Answered step by step

Verified Expert Solution

Question

1 Approved Answer

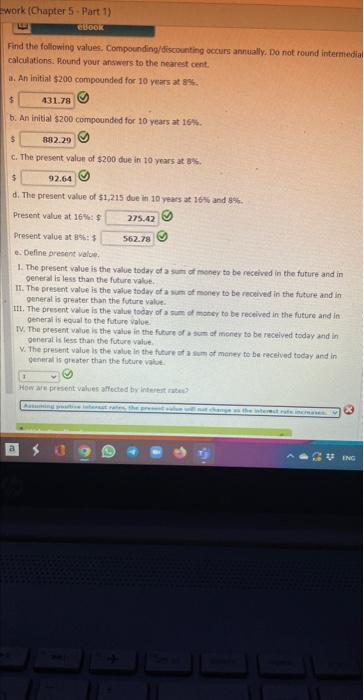

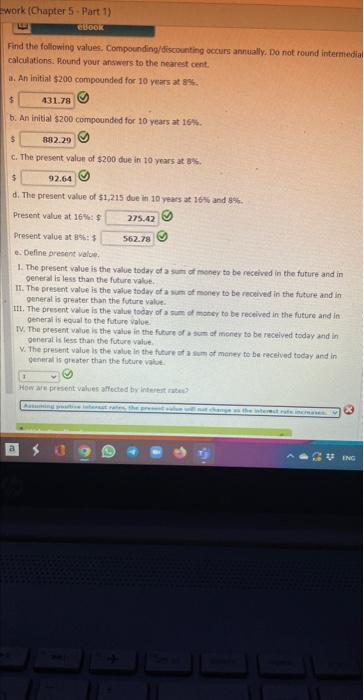

help me finding the answer for the last one Find the foliowing values. Compounding/ciscounting occurs annually, Do not round interetiedial calculations. Pound your answers to

help me finding the answer for the last one

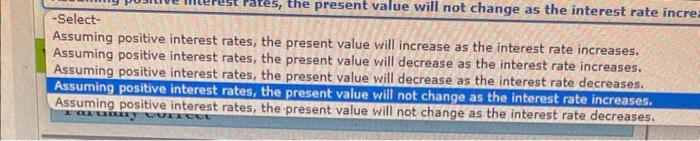

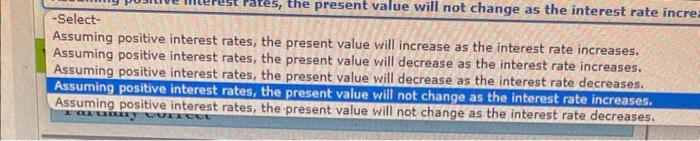

Find the foliowing values. Compounding/ciscounting occurs annually, Do not round interetiedial calculations. Pound your answers to the nearest cent. ii. An initial $200 compounded for 10 yens at 8 for. b. An initial $200 compoundted for 10 years at 16%. 5 C. The present yalun of $200 due in 10 vears at By2. Present value at 16%:5 Present value at geht $ e. Define arecont valioe. 1. The present value is the value today of a surr af moner to be received in the furure and in general is less than the future valoe. II. The present value is the value soday of a surm of miney to be recened in the future and in generat is greater than the future value. III. The present value is the value today of a san of moner to be received in the future and in general is equal to the future value TV. The present value is the value in the fohure of a scme ef meney to be received today and in generatis fess than the future value. V. The present value is the value in the future at a sum of marey to be exceived cocay and in serieral is oreater than the ficure vals. w alE fresent values alfected br intereit rateo? -Select- Assuming positive interest rates, the present value will increase as the interest rate increases. Assuming positive interest rates, the present value will decrease as the interest rate increases. Assuming positive interest rates, the present value will decrease as the interest rate decreases. Assuming positive interest rates, the present value will not change as the interest rate increases. Assuming positive interest rates, the present value will not change as the interest rate decreases. a axaining ve interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started