HELP ME TO SOLVE GENERAL LEDGER !!!!!!!!

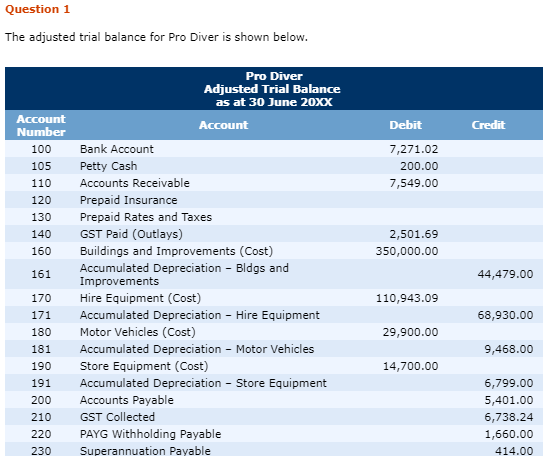

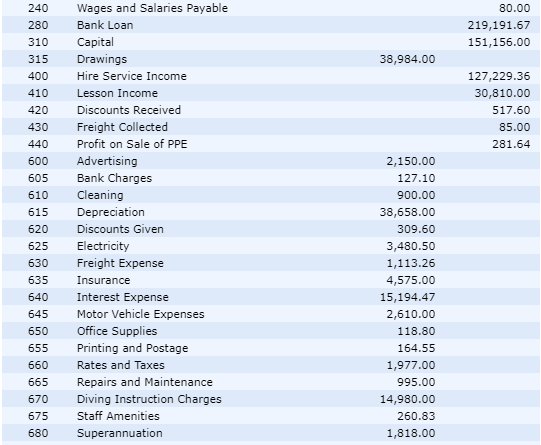

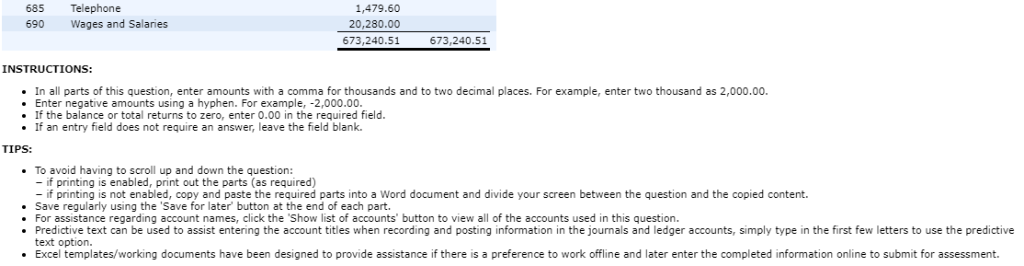

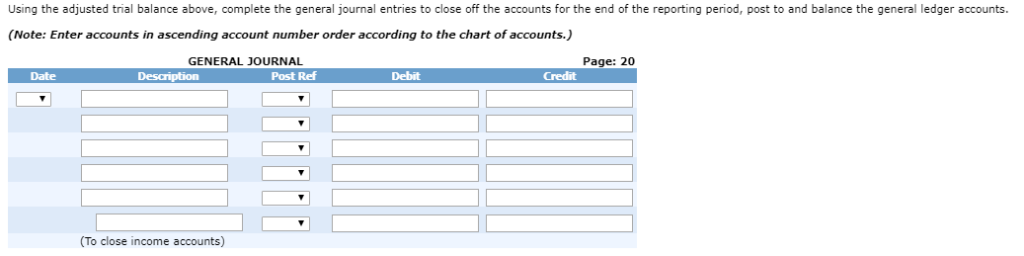

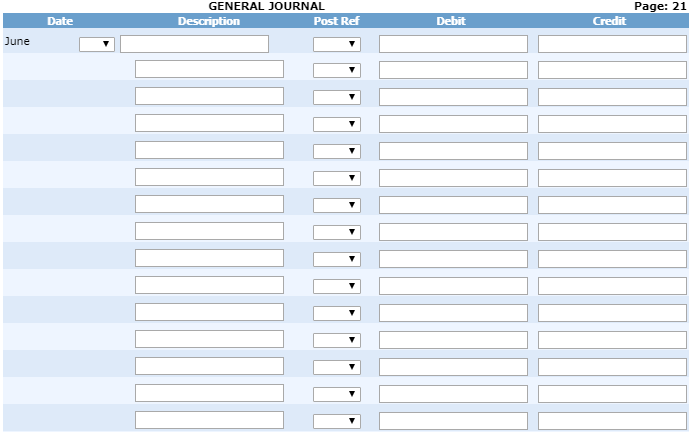

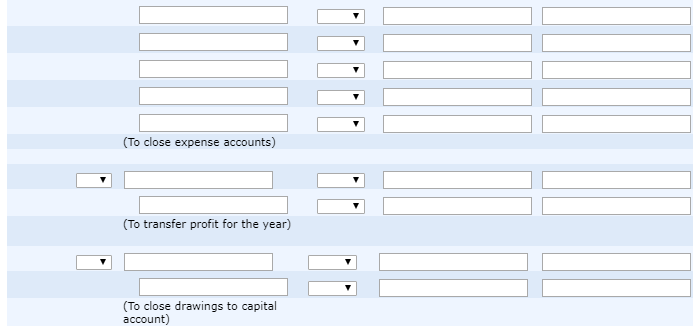

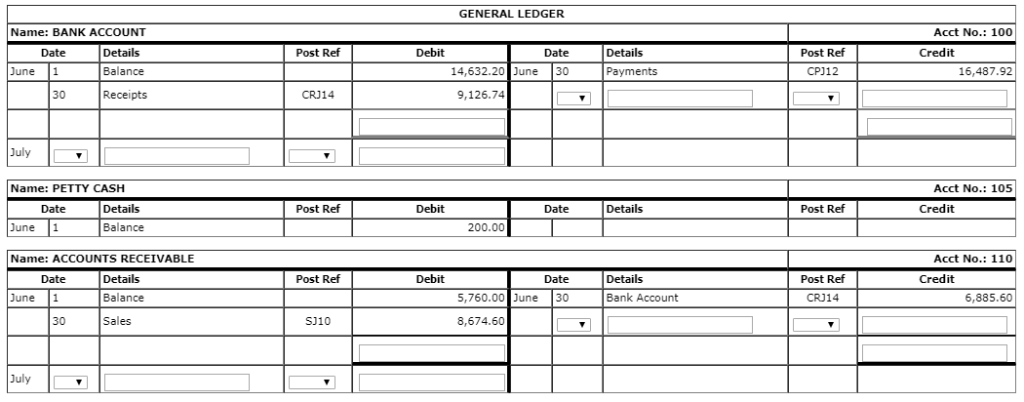

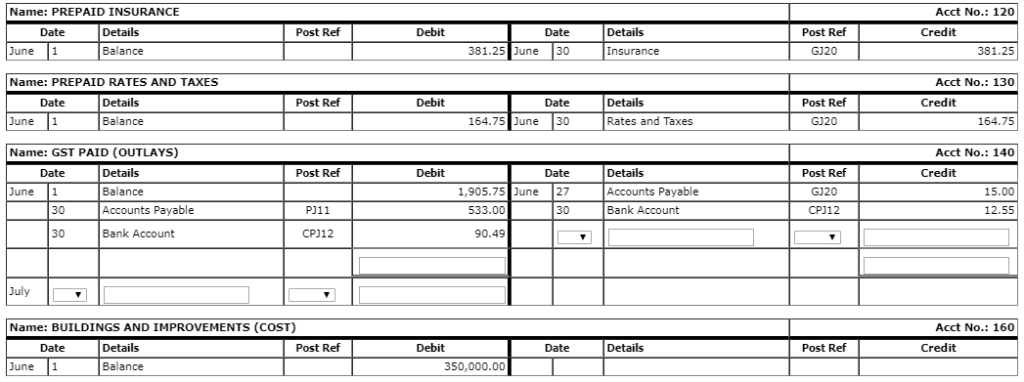

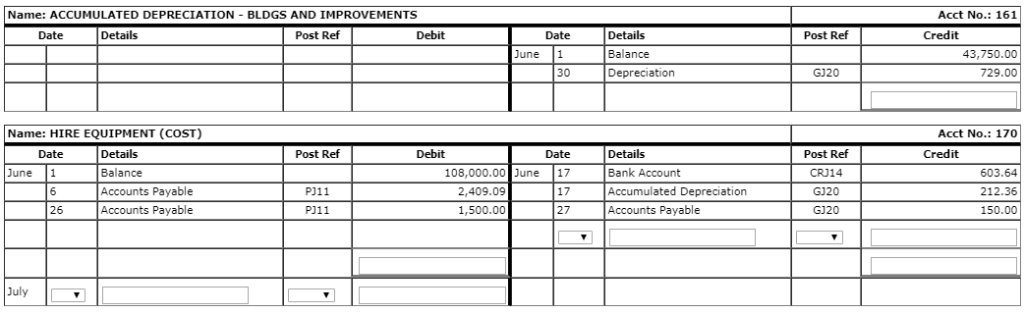

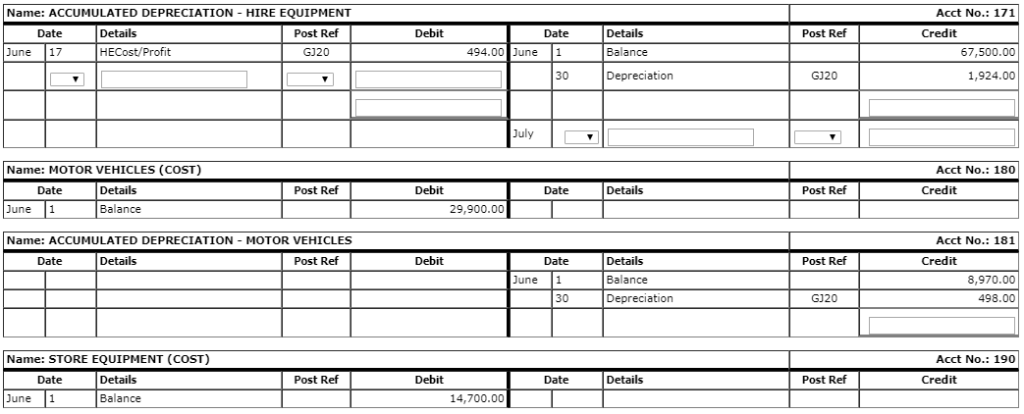

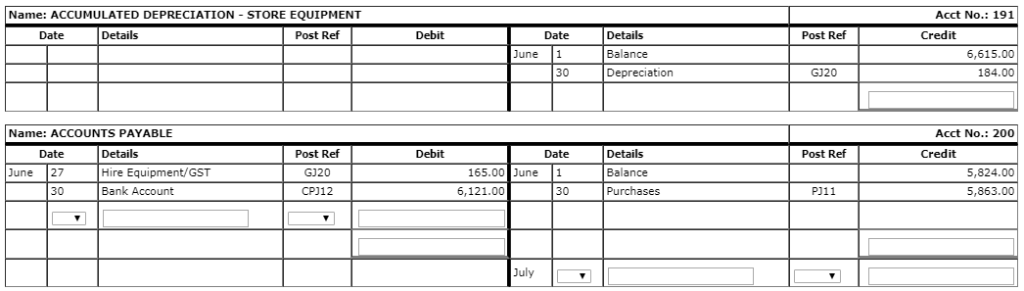

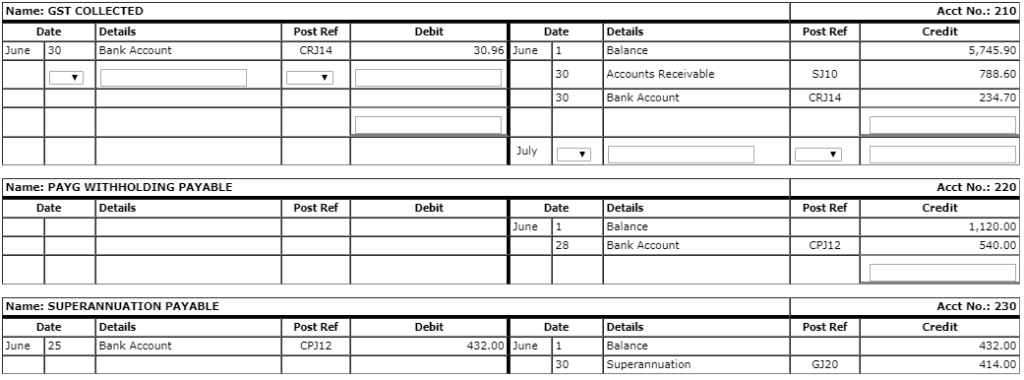

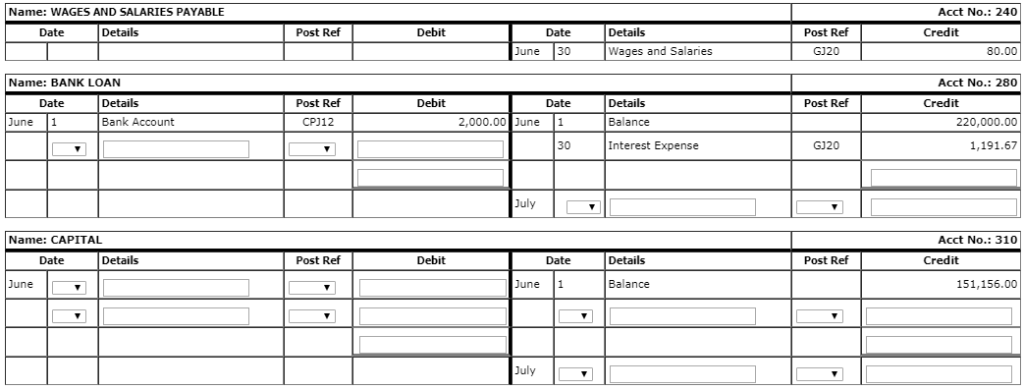

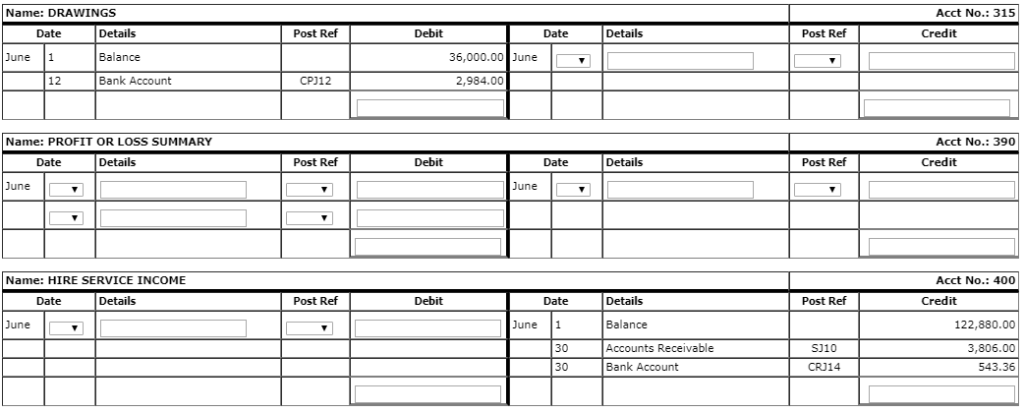

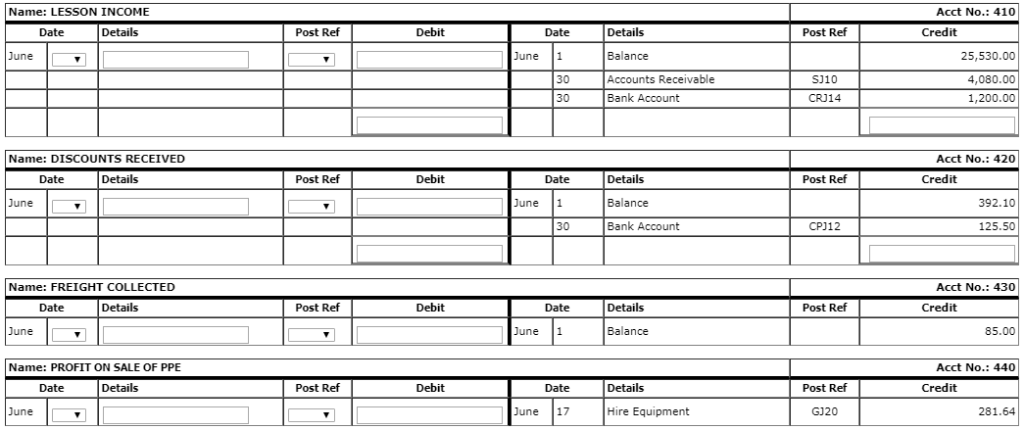

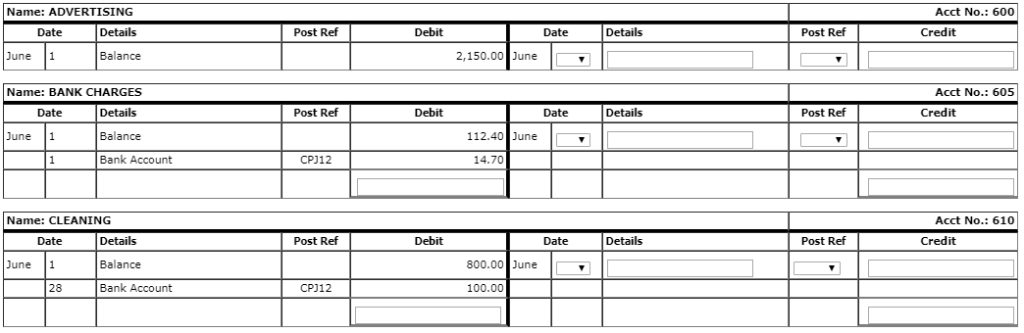

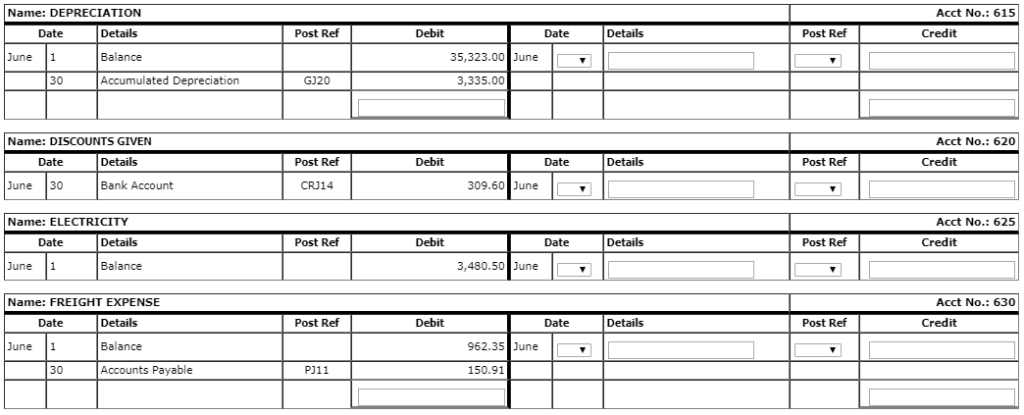

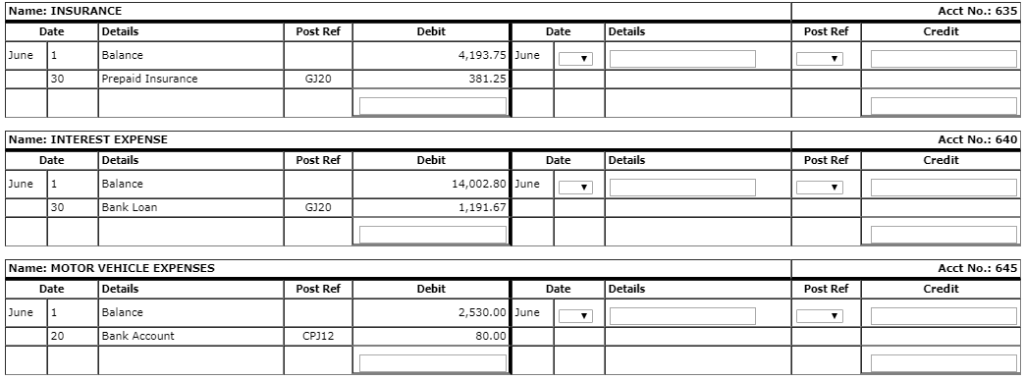

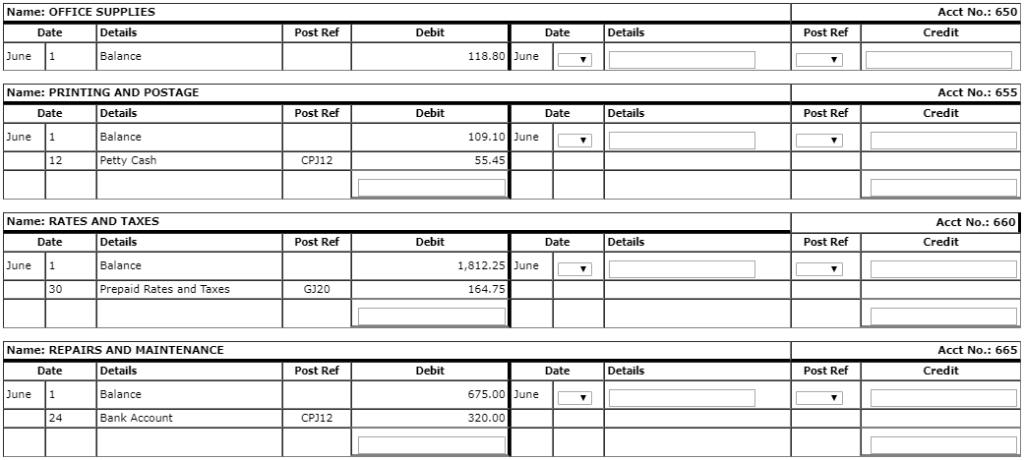

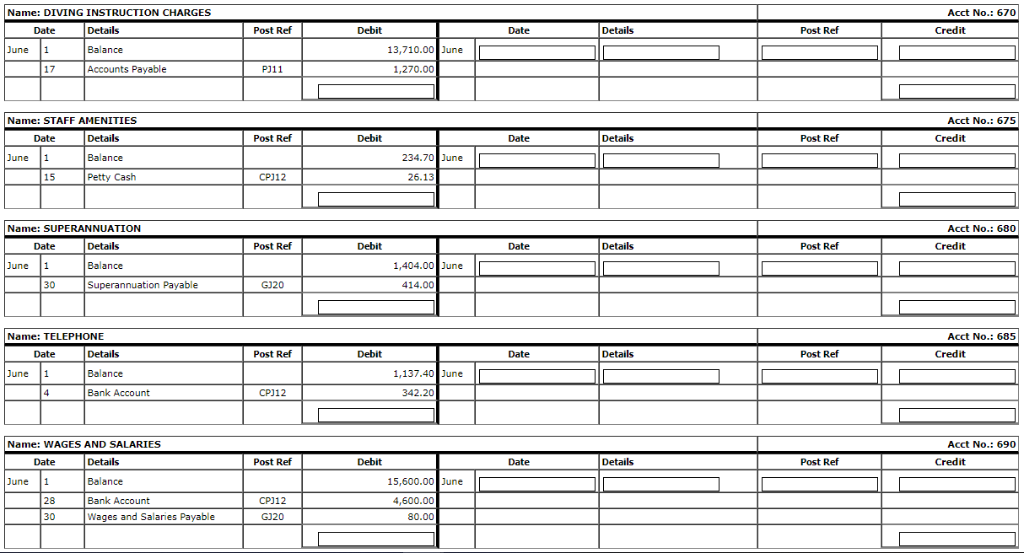

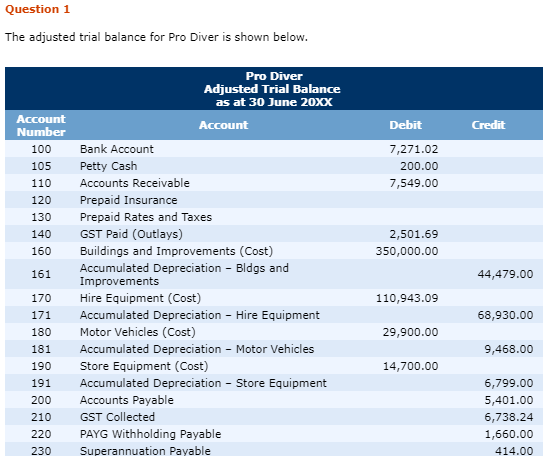

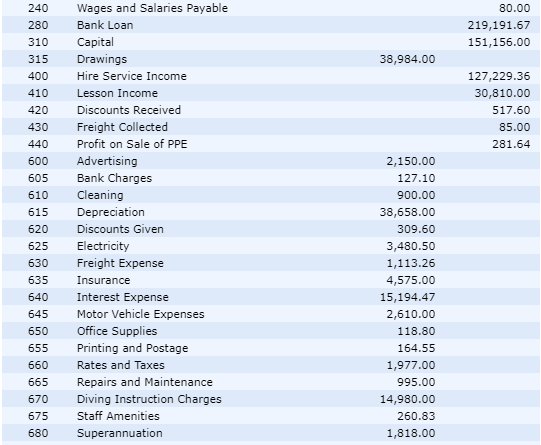

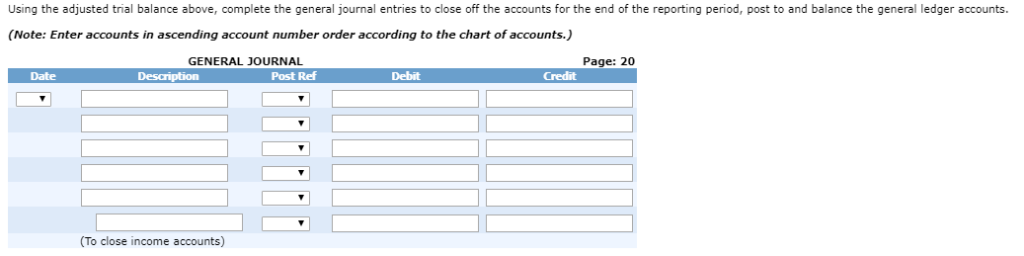

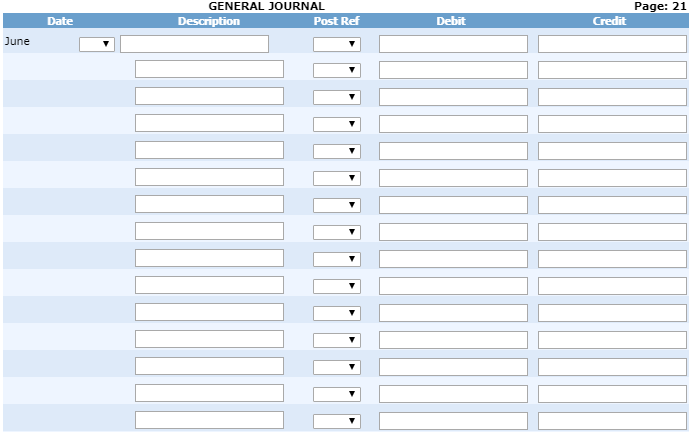

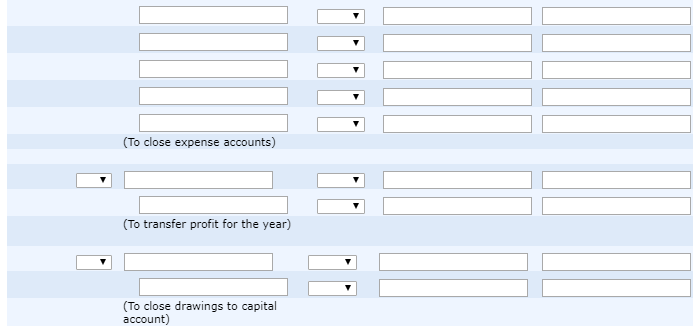

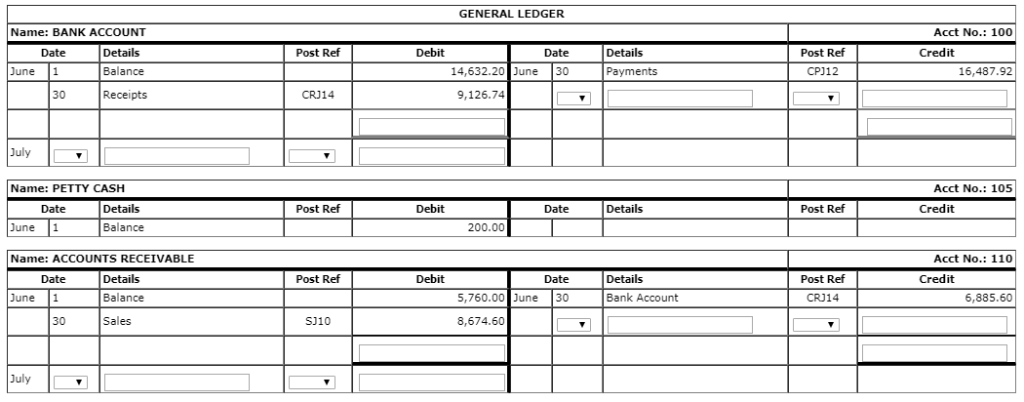

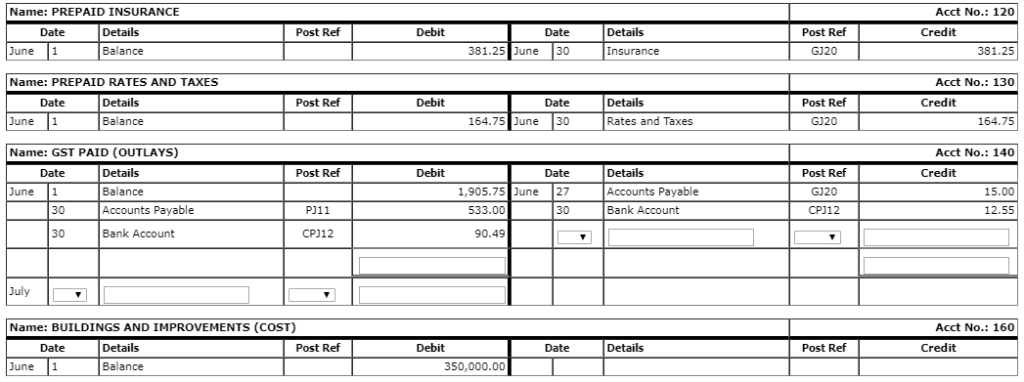

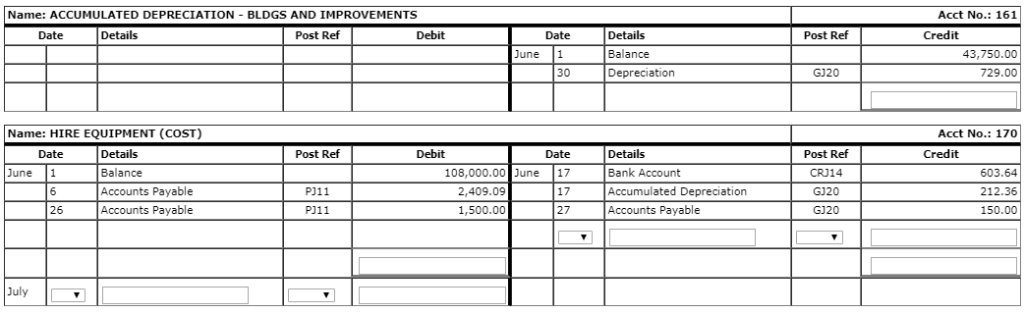

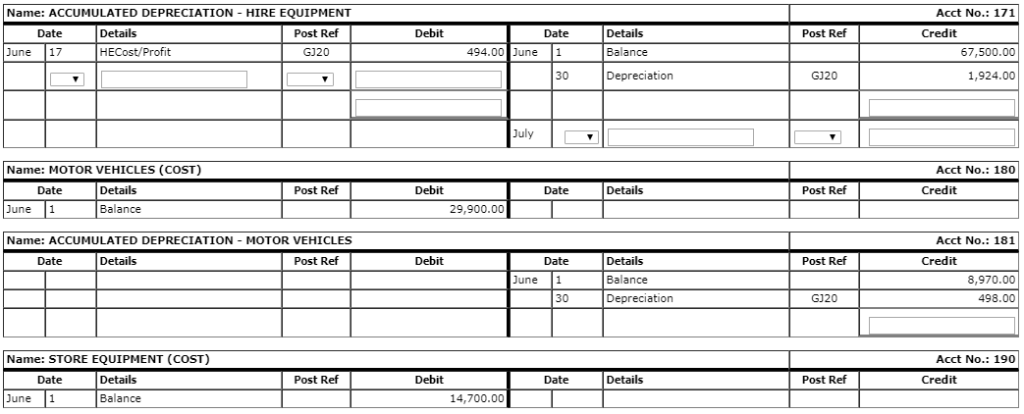

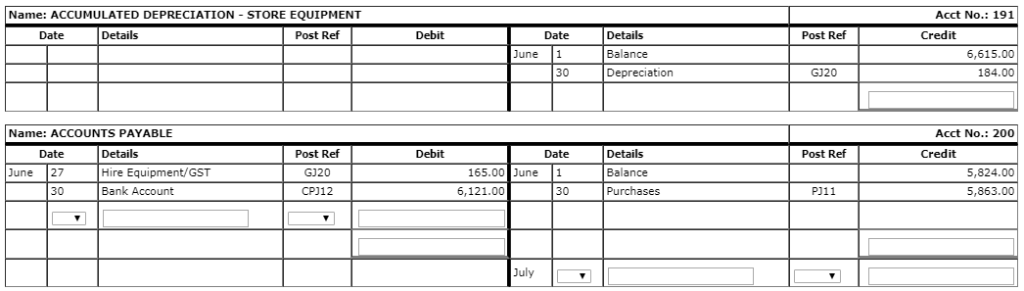

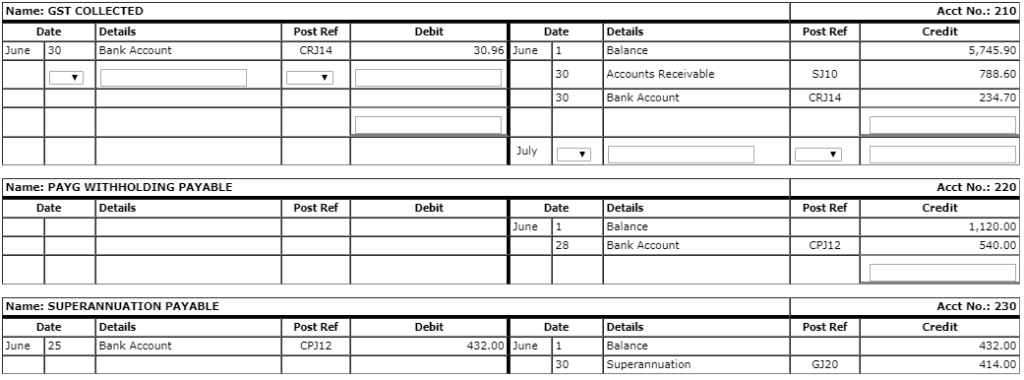

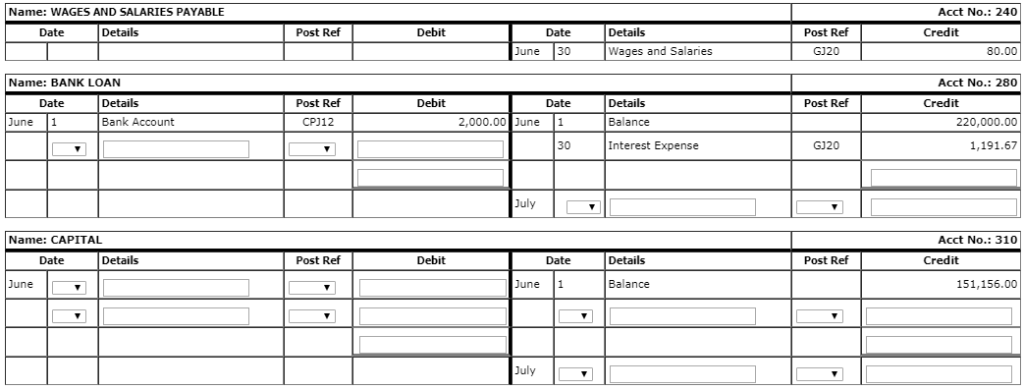

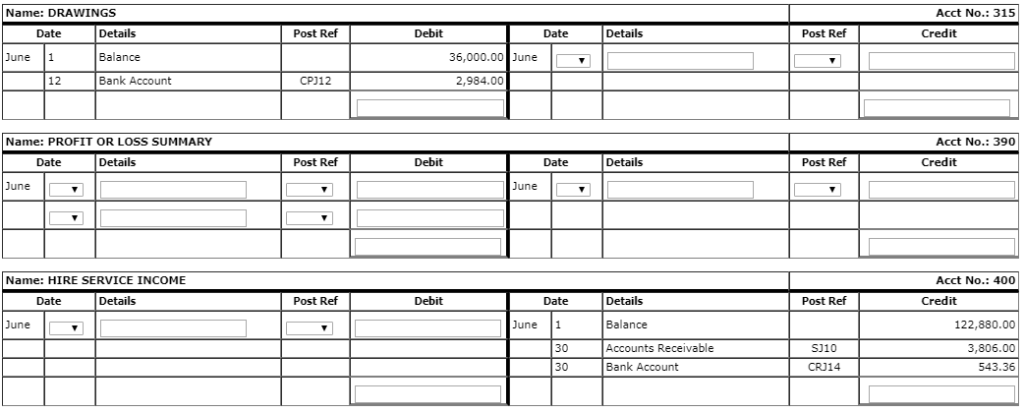

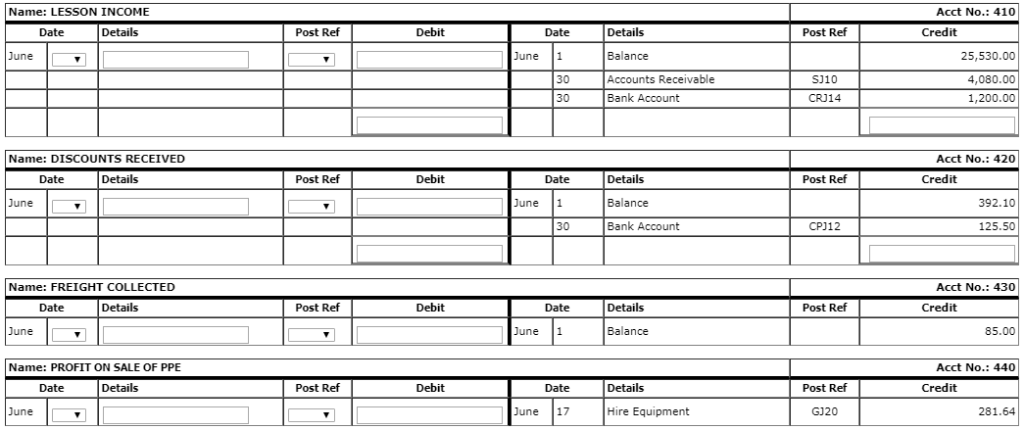

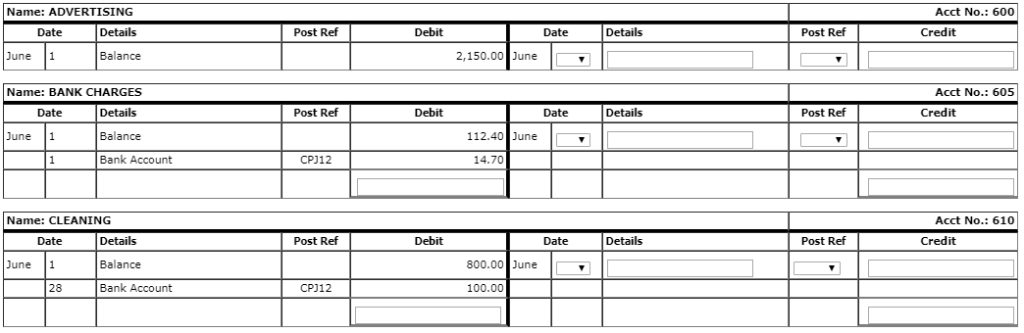

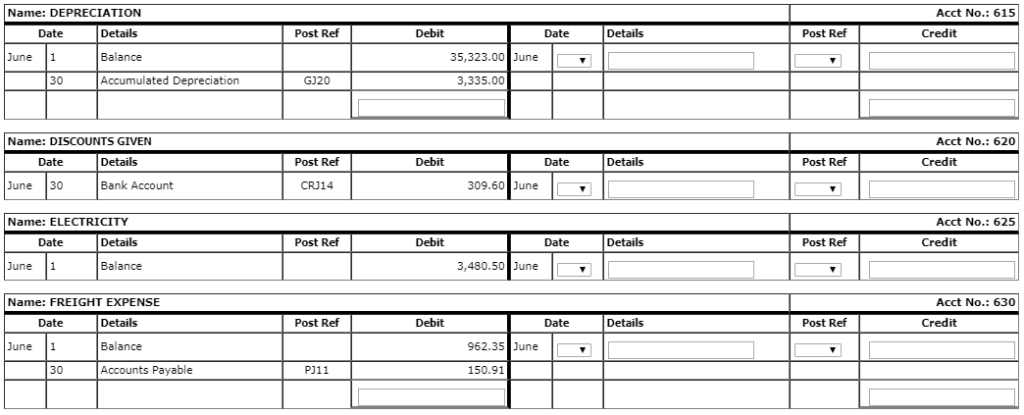

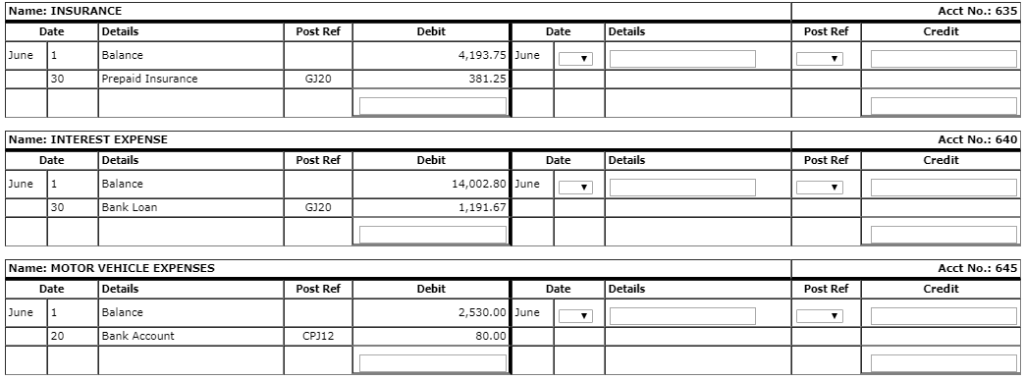

