help me solve this plss

help me solve this plss

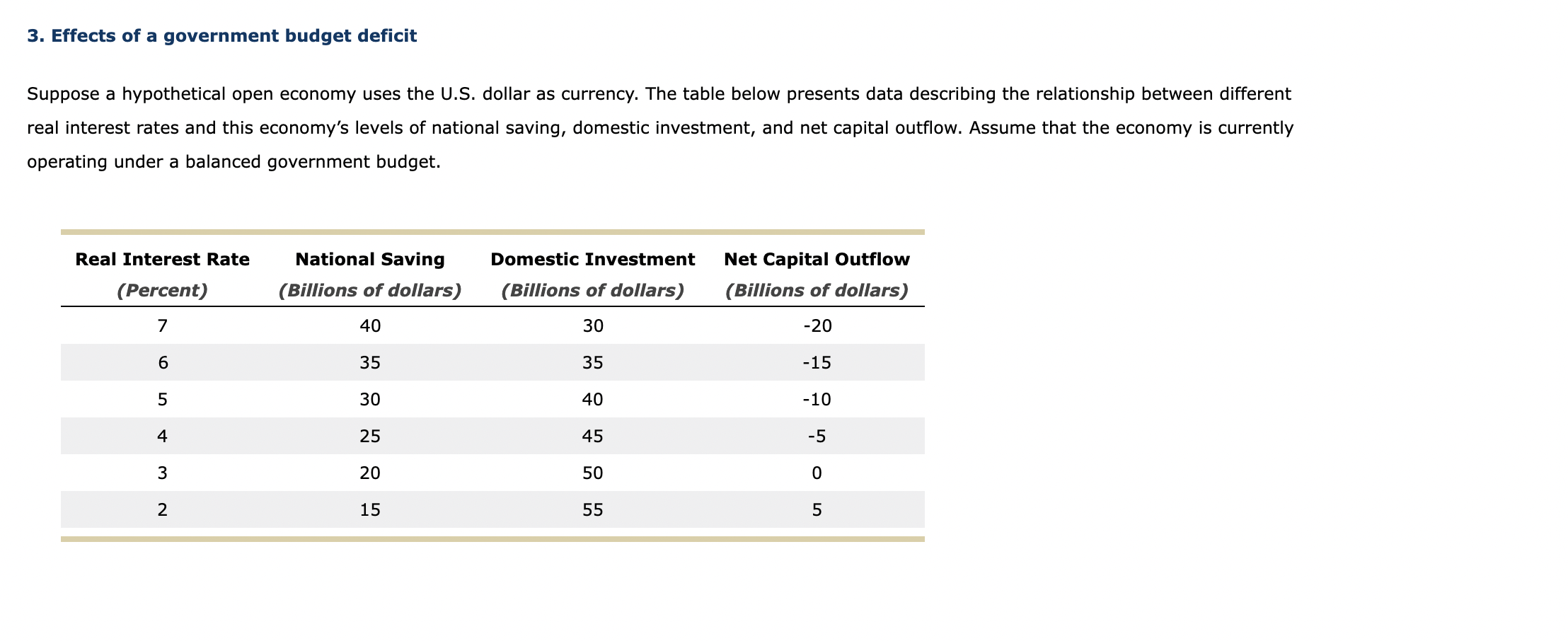

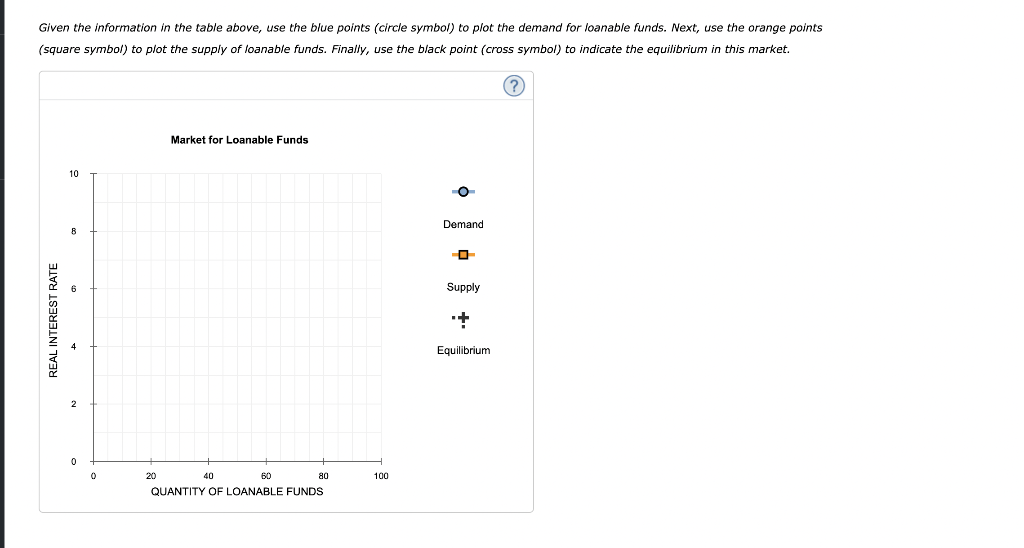

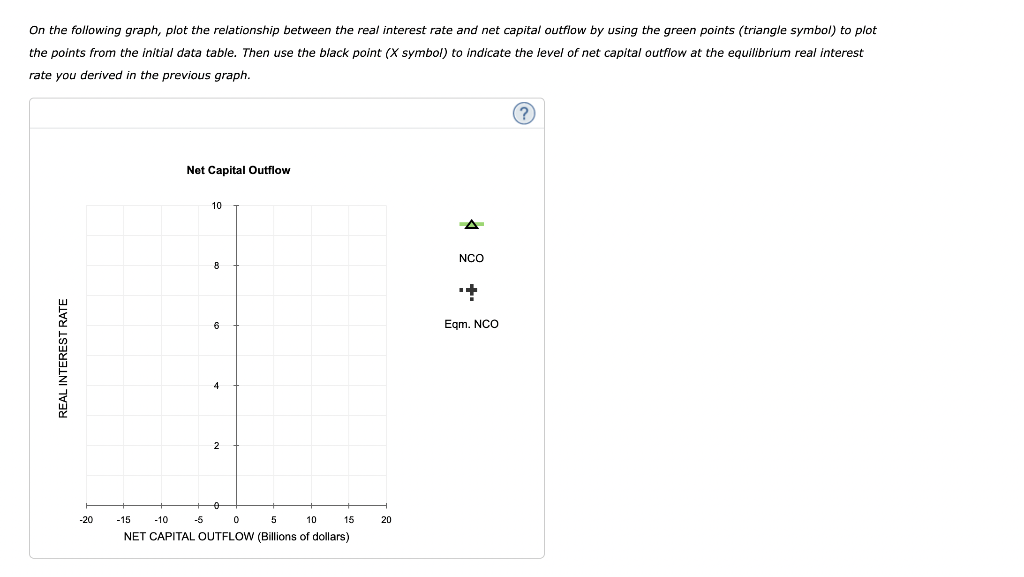

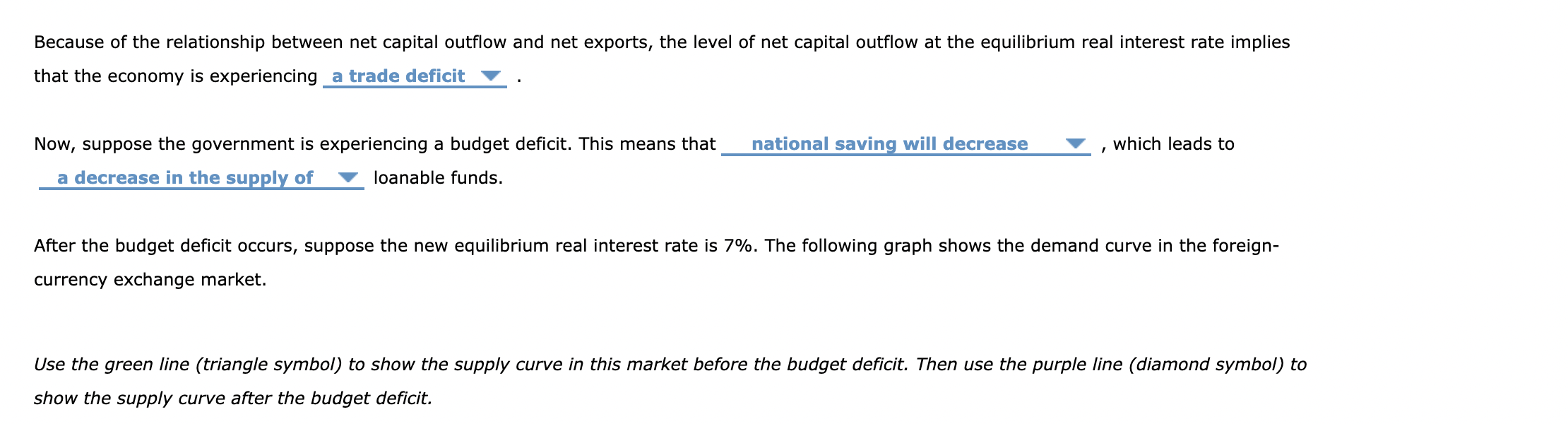

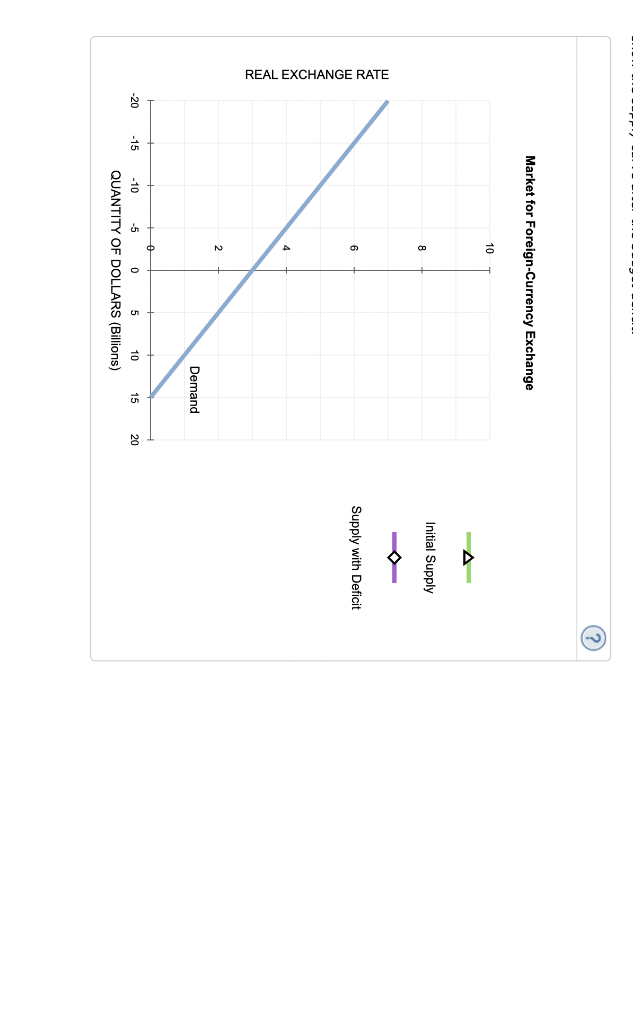

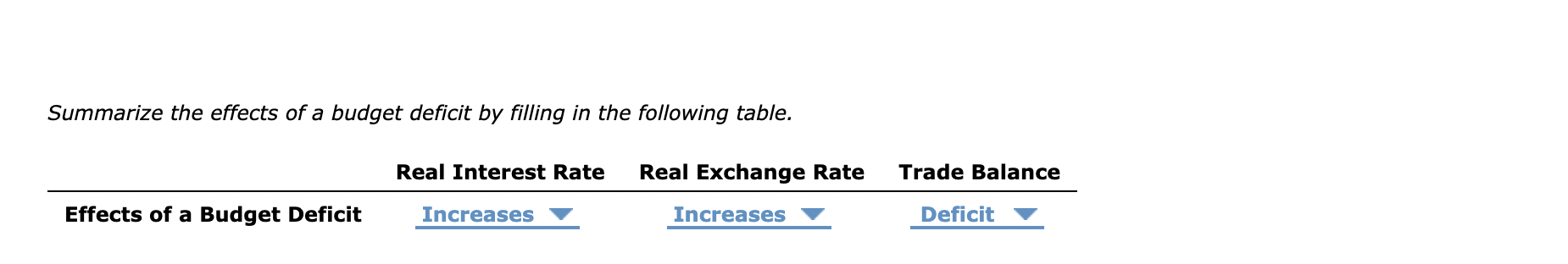

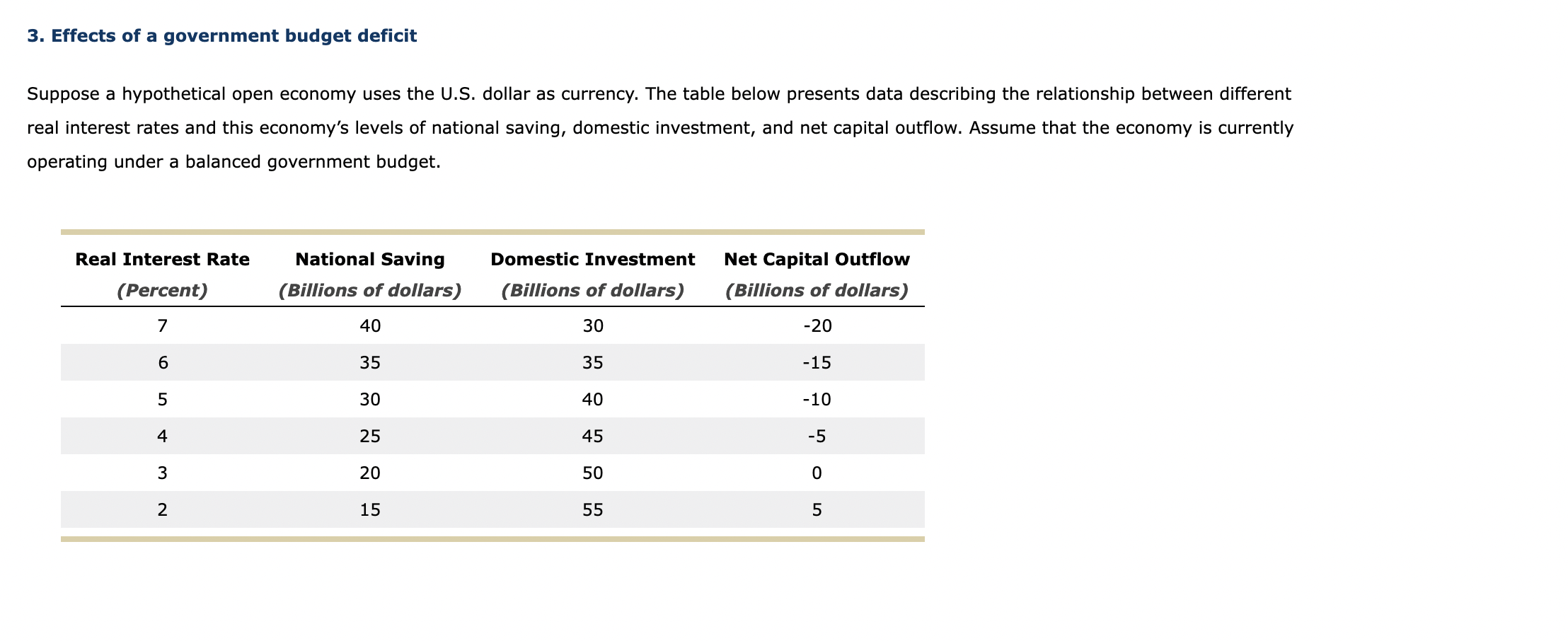

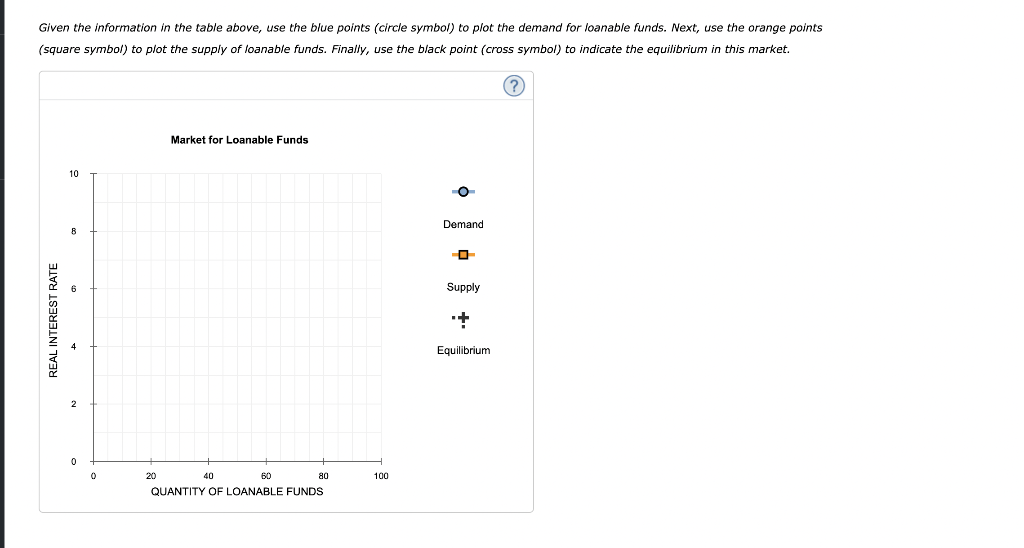

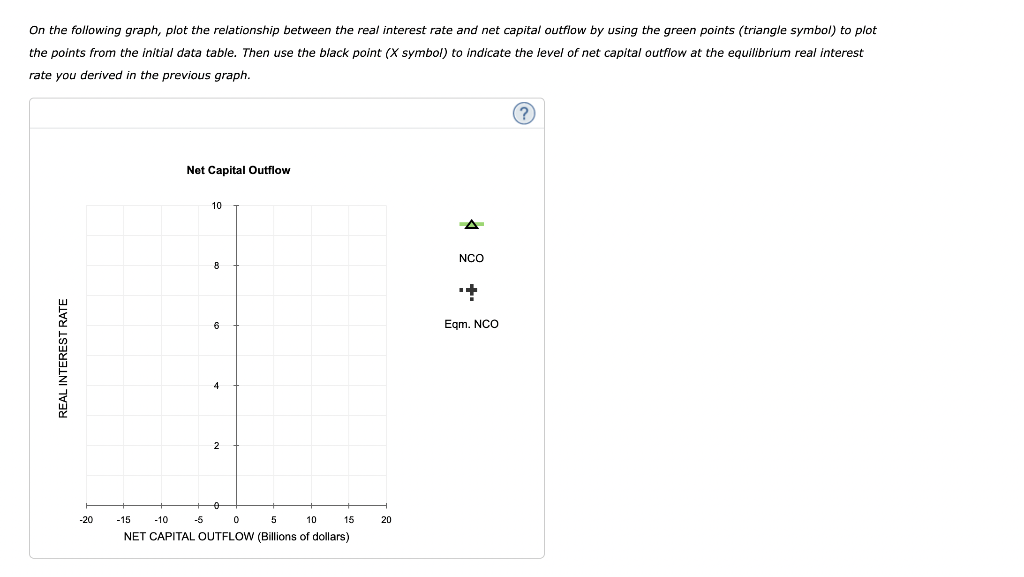

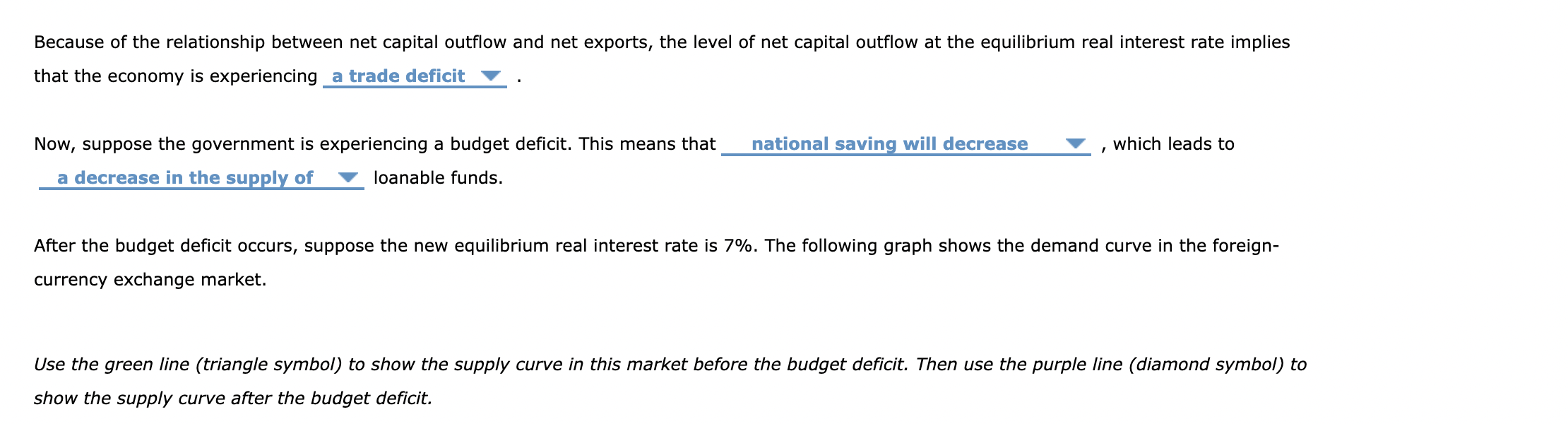

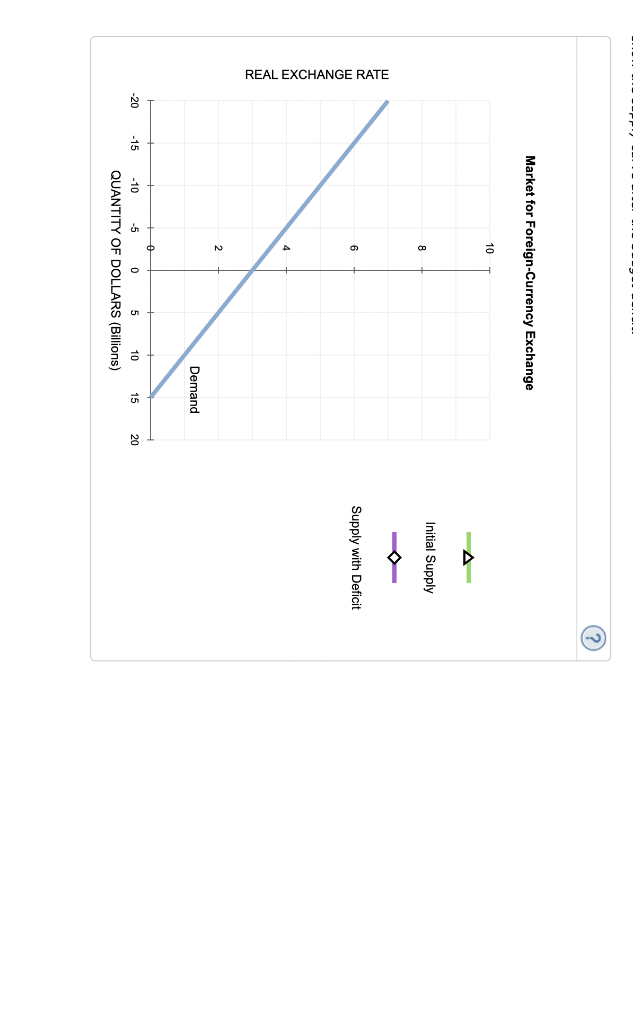

