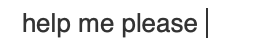

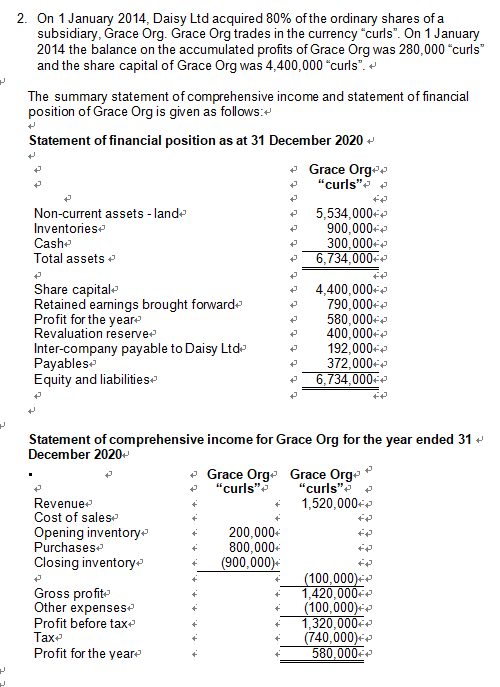

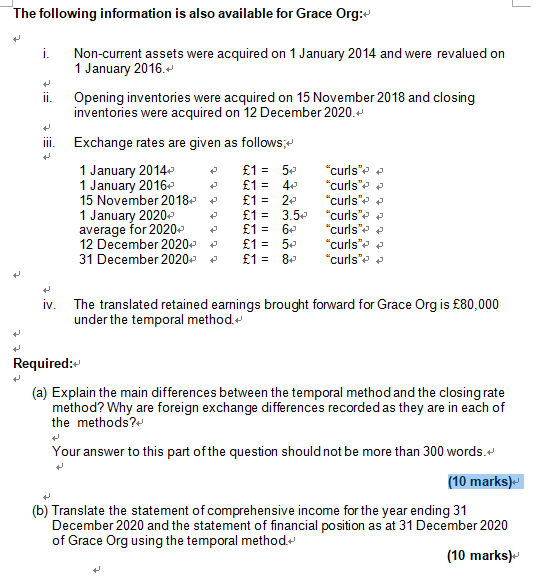

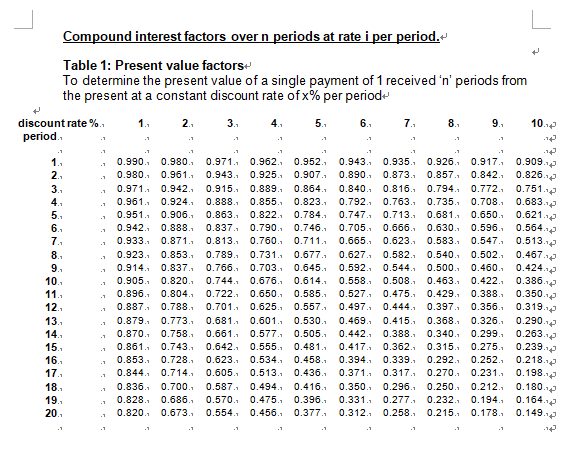

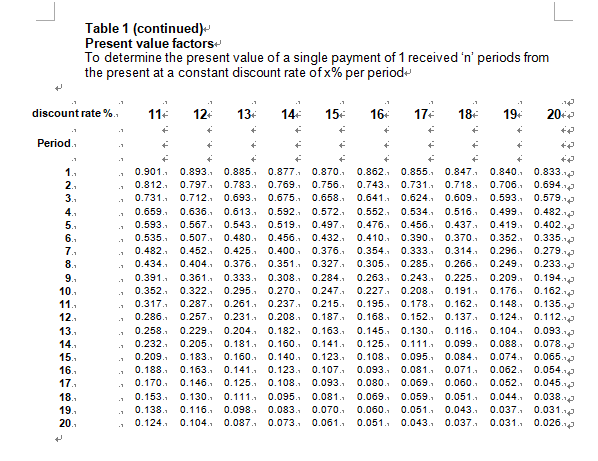

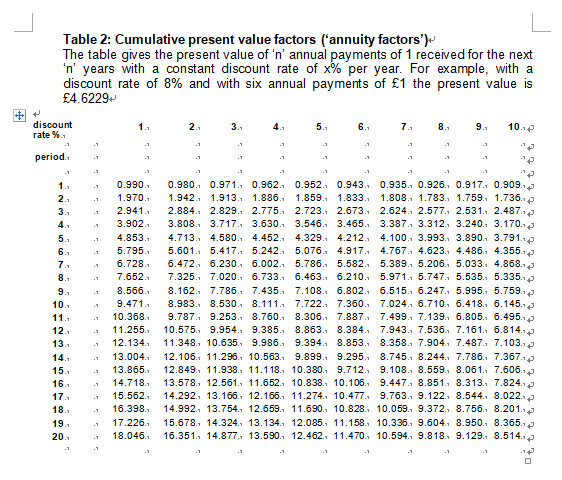

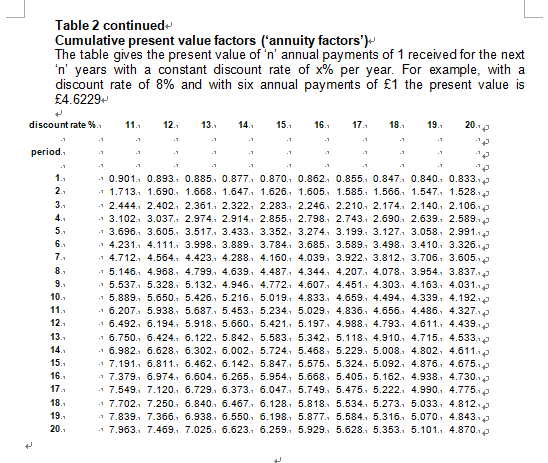

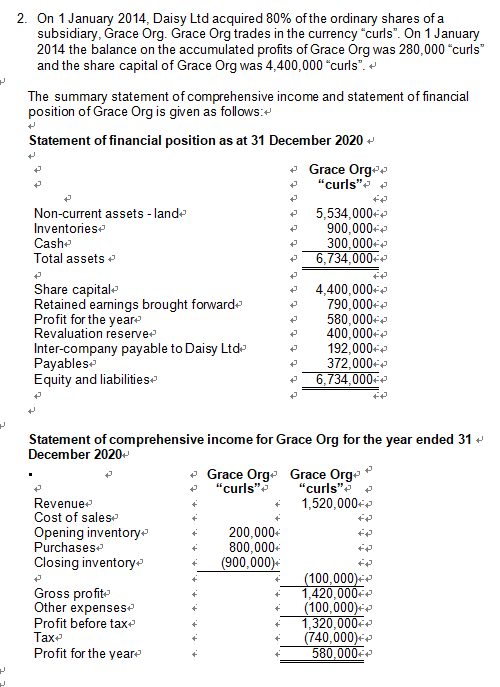

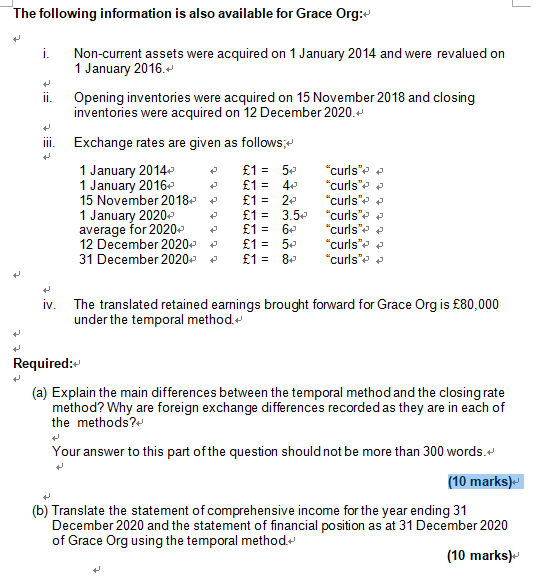

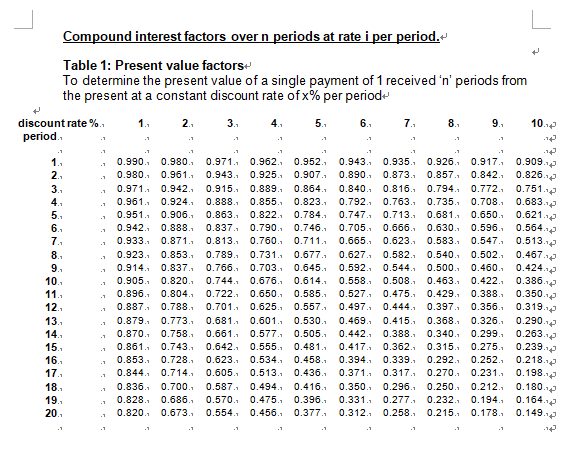

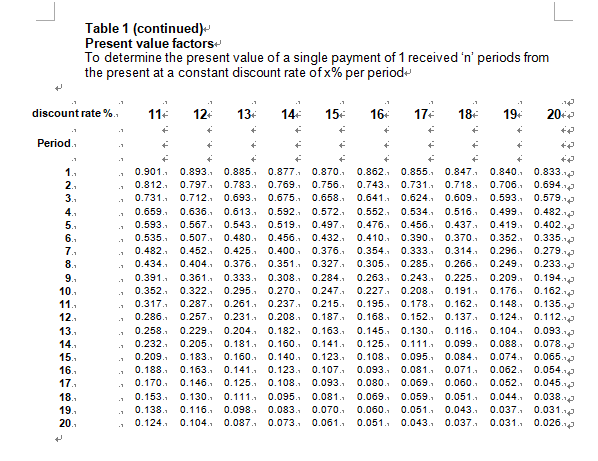

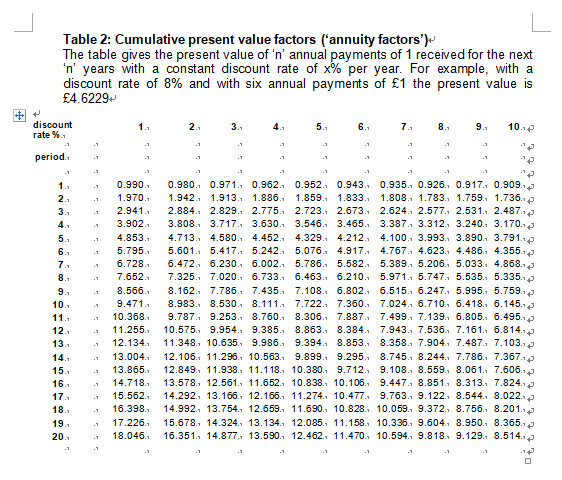

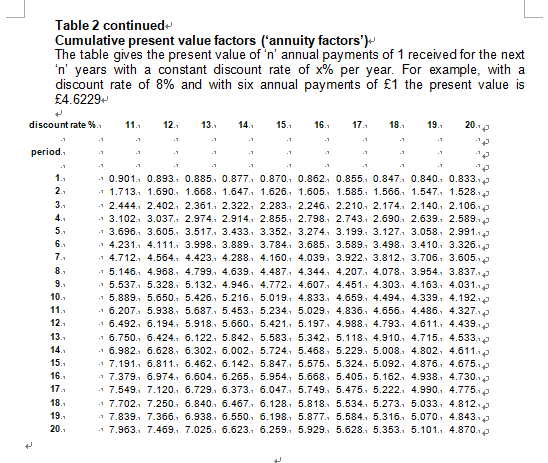

help me please 2. On 1 January 2014, Daisy Ltd acquired 80% of the ordinary shares of a subsidiary, Grace Org. Grace Org trades in the currency "curls". On 1 January 2014 the balance on the accumulated profits of Grace Org was 280,000 "curls and the share capital of Grace Org was 4,400,000 curls". The summary statement of comprehensive income and statement of financial position of Grace Org is given as follows: Statement of financial position as at 31 December 2020 + + Grace Orge + "curls" t t t t t Non-current assets - lande Inventoriese Cashe Total assets + t t 5,534,000++ 900,000++ 300,000++ 6,734,000++ + 4,400,000++ 790,000++ 580,000+ 400,000++ 192,000++ 372,000++ 6,734,000++ Share capitale Retained earnings brought forward Profit for the year Revaluation reserved Inter-company payable to Daisy Ltd Payables Equity and liabilities + t Statement of comprehensive income for Grace Org for the year ended 31 December 2020- + Grace Orge Grace Orge "curls" "curls" Revenue- 1,520,000++ Cost of sales + Opening inventory 200,000+ +2 Purchases 800,000+ Closing inventory (900,000) (100,000++ Gross profit- 1,420,000++ Other expenses (100,000) Profit before taxe 1,320,000++ Taxe (740,000)++ Profit for the year 580,000++ The following information is also available for Grace Org: i. + ii. + t Non-current assets were acquired on 1 January 2014 and were revalued on 1 January 2016 Opening inventories were acquired on 15 November 2018 and closing inventories were acquired on 12 December 2020. Exchange rates are given as follows: 1 January 2014 1 = 52 "curls" 1 January 2016 1 = 42 "curls" 15 November 2018 - 1 = 24 "curls" 1 January 2020- 1 = 3.5e "curls" e average for 2020- 1 = 6 "curls" 12 December 2020- 1 = 54 "curls" 31 December 2020- 1 = 84 "curls" t + iv. The translated retained earnings brought forward for Grace Org is 80,000 under the temporal method t Required: t (a) Explain the main differences between the temporal method and the closing rate method? Why are foreign exchange differences recorded as they are in each of the methods? Your answer to this part of the question should not be more than 300 words.' (10 marks) (b) Translate the statement of comprehensive income for the year ending 31 December 2020 and the statement of financial position as at 31 December 2020 of Grace Org using the temporal method.