help me solve the following

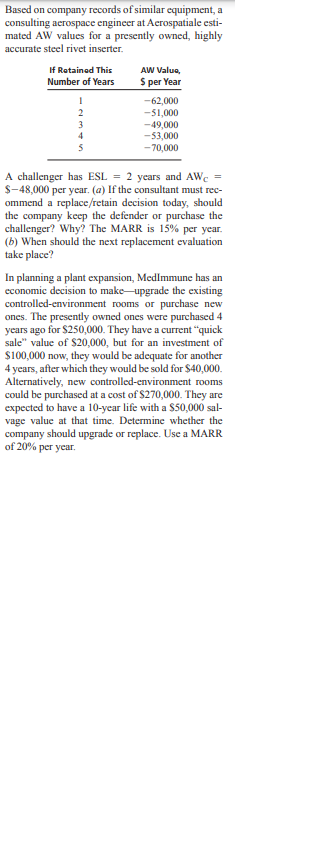

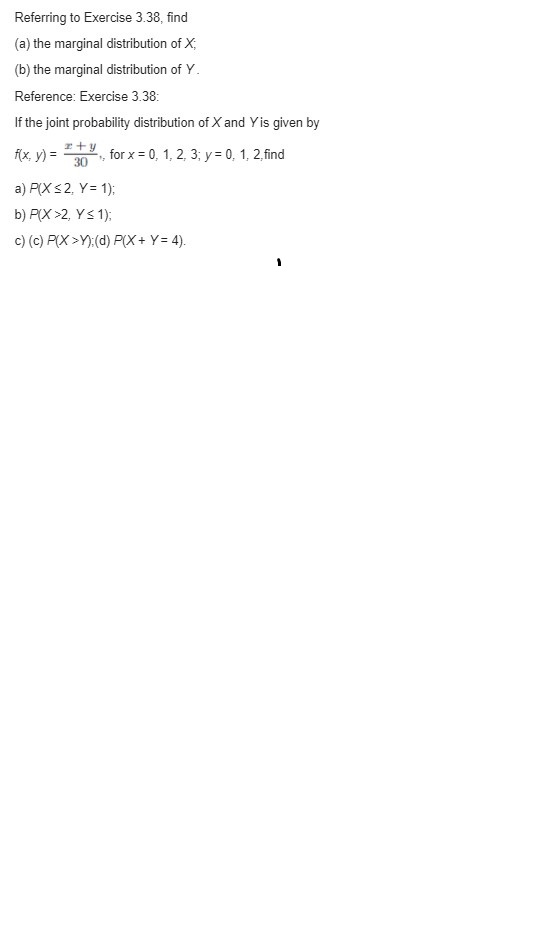

If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits, disbenefits, costs, or savings? The cost of grading and spreading gravel on a short rural road is expected to be $300,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously could only be reached with off-road vehicles. The improved accessibility has led to a 150% increase in the property values along the road. If the previ- ous market value of a property was $900,000, calculate the B/C ratio using an interest rate of 6% per year and a 20-year study period. Arsenic enters drinking water supplies from natu- ral deposits in the earth or from agricultural and industrial practices. Since it has been linked to cancer of the bladder, kidney, and other internal organs, the EPA has lowered the arsenic standard for drinking water from 0.050 parts per million to 0.010 parts per million (10 parts per billion). The annual cost to public water utilities to meet the new standard is estimated to be $200 per house- hold. If it is estimated that there are 90 million households in the United States and that the lower standard can save 50 lives per year valued at $4,000,000 per life, what is the benefit/cost ratio of the regulation?A public corporation in which you own common stock reported a WACC of 11.1% for the year in its report to stockholders. The common stock that you own has averaged a total return of 7% per year over the last 3 years. The annual report also men- tions that projects within the corporation are 75% funded by its own capital. Estimate the company's cost of debt capital. BASF will invest $14 million this year to upgrade its ethylene glycol processes. This chemical is used to produce polyester resins to manufacture products varying from construction materials to aircraft, and from luggage to home appliances. Eq- uity capital costs 14.5% per year and will supply 65% of the capital funds. Debt capital costs 10% per year before taxes. The effective tax rate for BASF is 36% (a) Determine the amount of annual revenue after taxes that is consumed in covering the interest on the project's initial cost. (b) If the corporation does not want to use 65% of its own funds, the financing plan may in- clude 75% debt capital. Determine the amount of annual revenue needed to cover the interest with this plan, and explain the ef- fect it may have on the corporation's ability to borrow in the future. A couple planning for their child's college educa- tion can fund part of or all the expected $100,000 tuition cost from their own funds (through an edu- cation IRA) or borrow all or part of it. The average return for their own funds is 7% per year, but the loan is expected to have a higher interest rate as the loan amount increases. Use a spreadsheet to generate a plot of the WACC curve with the esti- mated loan interest rates below and determine the best D-E mix for the couple.A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.Based on company records of similar equipment, a consulting acrospace engineer at Acrospatiale esti- mated AW values for a presently owned, highly accurate steel rivet inserter. If Retained This AW Valua, Number of Years S per Year -62,000 -$1,000 -49,000 WA w -$3,000 -70,000 A challenger has ESL = 2 years and AWc = $-48,000 per year. (a) If the consultant must rec- commend a replace/retain decision today, should the company keep the defender or purchase the challenger? Why? The MARR is 15% per year. (b) When should the next replacement evaluation take place? In planning a plant expansion, MedImmune has an economic decision to make-upgrade the existing controlled-environment rooms or purchase new ones. The presently owned ones were purchased 4 years ago for $250,000. They have a current "quick sale" value of $20,000, but for an investment of $100,000 now, they would be adequate for another 4 years, after which they would be sold for $40,000. Alternatively, new controlled-environment rooms could be purchased at a cost of $270,000. They are expected to have a 10-year life with a $50,000 sal- vage value at that time. Determine whether the company should upgrade or replace. Use a MARR of 20% per year.Referring to Exercise 3.38, find (a) the marginal distribution of X; (b) the marginal distribution of Y. Reference: Exercise 3.38: If the joint probability distribution of X and Y is given by RX, y) = 30 Ity, for x = 0, 1, 2, 3; y = 0, 1, 2, find a) P(X $2, Y= 1); b) P(X >2, Y= 1); c) (c) P(X >Y):(d) P(X + Y = 4).An alternative with an infinite life has a B/C ratio of 1.5. The alternative has benefits of $50,000 per year and annual maintenance costs of $10,000 per year. The first cost of the alternative at an interest rate of 10% per year is closest to: (a) $23,300 (b) $85.400 (c) $146,100 (ad) $233,000 Cost-effectiveness analysis (CEA) differs from cost-benefit (B/C) analysis in that: (a) CEA cannot handle multiple alternatives. (b) CEA expresses outcomes in natural units rather than in currency units. (c) CEA cannot handle independent alternatives. (d) CEA is more time-consuming and resource- intensive. Several private colleges claim to have programs that are very effective at teaching enrollees how to become entrepreneurs. Two programs, identi- fied as program X and program Y, have produced 4 and 6 persons per year, respectively, who were recognized as entrepreneurs. If the total cost of the programs is $25,000 and $33,000, respec- tively, the incremental cost-effectiveness ratio is closest to: (a) 6250 (b) 5500 (c) 4000 (d) 1333