Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me please I need to make this now: 1. Mandy has been in business for some years. The following balances were brought forward in

help me please I need to make this now:

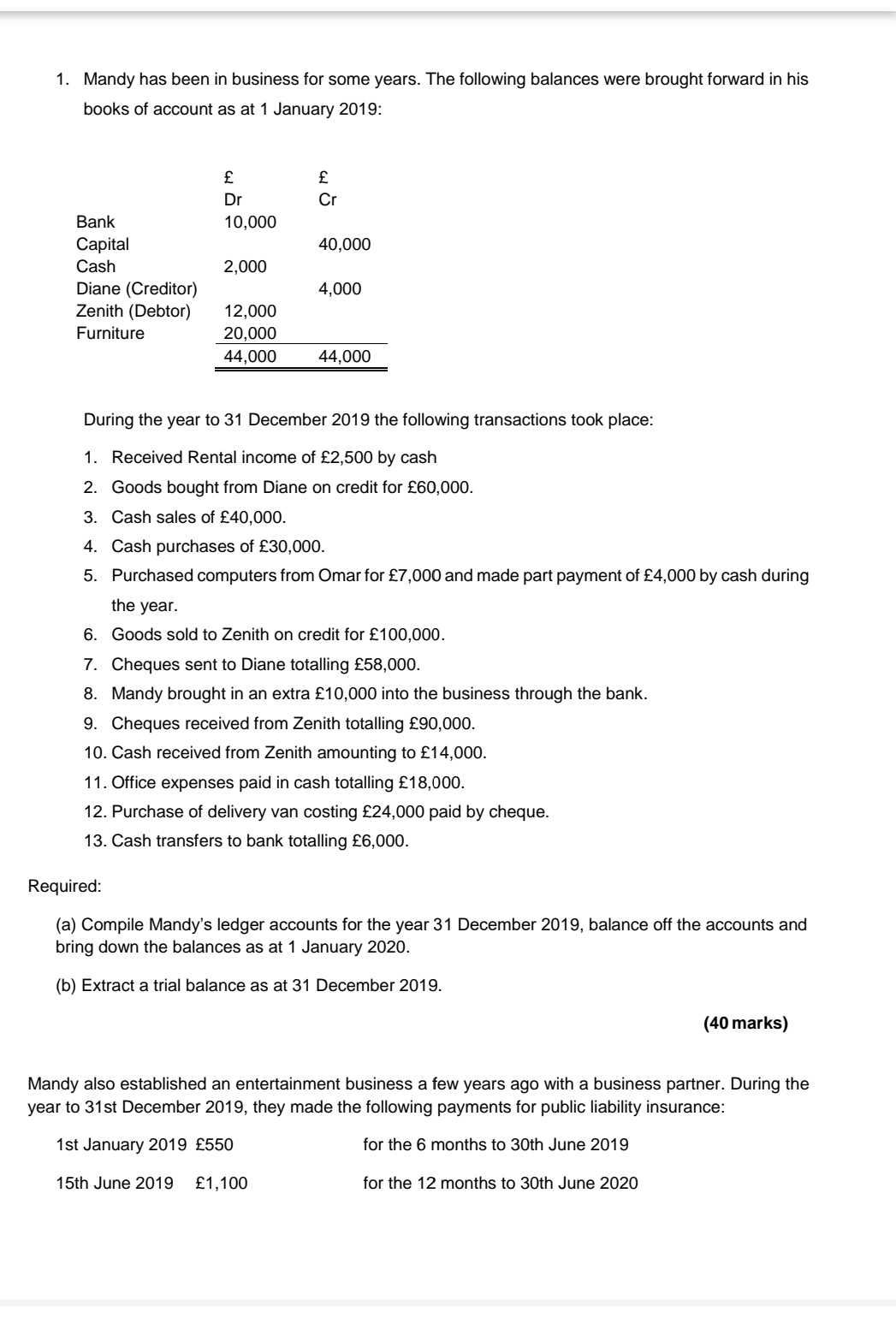

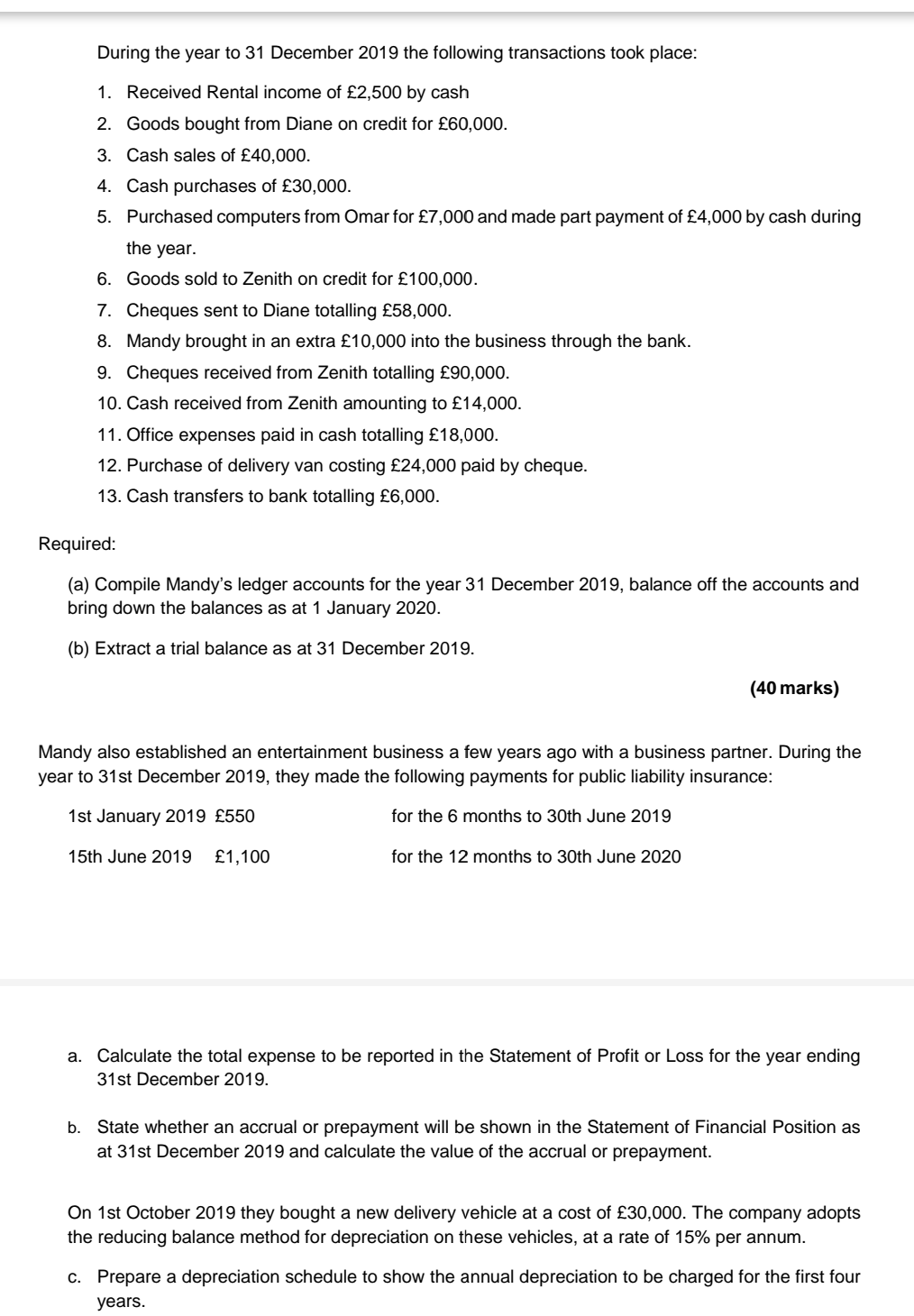

1. Mandy has been in business for some years. The following balances were brought forward in his books of account as at 1 January 2019: Dr 10,000 Cr 40,000 2,000 Bank Capital Cash Diane (Creditor) Zenith (Debtor) Furniture 4,000 12,000 20,000 44,000 44,000 During the year to 31 December 2019 the following transactions took place: 1. Received Rental income of 2,500 by cash 2. Goods bought from Diane on credit for 60,000. 3. Cash sales of 40,000. 4. Cash purchases of 30,000. 5. Purchased computers from Omar for 7,000 and made part payment of 4,000 by cash during the year. 6. Goods sold to Zenith on credit for 100,000. 7. Cheques sent to Diane totalling 58,000. 8. Mandy brought in an extra 10,000 into the business through the bank. 9. Cheques received from Zenith totalling 90,000. 10. Cash received from Zenith amounting to 14,000. 11. Office expenses paid in cash totalling 18,000. 12. Purchase of delivery van costing 24,000 paid by cheque. 13. Cash transfers to bank totalling 6,000. Required: (a) Compile Mandy's ledger accounts for the year 31 December 2019, balance off the accounts and bring down the balances as at 1 January 2020. (b) Extract a trial balance as at 31 December 2019. (40 marks) Mandy also established an entertainment business a few years ago with a business partner. During the year to 31st December 2019, they made the following payments for public liability insurance: 1st January 2019 550 for the 6 months to 30th June 2019 15th June 2019 1,100 for the 12 months to 30th June 2020 During the year to 31 December 2019 the following transactions took place: 1. Received Rental income of 2,500 by cash 2. Goods bought from Diane on credit for 60,000. 