HELP ME TO .SOLVE THE QUESTIONS ATTACHED BELOW.This question is complete.

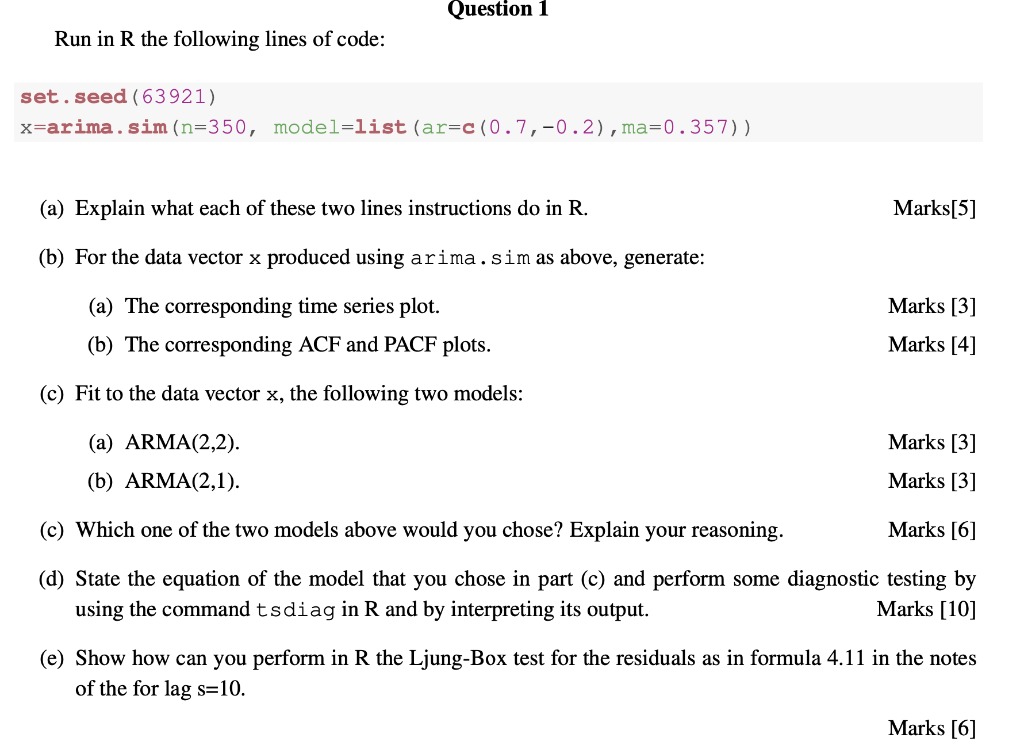

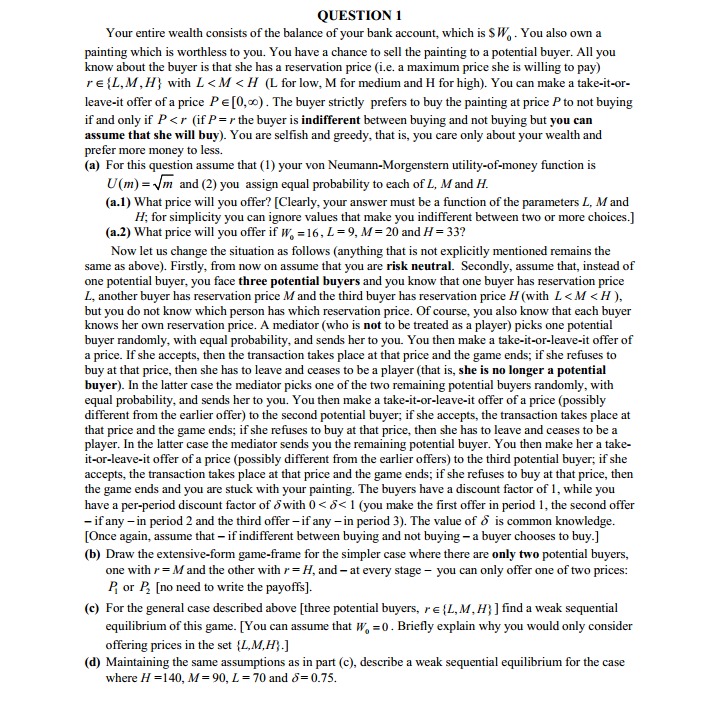

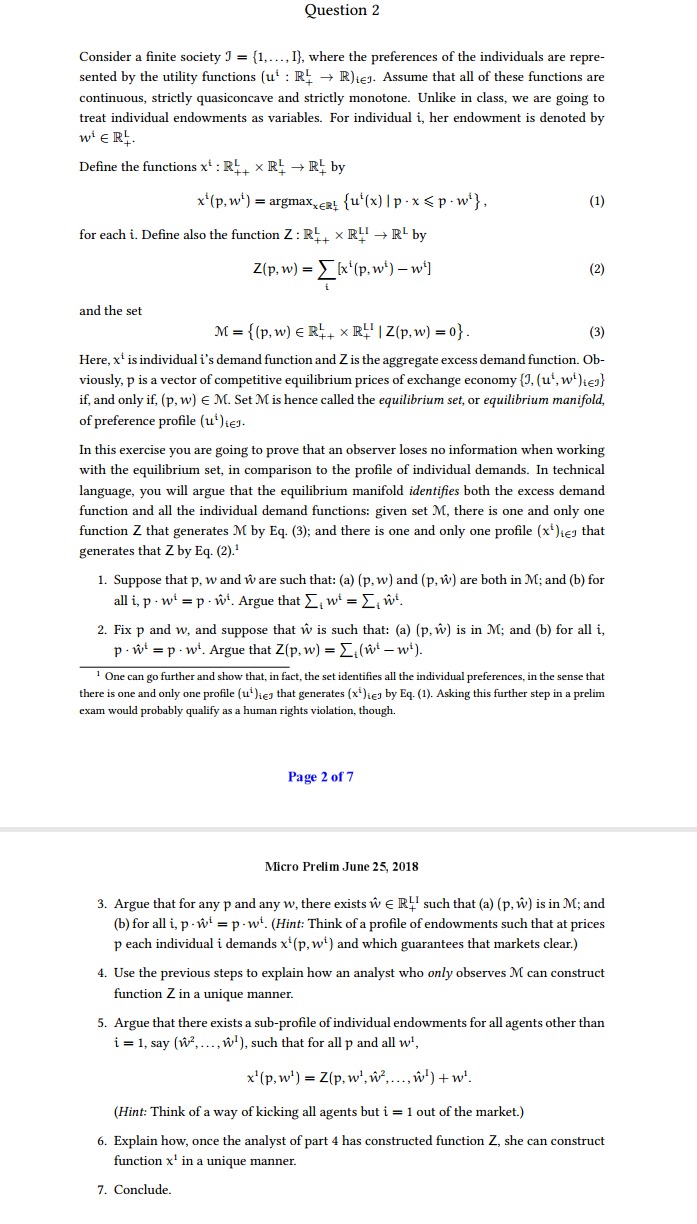

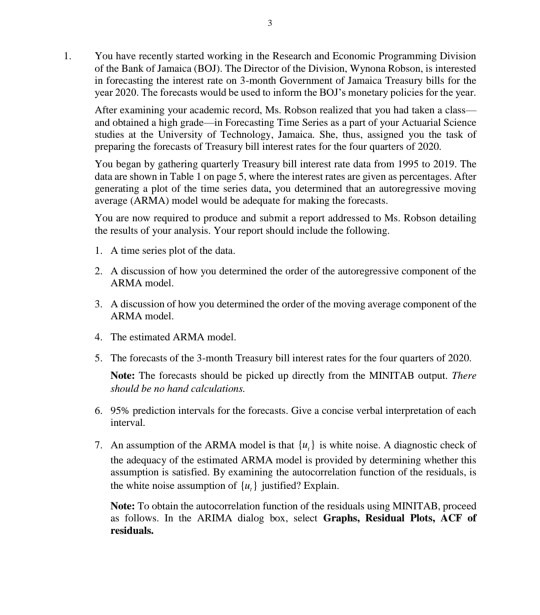

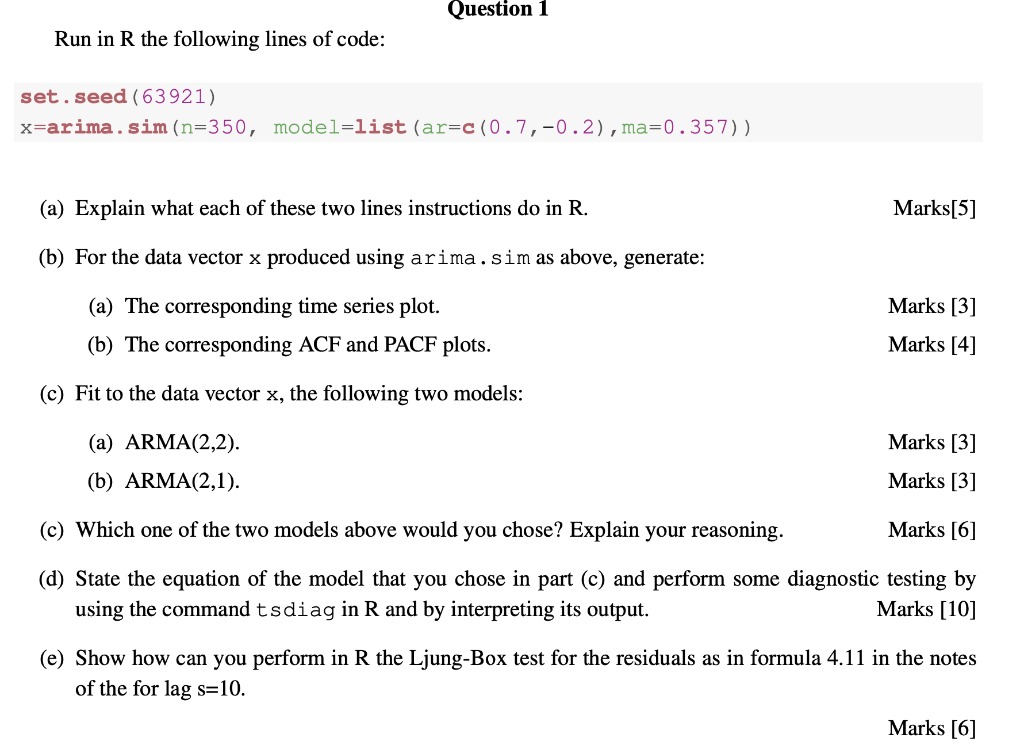

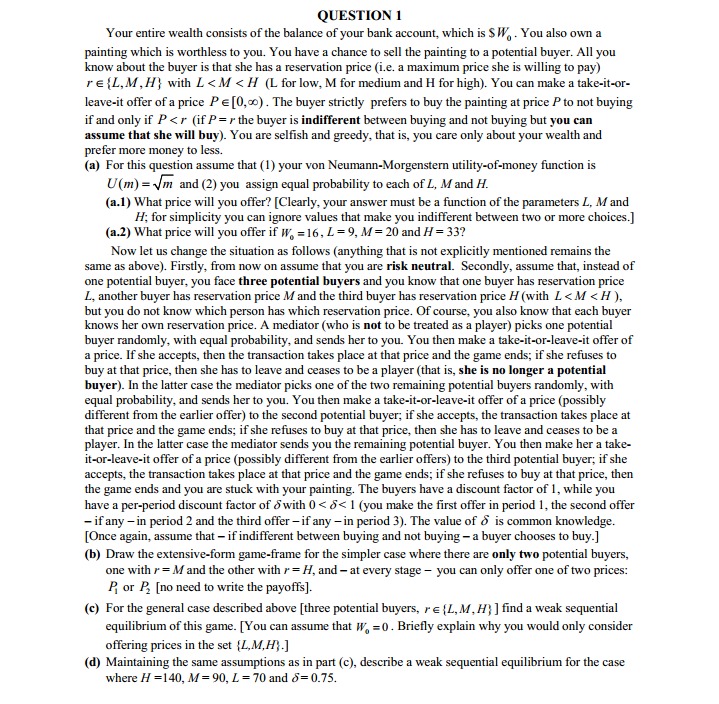

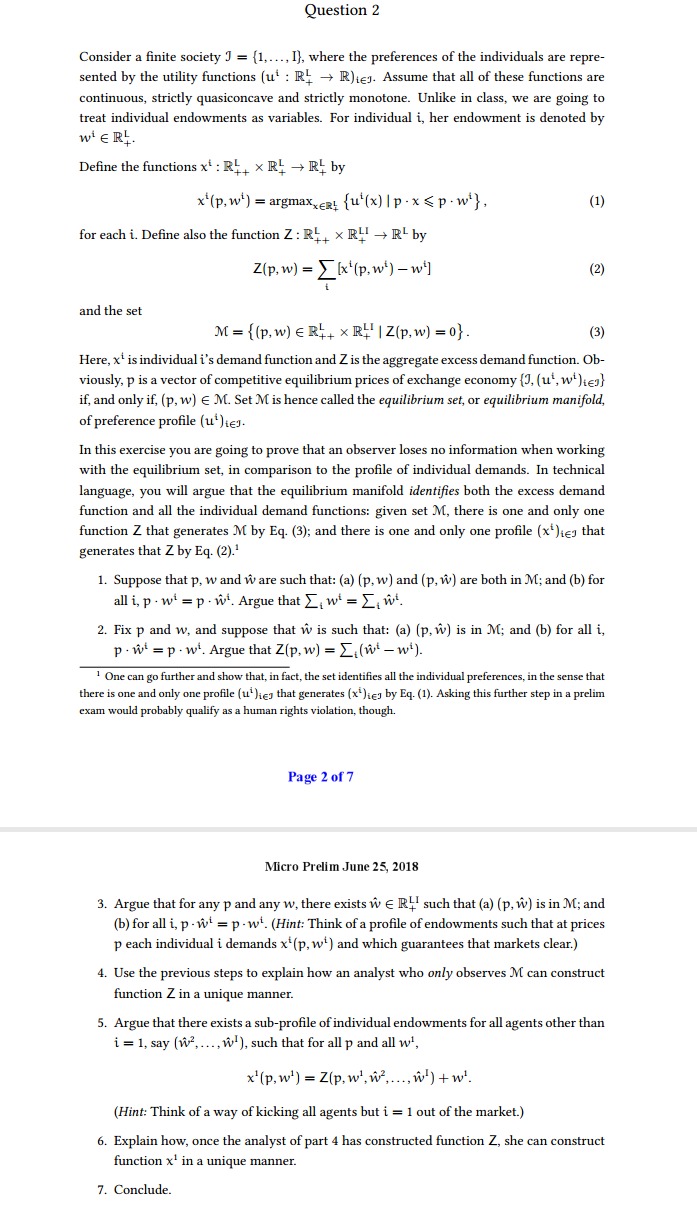

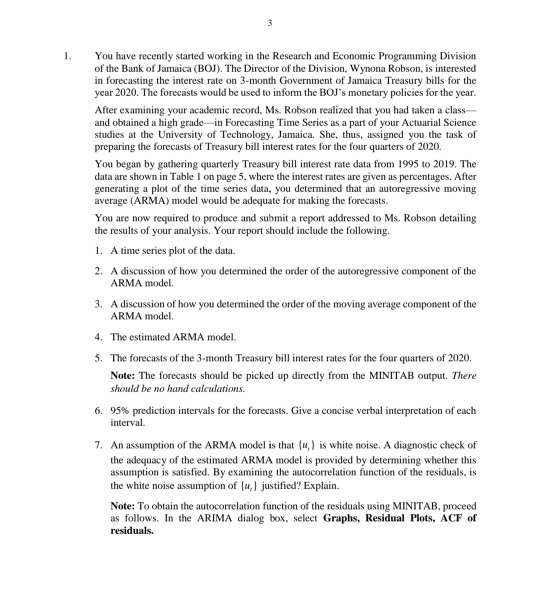

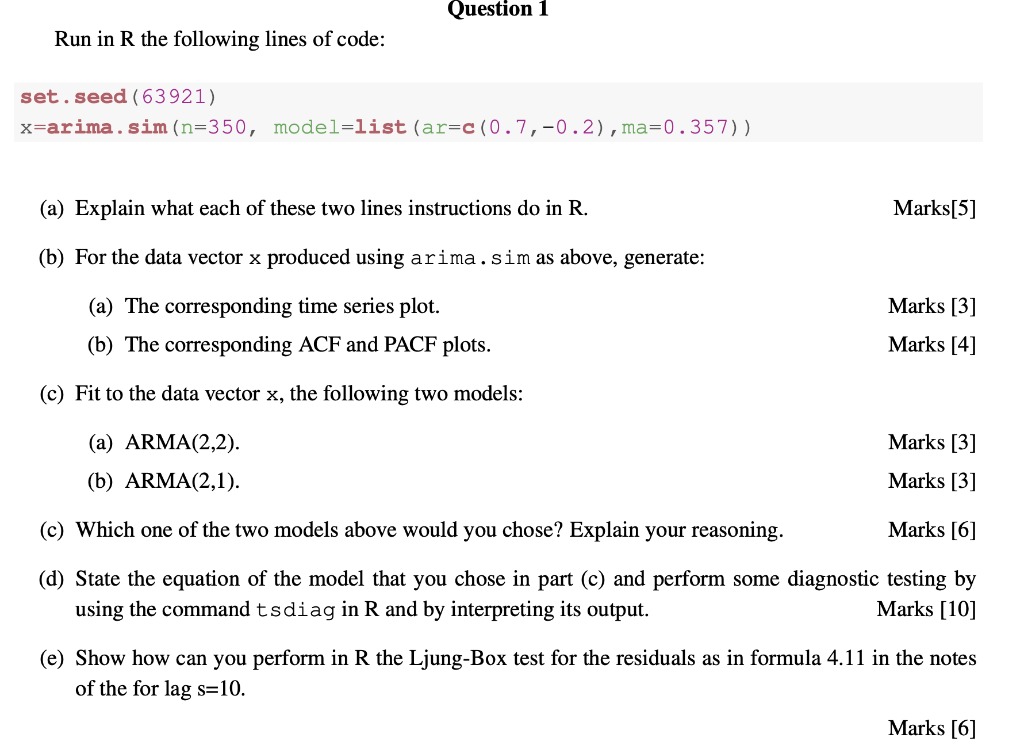

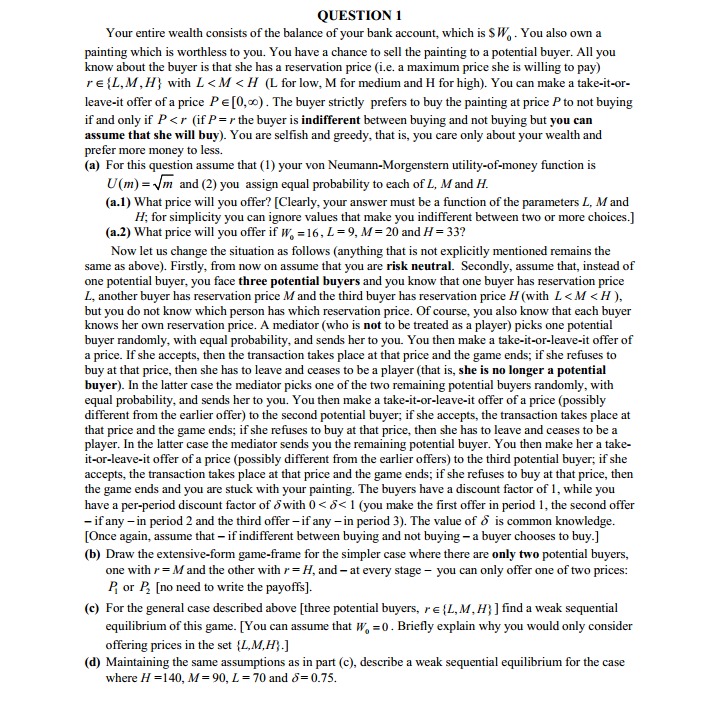

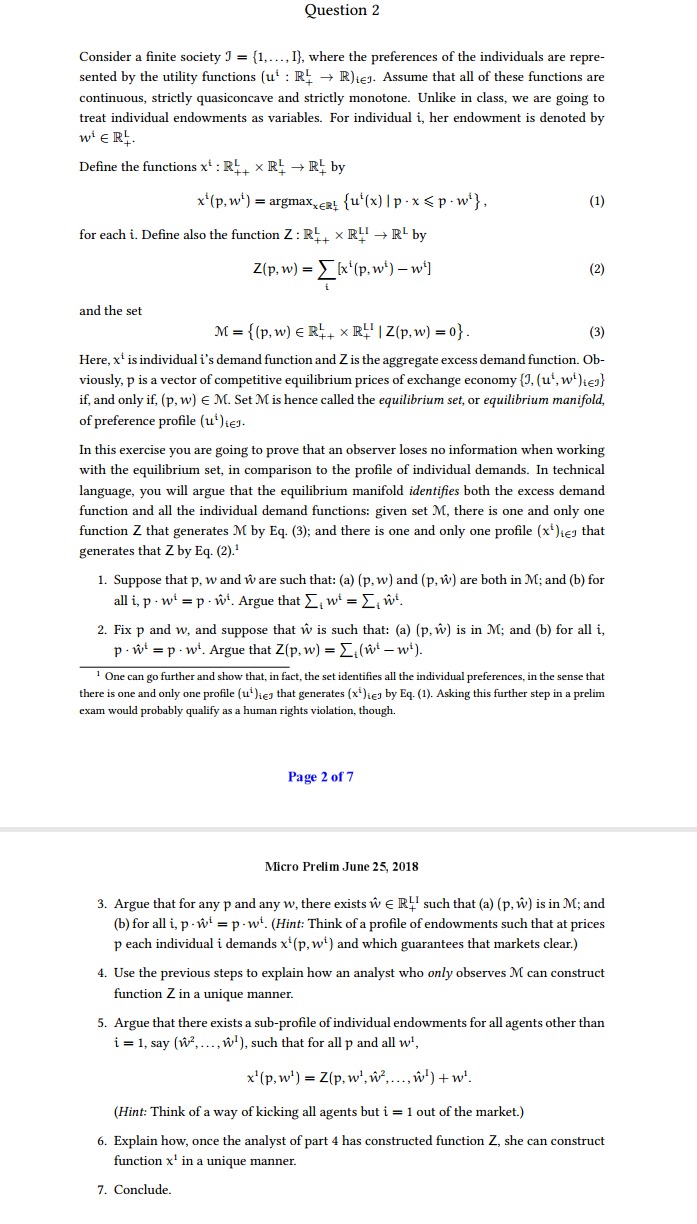

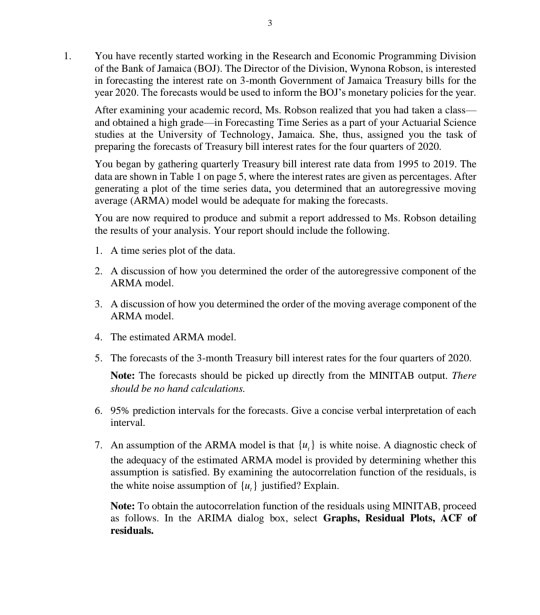

Question 1 Run in R the following lines of code: set.seed{63921) x=arima.sim(n=350, model=1ist{ar=c {0 . 7", O .2) ,ma=0. 357)] (a) Explain what each of theSe two lines instructions do in R. MarksES] (b) For the data vector x produced using arima . 