Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me solve this Exercise 6A-3 (Static) Cost Behavior; High-Low Method [L06-10] Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The

Help me solve this

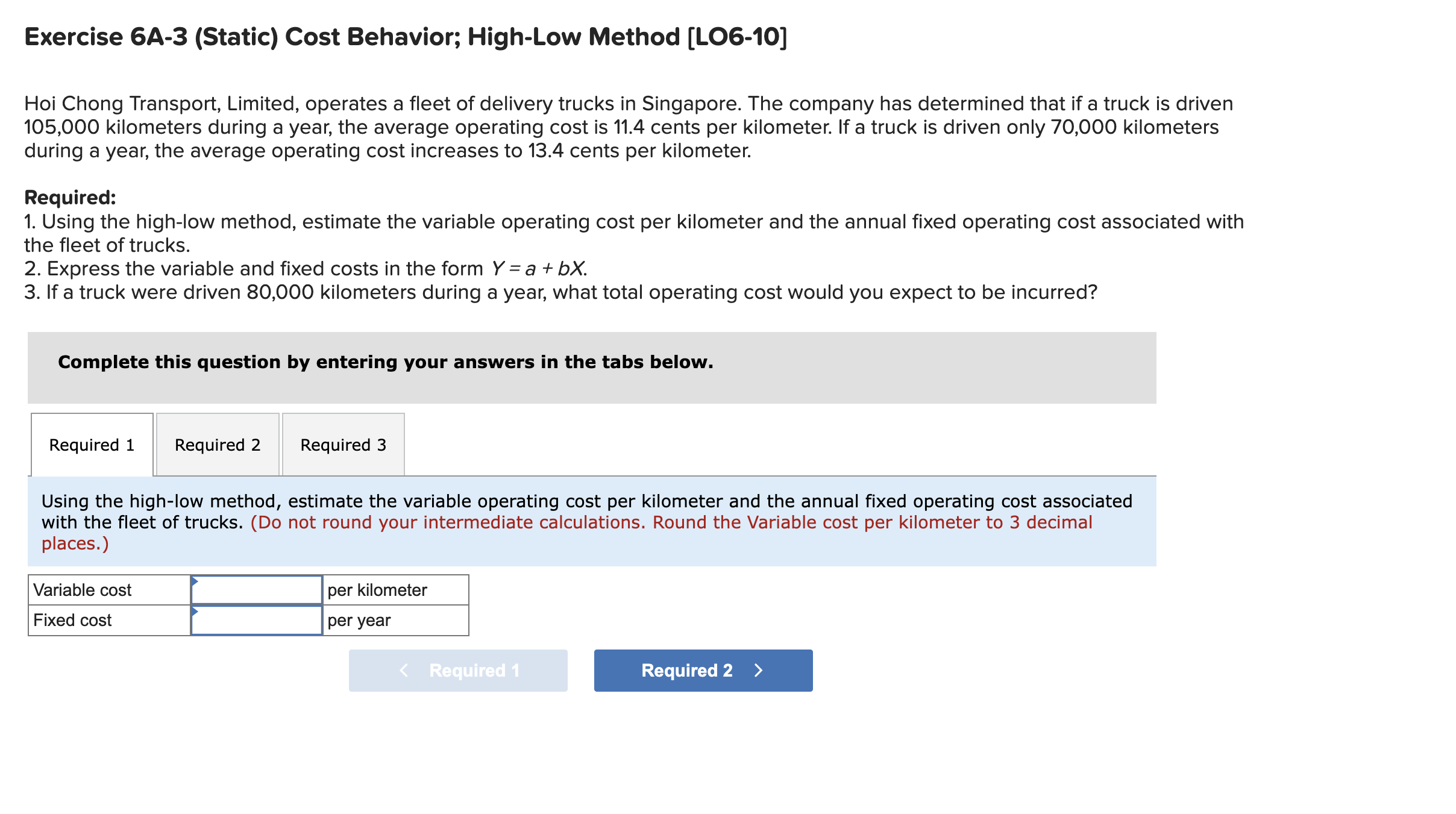

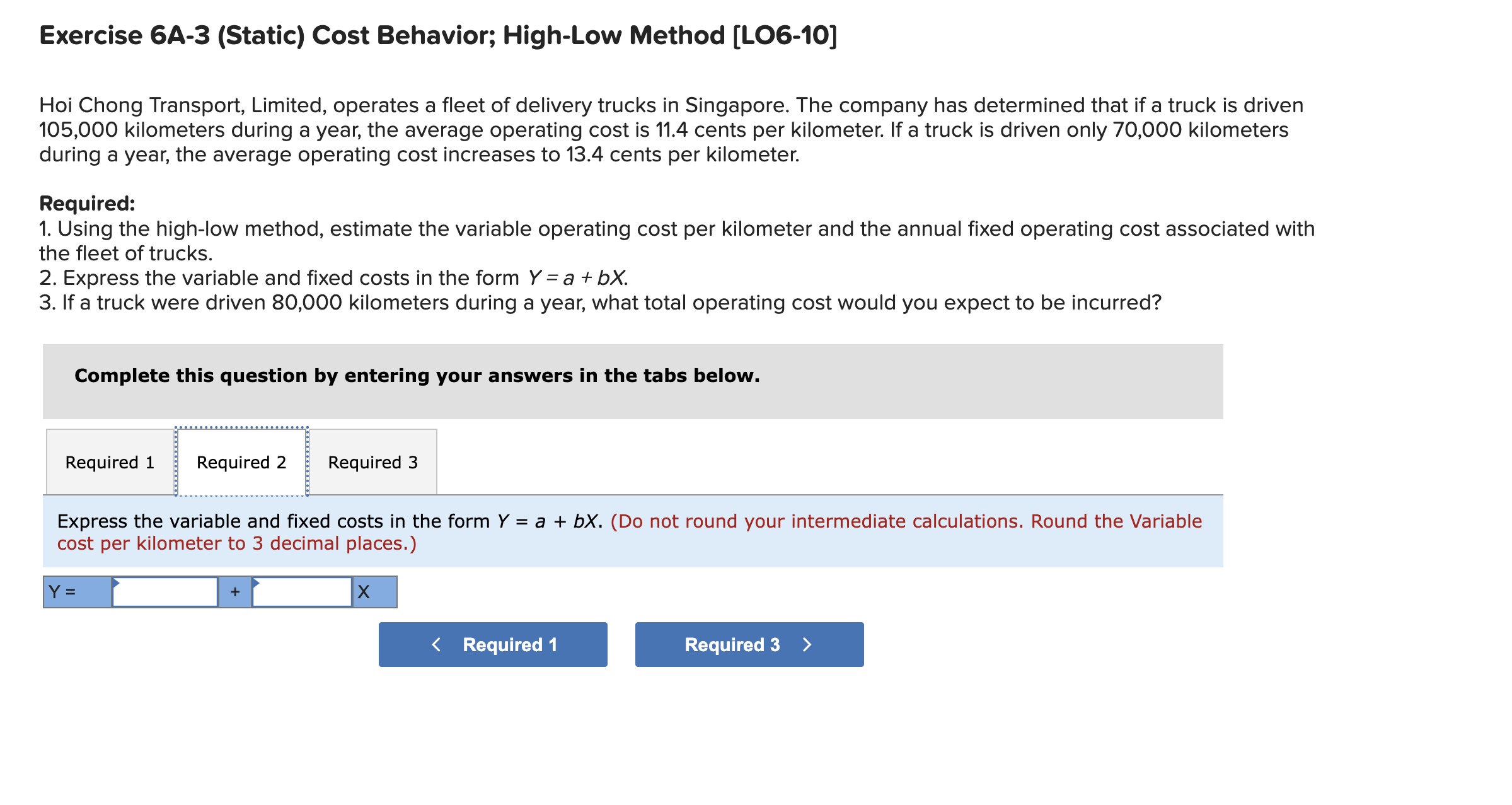

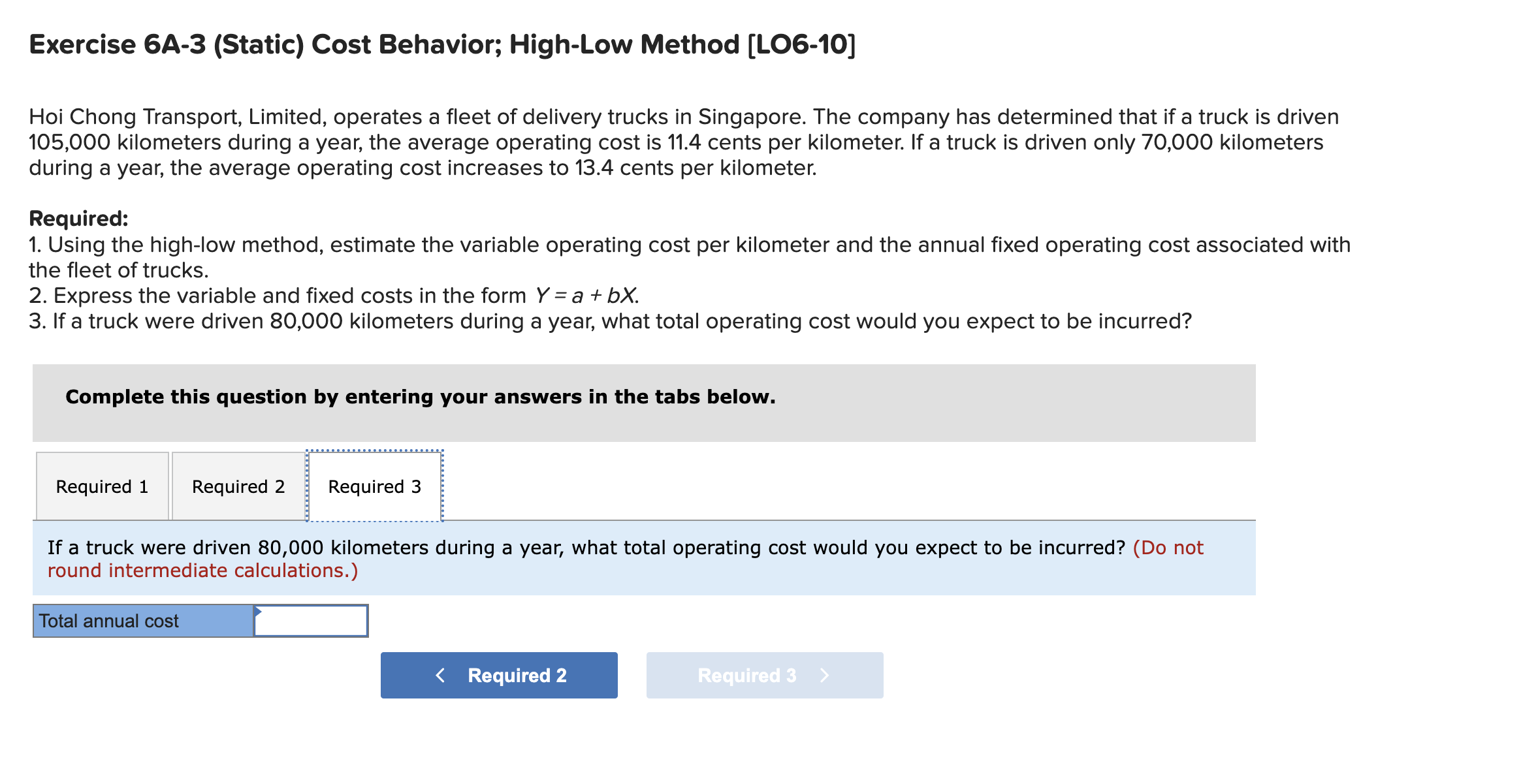

Exercise 6A-3 (Static) Cost Behavior; High-Low Method [L06-10] Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The company has determined that if a truck is driven 105,000 kilometers during a year, the average operating cost is 11.4 cents per kilometer. If a truck is driven only 70,000 kilometers during a year, the average operating cost increases to 13.4 cents per kilometer. Required: 1. Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. 2. Express the variable and fixed costs in the form Y=a+bX. 3. If a truck were driven 80,000 kilometers during a year, what total operating cost would you expect to be incurred? Complete this question by entering your answers in the tabs below. Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. (Do not round your intermediate calculations. Round the Variable cost per kilometer to 3 decimal places.) Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The company has determined that if a truck is driven 105,000 kilometers during a year, the average operating cost is 11.4 cents per kilometer. If a truck is driven only 70,000 kilometers during a year, the average operating cost increases to 13.4 cents per kilometer. Required: 1. Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. 2. Express the variable and fixed costs in the form Y=a+bX. 3. If a truck were driven 80,000 kilometers during a year, what total operating cost would you expect to be incurred? Complete this question by entering your answers in the tabs below. Express the variable and fixed costs in the form Y=a+bX. (Do not round your intermediate calculations. Round the Variable cost per kilometer to 3 decimal places.) Exercise 6A-3 (Static) Cost Behavior; High-Low Method [LO6-10] Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The company has determined that if a truck is driven 105,000 kilometers during a year, the average operating cost is 11.4 cents per kilometer. If a truck is driven only 70,000 kilometers during a year, the average operating cost increases to 13.4 cents per kilometer. Required: 1. Using the high-low method, estimate the variable operating cost per kilometer and the annual fixed operating cost associated with the fleet of trucks. 2. Express the variable and fixed costs in the form Y=a+bX. 3. If a truck were driven 80,000 kilometers during a year, what total operating cost would you expect to be incurred? Complete this question by entering your answers in the tabs below. If a truck were driven 80,000 kilometers during a year, what total operating cost would you expect to be incurred? (Do not round intermediate calculations.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started