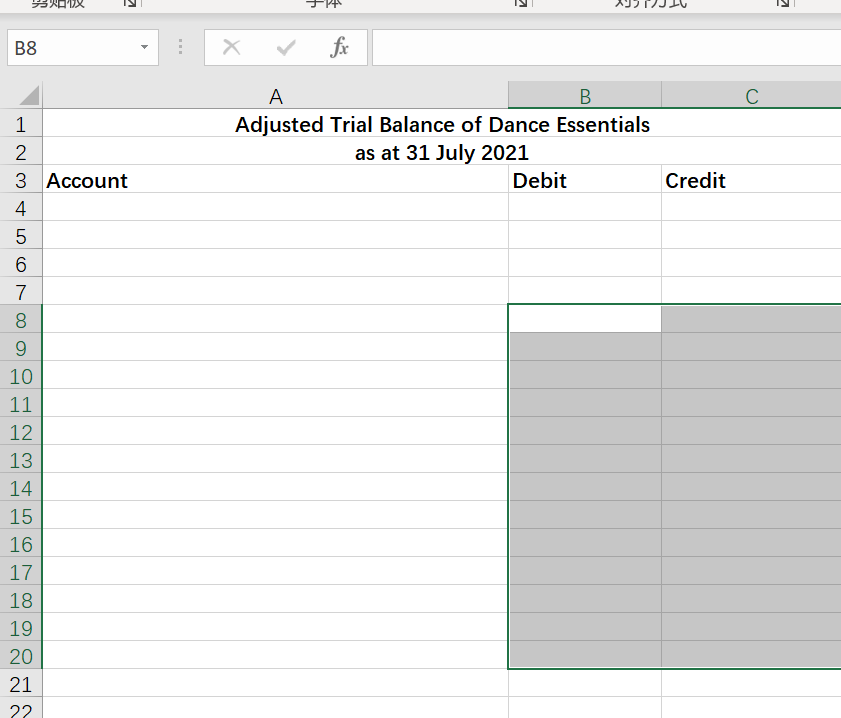

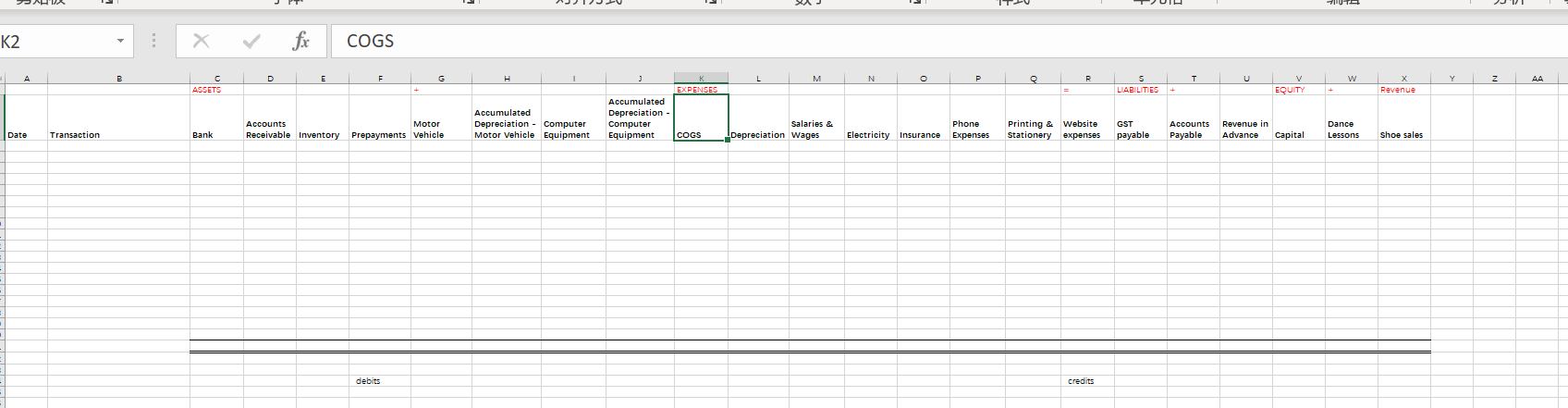

help me to do journal template, ledger template, Transaction analysis and Adjusuted Trial Balance Thanks.

