Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP ME PLEAS GUYSSS. QUICKK GUYSSS PLSSS Problem 1: (2.5p) The NEMN Co. paid no dividend recently. However, it projected to pay $10 dividend per

HELP ME PLEAS GUYSSS. QUICKK GUYSSS PLSSS

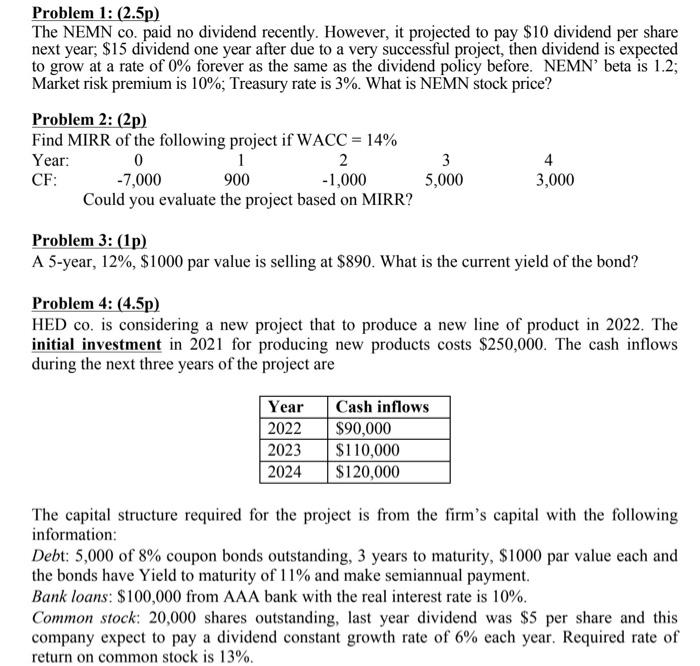

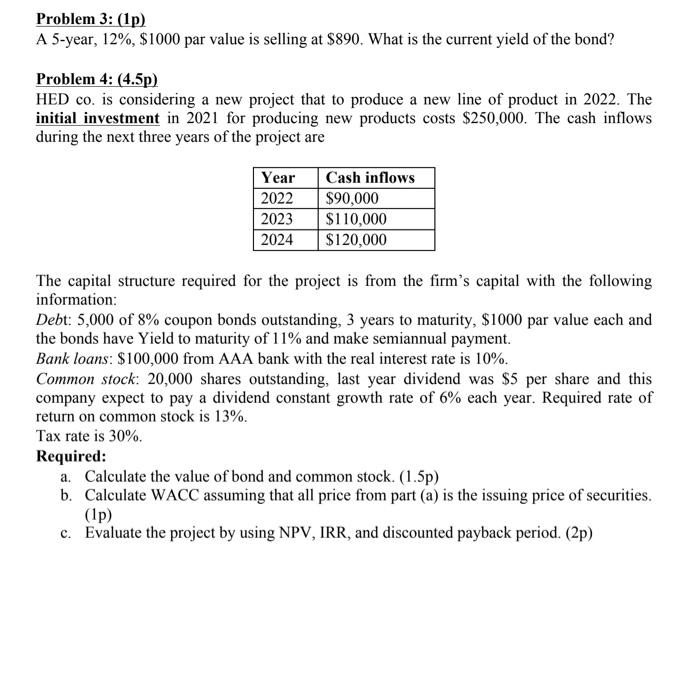

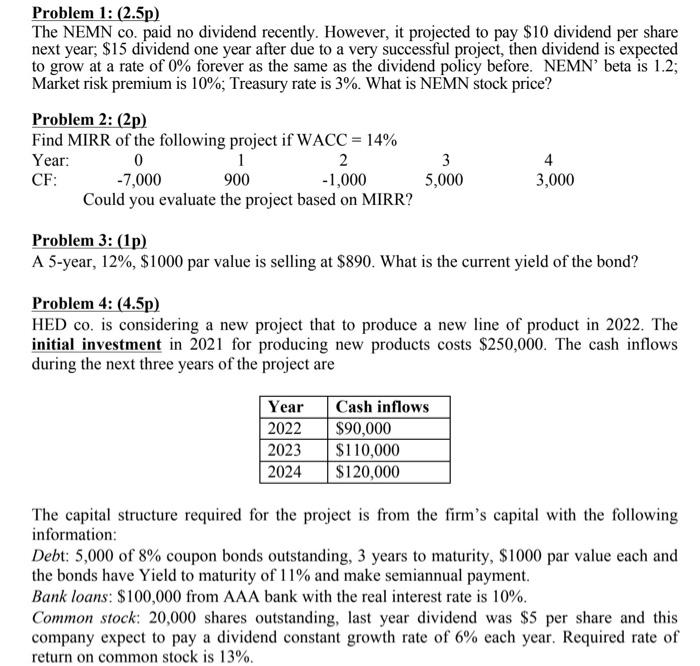

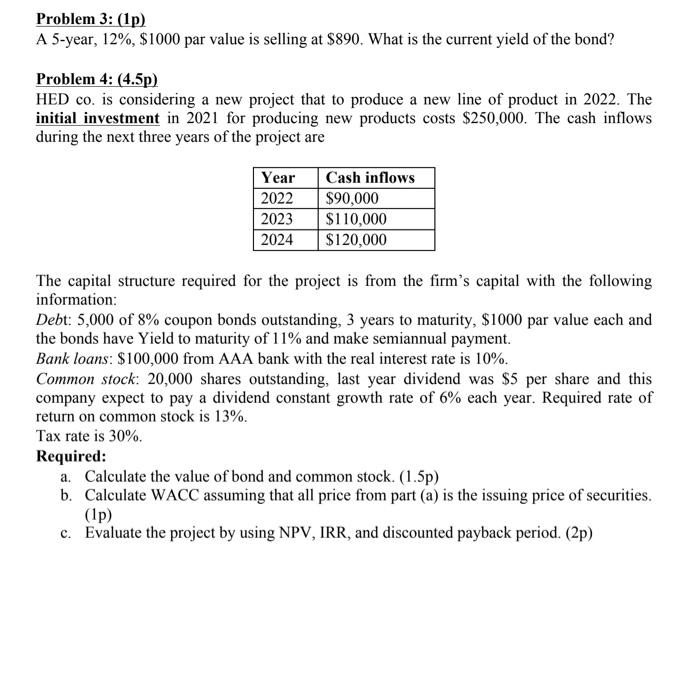

Problem 1: (2.5p) The NEMN Co. paid no dividend recently. However, it projected to pay $10 dividend per share next year; $15 dividend one year after due to a very successful project, then dividend is expected to grow at a rate of 0% forever as the same as the dividend policy before. NEMN' beta is 1.2; Market risk premium is 10%; Treasury rate is 3%. What is NEMN stock price? Problem 2: (2p) Find MIRR of the following project if WACC = 14% Year: 0 1 2 3 4 CF: -7,000 900 -1,000 5,000 3,000 Could you evaluate the project based on MIRR? Problem 3: (10) A 5-year, 12%, $1000 par value is selling at $890. What is the current yield of the bond? Problem 4: (4.5p) HED Co. is considering a new project that to produce a new line of product in 2022. The initial investment in 2021 for producing new products costs $250,000. The cash inflows during the next three years of the project are Year 2022 2023 2024 Cash inflows $90,000 $110,000 $120,000 The capital structure required for the project is from the firm's capital with the following information: Debt: 5,000 of 8% coupon bonds outstanding, 3 years to maturity, $1000 par value each and the bonds have Yield to maturity of 11% and make semiannual payment. Bank loans: $100,000 from AAA bank with the real interest rate is 10%. Common stock: 20,000 shares outstanding, last year dividend was $5 per share and this company expect to pay a dividend constant growth rate of 6% each year. Required rate of return on common stock is 13%. Problem 3: (1p) A 5-year, 12%, $1000 par value is selling at $890. What is the current yield of the bond? Problem 4: (4.5p) HED co. is considering a new project that to produce a new line of product in 2022. The initial investment in 2021 for producing new products costs $250,000. The cash inflows during the next three years of the project are Year 2022 2023 2024 Cash inflows $90,000 $110,000 $120,000 The capital structure required for the project is from the firm's capital with the following information: Debt: 5,000 of 8% coupon bonds outstanding, 3 years to maturity, $1000 par value each and the bonds have Yield to maturity of 11% and make semiannual payment. Bank loans: $100,000 from AAA bank with the real interest rate is 10%. Common stock: 20,000 shares outstanding, last year dividend was $5 per share and this company expect to pay a dividend constant growth rate of 6% each year. Required rate of return on common stock is 13%. Tax rate is 30% Required: a. Calculate the value of bond and common stock. (1.5p) b. Calculate