Answered step by step

Verified Expert Solution

Question

1 Approved Answer

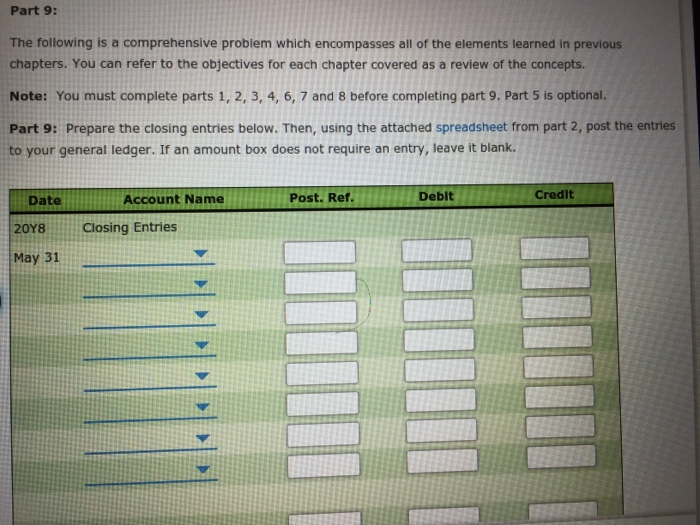

help me with part 9&10 please i got 2 of them wrong, if u could help with that also Part 1: The following is a

