Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me please!! I need help with these excel assignment The steps you will follow for this project arn as follows. 1) Download the Excel

help me please!!

I need help with these excel assignment

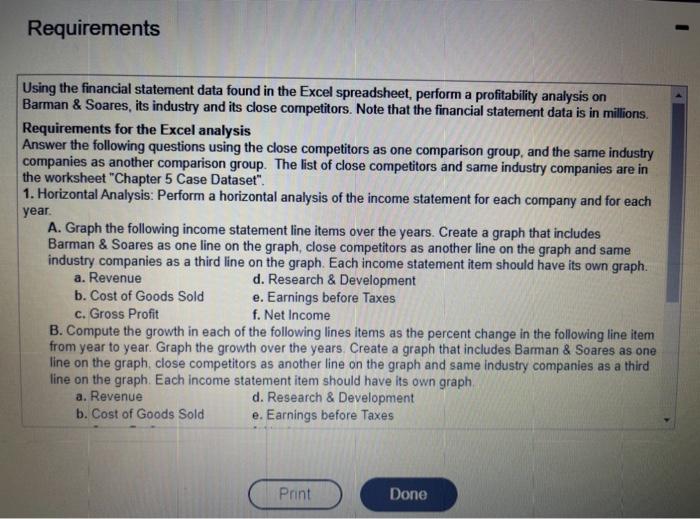

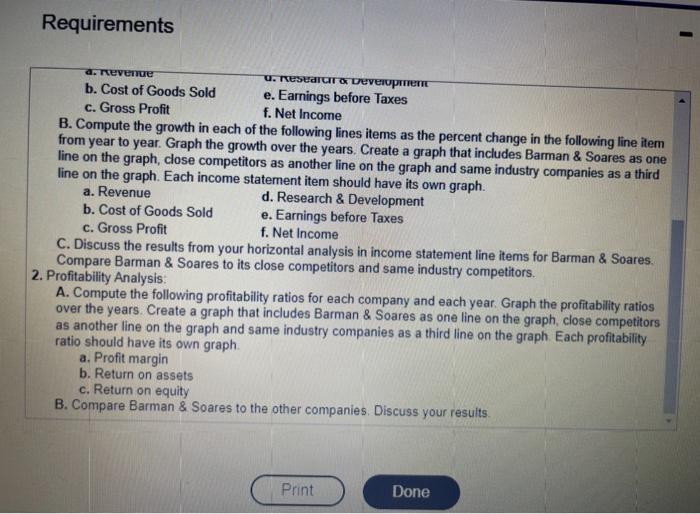

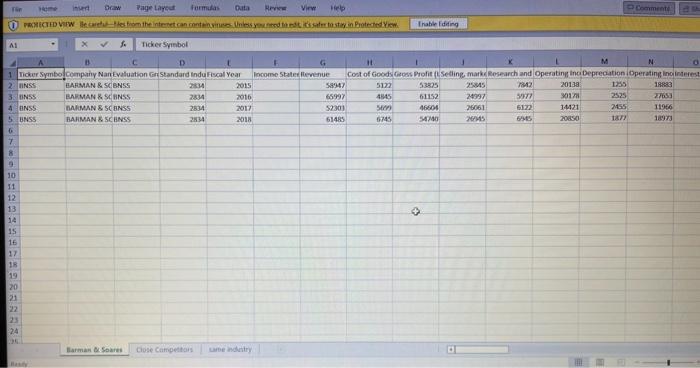

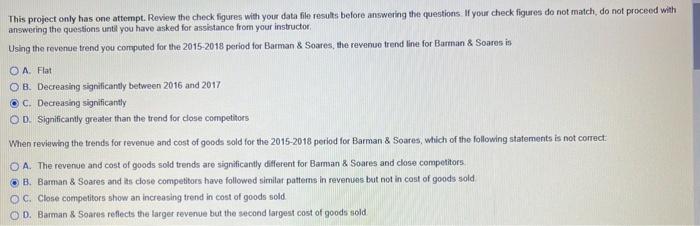

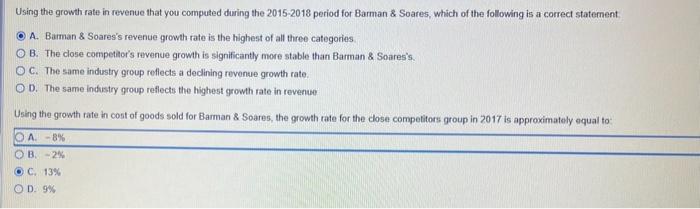

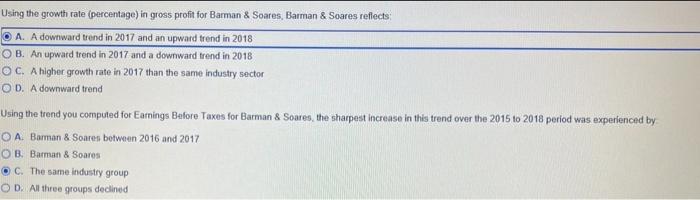

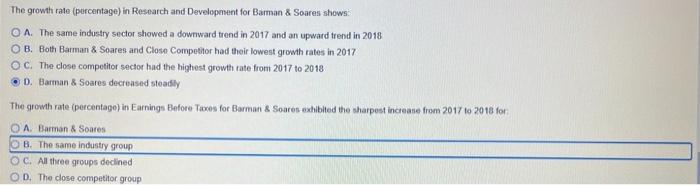

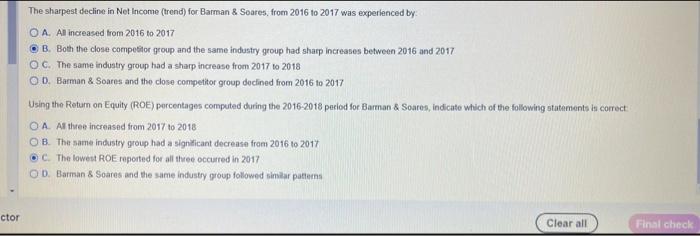

The steps you will follow for this project arn as follows. 1) Download the Excel data fien. (After you downhoad the lile YOU NEFD TO -SAVE" YOUR ASSIGNMENT BY CUCKING THE SAVE BUITION IN THE UPPER RIGHI HAND CORNER BEFORE YOU EXIT. If yoe do not save your assignment, the next time you enter, you may see a diflerent company and set of data.) 2) Perform the requiemente on the data file 3) Check your work in the Exorl file with these check figurests 4) Use your Excel file to answer the ten muitiple choice questions below. (You will have to scroll down to see all of the questions.). Resources A) Intormation on how to update Exsel and office 365 By fif you de not have Ollice 365 , dick here to beam how to.get it for fetele Requirements Using the financial statement data found in the Excel spreadsheet, perform a profitability analysis on Barman \& Soares, its industry and its close competitors. Note that the financial statement data is in millions. Requirements for the Excel analysis Answer the following questions using the close competitors as one comparison group, and the same industry companies as another comparison group. The list of close competitors and same industry companies are in the worksheet "Chapter 5 Case Dataset". 1. Horizontal Analysis: Perform a horizontal analysis of the income statement for each company and for each year. A. Graph the following income statement line items over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income B. Compute the growth in each of the following lines items as the percent change in the following line item from year to year. Graph the growth over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes Requirements a. revenue u. reserarur a beveropmirem b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income B. Compute the growth in each of the following lines items as the percent change in the following line item from year to year. Graph the growth over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income C. Discuss the results from your horizontal analysis in income statement line items for Barman \& Soares. Compare Barman \& Soares to its close competitors and same industry competitors. 2. Profitability Analysis: A. Compute the following profitability ratios for each company and each year. Graph the profitability ratios over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each profitability ratio should have its own graph. a. Profit margin b. Return on assets c. Return on equity B. Compare Barman \& Soares to the other companies. Discuss your results. Check Figures This project only has one attempt. Review the check figures with your data file results before answering the questions. If your check figures do not match, do not proceed with answering the qoestions untl you