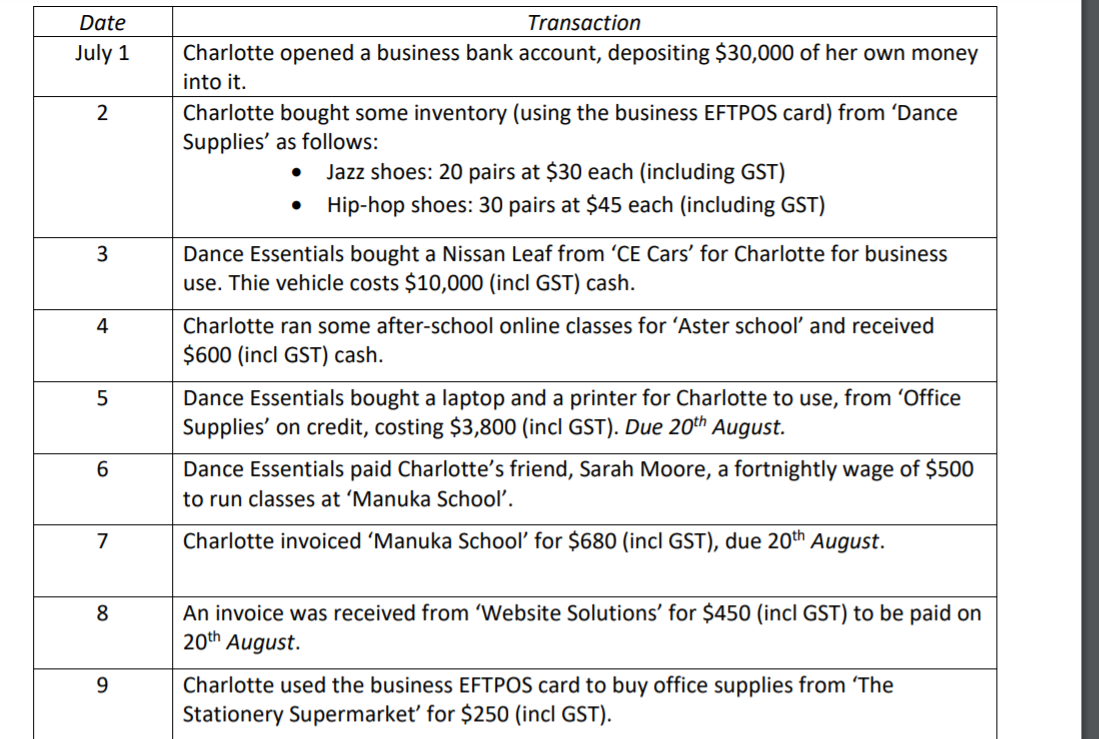

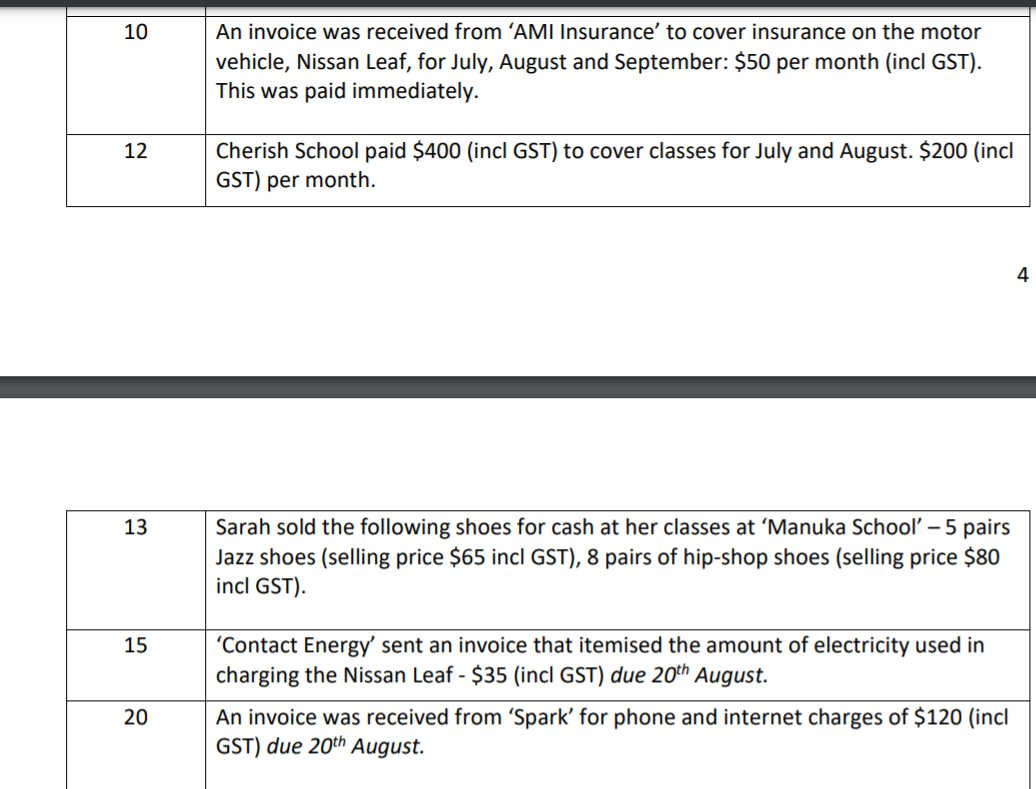

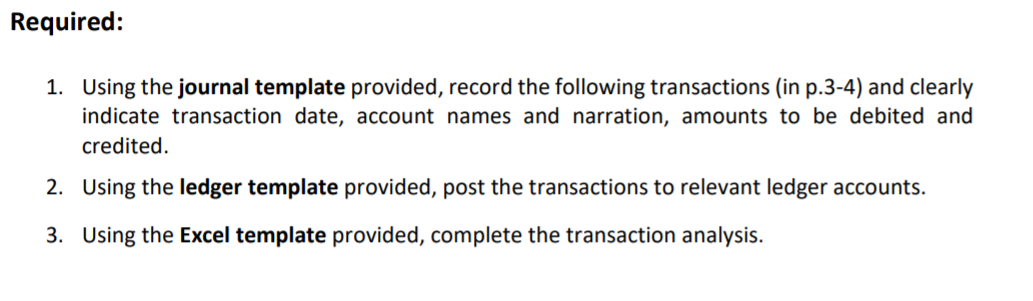

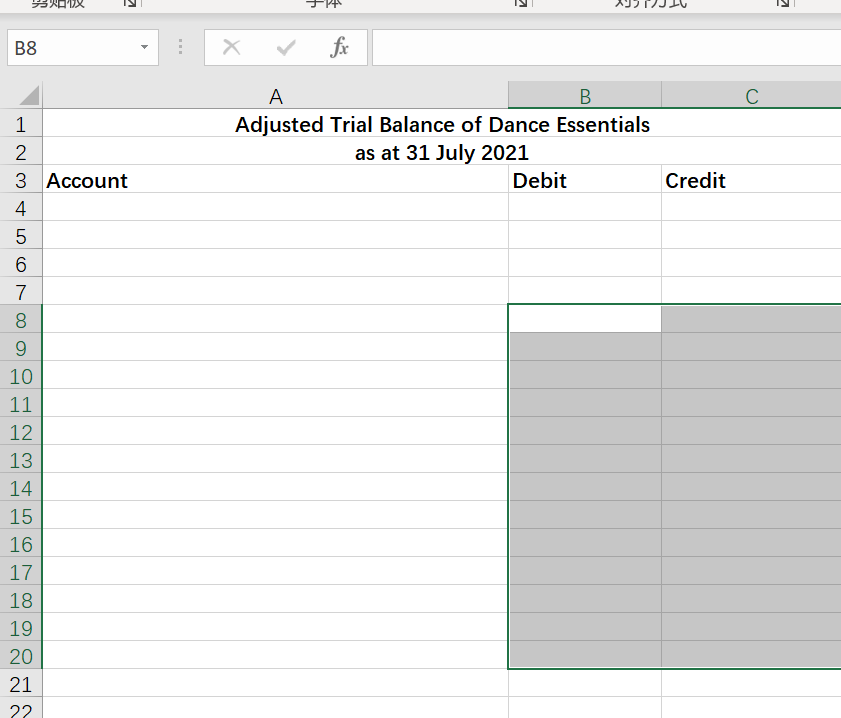

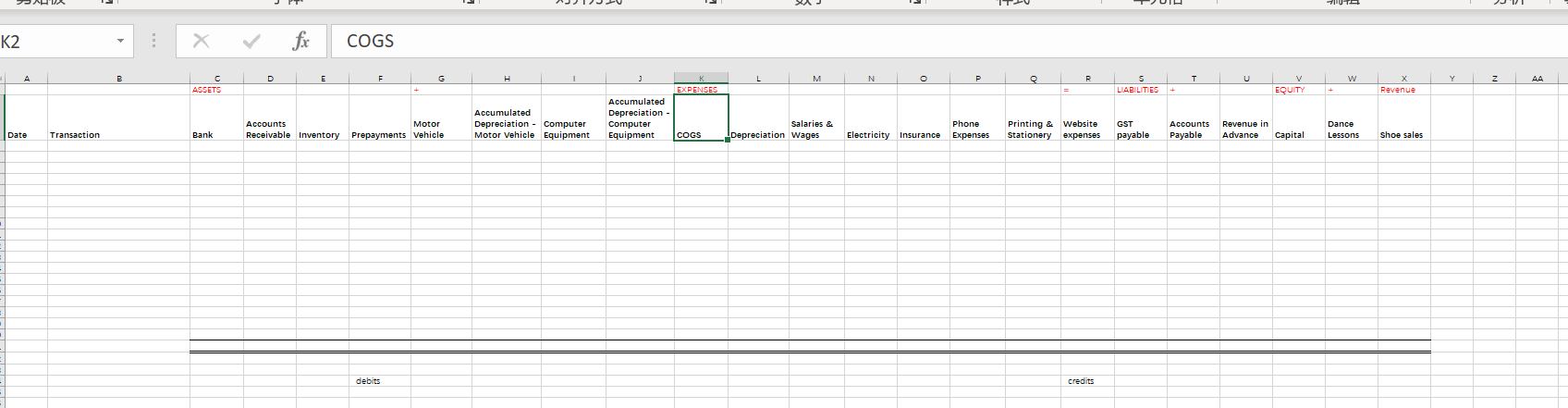

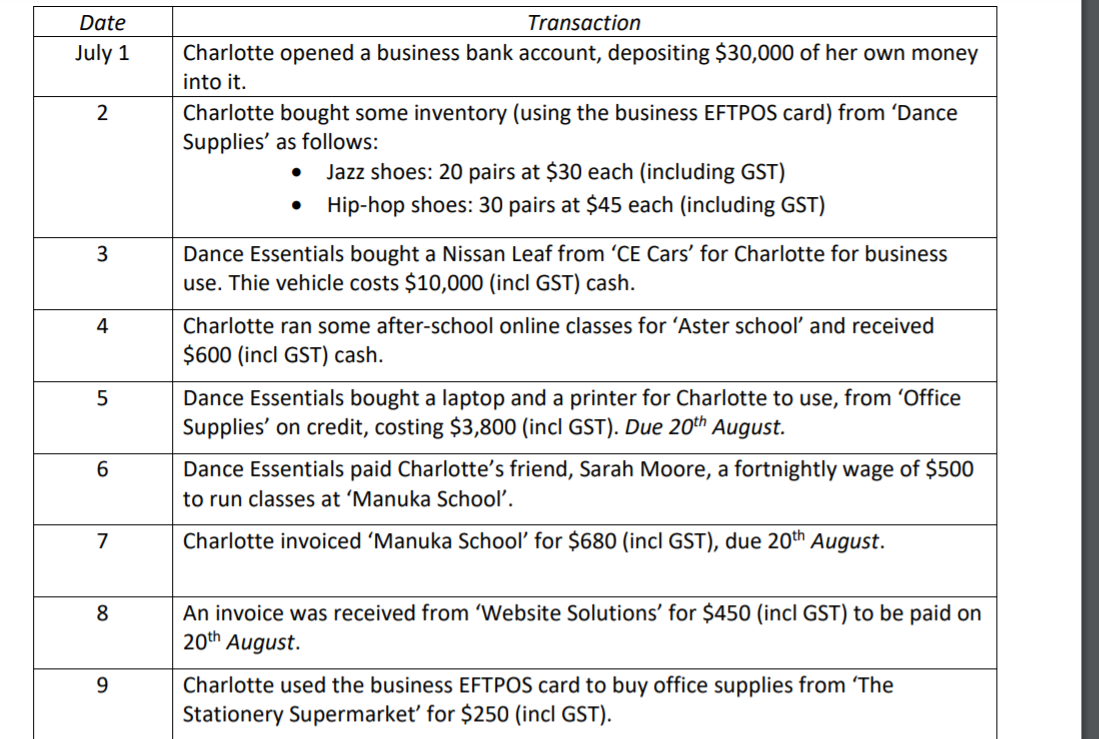

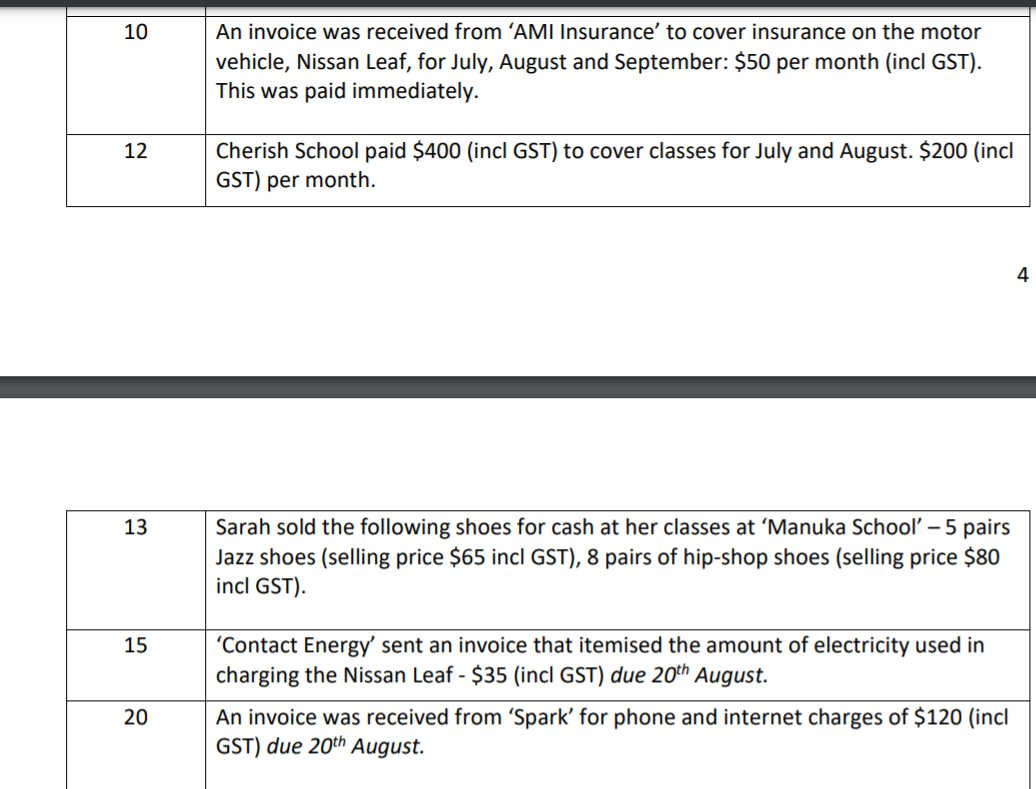

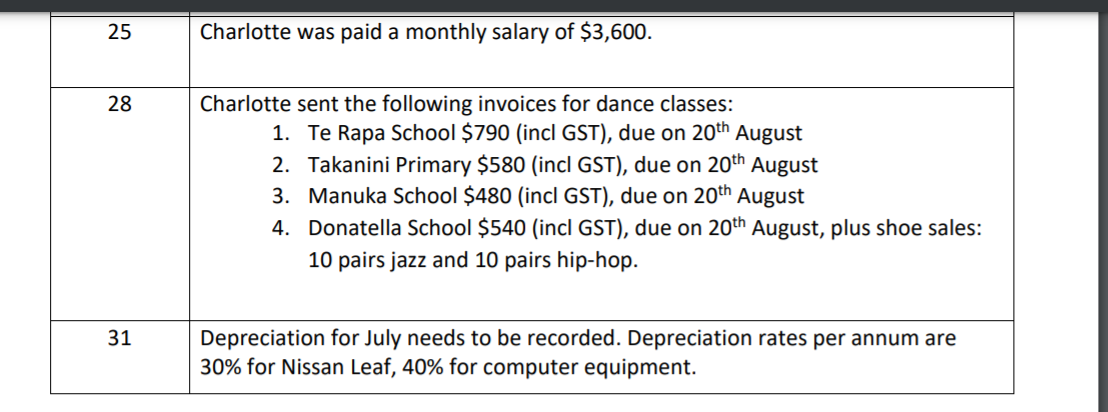

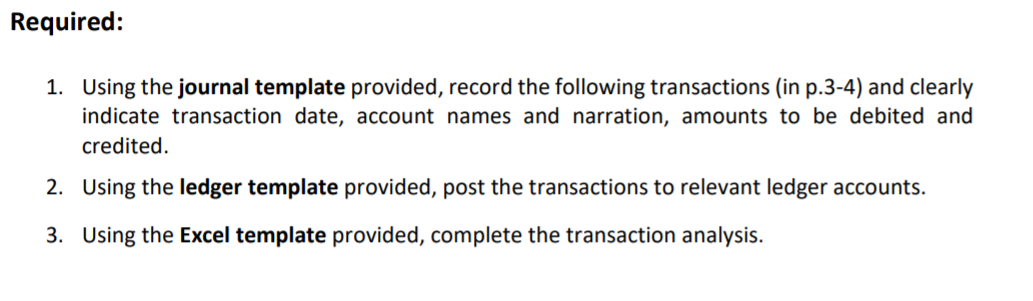

SRDX is B8 X fx . B. Adjusted Trial Balance of Dance Essentials as at 31 July 2021 Debit Credit 1 2 3 Account 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22. - K2 X fic COGS A B D E F G H M N o P Q R U w Y z C ASSETS S LIABILITIES v EQUITY + Revenue 3 EXPENSES Accumulated Depreciation - Computer Equipment COGS Date Accumulated Depreciation - Computer Motor