3 im as above, generate: (a) The corresponding time series plot. Marks [3] (b) The corresponding ACF and PACF plots. Marks {4] (0) Fit to the data vector x, the following two models: (a) ARMA(2,2). Marks [3] (b) ARMA(2,1). Marks [3] {c} Which one of the two models above would you chose? Explain your reasoning. Marks [6] ((1) State the equation of the model that you chose in part (c) and perform some diagnostic testing by using the command t sdiag in R and by interpreting its output. Marks [10] (e) Show how can you perform in R the Ljung-Box test for the residuals as in formula 4.11 in the notes of the for lag 5:10. Marks {6] QUESTION 1 Your entire wealth consists of the balance of your bank account, which is $ W, . You also own a painting which is worthless to you. You have a chance to sell the painting to a potential buyer. All you know about the buyer is that she has a reservation price (i.e. a maximum price she is willing to pay) re(L, M, H) with L RL by Z (p, w) = [lx'(p, w') - w'] (2) and the set M = {(p, w) ER! x RY | Z(p, w) =0}. (3) Here, x' is individual i's demand function and Z is the aggregate excess demand function. Ob- viously, p is a vector of competitive equilibrium prices of exchange economy (3, (ut, wthe} if, and only if, (p, w) E M. Set M is hence called the equilibrium set, or equilibrium manifold, of preference profile (u' )ies. In this exercise you are going to prove that an observer loses no information when working with the equilibrium set, in comparison to the profile of individual demands. In technical language, you will argue that the equilibrium manifold identifies both the excess demand function and all the individual demand functions: given set M, there is one and only one function Z that generates M by Eq. (3); and there is one and only one profile (x' heg that generates that Z by Eq. (2).' 