Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me solve this 1 You are considering building a small house for rent as an investment. The land costs $5,000, the materials costs $10,000,

help me solve this

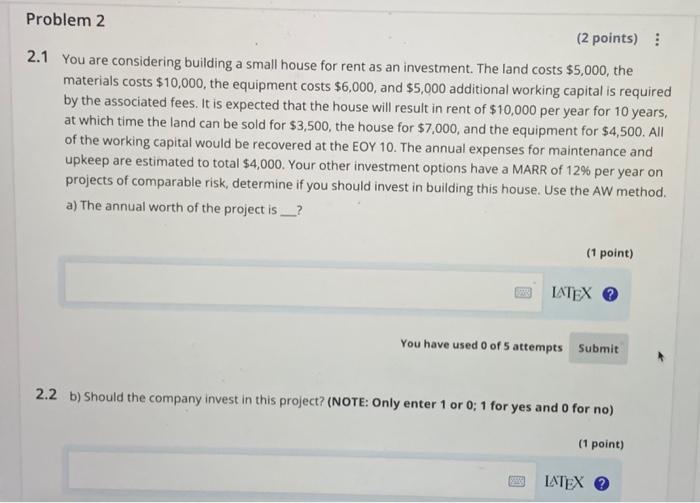

1 You are considering building a small house for rent as an investment. The land costs $5,000, the materials costs $10,000, the equipment costs $6,000, and $5,000 additional working capital is required by the associated fees. It is expected that the house will result in rent of $10,000 per year for 10 years, at which time the land can be sold for $3,500, the house for $7,000, and the equipment for $4,500. All of the working capital would be recovered at the EOY 10 . The annual expenses for maintenance and upkeep are estimated to total $4,000. Your other investment options have a MARR of 12% per year on projects of comparable risk, determine if you should invest in building this house. Use the AW method. a) The annual worth of the project is (1 point) You have used 0 of 5 attempts 2.2 b) Should the company invest in this project? (NOTE: Only enter 1 or 0;1 for yes and 0 for no)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started