Vehicle Equipment Accounts Receivable Inventory Bank Motor Prepayments Vehicle Salaries & Depreciation Wages Phone Expenses Electricity Insurance Printing & Website Stationery expenses Transaction GST payable Accounts Payable Revenue in Advance Dance Lessons Capital Shoe sales debits credits Date July 1 2 Transaction Charlotte opened a business bank account, depositing $30,000 of her own money into it. Charlotte bought some inventory (using the business EFTPOS card) from 'Dance Supplies' as follows: Jazz shoes: 20 pairs at $30 each (including GST) Hip-hop shoes: 30 pairs at $45 each (including GST) 3 Dance Essentials bought a Nissan Leaf from CE Cars' for Charlotte for business use. Thie vehicle costs $10,000 (incl GST) cash. Charlotte ran some after-school online classes for 'Aster school and received $600 (incl GST) cash. 4 5 6 Dance Essentials bought a laptop and a printer for Charlotte to use, from Office Supplies' on credit, costing $3,800 (incl GST). Due 20th August. Dance Essentials paid Charlotte's friend, Sarah Moore, a fortnightly wage of $500 to run classes at 'Manuka School'. Charlotte invoiced 'Manuka School for $680 (incl GST), due 20th August. 7 8 An invoice was received from 'Website Solutions' for $450 (incl GST) to be paid on 20th August Charlotte used the business EFTPOS card to buy office supplies from 'The Stationery Supermarket for $250 (incl GST). 9 10 An invoice was received from 'AMI Insurance' to cover insurance on the motor vehicle, Nissan Leaf, for July, August and September: $50 per month (incl GST). This was paid immediately. 