Help me tutors

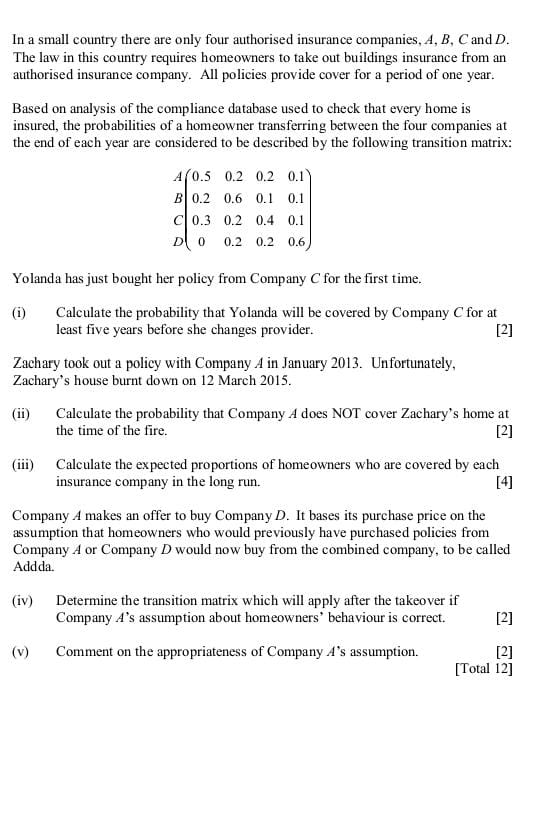

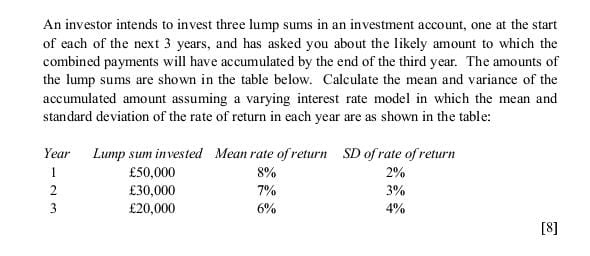

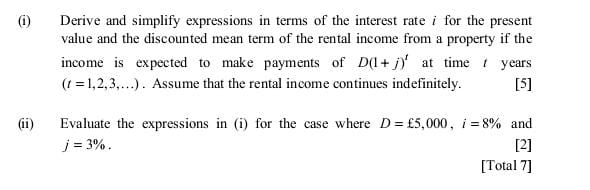

In a small country there are only four authorised insurance companies. A. E. C and D. The law in this country requires homeowners to take out buildings insurance from an authorised insurance company. All policies provide cover for a period of one year. Based on analysis of the compliance database used to check that every home is insured. the probabilities of a homeowner transferring between the four companies at the end of each year are considered to be described by the following transition matrix: A il ill ill Ill] 3 ill {LEI ll] ill C Ill} ill Ill-I'l {Li D D {12 {12 t? Yolanda has just bought her policy from Company C for the rst time. {i} Calculate the probability that Yuma 1will be covered by Company C for at least ve yeasts before she changes provider. [2] anhary too]: out a policy with Company at in January 1013. Unfortunately. Zaehaiy's house burnt down on 11 March El. {ii} Cale ulate me probability that Company A dam NUT cover anhary's borne at the time of the re. [2] {iii} Calculate the expected proportions ofhomeowners who are covered by each insurance company in the long run. [4] Company .4! makes an offer to buy Company D. It b its purchase price on the assumption that homeowners who would previously have purchased policies from Company A or Company B would now buy from the combined company. to be called Addda. {iv} Determine the transition matrix. which will apply after the takeover if Company A's assumption about homeowners' behaviour is correct [2] {v} Comment on. the appropriateness of Company A's assumption. [1] [Total 12] An investor intends to invest three lump sums in an investment account, one at the start of each of the next 3 years, and has asked you about the likely amount to which the combined payments will have accumulated by the end of the third year. The amounts of the lump sums are shown in the table below. Calculate the mean and variance of the accumulated amount assuming a varying interest rate model in which the mean and standard deviation of the rate of return in each year are as shown in the table: Year Lump sum invested Mean rate of return SD of rate of return $50,000 8% W N - E30,000 7% 3% $20,000 6% 4% [8](1) Derive and simplify expressions in terms of the interest rate i for the present value and the discounted mean term of the rental income from a property if the income is expected to make payments of D(1+ /) at time / years (1 =1,2,3....) . Assume that the rental income continues indefinitely. [5] (i) Evaluate the expressions in (i) for the case where D = (5,000, / =8% and j = 3%. [2] [Total 7]