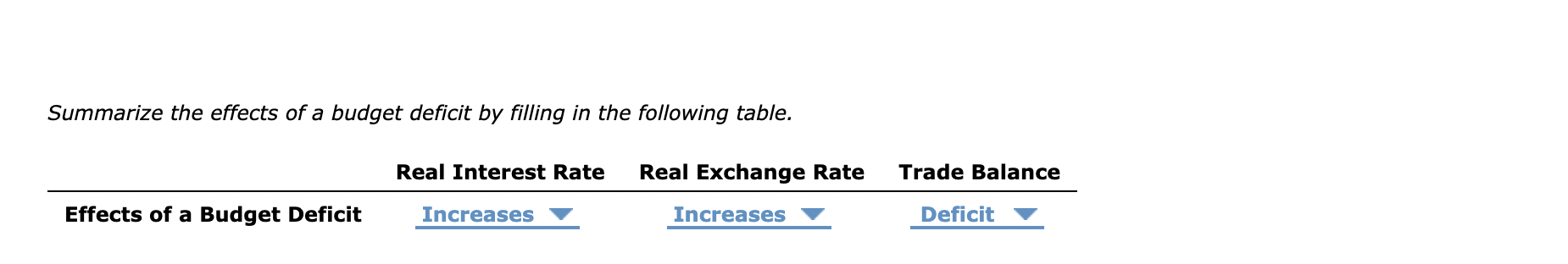

3. Effects of a government budget deficit Suppose a hypothetical open economy uses the U.S. dollar as currency. The table below presents data describing the relationship between different real interest rates and this economy's levels of national saving, domestic investment, and net capital outflow. Assume that the economy is currently operating under a balanced government budget. Given the information in the table above, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. On