3. Cash sales of 40,000. 4. Cash purchases of 30,000. 5. Purchased computers from Omar for 7,000 and made part payment of 4,000 by cash during the year. 6. Goods sold to Zenith on credit for 100,000. 7. Cheques sent to Diane totalling 58,000. 8. Mandy brought in an extra 10,000 into the business through the bank. 9. Cheques received from Zenith totalling 90,000. 10. Cash received from Zenith amounting to 14,000. 11. Office expenses paid in cash totalling 18,000. 12. Purchase of delivery van costing 24,000 paid by cheque. 13. Cash transfers to bank totalling 6,000. Required: (a) Compile Mandy's ledger accounts for the year 31 December 2019, balance off the accounts and bring down the balances as at 1 January 2020. (b) Extract a trial balance as at 31 December 2019. (40 marks) Mandy also established an entertainment business a few years ago with a business partner. During the year to 31st December 2019, they made the following payments for public liability insurance: 1st January 2019 550 for the 6 months to 30th June 2019 15th June 2019 1,100 for the 12 months to 30th June 2020 a. Calculate the total expense to be reported in the Statement of Profit or Loss for the year ending 31st December 2019. b. State whether an accrual or prepayment will be shown in the Statement of Financial Position as at 31st December 2019 and calculate the value of the accrual or prepayment. On 1st October 2019 they bought a new delivery vehicle at a cost of 30,000. The company adopts the reducing balance method for depreciation on these vehicles, at a rate of 15% per annum. C. Prepare a depreciation schedule to show the annual depreciation to be charged for the first four yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started