help me with the few mistakes i made

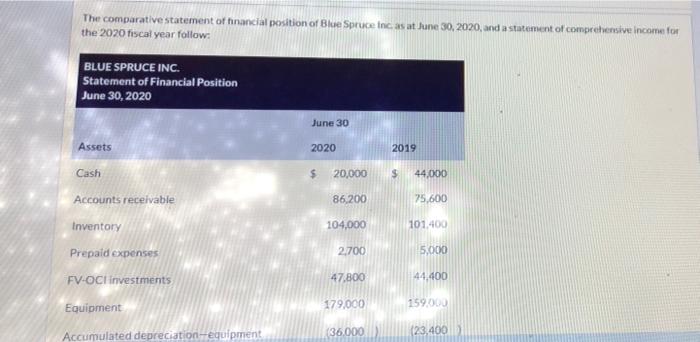

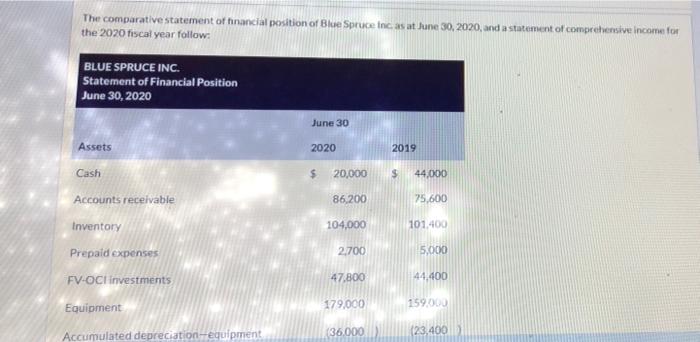

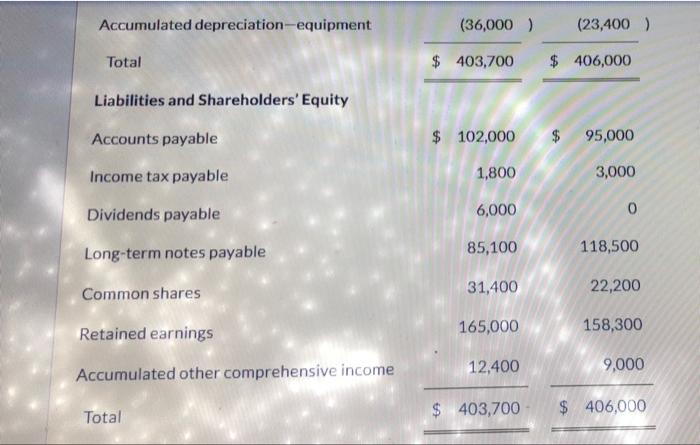

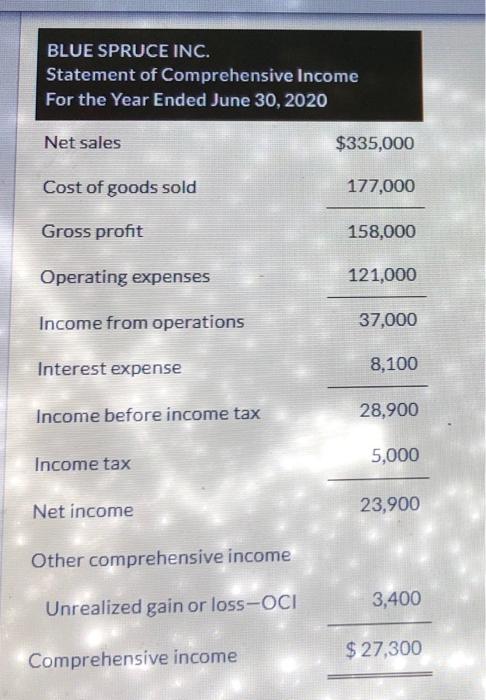

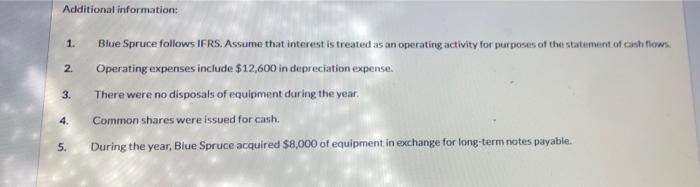

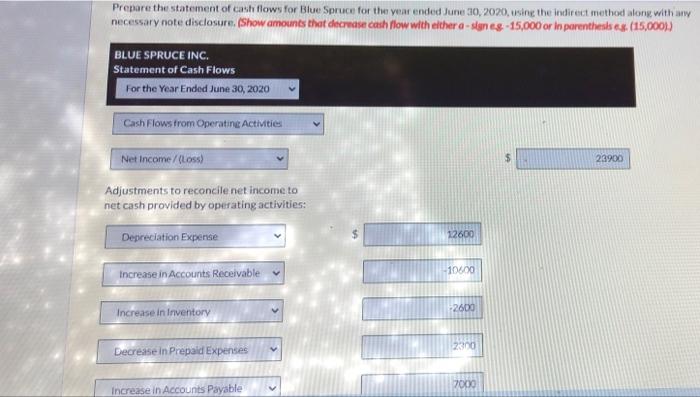

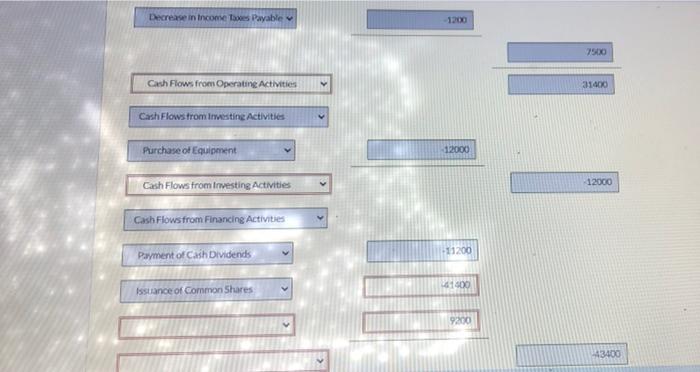

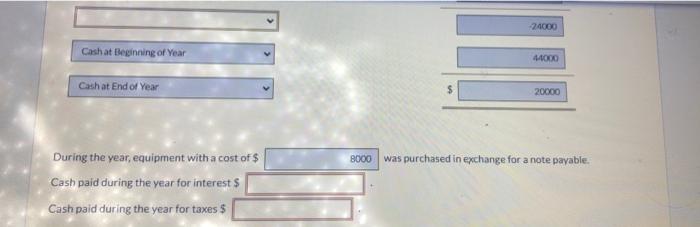

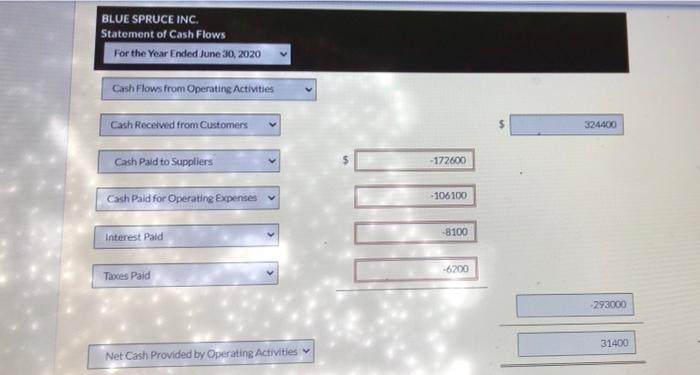

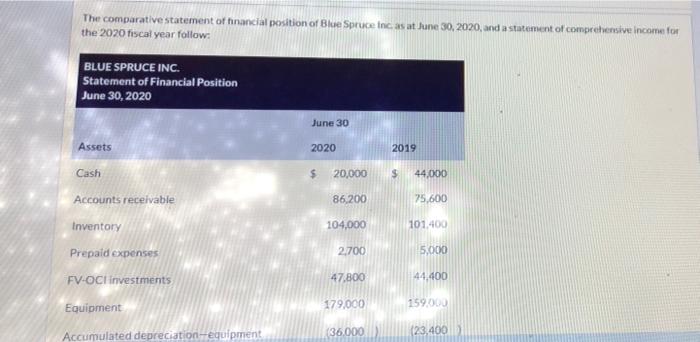

The comparative statement of hinancial position of Blue Spruce incasat June 30, 2020, and a statement of comprehensive income for the 2020 fiscal year follow. BLUE SPRUCE INC. Statement of Financial Position June 30, 2020 June 30 Assets 2020 2019 Cash $ 20,000 $ 44,000 86,200 75,600 101.400 104,000 Accounts receivable Inventory Prepaid expenses FV-OCI investments 2.700 5,000 47.800 44,400 Equipment 179,000 159.000 Accumulated depreciation equipment (23,400 136.000 Accumulated depreciation equipment (36,000) (23,400) Total $ 403,700 $ 406,000 Liabilities and Shareholders' Equity Accounts payable $ 102,000 $ 95,000 Income tax payable 1,800 3,000 6,000 0 Dividends payable Long-term notes payable 85,100 118,500 Common shares 31,400 22,200 Retained earnings 165,000 158,300 12,400 9,000 Accumulated other comprehensive income Total $ 403,700 $ 406,000 BLUE SPRUCE INC. Statement of Comprehensive Income For the Year Ended June 30, 2020 Net sales $335,000 Cost of goods sold 177,000 Gross profit 158,000 Operating expenses 121,000 Income from operations 37,000 Interest expense 8,100 Income before income tax 28,900 Income tax 5,000 Net income 23,900 Other comprehensive income 3,400 Unrealized gain or loss-OCI $ 27,300 Comprehensive income Additional information 1. 2. 