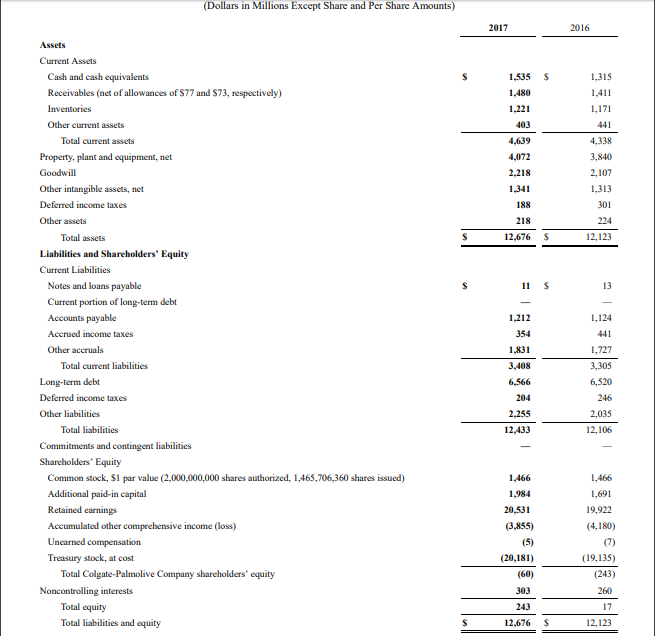

Executive Overview Colgate-Palmolive Company (together with its subsidiaries, the "Company" or "Colgate") seeks to deliver strong, consistent business results and superior shareholder returns by providing consumers globally with products that make their lives healthier and more enjoyable. To this end, the Company is tightly focused on two product segments: Oral, Personal and Home Care; and Pet Nutrition. Within these segments, the Company follows a closely defined business strategy to develop and increase market leadership positions in key product categories. These product categories are prioritized based on their capacity to maximize the use of the organization's core competencies and strong global equities and to deliver sustainable long-term growth. Operationally, the Company is organized along geographic lines with management teams having responsibility for the business and financial results in cach region. The Company competes in more than 200 countries and territories worldwide with established businesses in all regions contributing to the Company's sales and profitability. Approximately 75% of the Company's Net sales are generated from markets outside the U.S., with approximately 50% of the Company's Net sales coming from emerging markets (which consist of Latin America, Asia (excluding Japan), Africa/Eurasia and Central Europe). This geographic diversity and balance help to reduce the Company's exposure to business and other risks in any one country or part of the world. The Oral, Personal and Home Care product segment is managed geographically in five reportable operating segments: North America, Latin America, Europe, Asia Pacific and Africa/Eurasia, all of which sell to a variety of retail and wholesale customers and distributors. The Company, through Hill's Pet Nutrition, also competes on a worldwide basis in the pet nutrition market, selling its products principally through authorized pet supply retailers and veterinarians. Many of the Company's products are also sold online through various e-commerce platforms and retailers. On an ongoing basis, management focuses on a variety of key indicators to monitor business health and performance. These indicators include market share, net sales (including volume, pricing and foreign exchange components), organic sales growth (net sales growth excluding, as applicable, the impact of foreign exchange, acquisitions, divestments and the deconsolidation of the Company's Venezuelan operations), a non-GAAP financial measure, and gross profit margin, operating profit, net income and earnings per share, in cach case, on a GAAP and non-GAAP basis, as well as measures used to optimize the management of working capital, capital expenditures, cash flow and return on capital. The monitoring of these indicators and the Company's Code of Conduct and corporate governance practices help to maintain business health and strong internal controls. For additional information regarding non- GAAP financial measures, see "Non-GAAP Financial Measures below. To achieve its business and financial objectives, the Company focuses the organization on initiatives to drive and fund growth. The Company seeks to capture significant opportunities for growth by identifying and meeting consumer needs within its core categories, through its focus on innovation and the deployment of valuable consumer and shopper insights in the development of successful new products regionally, which are then rolled out on a global basis. To enhance these efforts, the Company has developed key initiatives to build strong relationships with consumers, dental and veterinary professionals and retail customers. In addition, the Company has strengthened its capabilities in e-commerce, including by developing its relationships with online-only retailers and enhancing its digital marketing capabilities. Growth opportunities are greater in those areas of the world in which cconomic development and rising consumer incomes expand the size and number of markets for the Company's products. The investments needed to support growth are developed through continuous, Company-wide initiatives to lower costs and increase effective asset utilization. Through these initiatives, which are referred to as the Company's funding-the-growth initiatives, the Company seeks to become even more effective and efficient throughout its businesses. These initiatives are designed to reduce costs associated with direct materials, indirect expenses, distribution and logistics, and advertising and promotional materials, among other things, and encompass a wide range of projects, examples of which include raw material substitution, reduction of packaging materials, consolidating suppliers to leverage volumes and increasing manufacturing efficiency through SKU reductions and formulation