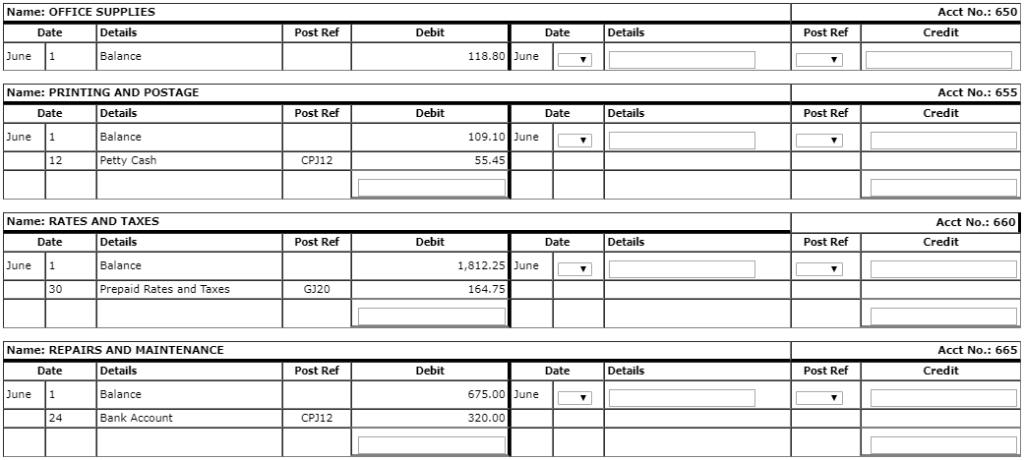

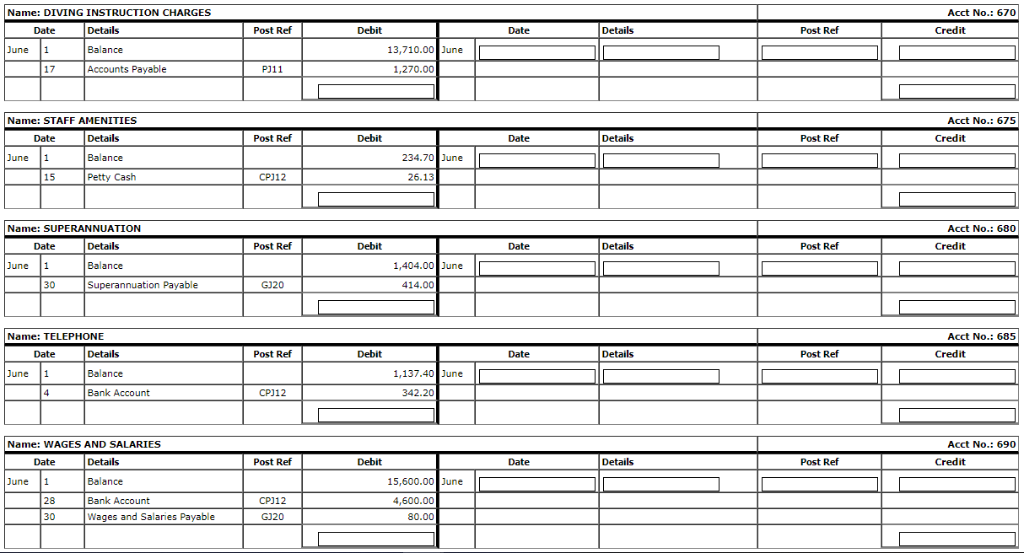

Question 1 The adjusted trial balance for Pro Diver is shown below. Debit Credit Account Number 100 105 110 120 130 140 160 7,271.02 200.00 7,549.00 2,501.69 350,000.00 Pro Diver Adjusted Trial Balance as at 30 June 20xx Account Bank Account Petty Cash Accounts Receivable Prepaid Insurance Prepaid Rates and Taxes GST Paid (Outlays) Buildings and Improvements (Cost) Accumulated Depreciation - Bldgs and Improvements Hire Equipment (Cost) Accumulated Depreciation - Hire Equipment Motor Vehicles (Cost) Accumulated Depreciation - Motor Vehicles Store Equipment (Cost) Accumulated Depreciation - Store Equipment Accounts Payable GST Collected PAYG Withholding Payable Superannuation Payable 161 44,479.00 110,943.09 68,930.00 29,900.00 9,468.00 170 171 180 181 190 191 200 210 220 230 14,700.00 6,799.00 5,401.00 6,738.24 1,660.00 414.00 80.00 219,191.67 151,156.00 38,984.00 127,229.36 30,810.00 517.60 85.00 281.64 240 280 310 315 400 410 420 430 440 600 605 610 615 620 625 630 635 640 645 650 655 660 665 670 675 680 Wages and Salaries Payable Bank Loan Capital Drawings Hire Service Income Lesson Income Discounts Received Freight Collected Profit on Sale of PPE Advertising Bank Charges Cleaning Depreciation Discounts Given Electricity Freight Expense Insurance Interest Expense Motor Vehicle Expenses Office Supplies Printing and Postage Rates and Taxes Repairs and Maintenance Diving Instruction Charges Staff Amenities Superannuation 2,150.00 127.10 900.00 38,658.00 