help me finish up the NPV parts

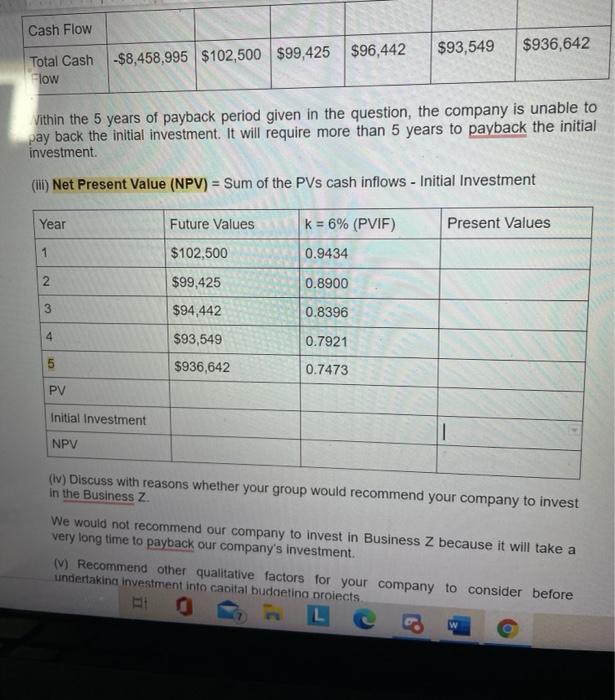

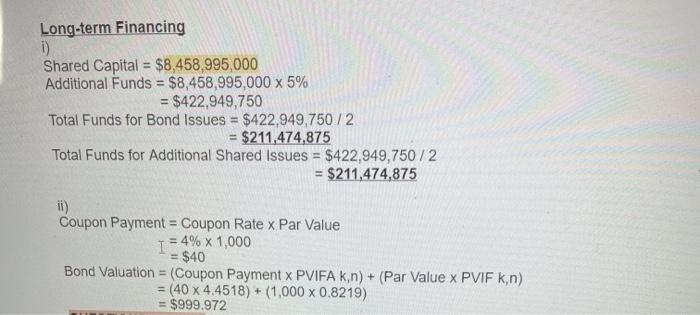

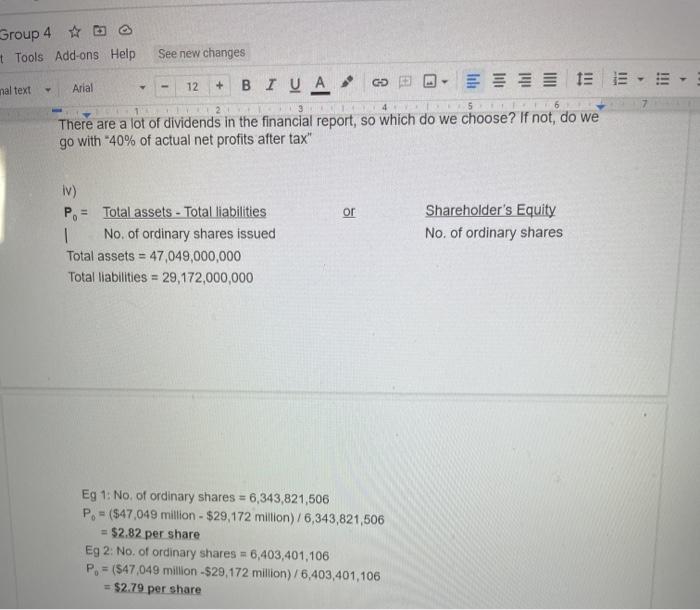

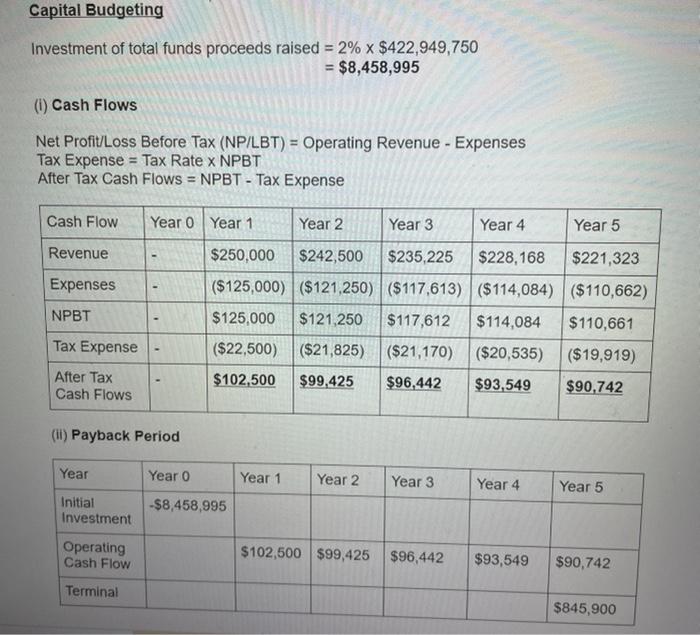

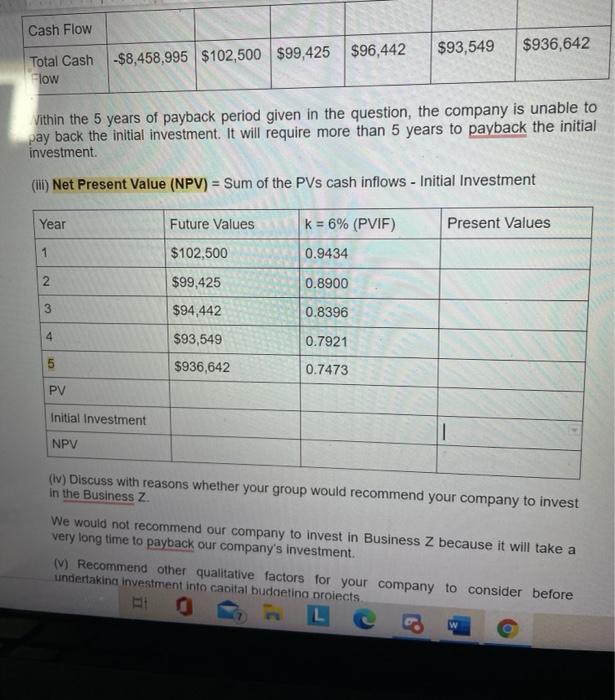

Long-term Financing 1) Shared Capital = $8,458,995,000 Additional Funds = $8,458,995,000 x 5% = $422,949,750 Total Funds for Bond Issues = $422.949,750 / 2 = $211,474,875 Total Funds for Additional Shared Issues = $422,949,750/2 = $211,474,875 11) Coupon Payment = Coupon Rate x Par Value 1 =4% x 1,000 = $40 Bond Valuation = (Coupon Payment x PVIFA k n) + (Par Value x PVIF kn) (40 x 4.4518) + (1.000 x 0.8219) = $999.972 Group 4 + Tools Add-ons Help See new changes Arial IEEE 12 nal text + BIU A GDE 2 3 4 There are a lot of dividends in the financial report, so which do we choose? If not, do we go with 40% of actual net profits after tax" or IV) P. = Total assets - Total liabilities 1 No. of ordinary shares issued Total assets = 47,049,000,000 Total liabilities = 29,172,000,000 Shareholder's Equity No. of ordinary shares Eg 1: No. of ordinary shares = 6,343,821,506 P. - ($47,049 million - $29,172 million)/6,343,821,506 =$2.82 per share Eg 2: No. of ordinary shares = 6,403,401,106 P. - (547,049 million-$29,172 million)/6,403,401,106 = $2.79 per share Capital Budgeting Investment of total funds proceeds raised = 2% x $422,949,750 $8,458,995 (1) Cash Flows Net Profit/Loss Before Tax (NP/LBT) = Operating Revenue - Expenses Tax Expense = Tax Rate x NPBT After