- (10 marks) Compound interest factors over n periods at rate i per period. Table 1: Present value factors To determine the present value of a single payment of 1 received 'n' periods from the present at a constant discount rate ofx% per periode discount rate %. period 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. .1 .1 1.. 2. 3. 4. 5. 6. 7. 8. 9. 10. . 0.990 0.980. 0.980, 0.961., 0.971., 0.942. 0.961., 0.924. 0.951., 0.906. 0.942. 0.888. 0.933. 0.871.. 0.923. 0.853. 0.914. 0.837. 0.905. 0.820. 0.896. 0.804.. 0.887 0.788. 0.879 0.773. 0.870.0.758. 0.861 0.743. 0.853 0.728. 0.844.0.714 0.836. 0.700. 0.828. 0.686. 0.820. 0.673. 0.971 0.962. 0.952. 0.943. 0.935., 0.926., 0.917. 0.909. 0.943. 0.925. 0.907. 0.890. 0.873. 0.857., 0.842 0.826.14 0.915. 0.889. 0.864 0.840. 0.816. 0.794. 0.772 0.751.14 0.8881 0.855. 0.823. 0.792.0.763. 0.735. 0.708. 0.683.14 0.863. 0.822. 0.784.. 0.747, 0.713. 0.681., 0.650. 0.621.2 0.837. 0.790. 0.746.. 0.705. 0.666. 0.630. 0.596, 0.564.12 0.813. 0.760. 0.711.. 0.665. 0.623 0.583 0.547, 0.513.12 0.789. 0.731, 0.677.1 0.627 0.582 0.540 0.502. 0.467. 0.766. 0.703. 0.645.. 0.592.0.544. 0.500. 0.460. 0.424. 0.744 0.676. 0.614.. 0.558 0.508. 0.463, 0.422 0.3861 0.722. 0.650. 0.585.. 0.527 0.475, 0.429 0.388. 0.350.42 0.701. 0.625. 0.557. 0.497., 0.444.. 0.397., 0.356. 0.319.10 0.681. 0.601. 0.530. 0.469. 0.415. 0.368 0.326. 0.290 12 0.661.1 0.577., 0.505. 0.442. 0.388. 0.340. 0.299 0.263.10 0.642. 0.555. 0.481, 0.417 0.362 0.315. 0.275. 0.239. 0.623. 0.534. 0.458. 0.394 0.339.0.292 0.252 0.218. 0.605. 0.513 0.436. 0.371., 0.317, 0.270. 0.231.. 0.198.1 0.587. 0.494. 0.416. 0.350. 0.296, 0.250 0.212 0.180.14 0.570. 0.475. 0.396.. 0.331 0.277 0.232 0.194 0.164.14 0.554 0.456. 0.377, 0.312. 0.258. 0.215. 0.178. 0.149. 11. . 12. 13. 14. 15. 16. 17. 18. 19. 20. .1 .1 + Table 1 (continued) Present value factors To determine the present value of a single payment of 1 received 'n' periods from the present at a constant discount rate ofx% per periode . discount rate % 11: 127 131 14 15 16 17 18+ + + + + + Period. t. . 1. 2. 3. .1 0.579 . .1 . 5. 6. 7. 8. . 19+ 20-2 +2 + 0.840 0.833. 0.706. 0.694.12 0.5931 0.499 0.482 0.419. 0.4022 0.352 0.335.4 0.296 0.279. 0.249.0.233. 0.209. 0.194.12 0.176.0.162.14 0.148 0.135. 