309.60 3,480.50 1,113.26 4,575.00 15,194.47 2,610.00 118.80 164.55 1,977.00 995.00 14,980.00 260.83 1,818.00 685 690 Telephone Wages and Salaries 1,479.60 20,280.00 673,240.51 673,240.51 INSTRUCTIONS: In all parts of this question, enter amounts with a comma for thousands and to two decimal places. For example, enter two thousand as 2,000.00. Enter negative amounts using a hyphen. For example, -2,000.00. If the balance or total returns to zero, enter 0.00 in the required field. If an entry field does not require an answer, leave the field blank. TIPS: To avoid having to scroll up and down the question: - if printing is enabled, print out the parts as required) - if printing is not enabled, copy and paste the required parts into a Word document and divide your screen between the question and the copied content. Save regularly using the "Save for later' button at the end of each part. For assistance regarding account names, click the "Show list of accounts' button to view all of the accounts used in this question. Predictive text can be used to assist entering the account titles when recording and posting information in the journals and ledger accounts, simply type in the first few letters to use the predictive text option. Excel templates/working documents have been designed to provide assistance if there is a preference to work offline and later enter the completed information online to submit for assessment. Using the adjusted trial balance above, complete the general journal entries to close off the accounts for the end of the reporting period, post to and balance the general ledger accounts. (Note: Enter accounts in ascending account number order according to the chart of accounts.) GENERAL JOURNAL Description Post Ref Date Page: 20 Credit Debit V (To close income accounts) GENERAL JOURNAL Description Post Ref Page: 21 Credit Date Debit June (To close expense accounts) (To transfer profit for the year) (To close drawings to capital account) GENERAL LEDGER Acct No.: 100 Name: BANK ACCOUNT Date Details June 1 Balance Post Ref Debit Credit Date 30 Details Payments Post Ref CP312 14,632.20 June 16,487.92 30 Receipts CRJ14 9,126.74 7 7 July Name: PETTY CASH Date Details June 1 Balance Acct No.: 105 Credit Post Ref Debit Date Details Post Ref 200.00 Name: ACCOUNTS RECEIVABLE Date Post Ref Debit Details Details Balance Date 5,760.00 June 30 Post Ref CRU14 Acct No.: 110 Credit 6,885.60 June 1 Bank Account 30 Sales SJ10 8,674.60 July Name: PREPAID INSURANCE Date Details June 1 Balance Post Ref Debit Date 381.25 June 30 Details Insurance Post Ref GJ20 Acct No.: 120 Credit 381.25 Acct No.: 130 Name: PREPAID RATES AND TAXES Date Details June 1 Balance Post Ref Debit Credit Date 164.75 June 30 Details Rates and Taxes Post Ref GJ20 164.75 Acct No.: 140 Post Ref Debit Post Ref Credit Name: GST PAID (OUTLAYS) Date Details June 1 Balance 30 Accounts Payable 30 Bank Account Date 1,905.75 June 27 533.00 30 Details Accounts Payable Bank Account GJ20 15.00 12.55 PJ11 CP)12 CP312 90.49 July Acct No.: 160 Name: BUILDINGS AND IMPROVEMENTS (COST) Date Details Post Ref June 1 Balance Debit Date Details Post Ref Credit 