Tax Cash Flows = NPBT - Tax Expense Cash Flow Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Expenses NPBT $250,000 $242,500 $235,225 $228,168 $221,323 ($125,000) ($121,250) ($117,613) ($114,084) ($110,662) $125,000 $121,250 $117,612 $114,084 $110,661 ($22,500) ($21,825) ($21,170) ($20,535) ($19,919) $102,500 $99,425 $96,442 $93,549 $90.742 Tax Expense After Tax Cash Flows (11) Payback Period Year Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Initial Investment -$8,458,995 Operating Cash Flow $102,500 $99,425 $96,442 $93,549 $90,742 Terminal $845,900 Cash Flow $93,549 $936,642 Total Cash Flow -$8,458,995 $102,500 $99,425 $96,442 Vithin the 5 years of payback period given in the question, the company is unable to pay back the initial investment. It will require more than 5 years to payback the initial investment (III) Net Present Value (NPV) = Sum of the PVs cash inflows - Initial Investment Year Future Values k = 6% (PVIF) Present Values 1 $102,500 0.9434 2 $99,425 0.8900 3 $94.442 0.8396 4 $93,549 0.7921 5 $936,642 0.7473 PV Initial Investment 1 NPV (Iv) Discuss with reasons whether your group would recommend your company to invest in the Business Z. We would not recommend our company to invest in Business Z because it will take a very long time to payback our company's investment. M Recommend other qualitative factors for your company to consider before undertaking investment into capital budgetina proiects W

help me finish up the NPV parts

help me finish up the NPV parts