0.124 0.112. 0.104, 0.093.1 0.088, 0.078.12 0.074, 0.065 0.062, 0.054. 0.052, 0.045 0.044, 0.038. 0.037 0.031.12 0.031 0.026.12 9. + + + + + + 0.901, 0.893. 0.885. 0.877. 0.870. 0.862 0.855. 0.847. 0.812. 0.797., 0.783. 0.769 0.756.. 0.743. 0.731.. 0.718. 0.731. 0.712. 0.693. 0.675 0.658. 0.641. 0.624. 0.609. 0.659. 0.636. 0.613. 0.592. 0.572. 0.552. 0.534, 0.516., 0.593 0.567, 0.543. 0.519. 0.497.. 0.476. 0.456. 0.437. 0.535. 0.507. 0.480. 0.456. 0.432. 0.410. 0.390.0.370.. 0.482 0.452. 0.425. 0.400 0.376.. 0.354. 0.333. 0.314.. 0.4341 0.404. 0.376. 0.351., 0.327. 0.305. 0.285. 0.266. 0.391 0.361, 0.333 0.308. 0.284.. 0.263. 0.243. 0.225. 0.352 0.322 0.295. 0.270, 0.247. 0.227. 0.208. 0.191.2 0.317., 0.287, 0.261.. 0.237 0.215. 0.195. 0.178.0.162 0.286 0.257 0.231, 0.208. 0.187. 0.168. 0.152 0.137 0.258. 0.229. 0.204. 0.182. 0.163. 0.145. 0.130. 0.116. 0.2321 0.205. 0.181 0.160. 0.141.. 0.125. 0.111., 0.099. 0.209 0.183. 0.160. 0.140 0.123. 0.108. 0.095, 0.084. 0.188. 0.163. 0.141. 0.123. 0.107. 0.093 0.081, 0.071.. 0.170. 0.146. 0.125 0.108. 0.093. 0.080. 0.069. 0.060.. 0.153 0.130 0.111., 0.095. 0.081 0.069. 0.059., 0.051, 0.138. 0.116. 0.098. 0.083. 0.070. 0.060, 0.051, 0.043.. 0.124 0.104. 0.087, 0.073. 0.061.. 0.051. 0.043. 0.037.. . . 10. 11.. 12. 13. 14. . . 15 16 17. . 18. 19. .1 20. . Table 2: Cumulative present value factors ('annuity factors')- The table gives the present value of 'n' annual payments of 1 received for the next 'n' years with a constant discount rate of x% per year. For example, with a discount rate of 8% and with six annual payments of 1 the present value is 4.62292 discount rate % 2. 3. 4. 5. 6. 7. 8. 9. 10.1 period. . . .1 . 1. 2. 3. 4. 5. 6. 7, 8. .1 .1 0.990.- 1.970 2.941. 3.902 4.853 5.795 6.7281 7.652. 8.566 9.471 10.368. 11.255. 12.134 13.004. 13.865 14.718. 15.562. 16.398. 17.226. 18.046 10. 11. 12. 13. 14. 15. 16. 17. 0.980. 0.971., 0.962., 0.952, 0.943. 0.935. 0.926., 0.917., 0.909.12 1.942., 1.913. 1.886. 1.859. 1.833.1 1.808.. 1.783. 1.759 1.736 2.884.. 2.829. 2.775., 2.723. 2.673.1 2.624.. 2.577., 2.531.. 2.487.1 3.808. 3.717., 3.630., 3.546.. 3.465.. 3.387.. 3.312., 3.240.. 3.170.12 4.713. 4.580. 4.452., 4.329.. 4.212. 4.100.. 3.993., 3.890.. 3.791.1 5.601.. 5.417., 5.242., 5.076.. 4.917., 4.767., 4.623., 4.486., 4.355.1 6.472.. 6.230. 6.002., 5.786., 5.582., 5.389. 5.206., 5.033., 4.868.12 7.325., 7.020. 6.733.. 6.463.. 6.210. 5.971., 5.747., 5.535., 5.335.12 8.162., 7.786., 7.435. 7.108. 6.802.. 6.515., 6.247. 5.995. 5.759. 8.983. 8.530. 8.111., 7.722., 7.360. 7.024.. 