350,000.00 Name: ACCUMULATED DEPRECIATION - BLDGS AND IMPROVEMENTS Acct No.: 161 Date Details Post Ref Debit Date Post Ref Credit Details Balance June 1 43,750.00 729.00 30 Depreciation GJ20 Acct No.: 170 Post Ref Credit Name: HIRE EQUIPMENT (COST) Date Details June 11 Balance 6 Accounts Payable 26 Accounts Payable Debit 108,000.00 June 2,409.09 1,500.00 Date 17 17 Details Bank Account Accumulated Depreciation Accounts Payable Post Ref CRJ14 GJ20 603.64 212.36 PJ11 P]11 27 GJ20 150.00 July 7 Name: ACCUMULATED DEPRECIATION - HIRE EQUIPMENT Date Details Post Ref 17 HECost/Profit GJ20 Debit Details Post Ref Acct No.: 171 Credit 67,500.00 June Date 494.00 June 1 Balance 30 Depreciation GJ20 1,924.00 July Name: MOTOR VEHICLES (COST) Acct No.: 180 Credit Date Post Ref Debit Date Details Post Ref Details Balance June 1 29,900.00 Name: ACCUMULATED DEPRECIATION - MOTOR VEHICLES Acct No.: 181 Date Details Post Ref Debit Post Ref Credit June Date 1 30 Details Balance Depreciation 8,970.00 498.00 GJ20 Acct No.: 190 Name: STORE EQUIPMENT (COST) Date Details June 1 Balance Post Ref Debit Date Details Post Ref Credit 14,700.00 Acct No.: 191 Name: ACCUMULATED DEPRECIATION - STORE EQUIPMENT Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance Depreciation 6,615.00 184.00 30 GJ20 Acct No.: 200 Debit Details Post Ref Credit Name: ACCOUNTS PAYABLE Date Details June 27 Hire Equipment/GST 30 Bank Account Post Ref GJ20 CP312 Date 165.00 June 1 6,121.00 30 Balance Purchases 5,824.00 5,863.00 PJ11 July Name: GST COLLECTED Acct No.: 210 Date Details Post Ref Debit Date Post