have asked for assistance from your instructor. Using the revenue trend you computed for the 2015-2018 period for Barman \& Soares, the revenus frend line for Barman \& Soares is A. Flat B. Decreasing signilicantly between 2016 and 2017 C. Decreasing significantly D. Significantly greater than the trend for close competitors When reviewing the trends for revenve and cost of goods sold for the 2015-2018 period for Barman \& Soares, which of the following statements is not correct: A. The revenue and cost of goods sold trends are significantly ditferent for Barman \& Soares and close competitors. B. Barman \& Soares and its close competitors have followed similat pattems in revenues but not in cost of goods sold C. Close competitors show an increasing trend in cost of goods sold. D. Barman \& Soares reflects the larget revenue but the second largest cost of goods sold Using the growth rate in revenue that you computed during the 2015-2018 period for Barman \& Soares, which of the following is a correct staternent. A. Barman \& Soares's revenue growth rate is the highest of all three categories. B. The close competilor's revenue growth is significantly more stable than Barman \& Soares's. C. The same industry group reflects a declining revenue growth rate. D. The same industry group reflects the highest growth rate in revenue Using the growth rate in cost of goods sold for Barman \& Soares, the growth rate for the dose competitors group in 2017 is approximately equal to: A. 8% B. 2% C. 13% D. 9% Using the growth rate (percentage) in gross profit for Barman \& Soares, Barman \& Soares reflects: A. A downward trend in 2017 and an upward trend in 2018 B. An upward trend in 2017 and a downward trend in 2018 C. A higher growth rate in 2017 than the same industry sector D. A downward trend Using the trend you computed for Earnings Before Taxes for Barman \& Soares, the sharpest increase in this trend over the 2015 to 2018 period was experienced by A. Barman & Soares botwaen 2016 and 2017 B. Barman \& Soares C. The same industry group D. All three groups declined The growth rate (percentage) in Research and Development for Barman \& Soares shows: A. The same industry sector showed a downward trend in 2017 and an upward trend in 2018 B. Both Barman & Soares and Close Competior had their lowest growth rates in 2017 C. The close competitor sector had the highest growt tate from 2017 to 2018 D. Barman 8 Soares decreased steasly The growh rate (percentage) in Earnings Before Taxes for Barman \& Soares exhiblted the aharpest increase from 2017 to 2018 for: A. Barman \& Soares B. The same industry group C. All three groups declined D. The close competitor group The sharpest decline in Net Income (trend) for Barman \& Soares. from 2016 to 2017 was experlenced by. A. Al increased from 2016 to 2017 B. Both the close compesitor group and the same industry group had sharp increases between 2016 and 2017 C. The same industry group had a sham increase from 2017 to 2018 D. Barman \& Soares and the close competitor group declined from 2016 to 2017 Using the Return on Equity (ROE) percentages computed during the 2016-2018 peelod for Bartnan 8 Soares, indicate which of the following statements is correct: A. A. thee increased from 2017 to 2018 B. The same industey group had a signiticant decrease from 2016 to 2017 C. The lowest ROE reperted for all thee occurred in 2017 D. Barman \& Soares and the same industry group followed finizar patierns The steps you will follow for this project arn as follows. 