6.710.. 6.418., 6.145.1 9.787., 9.253., 8.760.. 8.306.. 7.887, 7.499.. 7.139., 6.805., 6.495.1 10.575., 9.954. 9.385., 8.863., 8.384., 7.943. 7.536., 7.161.. 6.814.12 11.348. 10.635., 9.986., 9.394., 8.853. 8.358. 7.904., 7.487., 7.103.12 12.106.. 11.295. 10.563. 9.899., 9.295., 8.745., 8.244., 7.786., 7.367.12 12.849., 11.938., 11.1 18. 10.380. 9.712.. 9.108. 8.559, 8.061.. 7.606.12 13.578., 12.561.. 11.652., 10.838.. 10.106. 9.447., 8.851., 8.313.. 7.824.12 14.292.. 13.166., 12.166.. 11.274.. 10.477., 9.763. 9.122. 8.544., 8.02.12 14.992., 13.754. 12.659., 11.690., 10.828. 10.059. 9.372.. 8.756., 8.201.12 15.678.. 14.324.. 13.134., 12.085., 11.158. 10.336. 9.504., 8.950., 8.365.1 16.351.. 14.877., 13.590., 12.462., 11.470. 10.594. 9.818., 9.129.. 8.514.12 .1 .1 18.1 .1 19. 20. . Table 2 continued Cumulative present value factors ('annuity factors') The table gives the present value of 'n' annual payments of 1 received for the next 'n' years with a constant discount rate of x% per year. For example, with a discount rate of 8% and with six annual payments of 1 the present value is 4.6229 t discount rate % 11. 12. 13. 14 15. 16. 17. 18. 19. 2012 period. .1 .1 1.. 2. 3. 5. 6.1 7.1 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. - 0.901., 0.893. 0.885., 0.877., 0.870. 0.862.. 0.855., 0.847., 0.840., 0.833.1 - 1.713. 1.690. 1.668.. 1.647., 1.626. 1.605.. 1.585., 1.566., 1.547., 1.528.12 .- 2.444.. 2.402.. 2.361.. 2.322.. 2.283.. 2.246.. 2.210. 2.174. 2.140.. 2.106.14 - 3.102., 3.037.. 2.974., 2.914.. 2.855. 2.798. 2.743., 2.690. 2.639. 2.589.1 - 3.696. 3.605. 3.517., 3.433. 3.352.. 3.274., 3.199.. 3.127., 3.058.. 2.991.1 .1 4.231.. 4.111.. 3.998. 3.889. 3.784. 3.685., 3.589.. 3.498. 3.410.. 3.326.1 .1 4.712., 4.564.. 4.423., 4.288., 4.160. 4.039., 3.922.. 3.812., 3.706., 3.605.1 - 5.146., 4.968., 4.799., 4.639. 4.487., 4.344., 4.207., 4.078. 3.954., 3.837.1 . 5.537, 5.328. 5.132., 4.946. 4.772., 4.607., 4.451., 4.303., 4.163., 4.031.12 - 5.889. 5.650. 5.426.. 5.216., 5.019. 4.833., 4.659.. 4.494. 4.339. 4.192.1 .- 6.207., 5.938. 5.687., 5.453., 5.234. 5.029., 4.836., 4.656., 4.486., 4.327.12 .- 6.492.. 6.194., 5.918. 5.660.. 5.421.. 5.197.. 4.988., 4.793., 4.611.. 4.439. .- 6.750. 6.424.. 6.122., 5.842., 5.583. 5.342., 5.118., 4.910. 4.715., 4.533.1 ... 5.982., 6.628. 6.302.. 6.002., 5.724. 5.468. 5.229. 5.008. 4.802., 4.511.12 - 7.191.. 6.811.. 6.462.. 6.142., 5.847., 5.575., 5.324., 5.092., 4.876., 4.675.1 - 7.379., 6.974., 6.604., 6.265. 5.954. 5.668. 5.405., 5.162., 4.938., 4.730.12 - 7.549. 7.120. 6.729. 