Ref Credit Details Balance June 30 Bank Account CRJ14 30.96 June 1 5,745.90 30 Accounts Receivable SJ10 788.60 30 Bank Account CRJ14 234.70 July Name: PAYG WITHHOLDING PAYABLE Date Details Post Ref Debit Date Post Ref Acct No.: 220 Credit 1,120.00 540.00 June 1 Details Balance Bank Account 28 CP)12 Name: SUPERANNUATION PAYABLE Date Details June 25 Bank Account Debit Post Ref Post Ref CP312 Date 432.00 June 1 30 Details Balance Superannuation Acct No.: 230 Credit 432.00 414.00 GJ20 Name: WAGES AND SALARIES PAYABLE Date Details Post Ref Debit Date June 30 Details Wages and Salaries Post Ref GJ20 Acct No.: 240 Credit 80.00 Acct No.: 280 Name: BANK LOAN Date Details June 1 Bank Account Post Ref Debit Date Post Ref Credit Details Balance CP)12 2,000.00 June 1 220,000.00 30 Interest Expense GJ20 1,191.67 July Name: CAPITAL Date Details Acct No.: 310 Credit Post Ref Debit Date Details Post Ref June June 1 Balance 151,156.00 July Name: DRAWINGS Date Details Acct No.: 315 Credit Post Ref Debit Date Details Post Ref June 1 Balance 36,000.00 June 2,984.00 12 Bank Account CP312 Acct No.: 390 Name: PROFIT OR LOSS SUMMARY Date Details Post Ref Debit Date Details Post Ref Credit June June Acct No.: 400 Name: HIRE SERVICE INCOME Date Details Post Ref Debit Date Details Post Ref Credit June June 1 Balance 122,880.00 SJ10 30 30 Accounts Receivable Bank Account 3,806.00 543.36 CRJ14 Acct No.: 410 Name: LESSON INCOME Date Details Post Ref Debit Date Details Post Ref Credit June June 1 Balance 25,530.00 SJ10 30 30 Accounts Receivable Bank Account 4,080.00 1,200.00 CRJ14 