12 Cherish School paid $400 (incl GST) to cover classes for July and August. $200 (incl GST) per month. 4 13 Sarah sold the following shoes for cash at her classes at 'Manuka School - 5 pairs Jazz shoes (selling price $65 incl GST), 8 pairs of hip-shop shoes (selling price $80 incl GST). 15 Contact Energy' sent an invoice that itemised the amount of electricity used in charging the Nissan Leaf - $35 (incl GST) due 20th August. An invoice was received from 'Spark' for phone and internet charges of $120 (incl GST) due 20th August. 20 25 Charlotte was paid a monthly salary of $3,600. 28 Charlotte sent the following invoices for dance classes: 1. Te Rapa School $790 (incl GST), due on 20th August 2. Takanini Primary $580 (incl GST), due on 20th August 3. Manuka School $480 (incl GST), due on 20th August 4. Donatella School $540 (incl GST), due on 20th August, plus shoe sales: 10 pairs jazz and 10 pairs hip-hop. 31 Depreciation for July needs to be recorded. Depreciation rates per annum are 30% for Nissan Leaf, 40% for computer equipment. Required: 1. Using the journal template provided, record the following transactions (in p.3-4) and clearly indicate transaction date, account names and narration, amounts to be debited and credited. 2. Using the ledger template provided, post the transactions to relevant ledger accounts. 3. Using the Excel template provided, complete the transaction analysis