Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me please by creating theses: D) Pro forma balance sheet E)Pro forma Income statement (variable cost basis) F) Pro forma statement of retained earnings

Help me please by creating theses: D) Pro forma balance sheet E)Pro forma Income statement (variable cost basis) F) Pro forma statement of retained earnings

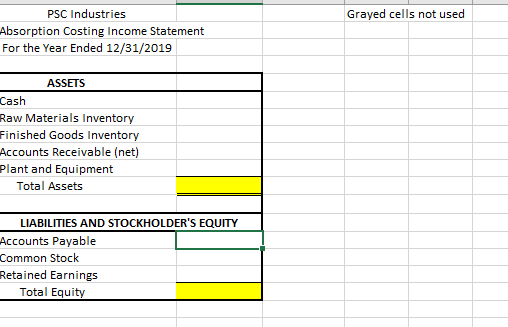

Balance sheet template:

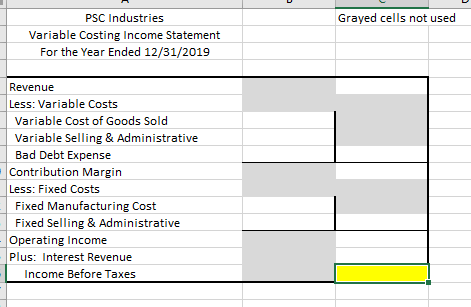

Variable income statement template:

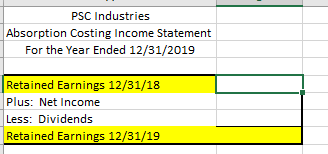

retained earnings template:

