Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP ME TO ANSWER THIS QUESTIONS, THANK YOU a The information given below pertains to three companies which recently paid exactly the same dividends of

HELP ME TO ANSWER THIS QUESTIONS, THANK YOU

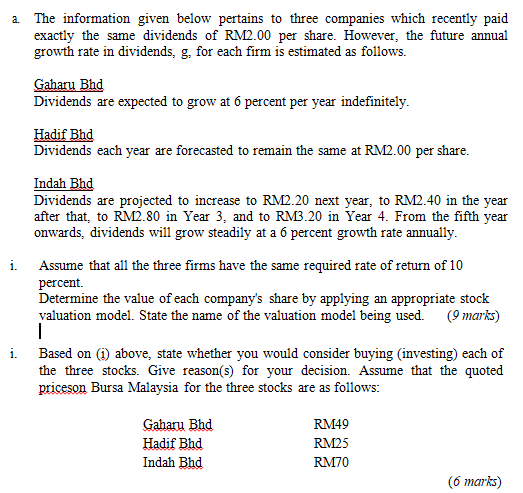

a The information given below pertains to three companies which recently paid exactly the same dividends of RM2.00 per share. However, the future annual growth rate in dividends, g, for each firm is estimated as follows. Gaharu Bhd Dividends are expected to grow at 6 percent per year indefinitely. Hadif Bhd Dividends each year are forecasted to remain the same at RM2.00 per share. Indah Bhd Dividends are projected to increase to RM2.20 next year, to RM2.40 in the year after that, to RM2.80 in Year 3, and to RM3.20 in Year 4. From the fifth year onwards, dividends will grow steadily at a 6 percent growth rate annually. i. Assume that all the three firms have the same required rate of return of 10 percent. Determine the value of each company's share by applying an appropriate stock valuation model. State the name of the valuation model being used (9 marks) i. Based on (1) above, state whether you would consider buying investing) each of the three stocks. Give reason(s) for your decision. Assume that the quoted priceson Bursa Malaysia for the three stocks are as follows: Gaharu Bhd Hadif Bhd Indah Bhd RM49 RM25 RM70 (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started