6.373., 6.047., 5.749., 5.475., 5.222., 4.990., 4.775.1 - 7.702.. 7.250. 6.840. 6.467., 6.128. 5.818. 5.534., 5.273. 5.033., 4.8121 - 7.839. 7.366. 6.938. 6.550. 6.198. 5.877.. 5.584., 5.316. 5.070.. 4.843.12 - 7.963. 7.469. 7.025., 6.623., 6.259. 5.929., 5.628. 5.353. 5.101.. 4.870.14 help me please 2. On 1 January 2014, Daisy Ltd acquired 80% of the ordinary shares of a subsidiary, Grace Org. Grace Org trades in the currency "curls". On 1 January 2014 the balance on the accumulated profits of Grace Org was 280,000 "curls and the share capital of Grace Org was 4,400,000 curls". The summary statement of comprehensive income and statement of financial position of Grace Org is given as follows: Statement of financial position as at 31 December 2020 + + Grace Orge + "curls" t t t t t Non-current assets - lande Inventoriese Cashe Total assets + t t 5,534,000++ 900,000++ 300,000++ 6,734,000++ + 4,400,000++ 790,000++ 580,000+ 400,000++ 192,000++ 372,000++ 6,734,000++ Share capitale Retained earnings brought forward Profit for the year Revaluation reserved Inter-company payable to Daisy Ltd Payables Equity and liabilities + t Statement of comprehensive income for Grace Org for the year ended 31 December 2020- + Grace Orge Grace Orge "curls" "curls" Revenue- 1,520,000++ Cost of sales + Opening inventory 200,000+ +2 Purchases 800,000+ Closing inventory (900,000) (100,000++ Gross profit- 1,420,000++ Other expenses (100,000) Profit before taxe 1,320,000++ Taxe (740,000)++ Profit for the year 580,000++ The following information is also available for Grace Org: i. + ii. + t Non-current assets were acquired on 1 January 2014 and were revalued on 1 January 2016 Opening inventories were acquired on 15 November 2018 and closing inventories were acquired on 12 December 2020. Exchange rates are given as follows: 1 January 2014 1 = 52 "curls" 1 January 2016 1 = 42 "curls" 15 November 2018 - 1 = 24 "curls" 1 January 2020- 1 = 3.5e "curls" e average for 2020- 1 = 6 "curls" 12 December 2020- 1 = 54 "curls" 31 December 2020- 1 = 84 "curls" t + iv. The translated retained earnings brought forward for Grace Org is 80,000 under the temporal method t Required: t (a) Explain the main differences between the temporal method and the closing rate method? Why are foreign exchange differences recorded as they are in each of the methods? Your answer to this part of the question should not be more than 300 words.' (10 marks) (b) Translate the statement of comprehensive income for the year ending 31 December 2020 and the statement of financial position as at 31 December 2020 of Grace Org using the temporal method.