simplification. The Company also continues to prioritize its investments toward its higher margin businesses, specifically Oral Care, Personal Care and Pet Nutrition. Operating Profit Operating profit decreased 6% to $3.589 in 2017 from $3.837 in 2016. Operating profit increased 38% to $3.837 in 2016 from $2,789 in 2015. In 2017, 2016 and 2015, Operating profit included charges related to the Global Growth and Efficiency Program. In 2016 and 2015, Operating profit also included charges for litigation matters. In 2016, Operating profit also included a gain on sale of land in Mexico. In 2015, Operating profit also included a charge related to the deconsolidation of the Company's Venezuelan operations, charges related to the Venezuela Remeasurements and a gain on the sale of the Company's laundry detergent business in the South Pacific. Excluding these items in all periods, as applicable, Operating profit decreased 2% in 2017, primarily due to an increase in Selling, general and administrative expenses, which was partially offset by higher Gross profit, and Operating profit in 2016 was even with 2015. primarily due to lower Gross profit, which was offset by a decrease in Selling, general and administrative expenses. Operating profit margin was 23.2% in 2017, compared with 25.3% in 2016 and 17.4% in 2015. Excluding the items described above in 2017 and 2016, as applicable, Operating profit margin decreased 80 bps to 25.4% in 2017 compared to 26.2% in 2016. This decrease is due to an increase in Selling, general and administrative expenses (100 bps), partially offset by an increase in Gross profit (20 bps), both as a percentage of Net sales. Excluding the items described above in 2016 and 2015, as applicable, Operating profit margin increased 130 bps in 2016 compared to 2015. primarily due to an increase in Gross profit (160 bps), partially offset by an increase in Selling, general and administrative expenses (30 bps), both as a percentage of Net sales. 2017 2016 % Change 2015 % Change Operating profit, GAAP $ 3,589 $ 3.837 (6)% = 2.789 Global Growth and Efficiency Program 333 Gain on sale of land in Mexico (97) Charges for litigation matters Venezuela deconsolidation 1,084 Venezuela remeasurement charges Gain on sale of South Pacific laundry detergent business (187) Operating profit, non-GAAP 228 254 $ 3,92 5 3,985 emais 3,98 _-* 15. Segment Information The Company operates in two product segments: Oral, Personal and Home Care; and Pet Nutrition. The operations of the Oral, Personal and Home Care product segment are managed geographically in five reportable operating segments: North America, Latin America, Europe, Asia Pacific and Africa/Eurasia. The Company evaluates segment performance based on several factors, including Operating profit. The Company uses Operating profit as a measure of operating segment performance because it excludes the impact of Corporate-driven decisions related to interest expense and income taxes. The accounting policies of the operating segments are generally the same as those described in Note 2. Summary of Significant Accounting Policies. Intercompany sales have been eliminated. Corporate operations include costs related to stock options and restricted stock units, research and development costs, Corporate overhead costs, restructuring and related implementation costs and gains and losses on sales of non-core product lines and assets. The Company reports these items within Corporate operations as they relate to Corporate-based responsibilities and decisions and are not included in the internal measures of segment operating performance used by the Company to measure the underlying performance of the operating segments. COLGATE-PALMOLIVE COMPANY Notes to Consolidated Financial Statements continued) (Dollars in Millions Except Share and Per Share Amounts) Approximately 75% of the Company's Net sales are generated from markets outside the U.S., with approximately 50% of the Company's Net sales coming from emerging markets (which consist of Latin America, Asia (excluding Japan), Africa/Eurasia and Central Europe). Oral, Personal and Home Care sales to Wal-Mart Stores, Inc. and its affiliates represent approximately 11% of the Company's Net sales in 2017. No other customer represents more than 10% of Net sales. In 2017, Corporate Operating profit (loss) includes charges of $333 resulting from the Global Growth and Efficiency Program. In 2016, Corporate Operating profit (loss) includes charges of $228 resulting from the Global Growth and Efficiency Program and $17 for a litigation matter and a gain of $97 on the sale of land in Mexico. In 2015, Corporate Operating profit (loss) included charges of $1,084 related to the deconsolidation of the Company's Venezuelan operations, $254 related to the Global Growth and Efficiency Program, $34 related to the remeasurement of CP Venezuela's local currency-denominated net monetary assets as a result of effective devaluations and $14 for a litigation matter and a gain of $187 on the sale of the Company's laundry detergent business in the South Pacific. 