1. Suppose that p, w and ware such that: (a) (p, w) and (p, w) are both in M; and (b) for all i, p . wi = p . wi. Argue that ), wi = _, wi. 2. Fix p and w, and suppose that w is such that: (a) (p, w) is in M; and (b) for all i, p . W = p . w. Argue that Z(p, w) = Z(wi - wi ). 1 One can go further and show that, in fact, the set identifies all the individual preferences, in the sense that there is one and only one profile (u' lies that generates (x' )ies by Eq. (1). Asking this further step in a prelim exam would probably qualify as a human rights violation, though. Page 2 of 7 Micro Prelim June 25, 2018 3. Argue that for any p and any w, there exists we Ry such that (a) (p, w) is in M; and (b) for all i, p. wi = p. w. (Hint: Think of a profile of endowments such that at prices p each individual i demands x' (p, w' ) and which guarantees that markets clear.) 4. Use the previous steps to explain how an analyst who only observes M can construct function Z in a unique manner. 5. Argue that there exists a sub-profile of individual endowments for all agents other than i = 1, say (we,..., w ), such that for all p and all wi, x' (p, w' ) = Z(p, w', w/,..., w') + w. (Hint: Think of a way of kicking all agents but i = 1 out of the market.) 6. Explain how, once the analyst of part 4 has constructed function Z, she can construct function x' in a unique manner. 7. Conclude.1. You have recently started working in the Research and Economic Programming Division of the Bank of Jamaica (BOJ). The Director of the Division. Wynona Robson. is interested in forecasting the interest rate on 3-month Government of Jamaica Treasury bills for the year 2020. The forecasts would be used to inform the BOJ's monetary policies for the year. After examining your academic record, Ms. Robson realized that you had taken a class- and