Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me please Nigel French, an analyst at Taurus lnvestment Management, is analyzing Archway Technologies, a manufacturer of luaury electronic auto equipment, at the request

help me please

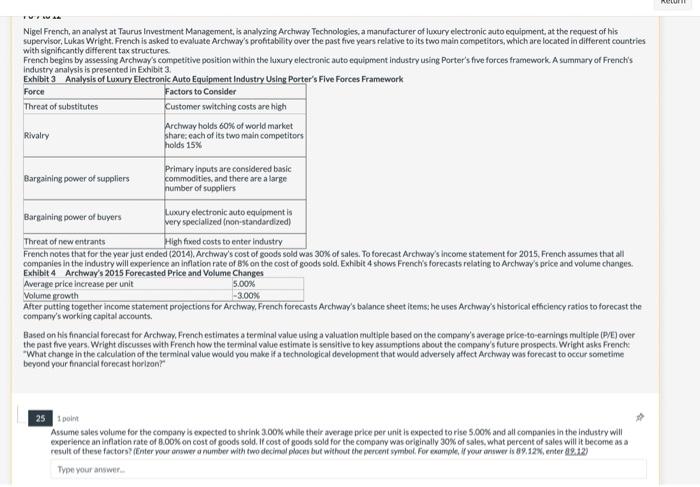

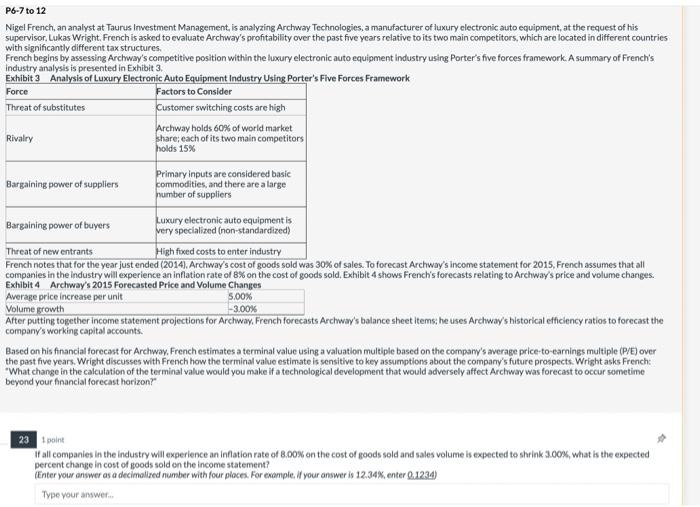

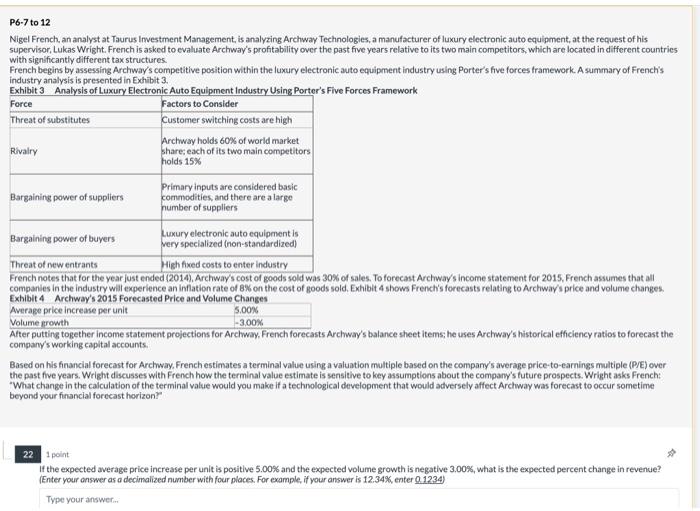

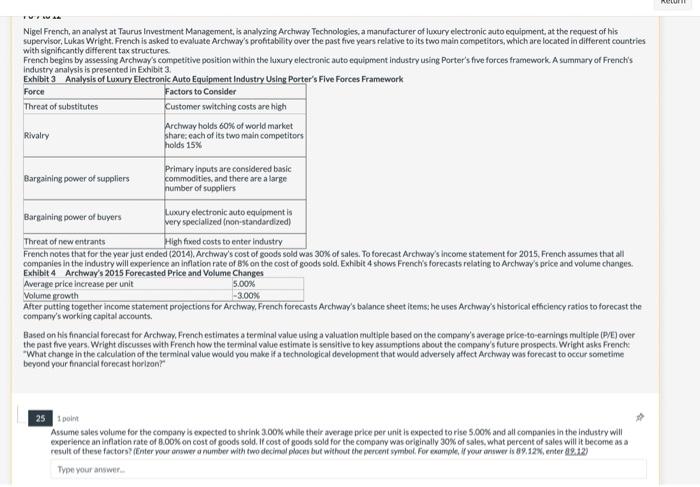

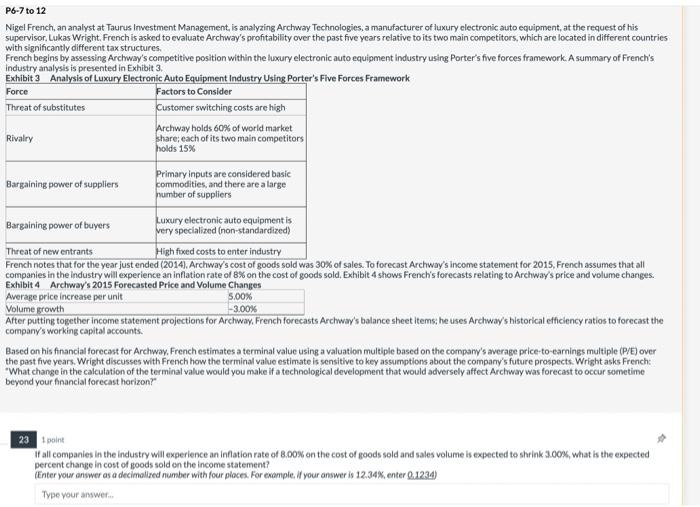

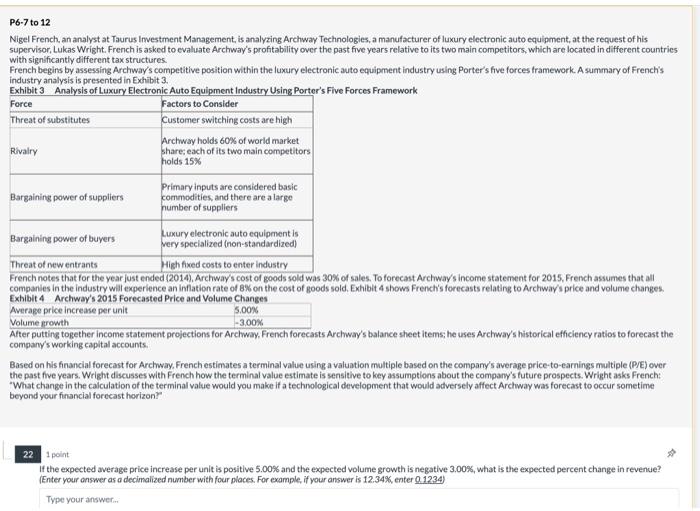

Nigel French, an analyst at Taurus lnvestment Management, is analyzing Archway Technologies, a manufacturer of luaury electronic auto equipment, at the request of his supervisor, Lukas Wright. French is asked to evaluate Archway's profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures. French begins by assessing Archway's competitive position within the luxury electronic auto equipment industry using Porter's five forces framework A summary of French's industry analysis is presented in Exhibit 3. Exhibit 3 Analysis of Luxury Electronic Auto Equipment Industry Using Porter's Five Forces Framework French notes that for the year just ended (2014). Archway's cost of goods soid was 30% of sales. To forecast Archway's income statement for 2015 , French assumes that all companies in the industry will experience an inflation rate of Bxs on the cost of goods sold. Exhibit 4 shows French's forecasts relating to Archway's price and volume changes. After putting together income statement projections for Archway. French forecasts Arclwway's balance sheet itemsi he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway. French estimates a terminal value using a valuation multiple based on the company's average orice-to-eamings multiple (PyE) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks Frenche "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?" 25 point Assume sales volume for the company is expected to shrink 3.00% while their average price per unit is expected to rise 5.000 and all companies in the industry will experience an inflation rate of 8.00% on cost of goods soid. If cost of goods sold for the compary was originally 30% of sales. what percent of sales will it become as a result of these factors? (Enter pour answer a number with two decimal places but without the percent symbel. For example, if your answer is 69.12% enter 89. 2 2) Nigel French, an analyst at Taurus Investment Management, is analyzing Archway Technologies, a manufacturer of luxury electronic auto equipment, at the request of his supervisor, Lukas Wright. French is asked to evaluate Archway's profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures. French begins by assessing Archway's competitive position within the haxury electronic auto equipment industry using Porter's five forces framework. A summary of French's industry analysis is presented in Exhibit 3. Exhibit 3 Analysis of Luxury Electronic Auto Eauipment Industry Using Porter's Five Forces Framework French notes that for the year just ended (2014). Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015 , French assumes that all companies in the industry will experience an inflation rate of 8% on the cost of goods sold, Exhibit 4 shows French's forecasts relating to Archway's price and volume changes. Exhibit 4 Archwav's 2015 Forecasted Price and Volume Chaneses After putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway. French estimates a terminal value using a valuation multiple based on the company's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur semetime beyond your financial forecast horizon? 23 peint If all companies in the industry will experience an inflation rate of 8.00% on the cost of goods sold and sales volume is expected to shrink 3.00%, what is the expected percent change in cost of goods sold on the income statement? (Enter your anwer as a decimalized number with four ploces. For example. If your answer is 12.34\%, enter Q.1234) Type your answer... Nigel French, an analyst at Taurus Imvestment Management, is analyzing Archway Technologies, a manufacturer of luxury electronic auto equipment, at the repuest of his supervisor, Lukas Wright. French is asked to evaluate Archway's profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures. French begins by assessing Archway's competitive position within the luxury electronic auto equipment industry using Porter's five forces framework. A summary of French's industry analysis is presented in Exhibit 3. Exhibit 3 Analvsis of Luxury Electronic Auto Equibment Industry Using Porter's Five Forces Framework French notes that for the year just ended (2014). Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015, French assumes that all companes in the industry will experience an inflation rate of B\% on the cost of goods sold. Exhiblt 4 shows French's forecasts relating to Archway's price and volume changes. After putting together income statement projections for Archway. French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway. French estimates a terminal value using a valuation multiple based on the company's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?" 22 ipoint. If the expected average price increase per unit is positive 5.00% and the expected volume growth is negative 3.00%, what is the expected percent change in revenue? (Enter your onswer as a decimalized number with four places. For example, if your answer is 12.34%, enter 0.1234 ) Nigel French, an analyst at Taurus Investment Management, is analyzing Archway Technologies, a manufacturer of luxury electronic auto equipment, at the request of his supervisor, Lukas Wright. French is asked to evaluate Archway's profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures. French begins by assessing Archway's competitive position within the luxury electronic auto equipment industry using Porter's five forces framework. A summary of French's industry analysis is presented in Exhibit 3 . Exhibit 3 Analvsis of Luxurv Electronic Auto Eauloment Industrv Usine Porter's Five Forces Framework French notes that for the year just ended (2014). Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015 , French assumes that all companies in the industry will experience an inflation rate of 8% on the cost of goods sold. Exhibit 4 shows French's forecasts relating to Archway's price and volume changes, After putting together income statement projections for Archway. French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple bassed on the compary's average price-to-earnings multiple (P/E) over the past frve years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the compary's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon? 26 t point For the year just ended (2014), Archway's gross margin was jercent. (Enter your answer as a whole number with no percent sign and zero decimol places. For evample, if your answer is 100%, enter 100) Gertrude Fromm is a transportation sector analyst at Tucana Investments. She is conducting an analysis of Omikroon, N.V. a publicly traded European transportation company that manufactures and sells scooters and commercial truckss. Omikroon's petrol scooter division is the market leader in its sector and has two competitors. Omikroon's petrol scooters have a strong brand name and a well-established distribution network, Glven the strong branding established by the market leaders, the cost of entering the industry is high. But Fromm anticipates that inexpensive imported small petrol-fueled motor-cycles may become substitutes for Omikroon's petrol scooters. Fromm uses return on invested capital as the metric to assess Omikroon's performance. Omikroon has just introduced the first electric scooter to the market at year-end 2014 . The company's expectations are as follows: - Competing electric scooters will reach the market in 2016. - Electric scooters will not be a substitute for petrol scooters. - The important research costs in 2015 and 2016 will lead to more efficient electric scooters. Fromm decides to use a five-year forecast horizon for Omikroon after considering the following factors: Factor 1: The annual portfolio turnover at Tucana imestments is 30%. Factor 2. The electronic scooter industry is expected to grow rapidly over the next 10 years. Factor 3: Omikroon has announced it would acquire a light truck manufacturer that will be fully integrated to its truck division by 2016 and will add 2% to its total revenues. Fromm uses the base case forecast for 2015 shown in Exhibit 5 to perform the following sensitivity analysis: - The price of an imported specialty metal used for engine parts increases by 20%. - This metal constitutes 4% of Omilkroon's cost of sales. - Omikroon will not be able to pass on the higher metal expense to its customers. Omikroon will initially outsource its electric scooter parts. But manufacturing these parts in-house beginning in 2016 will imply changes to an existing factory. This factory cost 7 million three years ago and had an estimated useful life of 10 years. Fromm is evaluating two scenarios: Scenario 1: Sell the existing factory for 5 million. Bulld a new factory costing 630 million with a useful life of 10 years. Scenario 2. Refit the existing factory for 27 million. 34 point Exhibit 5 shows cost of sales equal to 105. 38 , If an imported specialty metal constitutes 4% of this figure and the cost of that specialty metal goes up 20%, how much would cost of sales become in Fromm's sensitivity analysis? (Enter your answer as a number with two decimal places, like this: 899.12 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started