2017 2016 2015 $ Net sales Oral, Personal and Home Care North America(1) Latin America Europe Asia Pacific Africa/Eurasia Total Oral, Personal and Home Care Pet Nutrition) Total Net sales 3,117 3,887 2,394 2,781 983 13,162 2,292 15,454 3,183 3,650 2,342 2,796 960 12,931 2,264 15,195 3,149 4,327 2.411 2,937 998 13,822 2,212 16,034 $ $ $ (1) 2) Net sales in the U.S. for Oral, Personal and Home Care were $2,865, $2,932 and $2.896 in 2017, 2016 and 2015, respectively. Net sales in the U.S. for Pet Nutrition were $1,246, $1,243 and $1,223 in 2017, 2016 and 2015, respectively. 2017 2016 2015 $ $ Operating profit Oral, Personal and Home Care North America Latin America Europe Asia Pacific Africa/Eurasia Total Oral, Personal and Home Care Pet Nutrition Corporate Total Operating profit 986 1,162 599 841 179 3,767 653 (831) 3,589 1,030 1,132 579 887 186 3,814 653 974 1,209 615 888 178 3,864 612 (1,687) (630) $ 3,837 S 2.789 (Dollars in Millions Except Share and Per Share Amounts) 2017 2016 1,535 $ 1,480 1,221 403 4,639 4,072 2,218 1,341 1,315 1,411 1,171 441 4,338 3,840 2,107 1,313 188 218 301 224 $ 12,676 $ 12,123 11 $ 13 Assets Current Assets Cash and cash equivalents Receivables (net of allowances of $77 and $73, respectively) Inventories Other current assets Total current assets Property, plant and equipment, net Goodwill Other intangible assets, net Deferred income taxes Other assets Total assets Liabilities and Shareholders' Equity Current Liabilities Notes and loans payable Current portion of long-term debt Accounts payable Accrued income taxes Other accruals Total current liabilities Long-term debt Deferred income taxes Other liabilities Total liabilities Commitments and contingent liabilities Shareholders' Equity Common stock, $1 par value (2,000,000,000 shares authorized, 1,465,706,360 shares issued) Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Unearned compensation Treasury stock, at cost Total Colgate-Palmolive Company shareholders' equity Noncontrolling interests Total equity Total liabilities and equity 1.212 354 1.831 3,408 6,566 204 2,255 12,433 1.124 441 1.727 3,305 6.520 2,035 12.106 1,466 1,984 20.531 (3,855) (5) (20,181) (60) 1,466 1.691 19,922 (4,180) (7) (19,135) (243) 303 260 12.676 S 12.123 Executive Overview Colgate-Palmolive Company (together with its subsidiaries, the "Company" or "Colgate") seeks to deliver strong, consistent business results and superior shareholder returns by providing consumers globally with products that make their lives healthier and more enjoyable. To this end, the Company is tightly focused on two product segments: Oral, Personal and Home Care; and Pet Nutrition. Within these segments, the Company follows a closely defined business strategy to develop and increase market leadership positions in key product categories. These product categories are prioritized based on their capacity to maximize the use of the organization's core competencies and strong global equities and to deliver sustainable long-term growth. Operationally, the Company is organized along geographic lines with management teams having responsibility for the business and financial results in cach region. The Company competes in more than 200 countries and territories worldwide with established businesses in all regions contributing to the Company's sales and profitability. Approximately 75% of the Company's Net sales are generated from markets outside the U.S., with approximately 50% of the Company's Net sales coming from emerging markets (which consist of Latin America, Asia (excluding Japan), Africa/Eurasia and Central Europe). This geographic diversity and balance help to reduce the Company's exposure to business and other risks in any one country or part of the world. The Oral, Personal and Home Care product segment is managed geographically in five reportable operating segments: North America, Latin America, Europe, Asia Pacific and Africa/Eurasia, all of which sell to a variety of retail and wholesale customers and distributors. The Company, through Hill's Pet Nutrition, also competes on a worldwide basis in the pet nutrition market, selling its products principally through authorized pet supply retailers and veterinarians. Many of the Company's products are also sold online through various e-commerce platforms and retailers. On an ongoing basis, management focuses on a variety of key indicators to monitor business health and performance. These indicators include market share, net sales (including volume, pricing and foreign exchange components), organic sales growth (net sales growth excluding, as applicable, the impact of foreign exchange, acquisitions, divestments