Answered step by step

Verified Expert Solution

Question

1 Approved Answer

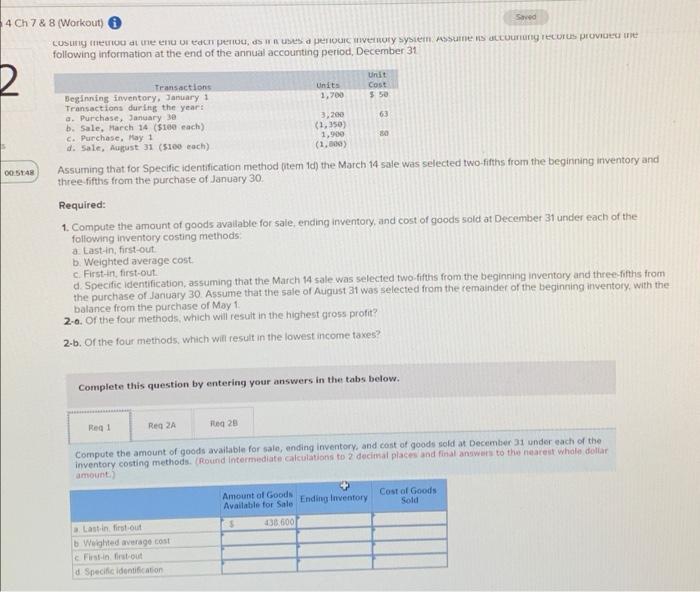

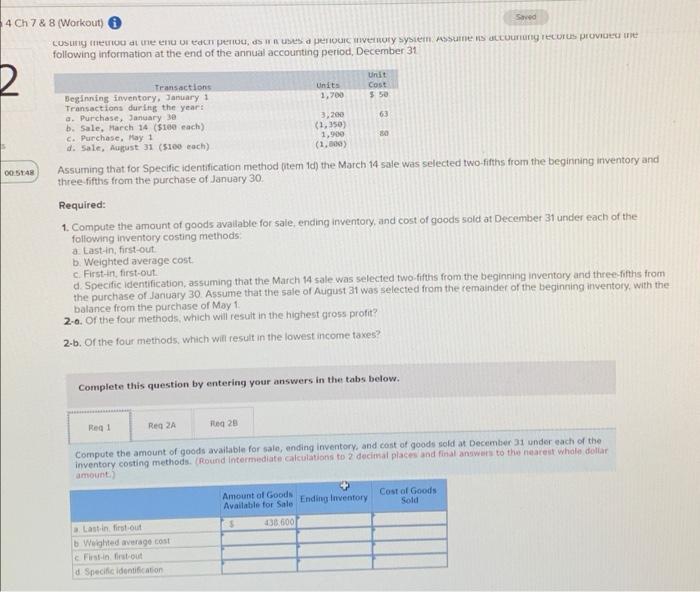

help me Saved 4 Ch 7 & 8 (Workout) CUSU med den urteo penou, Sud enou Very System Assume ring Teco provide following information at