1) Download the Excel data fien. (After you downhoad the lile YOU NEFD TO -SAVE" YOUR ASSIGNMENT BY CUCKING THE SAVE BUITION IN THE UPPER RIGHI HAND CORNER BEFORE YOU EXIT. If yoe do not save your assignment, the next time you enter, you may see a diflerent company and set of data.) 2) Perform the requiemente on the data file 3) Check your work in the Exorl file with these check figurests 4) Use your Excel file to answer the ten muitiple choice questions below. (You will have to scroll down to see all of the questions.). Resources A) Intormation on how to update Exsel and office 365 By fif you de not have Ollice 365 , dick here to beam how to.get it for fetele Requirements Using the financial statement data found in the Excel spreadsheet, perform a profitability analysis on Barman \& Soares, its industry and its close competitors. Note that the financial statement data is in millions. Requirements for the Excel analysis Answer the following questions using the close competitors as one comparison group, and the same industry companies as another comparison group. The list of close competitors and same industry companies are in the worksheet "Chapter 5 Case Dataset". 1. Horizontal Analysis: Perform a horizontal analysis of the income statement for each company and for each year. A. Graph the following income statement line items over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income B. Compute the growth in each of the following lines items as the percent change in the following line item from year to year. Graph the growth over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes Requirements a. revenue u. reserarur a beveropmirem b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income B. Compute the growth in each of the following lines items as the percent change in the following line item from year to year. Graph the growth over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each income statement item should have its own graph. a. Revenue d. Research \& Development b. Cost of Goods Sold e. Earnings before Taxes c. Gross Profit f. Net Income C. Discuss the results from your horizontal analysis in income statement line items for Barman \& Soares. Compare Barman \& Soares to its close competitors and same industry competitors. 2. Profitability Analysis: A. Compute the following profitability ratios for each company and each year. Graph the profitability ratios over the years. Create a graph that includes Barman \& Soares as one line on the graph, close competitors as another line on the graph and same industry companies as a third line on the graph. Each profitability ratio should have its own graph. a. Profit margin b. Return on assets c. Return on equity B. Compare Barman \& Soares to the other companies. Discuss your results. Check Figures This project only has one attempt. Review the check figures with your data file results before answering the questions. If your check figures do not match, do not proceed with answering the qoestions untl you have asked for assistance from your instructor. Using the revenue trend you computed for the 2015-2018 period for Barman \& Soares, the revenus frend line for Barman \& Soares