WACC assuming that all price from part (a) is the issuing price of securities. (1p) c. Evaluate the project by using NPV, IRR, and discounted payback period. (2p) Problem 1: (2.5p) The NEMN Co. paid no dividend recently. However, it projected to pay $10 dividend per share next year; $15 dividend one year after due to a very successful project, then dividend is expected to grow at a rate of 0% forever as the same as the dividend policy before. NEMN' beta is 1.2; Market risk premium is 10%; Treasury rate is 3%. What is NEMN stock price? Problem 2: (2p) Find MIRR of the following project if WACC = 14% Year: 0 1 2 3 4 CF: -7,000 900 -1,000 5,000 3,000 Could you evaluate the project based on MIRR? Problem 3: (10) A 5-year, 12%, $1000 par value is selling at $890. What is the current yield of the bond? Problem 4: (4.5p) HED Co. is considering a new project that to produce a new line of product in 2022. The initial investment in 2021 for producing new products costs $250,000. The cash inflows during the next three years of the project are Year 2022 2023 2024 Cash inflows $90,000 $110,000 $120,000 The capital structure required for the project is from the firm's capital with the following information: Debt: 5,000 of 8% coupon bonds outstanding, 3 years to maturity, $1000 par value each and the bonds have Yield to maturity of 11% and make semiannual payment. Bank loans: $100,000 from AAA bank with the real interest rate is 10%. Common stock: 20,000 shares outstanding, last year dividend was $5 per share and this company expect to pay a dividend constant growth rate of 6% each year. Required rate of return on common stock is 13%. Problem 3: (1p) A 5-year, 12%, $1000 par value is selling at $890. What is the current yield of the bond? Problem 4: (4.5p) HED co. is considering a new project that to produce a new line of product in 2022. The initial investment in 2021 for producing new products costs $250,000. The cash inflows during the next three years of the project are Year 2022 2023 2024 Cash inflows $90,000 $110,000 $120,000 The capital structure required for the project is from the firm's capital with the following information: Debt: 5,000 of 8% coupon bonds outstanding, 3 years to maturity, $1000 par value each and the bonds have Yield to maturity of 11% and make semiannual payment. Bank loans: $100,000 from AAA bank with the real interest rate is 10%. Common stock: 20,000 shares outstanding, last year dividend was $5 per share and this company expect to pay a dividend constant growth rate of 6% each year. Required rate of return on common stock is 13%. Tax rate is 30% Required: a. Calculate the value of bond and common stock. (1.5p) b. Calculate WACC assuming that all price from part (a) is the issuing price of securities. (1p) c. Evaluate the project by using NPV, IRR, and discounted payback period. (2p)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started