Answered step by step

Verified Expert Solution

Question

1 Approved Answer

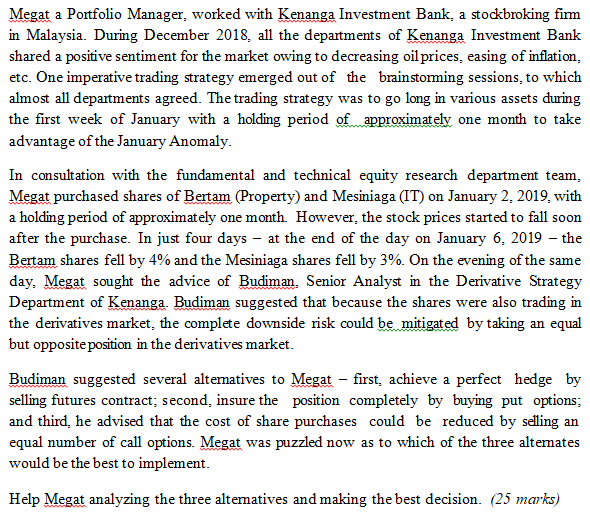

HELP ME TO ANSWER THIS QUESTION, THANK YOU IN ADVANCE Megat a Portfolio Manager, worked with Kenanga Investment Bank, a stockbroking fimm in Malaysia. During

HELP ME TO ANSWER THIS QUESTION, THANK YOU IN ADVANCE

Megat a Portfolio Manager, worked with Kenanga Investment Bank, a stockbroking fimm in Malaysia. During December 2018, all the departments of Kenanga Investment Bank shared a positive sentiment for the market owing to decreasing oil prices, easing of inflation, etc. One imperative trading strategy emerged out of the brainstorming sessions, to which almost all departments agreed. The trading strategy was to go long in various assets during the first week of January with a holding period of approximately one month to take advantage of the January Anomaly. In consultation with the fundamental and technical equity research department team, Megat purchased shares of Bertam (Property) and Mesiniaga (IT) on January 2, 2019, with a holding period of approximately one month. However, the stock prices started to fall soon after the purchase. In just four days at the end of the day on January 6, 2019 - the Bertam shares fell by 4% and the Mesiniaga shares fell by 3%. On the evening of the same day. Megat sought the advice of Budiman. Senior Analyst in the Derivative Strategy Department of Kenanga. Budiman suggested that because the shares were also trading in the derivatives market, the complete downside risk could be mitigated by taking an equal but opposite position in the derivatives market. Budiman suggested several alteratives to Megat - first, achieve a perfect hedge by selling futures contract; second, insure the position completely by buying put options; and third, he advised that the cost of share purchases could be reduced by selling an equal number of call options. Megat was puzzled now as to which of the three altemates would be the best to implement. Help Megat analyzing the three altematives and making the best decision. (25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started