Answered step by step

Verified Expert Solution

Question

1 Approved Answer

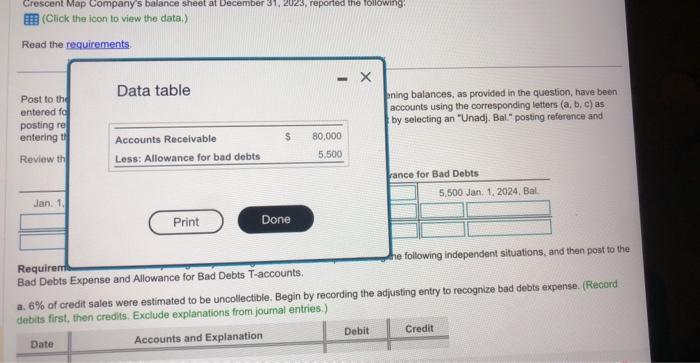

help me please! understand its long but its easy just tideous! Crescent Map Company's batance sheet at December 31,2023 , reported the following: EA (Click

help me please! understand its long but its easy just tideous!

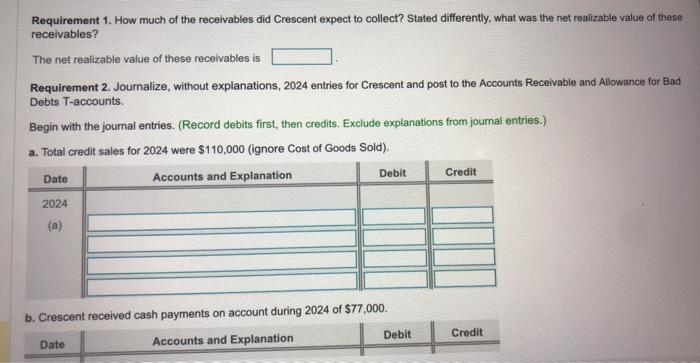

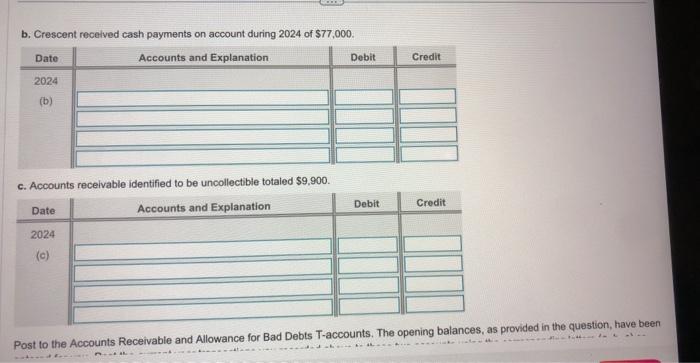

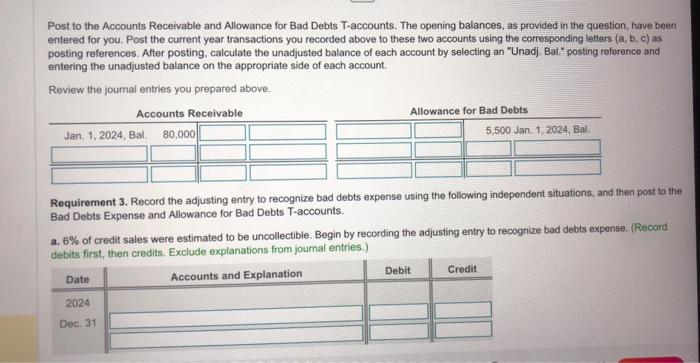

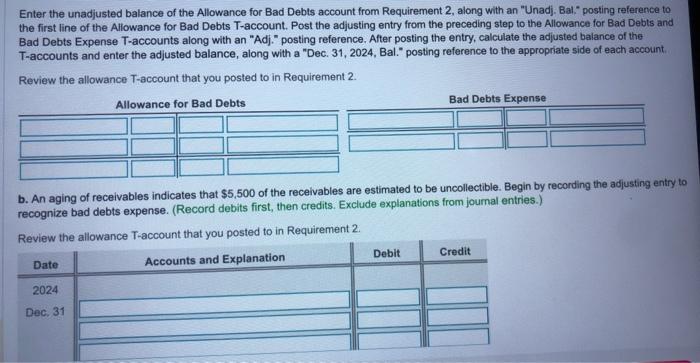

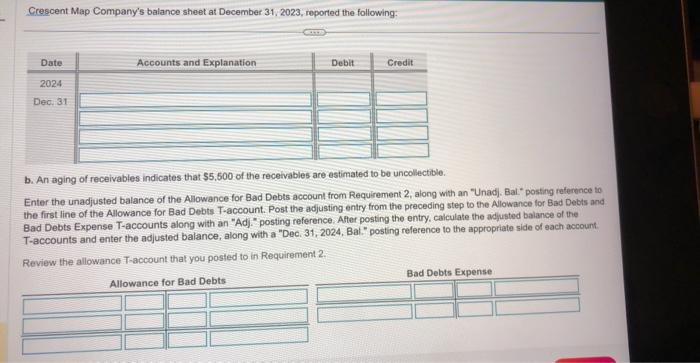

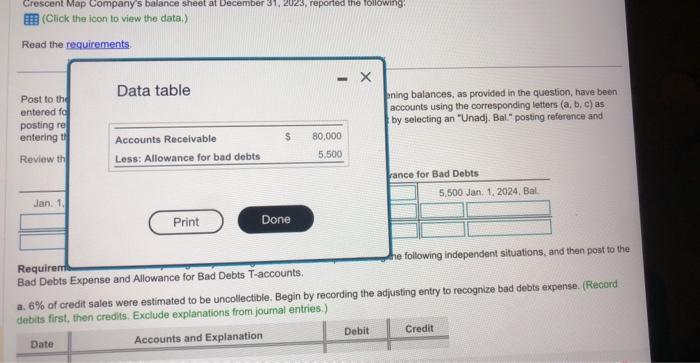

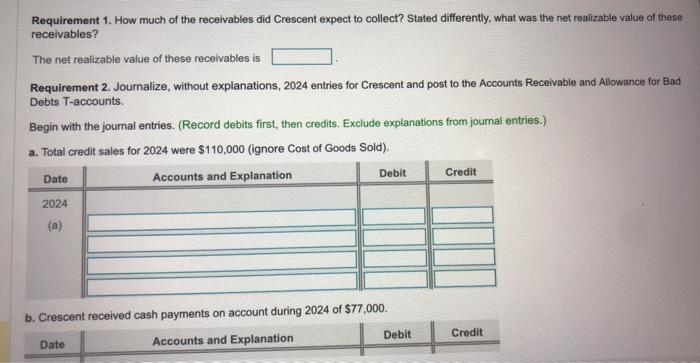

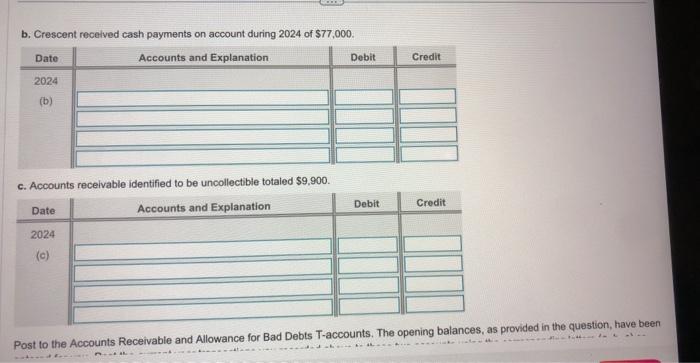

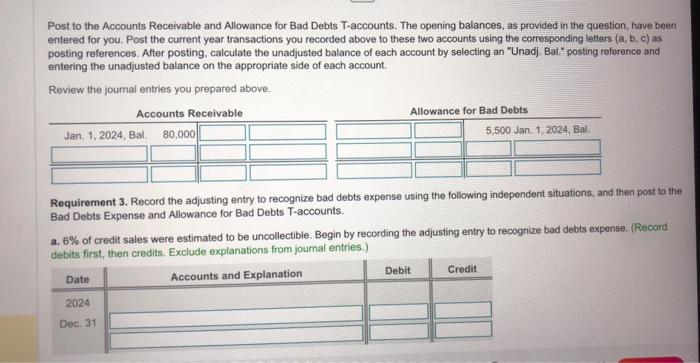

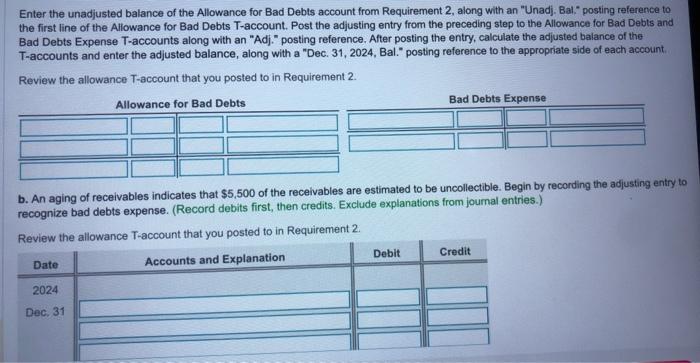

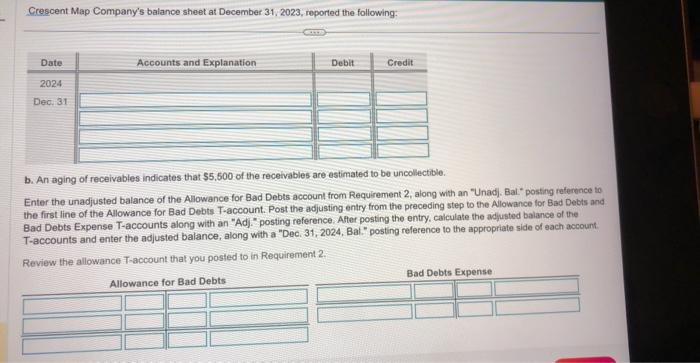

Crescent Map Company's batance sheet at December 31,2023 , reported the following: EA (Click the icon to view the data.) Read the requirements. Requirement 1. How much of the receivables did Crescent expect to collect? Stated differently, what was the net realizable value of these receivables? The net realizable value of these receivables is Requirement 2. Joumalize, without explanations, 2024 entries for Crescent and post to the Accounts Receivable and Allowance for Bad Debts T-accounts. Begin with the journal entries. (Record debits first, then credits. Exclude explanations from journal entries.) a. Total credit sales for 2024 were $110,000 (ignore Cost of Goods Sold). b. Crescent received cash payments