Name: DISCOUNTS RECEIVED Acct No.: 420 Credit Date Details Post Ref Debit Date Post Ref June June 1 7 Details Balance Bank Account 392.10 30 CPJ12 125.50 Name: FREIGHT COLLECTED Acct No.: 430 Date Details Post Ref Debit Date Details Post Ref Credit June V June 1 Balance 85.00 Name: PROFIT ON SALE OF PPE Date Details June Acct No.: 440 Credit Post Ref Debit Date Details Post Ref June 17 Hire Equipment GJ20 281.64 Acct No.: 600 Name: ADVERTISING Date Details June 1 Balance Post Ref Debit Date Details Post Ref Credit 2,150.00 June Name: BANK CHARGES Date Details Acct No.: 605 Credit Post Ref Debit Date Details Post Ref June 1 112.40 June Balance Bank Account 1 CP)12 14.70 Name: CLEANING Acct No.: 610 Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 800.00 June 7 28 Bank Account CP)12 100.00 Acct No.: 615 Name: DEPRECIATION Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 35,323.00 June 30 Accumulated Depreciation GJ20 3,335.00 Name: DISCOUNTS GIVEN Acct No.: 620 Date Details Post Ref Debit Date Details Post Ref Credit June 30 Bank Account CRU14 309.60 June Acct No.: 625 Name: ELECTRICITY Date Details June 1 Balance Post Ref Debit Date Details Post Ref Credit 3,480.50 June Name: FREIGHT EXPENSE Acct No.: 630 Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 962.35 June 7 30 Accounts Payable P]11 150.91 Acct No.: 635 Name: INSURANCE Date Details Post Ref Debit Date Details Post Ref Credit Balance 4,193.75 June June 1 30 Prepaid Insurance GJ20 381.25 Acct No.: 640 Credit Post Ref Debit Date Details Post Ref Name: INTEREST EXPENSE Date Details June 