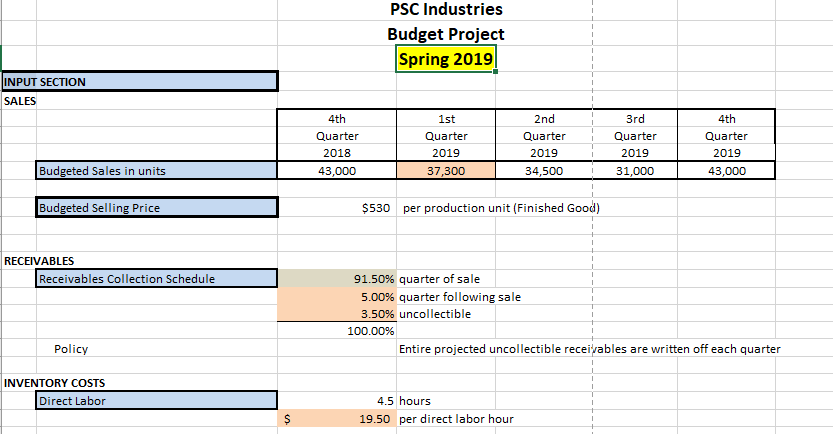

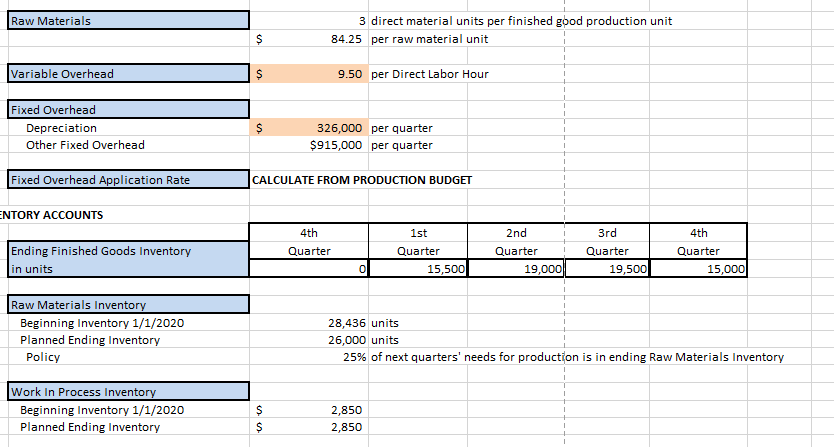

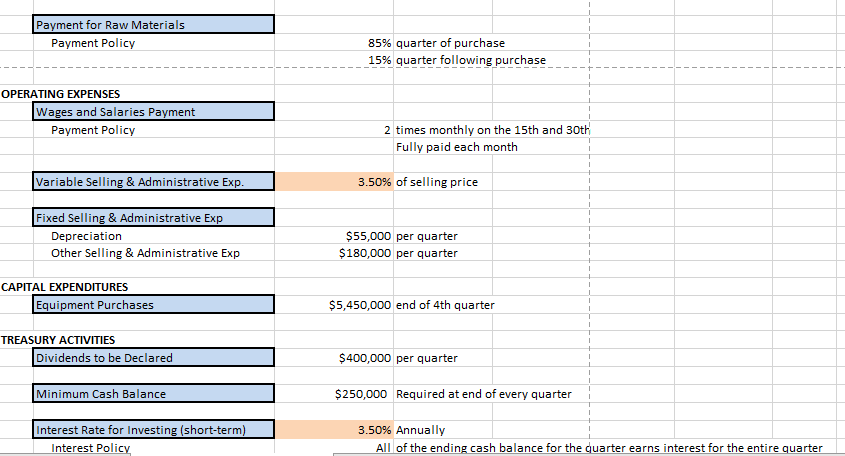

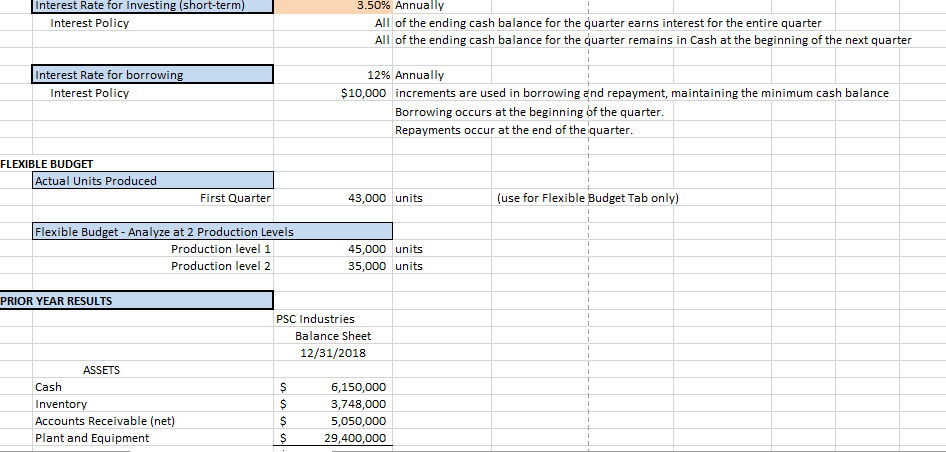

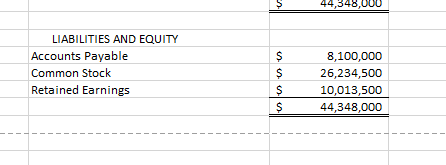

PSC Industries Budget Project Spring 2019 INPUT SECTION SALES 2nd QuarterQuarter 4th Quarter 2018 43,000 1st Quarter 2019 37,300 4th Quarter 2019 43,000 2019 2019 Budgeted Sales in units 34,500 31,000 Budgeted Selling Price $530 per production unit (Finished Good) RECEIVABLES Receivables Collection Schedule 91.50% quarter of sale 5.00% quarter following sale 3.50% uncollectible 100.00% Policy Entire projected uncollectible receivables are written off each quarter INVENTORY COSTS Direct Labor 4.5 hours 19.50 per direct labor hour Raw Materials 3 direct material units per finished good production unit 84.25 per raw material unit Variable Overhead 9.50 per Direct Labor Hour Fixed Overhead Depreciation Other Fixed Overhead 326,000 per quarter $915,000 per quarter Fixed Overhead Application Rate CALCULATE FROM PRODUCTION BUDGET NTORY ACCOUNTS 4th 2nd Quarter 4th 1st Quarter Ending Finished Goods Inventory in units Quarter Quarter Quarter 0 15,500 19,000 19,500 15,000 Raw Materials Inventor Beginning Inventory 1/1/2020 Planned Ending Inventory 28,436 units 26,000 units Policy 25% of next quarters' needs for production is in ending Raw Materials Inventory Work In Process Inventory Beginning Inventory 1/1/2020 Planned Ending Inventory 2,850 2,850 Payment for Raw Materials 85% quarter of purchase 15% quarterfollowing purchase Payment Policy + OPERATING EXPENSES Wages and Salaries Payment Payment Policy 2 times monthly on the 15th and 30th Fully paid each month Variable Selling & Administrative Exp 3.50% of selling price Fixed Selling& Administrative Exp Depreciation Other Selling & Administrative Exp $55,000 per quarter $180,000 per quarter CAPITAL EXPENDITURES Equipment Purchases $5,450,000 end of 4th quarter TREASURY ACTIVITIES Dividends to be Declared $400,000 per quarter Minimum Cash Balance $250,000 Required at end of every quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter Interest Rate for Investing (short-term) 3.50% Annually Interest Policy All of the ending cash balance for the quarter earns interest for the entire quarter All of the ending cash balance for the quarter remains in Cash at the beginning of the next quarter Interest Rate for borrowing 12% Annually Interest Policy $10,000 increments are used in borrowing and repayment, maintaining the minimum cash balance Borrowing occurs at the beginning of the quarter Repayments occur at the end of the iquarter FLEXIBLE BUDGET Actual Units Produced First Quarter 43,000 units (use for Flexible Budget Tab only) Flexible Budget - Analyze at 2 Production Levels Production level 1 Production level 2 45,000 units 35,000 units PRIOR YEAR RESULTS PSC Industries Balance Sheet 12/31/2018 ASSETS Cash Inventory Accounts Receivable (net) Plant and Equipment 6,150,000 3,748,000 5,050,000 29,400,000 LIABILITIES AND EQUITY Accounts Payable Common Stock Retained Earnings 8,100,000 26,234,500 $ 10,013,500 44,348,000 PSC Industries Grayed cells not used Absorption Costing Income Statement For the Year Ended 12/31/2019 ASSETS Cash Raw Materials Inventory Finished Goods Inventory Accounts Receivable (net) Plant and Equipment Total Assets LIABILITIES AND STOCKHOLDER'S EQUITY Accounts Payable Common Stock Retained Earnings Total Equity PSC Industries Variable Costing Income Statement For the Year Ended 12/31/2019 Grayed cells not used Revenue Less: Variable Costs Variable Cost of Goods Sold Variable Selling & Administrative Bad Debt Expense Contribution Margin Less: Fixed Costs Fixed Manufacturing Cost Fixed Selling & Administrative Operating Income Plus: Interest Revenue Income Before Taxes PSC Industries Absorption Costing Income Statement For the Year Ended 12/31/2019 Retained Earnings 12/31/18 Plus: Net Income Less: Dividends Retained Earnings 12/31/19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started