and the deconsolidation of the Company's Venezuelan operations), a non-GAAP financial measure, and gross profit margin, operating profit, net income and earnings per share, in cach case, on a GAAP and non-GAAP basis, as well as measures used to optimize the management of working capital, capital expenditures, cash flow and return on capital. The monitoring of these indicators and the Company's Code of Conduct and corporate governance practices help to maintain business health and strong internal controls. For additional information regarding non- GAAP financial measures, see "Non-GAAP Financial Measures below. To achieve its business and financial objectives, the Company focuses the organization on initiatives to drive and fund growth. The Company seeks to capture significant opportunities for growth by identifying and meeting consumer needs within its core categories, through its focus on innovation and the deployment of valuable consumer and shopper insights in the development of successful new products regionally, which are then rolled out on a global basis. To enhance these efforts, the Company has developed key initiatives to build strong relationships with consumers, dental and veterinary professionals and retail customers. In addition, the Company has strengthened its capabilities in e-commerce, including by developing its relationships with online-only retailers and enhancing its digital marketing capabilities. Growth opportunities are greater in those areas of the world in which cconomic development and rising consumer incomes expand the size and number of markets for the Company's products. The investments needed to support growth are developed through continuous, Company-wide initiatives to lower costs and increase effective asset utilization. Through these initiatives, which are referred to as the Company's funding-the-growth initiatives, the Company seeks to become even more effective and efficient throughout its businesses. These initiatives are designed to reduce costs associated with direct materials, indirect expenses, distribution and logistics, and advertising and promotional materials, among other things, and encompass a wide range of projects, examples of which include raw material substitution, reduction of packaging materials, consolidating suppliers to leverage volumes and increasing manufacturing efficiency through SKU reductions and formulation simplification. The Company also continues to prioritize its investments toward its higher margin businesses, specifically Oral Care, Personal Care and Pet Nutrition. Operating Profit Operating profit decreased 6% to $3.589 in 2017 from $3.837 in 2016. Operating profit increased 38% to $3.837 in 2016 from $2,789 in 2015. In 2017, 2016 and 2015, Operating profit included charges related to the Global Growth and Efficiency Program. In 2016 and 2015, Operating profit also included charges for litigation matters. In 2016, Operating profit also included a gain on sale of land in Mexico. In 2015, Operating profit also included a charge related to the deconsolidation of the Company's Venezuelan operations, charges related to the Venezuela Remeasurements and a gain on the sale of the Company's laundry detergent business in the South Pacific. Excluding these items in all periods, as applicable, Operating profit decreased 2% in 2017, primarily due to an increase in Selling, general and administrative expenses, which was partially offset by higher Gross profit, and Operating profit in 2016 was even with 2015. primarily due to lower Gross profit, which was offset by a decrease in Selling, general and administrative expenses. Operating profit margin was 23.2% in 2017, compared with 25.3% in 2016 and 17.4% in 2015. Excluding the items described above in 2017 and 2016, as applicable, Operating profit margin decreased 80 bps to 25.4% in 2017 compared to 26.2% in 2016. This decrease is due to an increase in Selling, general and administrative expenses (100 bps), partially offset by an increase in Gross profit (20 bps), both as a percentage of Net sales. Excluding the items described above in 2016 and 2015, as applicable, Operating profit margin increased 130 bps in 2016 compared to 2015. primarily due to an increase in Gross profit (160 bps), partially offset by an increase in Selling, general and administrative expenses (30 bps), both as a percentage of Net sales. 