1 Balance 30 Bank Loan 14,002.80 June GJ20 1,191.67 Name: MOTOR VEHICLE EXPENSES Acct No.: 645 Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 2,530.00 June 20 Bank Account CP312 80.00 Name: OFFICE SUPPLIES Date Details June 1 Balance Acct No.: 650 Credit Post Ref Debit Date Details Post Ref 118.80 June Name: PRINTING AND POSTAGE Date Details 1 Balance Acct No.: 655 Credit Post Ref Debit Date Details Post Ref June 109.10 June 12 Petty Cash CP312 55.45 Acct No.: 660 Name: RATES AND TAXES Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 1,812.25 June 30 Prepaid Rates and Taxes GJ20 164.75 Acct No.: 665 Name: REPAIRS AND MAINTENANCE Date Details Post Ref Debit Date Details Post Ref Credit June 1 Balance 675.00 June 24 Bank Account CP312 320.00 Name: DIVING INSTRUCTION CHARGES Date Details Acct No.: 670 Credit Post Ref Debit Date Details Post Ref June 1 Balance 13,710.00 June 17 Accounts Payable P311 1.270.00 Name: STAFF AMENITIES Date Details June 1 Balance Acct No.: 675 Credit Post Ref Debit Date Details Post Ref 234.70 June 15 Petty Cash CP312 26.13 Name: SUPERANNUATION Date Details Acct No.: 680 Credit Post Rel Debit Date Details Post Ref June 1 Balance 1,404.00 June 30 Superannuation Payable GJ20 414.00 Name: TELEPHONE Date Details Acct No.: 685 Credit Post Ref Debit Date Details Post Ref June 1 Balance 1,137.40 June 14 Bank Account CP312 342.20 Name: WAGES AND SALARIES Acct No.: 690 Credit Date Details Post Ref Debit Date Details Post Ref June 1 Balance 15,600.00 June 4,600.00 28 30 Bank Account Wages and Salaries Payable CP312 GJ20 80.00