- (10 marks) Compound interest factors over n periods at rate i per period. Table 1: Present value factors To determine the present value of a single payment of 1 received 'n' periods from the present at a constant discount rate ofx% per periode discount rate %. period 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. .1 .1 1.. 2. 3. 4. 5. 6. 7. 8. 9. 10. . 0.990 0.980. 0.980, 0.961., 0.971., 0.942. 0.961., 0.924. 0.951., 0.906. 0.942. 0.888. 0.933. 0.871.. 0.923. 0.853. 0.914. 0.837. 0.905. 0.820. 0.896. 0.804.. 0.887 0.788. 0.879 0.773. 0.870.0.758. 0.861 0.743. 0.853 0.728. 0.844.0.714 0.836. 0.700. 0.828. 0.686. 0.820. 0.673. 0.971 0.962. 0.952. 0.943. 0.935., 0.926., 0.917. 0.909. 0.943. 0.925. 0.907. 0.890. 0.873. 0.857., 0.842 0.826.14 0.915. 0.889. 0.864 0.840. 0.816. 0.794. 0.772 0.751.14 0.8881 0.855. 0.823. 0.792.0.763. 0.735. 0.708. 0.683.14 0.863. 0.822. 0.784.. 0.747, 0.713. 0.681., 0.650. 0.621.2 0.837. 0.790. 0.746.. 0.705. 0.666. 0.630. 0.596, 0.564.12 0.813. 0.760. 0.711.. 0.665. 0.623 0.583 0.547, 0.513.12 0.789. 0.731, 0.677.1 0.627 0.582 0.540 0.502. 0.467. 0.766. 0.703. 0.645.. 0.592.0.544. 0.500. 0.460. 0.424. 0.744 0.676. 0.614.. 0.558 0.508. 0.463, 0.422 0.3861 0.722. 0.650. 0.585.. 0.527 0.475, 0.429 0.388. 0.350.42 0.701. 0.625. 0.557. 0.497., 0.444.. 0.397., 0.356. 0.319.10 0.681. 0.601. 0.530. 0.469. 0.415. 0.368 0.326. 0.290 12 0.661.1 0.577., 0.505. 0.442. 0.388. 0.340. 0.299 0.263.10 0.642. 0.555. 0.481, 0.417 0.362 0.315. 0.275. 0.239. 0.623. 0.534. 0.458. 0.394 0.339.0.292 0.252 0.218. 0.605. 0.513 0.436. 0.371., 0.317, 0.270. 0.231.. 0.198.1 0.587. 0.494. 0.416. 0.350. 0.296, 0.250 0.212 0.180.14 0.570. 0.475. 0.396.. 0.331 0.277 0.232 0.194 0.164.14 0.554 0.456. 0.377, 0.312. 0.258. 0.215. 0.178. 0.149. 11. . 12. 13. 14. 15. 16. 17. 18. 19. 20. .1 .1 + Table 1 (continued) Present value factors To determine the present value of a single payment of 1 received 'n' periods from the present at a constant discount rate ofx% per periode . discount rate % 11: 127 131 14 15 16 17 18+ + + + + + Period. t. . 1. 2. 3. .1 0.579 . .1 . 5. 6. 7. 8. . 19+ 20-2 +2 + 0.840 0.833. 0.706. 0.694.12 0.5931 0.499 0.482 0.419. 0.4022 0.352 0.335.4 0.296 0.279. 0.249.0.233. 0.209. 0.194.12 0.176.0.162.14 0.148 0.135. 0.124 0.112. 0.104, 0.093.1 0.088, 0.078.12 0.074, 0.065 0.062, 0.054. 0.052, 0.045 0.044, 0.038. 0.037 0.031.12 0.031 0.026.12 9. + + + + + + 0.901, 0.893. 0.885. 0.877. 0.870. 0.862 0.855. 0.847. 0.812. 0.797., 0.783. 0.769 0.756.. 0.743. 0.731.. 0.718. 