on account during 2024 of $77,000. b. Crescent received cash payments on account during 2024 of $77,000. c. Accounts receivable identified to be uncollectible totaled $9.900. Post to the Accounts Receivable and Allowance for Bad Debts T-accounts. The opening balances, as provided in the question, have been Post to the Accounts Receivable and Allowance for Bad Debts T-accounts. The opening balances, as provided in the question, have been entered for you. Post the current year transactions you recorded above to these two accounts using the corresponding letters (a, b, c ) as posting references. After posting, calculate the unadjusted balance of each account by selecting an "Unadj. Bal." posting reference and entering the unadjusted balance on the appropriate side of each account. Review the joumal entries you prepared above. Requirement 3. Record the adjusting entry to recognize bad debts expense using the following independent situations, and then post to the Bad Debts Expense and Allowance for Bad Debts T-accounts. a. 6% of credit sales were estimated to be uncollectible. Begin by recording the adjusting entry to recognize bad debts expense. (Record debits first, then credits. Exclude explanations from journal entries.) Enter the unadjusted balance of the Allowance for Bad Debts account from Requirement 2 , along with an "Unadj. Bal." posting reference to the first line of the Allowance for Bad Debts T-account. Post the adjusting entry from the preceding step to the Allowance for Bad Debts and Bad Debts Expense T-accounts along with an "Adj." posting reference. After posting the entry, calculate the adjusted balance of the T-accounts and enter the adjusted balance, along with a "Dec. 31,2024 , Bal." posting reference to the appropriate side of each account, Review the allowance T-account that you posted to in Requirement 2. b. An aging of receivables indicates that $5,500 of the receivables are estimated to be uncollectible. Begin by recording the adjusting entry to recognize bad debts expense. (Record debits first, then credits. Exclude explanations from joumal entries.) Daulaw tha allowance T-account that you posted to in Requirement 2 . Crescent Map Company's balance sheet at December 31, 2023, reported the following: b. An aging of receivables indicates that $5,500 of the receivables are estimated to be uncollectible. Enter the unadjusted balance of the Allowance for Bad Debts account from Requirement 2, along with an "Unadj. Bal" posting reference to the first line of the Allowance for Bad Debts T-account. Post the adjusting entry from the preceding step to the Allowance for Bad Debis and Bad Debts Expense T-accounts along with an "Adj." posting reference. After posting the entry, calculate the adiusted baiance of the T-accounts and enter the adjusted balance, along with a "Dec. 31, 2024, Bal." posting reference to the appropriate side of each account: Raview the allowance T-account that you posted to in Requirement 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started