help me

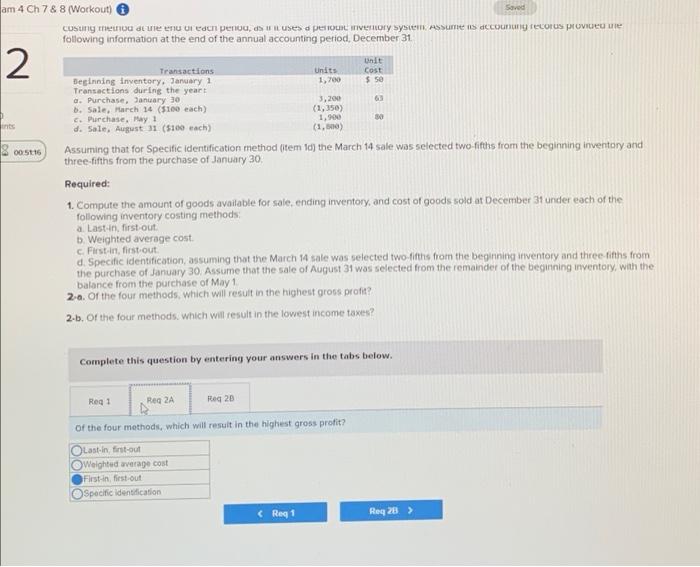

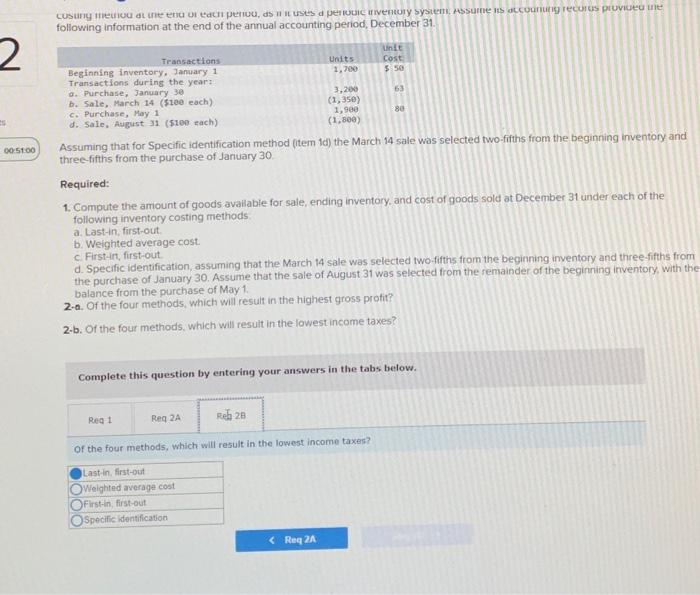

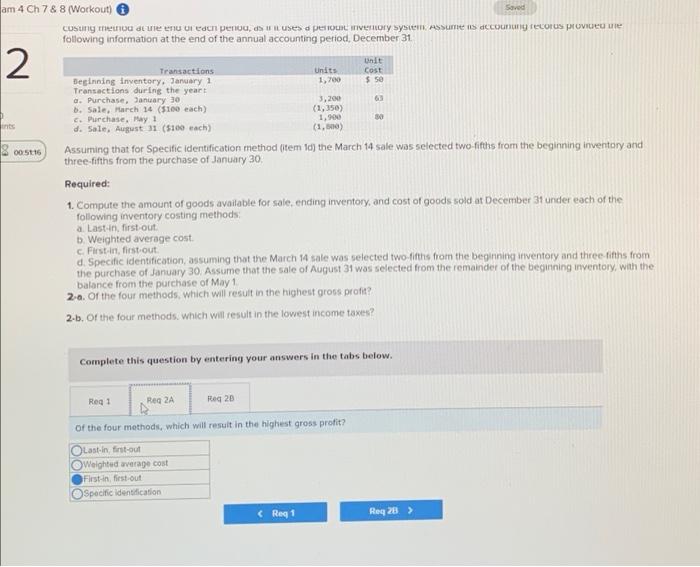

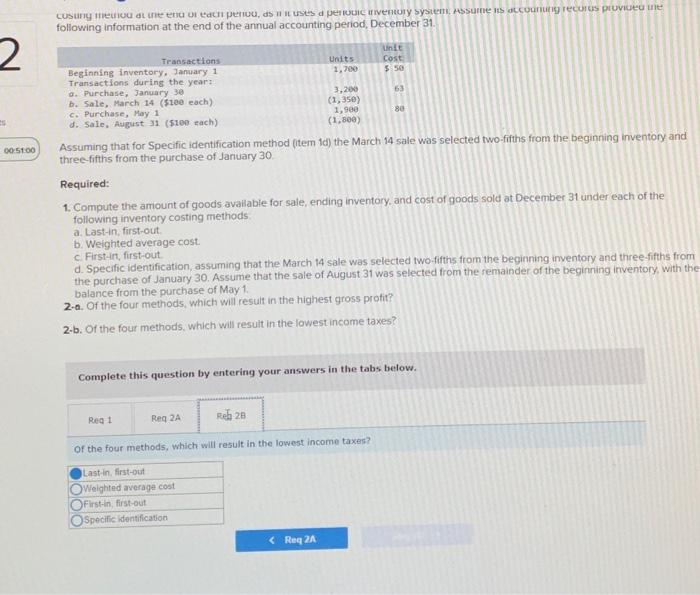

Saved 4 Ch 7 & 8 (Workout) CUSU med den urteo penou, Sud enou Very System Assume ring Teco provide following information at the end of the annual accounting period, December 31 63 00 STAR Unit Transactions Units Cost Beginning inventory, January 1 1,700 Transactions during the years . Purchase, January 30 3.200 b. Sale, March 14 (5100 each) (1.350) c. Purchase, May 1 1,900 d. Sale, August 31 (5100 each) (1.000) Assuming that for Specific identification method (item 1c) the March 14 sale was selected two fifths from the beginning inventory and three fifths from the purchase of January 30 Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods a Last-in, first-out b. Weighted average cost. c. First in first-out Specific Identification, assuming that the March 14 sale was selected two fifths from the beginning inventory and three fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory with the balance from the purchase of May 1 2-0. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Reg! Red 2A Reg 20 Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the inventory costing methods. Round Intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount Cost of Goods Sold Amount of Goods Available for Sale Ending Inventory 5 38 600 Last in first out Weighted average cost First in first out d Specific identification Seved am 4 Ch 7 & 8 (Workout) cosung meina at uie enu ul each penou, a uses a period ivery system assume is de counung recorus provide me following information at the end of the annual accounting period, December 31 2 Units Unit Cost $50 63 ents 00:51:16 Transactions Beginning inventory, January 1 Transactions during the year a. Purchase, January 30 3,200 b. Sale, March 14 (5100 each) (1,350) Purchase, May 1 1.900 50 d. Sale, August 31 (5100 each) (1) Assuming that for Specific identification method (item 1d) the March 14 sale was selected two fifths from the beginning inventory and three fifths from the purchase of January 30, Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods a. Last in, first out b. Weighted average cost. c First in, first-out d. Specific identification, assuming that the March 14 sale was selected two fifths from the beginning inventory and three fifths from the purchase of January 30, Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1 2.a. Or the four methods, which will result in the highest gross profit? 2.b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Req? Reg 2A Reg 20 of the four methods, which will result in the highest gross profit? Last in first-out Weighted average cost First in first out Specific identification CUSUNU meu dhe i tan penou, de a penitentury System Assume ducony TCUTS PLUVIU following information at the end of the annual accounting period, December 31. 2 Units 1.700 Unit Cost $ 50 63 Transactions Beginning inventory, January 1 Transactions during the years o. Purchase, January 30 b. Sale, March 14 ($100 each) c. Purchase, May 1 d. Sale, August 31 (5100 cach) 3.200 (1,350) 1,980 (1.300) 80 00 5100 Assuming that for Specific identification method item id) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods a. Last-in, first-out. b. Weighted average cost. c First in, first-out . Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1 2-a. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Regt Reg 2A Reh 20 of the four methods, which will result in the lowest income taxes? Last in first-out Weighted average cost First-in, first-out Specific identification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started