the following graph, plot the relationship between the real interest rate and net capital outflow by using the green points (triangle symbol) to plot the points from the initial data table. Then use the black point ( X symbol) to indicate the level of net capital outflow at the equilibrium real interest rate you derived in the previous graph. Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate implies that the economy is experiencing Now, suppose the government is experiencing a budget deficit. This means that , which leads to loanable funds. After the budget deficit occurs, suppose the new equilibrium real interest rate is 7%. The following graph shows the demand curve in the foreigncurrency exchange market. Use the green line (triangle symbol) to show the supply curve in this market before the budget deficit. Then use the purple line (diamond symbol) to show the supply curve after the budget deficit. REAL EXCHANGE RATE Summarize the effects of a budget deficit by filling in the following table. 3. Effects of a government budget deficit Suppose a hypothetical open economy uses the U.S. dollar as currency. The table below presents data describing the relationship between different real interest rates and this economy's levels of national saving, domestic investment, and net capital outflow. Assume that the economy is currently operating under a balanced government budget. Given the information in the table above, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. On the following graph, plot the relationship between the real interest rate and net capital outflow by using the green points (triangle symbol) to plot the points from the initial data table. Then use the black point ( X symbol) to indicate the level of net capital outflow at the equilibrium real interest rate you derived in the previous graph. Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate implies that the economy is experiencing Now, suppose the government is experiencing a budget deficit. This means that , which leads to loanable funds. After the budget deficit occurs, suppose the new equilibrium real interest rate is 7%. The following graph shows the demand curve in the foreigncurrency exchange market. Use the green line (triangle symbol) to show the supply curve in this market before the budget deficit. Then use the purple line (diamond symbol) to show the supply curve after the budget deficit. REAL EXCHANGE RATE Summarize the effects of a budget deficit by filling in the following table

help me solve this plss

help me solve this plss