obtained a high grade-in Forecasting Time Series as a part of your Actuarial Science studies at the University of Technology, Jamaica. She, thus, assigned you the task of preparing the forecasts of Treasury bill interest rates for the four quarters of 2020. You began by gathering quarterly Treasury bill interest rate data from 1995 to 2019, The data are shown in Table I on page 5, where the interest rates are given as percentages. After generating a plot of the time series data, you determined that an autoregressive moving average (ARMA) model would be adequate for making the forecasts. You are now required to produce and submit a report addressed to Ms. Robson detailing the results of your analysis. Your report should include the following. 1. A time series plot of the data. 2. A discussion of how you determined the order of the autoregressive component of the ARMA model. 3. A discussion of how you determined the order of the moving average component of the ARMA model. 4. The estimated ARMA model. 5. The forecasts of the 3-month Treasury bill interest rates for the four quarters of 2020, Note: The forecasts should be picked up directly from the MINITAB output. There should be no hand calculations. 6. 95% prediction intervals for the forecasts. Give a concise verbal interpretation of each interval. 7. An assumption of the ARMA model is that (m, ) is white noise. A diagnostic check of the adequacy of the estimated ARMA model is provided by determining whether this assumption is satisfied. By examining the autocorrelation function of the residuals, is the white noise assumption of {u, } justified? Explain. Note: To obtain the autocorrelation function of the residuals using MINITAB, proceed as follows. In the ARIMA dialog box, select Graphs, Residual Plots, ACF of residuals