2017 2016 % Change 2015 % Change Operating profit, GAAP $ 3,589 $ 3.837 (6)% = 2.789 Global Growth and Efficiency Program 333 Gain on sale of land in Mexico (97) Charges for litigation matters Venezuela deconsolidation 1,084 Venezuela remeasurement charges Gain on sale of South Pacific laundry detergent business (187) Operating profit, non-GAAP 228 254 $ 3,92 5 3,985 emais 3,98 _-* 15. Segment Information The Company operates in two product segments: Oral, Personal and Home Care; and Pet Nutrition. The operations of the Oral, Personal and Home Care product segment are managed geographically in five reportable operating segments: North America, Latin America, Europe, Asia Pacific and Africa/Eurasia. The Company evaluates segment performance based on several factors, including Operating profit. The Company uses Operating profit as a measure of operating segment performance because it excludes the impact of Corporate-driven decisions related to interest expense and income taxes. The accounting policies of the operating segments are generally the same as those described in Note 2. Summary of Significant Accounting Policies. Intercompany sales have been eliminated. Corporate operations include costs related to stock options and restricted stock units, research and development costs, Corporate overhead costs, restructuring and related implementation costs and gains and losses on sales of non-core product lines and assets. The Company reports these items within Corporate operations as they relate to Corporate-based responsibilities and decisions and are not included in the internal measures of segment operating performance used by the Company to measure the underlying performance of the operating segments. COLGATE-PALMOLIVE COMPANY Notes to Consolidated Financial Statements continued) (Dollars in Millions Except Share and Per Share Amounts) Approximately 75% of the Company's Net sales are generated from markets outside the U.S., with approximately 50% of the Company's Net sales coming from emerging markets (which consist of Latin America, Asia (excluding Japan), Africa/Eurasia and Central Europe). Oral, Personal and Home Care sales to Wal-Mart Stores, Inc. and its affiliates represent approximately 11% of the Company's Net sales in 2017. No other customer represents more than 10% of Net sales. In 2017, Corporate Operating profit (loss) includes charges of $333 resulting from the Global Growth and Efficiency Program. In 2016, Corporate Operating profit (loss) includes charges of $228 resulting from the Global Growth and Efficiency Program and $17 for a litigation matter and a gain of $97 on the sale of land in Mexico. In 2015, Corporate Operating profit (loss) included charges of $1,084 related to the deconsolidation of the Company's Venezuelan operations, $254 related to the Global Growth and Efficiency Program, $34 related to the remeasurement of CP Venezuela's local currency-denominated net monetary assets as a result of effective devaluations and $14 for a litigation matter and a gain of $187 on the sale of the Company's laundry detergent business in the South Pacific. 2017 2016 2015 $ Net sales Oral, Personal and Home Care North America(1) Latin America Europe Asia Pacific Africa/Eurasia Total Oral, Personal and Home Care Pet Nutrition) Total Net sales 3,117 3,887 2,394 2,781 983 13,162 2,292 15,454 3,183 3,650 2,342 2,796 960 12,931 2,264 15,195 3,149 4,327 2.411 2,937 998 13,822 2,212 16,034 $ $ $ (1) 2) Net sales in the U.S. for Oral, Personal and Home Care were $2,865, $2,932 and $2.896 in 2017, 2016 and 2015, respectively. Net sales in the U.S. for Pet Nutrition were $1,246, $1,243 and $1,223 in 2017, 2016 and 2015, respectively. 2017 2016 2015 $ $ Operating profit Oral, Personal and Home Care North America Latin America Europe Asia Pacific Africa/Eurasia Total Oral, Personal and Home Care Pet Nutrition Corporate Total Operating profit 986 1,162 599 841 179 3,767 653 (831) 3,589 1,030 1,132 579 887 186 3,814 653 974 1,209 615 888 178 3,864 612 (1,687) (630) $ 3,837 S 2.789 (Dollars in Millions Except Share and Per Share Amounts) 2017 2016 1,535 $ 1,480 1,221 403 4,639 4,072 2,218 1,341 1,315 1,411 1,171 441 4,338 3,840 2,107 1,313 188 218 301 224 $ 12,676 $ 12,123 11 $ 13 Assets Current Assets Cash and cash equivalents Receivables (net of allowances of $77 and $73, respectively) Inventories Other current assets Total current assets Property, plant and equipment, net Goodwill Other intangible assets, net Deferred income taxes Other assets Total assets Liabilities and Shareholders' Equity Current Liabilities Notes and loans payable Current portion of long-term debt Accounts payable Accrued income taxes Other accruals Total current liabilities Long-term debt Deferred income taxes Other liabilities Total liabilities Commitments and contingent liabilities Shareholders' Equity Common stock, $1 par value (2,000,000,000 shares authorized, 1,465,706,360 shares issued) Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Unearned compensation Treasury stock, at cost Total Colgate-Palmolive Company shareholders' equity Noncontrolling interests Total equity Total liabilities and equity 1.212 354 1.831 3,408 6,566 204 2,255 12,433 1.124 441 1.727 3,305 6.520 2,035 12.106 1,466 1,984 20.531 (3,855) (5) (20,181) (60) 1,466 1.691 19,922 (4,180) (7) (19,135) (243) 303 260 12.676 S 12.123