0.731. 0.712. 0.693. 0.675 0.658. 0.641. 0.624. 0.609. 0.659. 0.636. 0.613. 0.592. 0.572. 0.552. 0.534, 0.516., 0.593 0.567, 0.543. 0.519. 0.497.. 0.476. 0.456. 0.437. 0.535. 0.507. 0.480. 0.456. 0.432. 0.410. 0.390.0.370.. 0.482 0.452. 0.425. 0.400 0.376.. 0.354. 0.333. 0.314.. 0.4341 0.404. 0.376. 0.351., 0.327. 0.305. 0.285. 0.266. 0.391 0.361, 0.333 0.308. 0.284.. 0.263. 0.243. 0.225. 0.352 0.322 0.295. 0.270, 0.247. 0.227. 0.208. 0.191.2 0.317., 0.287, 0.261.. 0.237 0.215. 0.195. 0.178.0.162 0.286 0.257 0.231, 0.208. 0.187. 0.168. 0.152 0.137 0.258. 0.229. 0.204. 0.182. 0.163. 0.145. 0.130. 0.116. 0.2321 0.205. 0.181 0.160. 0.141.. 0.125. 0.111., 0.099. 0.209 0.183. 0.160. 0.140 0.123. 0.108. 0.095, 0.084. 0.188. 0.163. 0.141. 0.123. 0.107. 0.093 0.081, 0.071.. 0.170. 0.146. 0.125 0.108. 0.093. 0.080. 0.069. 0.060.. 0.153 0.130 0.111., 0.095. 0.081 0.069. 0.059., 0.051, 0.138. 0.116. 0.098. 0.083. 0.070. 0.060, 0.051, 0.043.. 0.124 0.104. 0.087, 0.073. 0.061.. 0.051. 0.043. 0.037.. . . 10. 11.. 12. 13. 14. . . 15 16 17. . 18. 19. .1 20. . Table 2: Cumulative present value factors ('annuity factors')- The table gives the present value of 'n' annual payments of 1 received for the next 'n' years with a constant discount rate of x% per year. For example, with a discount rate of 8% and with six annual payments of 1 the present value is 4.62292 discount rate % 2. 3. 4. 5. 6. 7. 8. 9. 10.1 period. . . .1 . 1. 2. 3. 4. 5. 6. 7, 8. .1 .1 0.990.- 1.970 2.941. 3.902 4.853 5.795 6.7281 7.652. 8.566 9.471 10.368. 11.255. 12.134 13.004. 13.865 14.718. 15.562. 16.398. 17.226. 18.046 10. 11. 12. 13. 14. 15. 16. 17. 0.980. 0.971., 0.962., 0.952, 0.943. 0.935. 0.926., 0.917., 0.909.12 1.942., 1.913. 1.886. 1.859. 1.833.1 1.808.. 1.783. 1.759 1.736 2.884.. 2.829. 2.775., 2.723. 2.673.1 2.624.. 2.577., 2.531.. 2.487.1 3.808. 3.717., 3.630., 3.546.. 3.465.. 3.387.. 3.312., 3.240.. 3.170.12 4.713. 4.580. 4.452., 4.329.. 4.212. 4.100.. 3.993., 3.890.. 3.791.1 5.601.. 5.417., 5.242., 5.076.. 4.917., 4.767., 4.623., 4.486., 4.355.1 6.472.. 6.230. 6.002., 5.786., 5.582., 5.389. 5.206., 5.033., 4.868.12 7.325., 7.020. 6.733.. 6.463.. 6.210. 5.971., 5.747., 5.535., 5.335.12 8.162., 7.786., 7.435. 7.108. 6.802.. 6.515., 6.247. 5.995. 5.759. 8.983. 8.530. 8.111., 7.722., 7.360. 7.024.. 6.710.. 6.418., 6.145.1 9.787., 9.253., 8.760.. 8.306.. 7.887, 7.499.. 7.139., 6.805., 6.495.1 10.575., 9.954. 9.385., 8.863., 8.384., 7.943. 7.536., 7.161.. 6.814.12 11.348. 10.635., 9.986., 9.394., 8.853. 8.358. 7.904., 7.487., 7.103.12 12.106.. 11.295. 10.563. 