is A. Flat B. Decreasing signilicantly between 2016 and 2017 C. Decreasing significantly D. Significantly greater than the trend for close competitors When reviewing the trends for revenve and cost of goods sold for the 2015-2018 period for Barman \& Soares, which of the following statements is not correct: A. The revenue and cost of goods sold trends are significantly ditferent for Barman \& Soares and close competitors. B. Barman \& Soares and its close competitors have followed similat pattems in revenues but not in cost of goods sold C. Close competitors show an increasing trend in cost of goods sold. D. Barman \& Soares reflects the larget revenue but the second largest cost of goods sold Using the growth rate in revenue that you computed during the 2015-2018 period for Barman \& Soares, which of the following is a correct staternent. A. Barman \& Soares's revenue growth rate is the highest of all three categories. B. The close competilor's revenue growth is significantly more stable than Barman \& Soares's. C. The same industry group reflects a declining revenue growth rate. D. The same industry group reflects the highest growth rate in revenue Using the growth rate in cost of goods sold for Barman \& Soares, the growth rate for the dose competitors group in 2017 is approximately equal to: A. 8% B. 2% C. 13% D. 9% Using the growth rate (percentage) in gross profit for Barman \& Soares, Barman \& Soares reflects: A. A downward trend in 2017 and an upward trend in 2018 B. An upward trend in 2017 and a downward trend in 2018 C. A higher growth rate in 2017 than the same industry sector D. A downward trend Using the trend you computed for Earnings Before Taxes for Barman \& Soares, the sharpest increase in this trend over the 2015 to 2018 period was experienced by A. Barman & Soares botwaen 2016 and 2017 B. Barman \& Soares C. The same industry group D. All three groups declined The growth rate (percentage) in Research and Development for Barman \& Soares shows: A. The same industry sector showed a downward trend in 2017 and an upward trend in 2018 B. Both Barman & Soares and Close Competior had their lowest growth rates in 2017 C. The close competitor sector had the highest growt tate from 2017 to 2018 D. Barman 8 Soares decreased steasly The growh rate (percentage) in Earnings Before Taxes for Barman \& Soares exhiblted the aharpest increase from 2017 to 2018 for: A. Barman \& Soares B. The same industry group C. All three groups declined D. The close competitor group The sharpest decline in Net Income (trend) for Barman \& Soares. from 2016 to 2017 was experlenced by. A. Al increased from 2016 to 2017 B. Both the close compesitor group and the same industry group had sharp increases between 2016 and 2017 C. The same industry group had a sham increase from 2017 to 2018 D. Barman \& Soares and the close competitor group declined from 2016 to 2017 Using the Return on Equity (ROE) percentages computed during the 2016-2018 peelod for Bartnan 8 Soares, indicate which of the following statements is correct: A. A. thee increased from 2017 to 2018 B. The same industey group had a signiticant decrease from 2016 to 2017 C. The lowest ROE reperted for all thee occurred in 2017 D. Barman \& Soares and the same industry group followed finizar patierns Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started