help me with part 9&10 please

i got 2 of them wrong, if u could help with that also

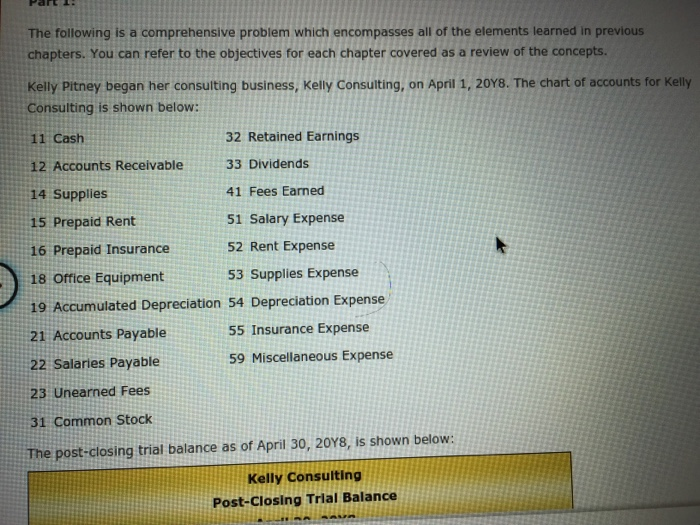

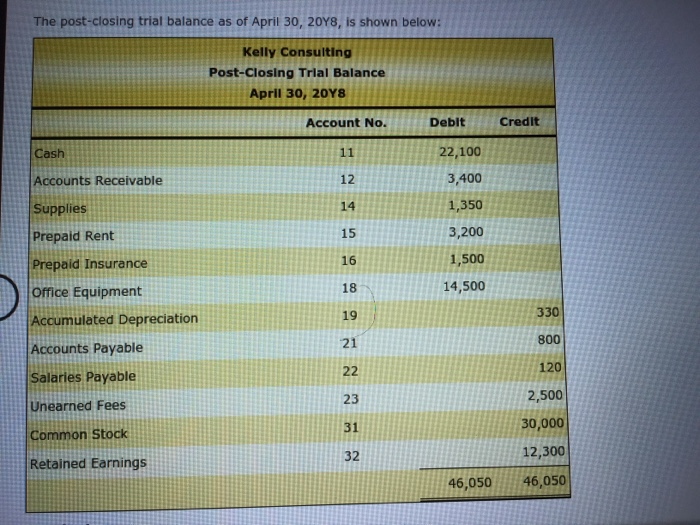

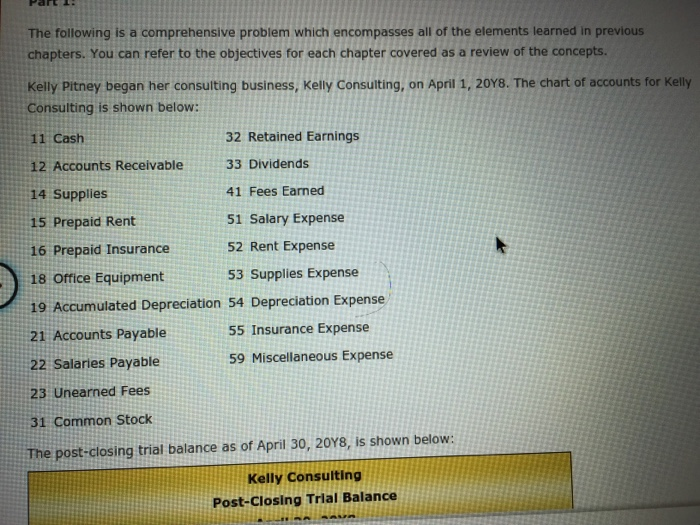

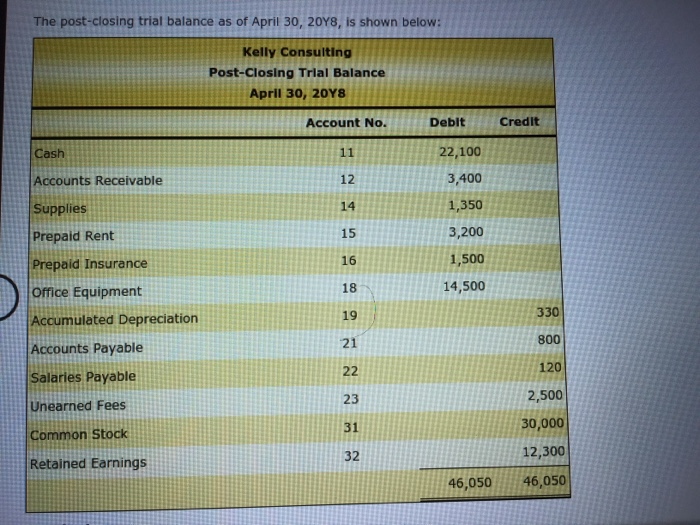

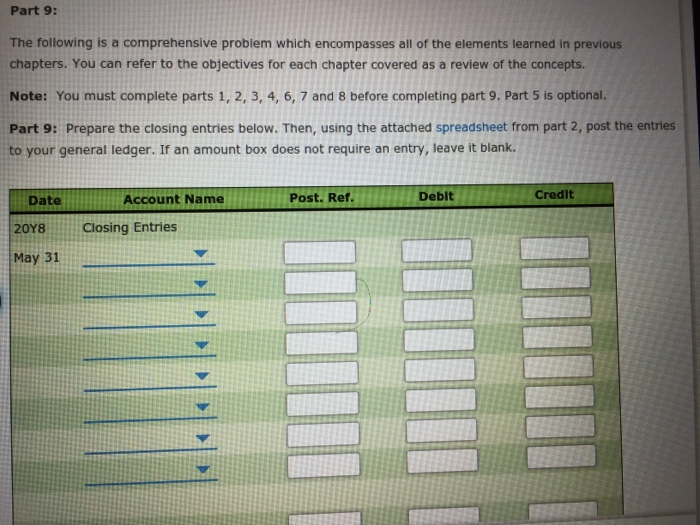

Part 1: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2048. The chart of accounts for Kelly Consulting is shown below: 11 Cash 32 Retained Earnings 12 Accounts Receivable 33 Dividends 14 Supplies 41 Fees Earned 15 Prepaid Rent 51 Salary Expense 16 Prepaid Insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 21 Accounts Payable 55 Insurance Expense 22 Salaries Payable 59 Miscellaneous Expense 23 Unearned Fees 31 Common Stock The post-closing trial balance as of April 30, 20Y8, is shown below: Kelly Consulting Post-Closing Trial Balance The post-closing trial balance as of April 30, 2018, is shown below: Kelly Consulting Post-Closing Trial Balance April 30, 2048 Account No. Debit Credit 22,100 3,400 1,350 3,200 1,500 14,500 Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings 330 800 120 2,500 30,000 12,300 46,050 46,050 Prepare a post-closing trial balance. If an amount box does not require an entry, leave it blank. Kelly Consulting Post-Closing Trial Balance May 31, 2048 Account Title Debit Balances Credit Balances alculator vereras d review Print item Le concepts. Notes You must compete parts epare an adjusted trial balance. If an amount box does not require an Kelly Consulting Adjusted Trial Balance May 31, 2048 Debit Credit Balances Account Title Balances 44,195 Accounts Receivable 8,080 715 Supplies Prepaid Rent 1,600 Prepaid Insurance 1,225 office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable 895 Salarles Payable 325 Unearned Fees Common Stock 3,210 42,300 X 42,300 x Retained Earnings Calculator Print Item office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable v 895 Salarles Payable 325 Unearned Fees 3,210 42,300 Common Stock o X Retained Earnings 42,300 Dividends 10,500V Fees Earned 40,000 Salary Expense Rent Expense Supplies Expense 1,705 1,600 1,370 330 275 Depreciation Expense Insurance Expense v Miscellaneous Expense v 1,295 87,390 87,390 Feedback Part 1: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2048. The chart of accounts for Kelly Consulting is shown below: 11 Cash 32 Retained Earnings 12 Accounts Receivable 33 Dividends 14 Supplies 41 Fees Earned 15 Prepaid Rent 51 Salary Expense 16 Prepaid Insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 21 Accounts Payable 55 Insurance Expense 22 Salaries Payable 59 Miscellaneous Expense 23 Unearned Fees 31 Common Stock The post-closing trial balance as of April 30, 20Y8, is shown below: Kelly Consulting Post-Closing Trial Balance The post-closing trial balance as of April 30, 2018, is shown below: Kelly Consulting Post-Closing Trial Balance April 30, 2048 Account No. Debit Credit 22,100 3,400 1,350 3,200 1,500 14,500 Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings 330 800 120 2,500 30,000 12,300 46,050 46,050 Prepare a post-closing trial balance. If an amount box does not require an entry, leave it blank. Kelly Consulting Post-Closing Trial Balance May 31, 2048 Account Title Debit Balances Credit Balances alculator vereras d review Print item Le concepts. Notes You must compete parts epare an adjusted trial balance. If an amount box does not require an Kelly Consulting Adjusted Trial Balance May 31, 2048 Debit Credit Balances Account Title Balances 44,195 Accounts Receivable 8,080 715 Supplies Prepaid Rent 1,600 Prepaid Insurance 1,225 office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable 895 Salarles Payable 325 Unearned Fees Common Stock 3,210 42,300 X 42,300 x Retained Earnings Calculator Print Item office Equipment 14,500 Accumulated Depreciation 660 Accounts Payable v 895 Salarles Payable 325 Unearned Fees 3,210 42,300 Common Stock o X Retained Earnings 42,300 Dividends 10,500V Fees Earned 40,000 Salary Expense Rent Expense Supplies Expense 1,705 1,600 1,370 330 275 Depreciation Expense Insurance Expense v Miscellaneous Expense v 1,295 87,390 87,390 Feedback

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started