3. Blue Spruce follows IFRS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows. Operating expenses include $12,600 in depreciation expense. There were no disposals of equipment during the year. Common shares were issued for cash. During the year, Blue Spruce acquired $8,000 of equipment in exchange for long-term notes payable. 5. Prepare the statement of cash flows for Blue Spruce for the year ended June 30, 2020, using the indirect method along with any necessary note disclosure. (Show amounts that decrease cash flow with either a-sang-15,000 or in parenthesses. (15,0001) BLUE SPRUCE INC. Statement of Cash Flows For the Year Ended June 30, 2020 Cash Flows from Operating Activities Net Income /(105) 23900 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Expense 12600 Increase in Accounts Receivable -10600 2600 Increase in Inventory Decrease in Prepaid Expenses 2200 7000 Increase in Accounts Payable Decrease in Income Taxes Payable 1200 7500 Cash Flows from Operating Activities 31400 Cash Flows from investing Activities Purchase of Equipment 12000 Cash Flows from investing Activities 12000 Cash Flows from Financing Activities 11200 Payment of Cash Dividends 1600 Issuance of Common Shares 9200 43400 24000 Cash at Beginning of Year 44000 Cash at End of Year 20000 8000 was purchased in exchange for a note payable. During the year, equipment with a cost of $ Cash paid during the year for interest Cash paid during the year for taxes $ BLUE SPRUCE INC. Statement of Cash Flows For the Year Ended June 30, 2020 Cash Flows from Operating Activities Cash Received from Customers 324400 Cash Paid to Suppliers -172600 Cash Paid for Operating Expenses -106100 -8100 Interest Paid -6200 Taoces Paid 293000 31400 Net Cash Provided by Operating Activities