9.899., 9.295., 8.745., 8.244., 7.786., 7.367.12 12.849., 11.938., 11.1 18. 10.380. 9.712.. 9.108. 8.559, 8.061.. 7.606.12 13.578., 12.561.. 11.652., 10.838.. 10.106. 9.447., 8.851., 8.313.. 7.824.12 14.292.. 13.166., 12.166.. 11.274.. 10.477., 9.763. 9.122. 8.544., 8.02.12 14.992., 13.754. 12.659., 11.690., 10.828. 10.059. 9.372.. 8.756., 8.201.12 15.678.. 14.324.. 13.134., 12.085., 11.158. 10.336. 9.504., 8.950., 8.365.1 16.351.. 14.877., 13.590., 12.462., 11.470. 10.594. 9.818., 9.129.. 8.514.12 .1 .1 18.1 .1 19. 20. . Table 2 continued Cumulative present value factors ('annuity factors') The table gives the present value of 'n' annual payments of 1 received for the next 'n' years with a constant discount rate of x% per year. For example, with a discount rate of 8% and with six annual payments of 1 the present value is 4.6229 t discount rate % 11. 12. 13. 14 15. 16. 17. 18. 19. 2012 period. .1 .1 1.. 2. 3. 5. 6.1 7.1 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. - 0.901., 0.893. 0.885., 0.877., 0.870. 0.862.. 0.855., 0.847., 0.840., 0.833.1 - 1.713. 1.690. 1.668.. 1.647., 1.626. 1.605.. 1.585., 1.566., 1.547., 1.528.12 .- 2.444.. 2.402.. 2.361.. 2.322.. 2.283.. 2.246.. 2.210. 2.174. 2.140.. 2.106.14 - 3.102., 3.037.. 2.974., 2.914.. 2.855. 2.798. 2.743., 2.690. 2.639. 2.589.1 - 3.696. 3.605. 3.517., 3.433. 3.352.. 3.274., 3.199.. 3.127., 3.058.. 2.991.1 .1 4.231.. 4.111.. 3.998. 3.889. 3.784. 3.685., 3.589.. 3.498. 3.410.. 3.326.1 .1 4.712., 4.564.. 4.423., 4.288., 4.160. 4.039., 3.922.. 3.812., 3.706., 3.605.1 - 5.146., 4.968., 4.799., 4.639. 4.487., 4.344., 4.207., 4.078. 3.954., 3.837.1 . 5.537, 5.328. 5.132., 4.946. 4.772., 4.607., 4.451., 4.303., 4.163., 4.031.12 - 5.889. 5.650. 5.426.. 5.216., 5.019. 4.833., 4.659.. 4.494. 4.339. 4.192.1 .- 6.207., 5.938. 5.687., 5.453., 5.234. 5.029., 4.836., 4.656., 4.486., 4.327.12 .- 6.492.. 6.194., 5.918. 5.660.. 5.421.. 5.197.. 4.988., 4.793., 4.611.. 4.439. .- 6.750. 6.424.. 6.122., 5.842., 5.583. 5.342., 5.118., 4.910. 4.715., 4.533.1 ... 5.982., 6.628. 6.302.. 6.002., 5.724. 5.468. 5.229. 5.008. 4.802., 4.511.12 - 7.191.. 6.811.. 6.462.. 6.142., 5.847., 5.575., 5.324., 5.092., 4.876., 4.675.1 - 7.379., 6.974., 6.604., 6.265. 5.954. 5.668. 5.405., 5.162., 4.938., 4.730.12 - 7.549. 7.120. 6.729. 6.373., 6.047., 5.749., 5.475., 5.222., 4.990., 4.775.1 - 7.702.. 7.250. 6.840. 6.467., 6.128. 5.818. 5.534., 5.273. 5.033., 4.8121 - 7.839. 7.366. 6.938. 6.550. 6.198. 5.877.. 5.584., 5.316. 5.070.. 4.843.12 - 7.963. 7.469. 7.025., 6.623., 6.259. 5.929., 5.628. 5.353. 5.101.. 4.870.14