Help me with the questions I won't and the ones I did wrong

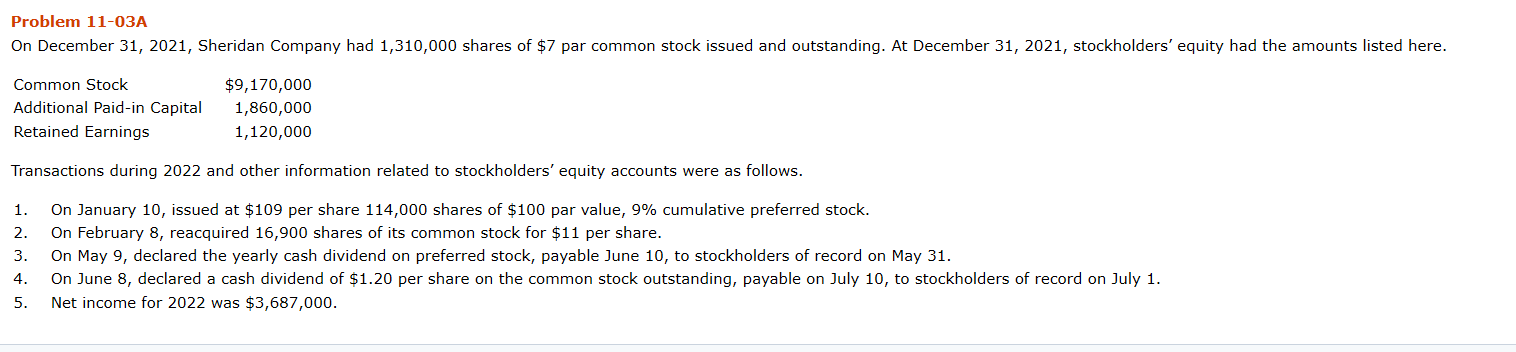

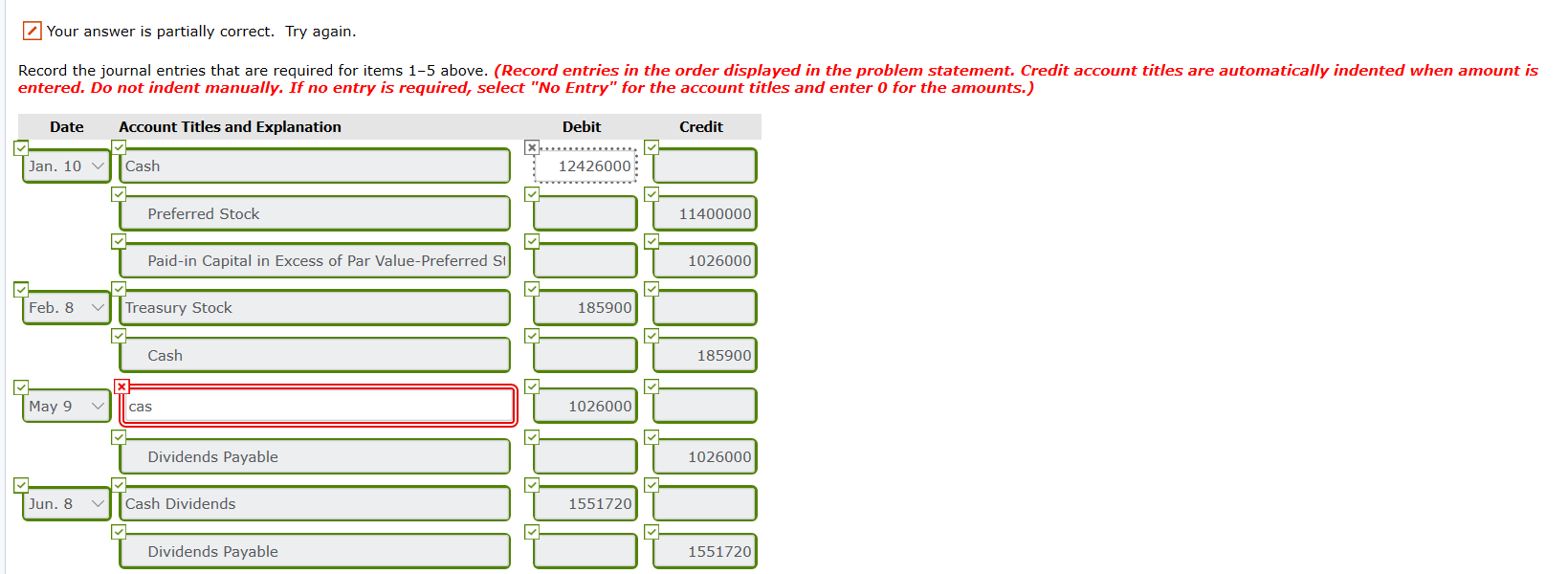

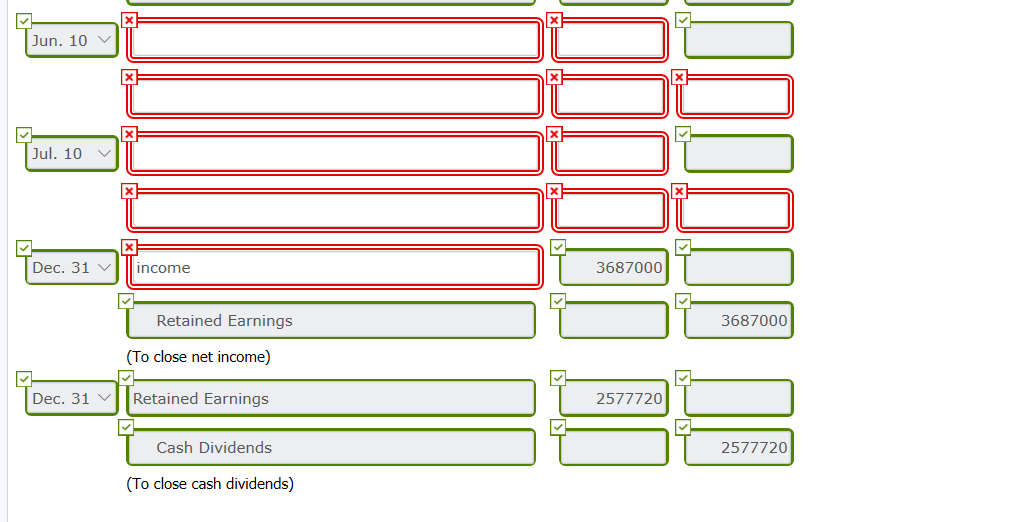

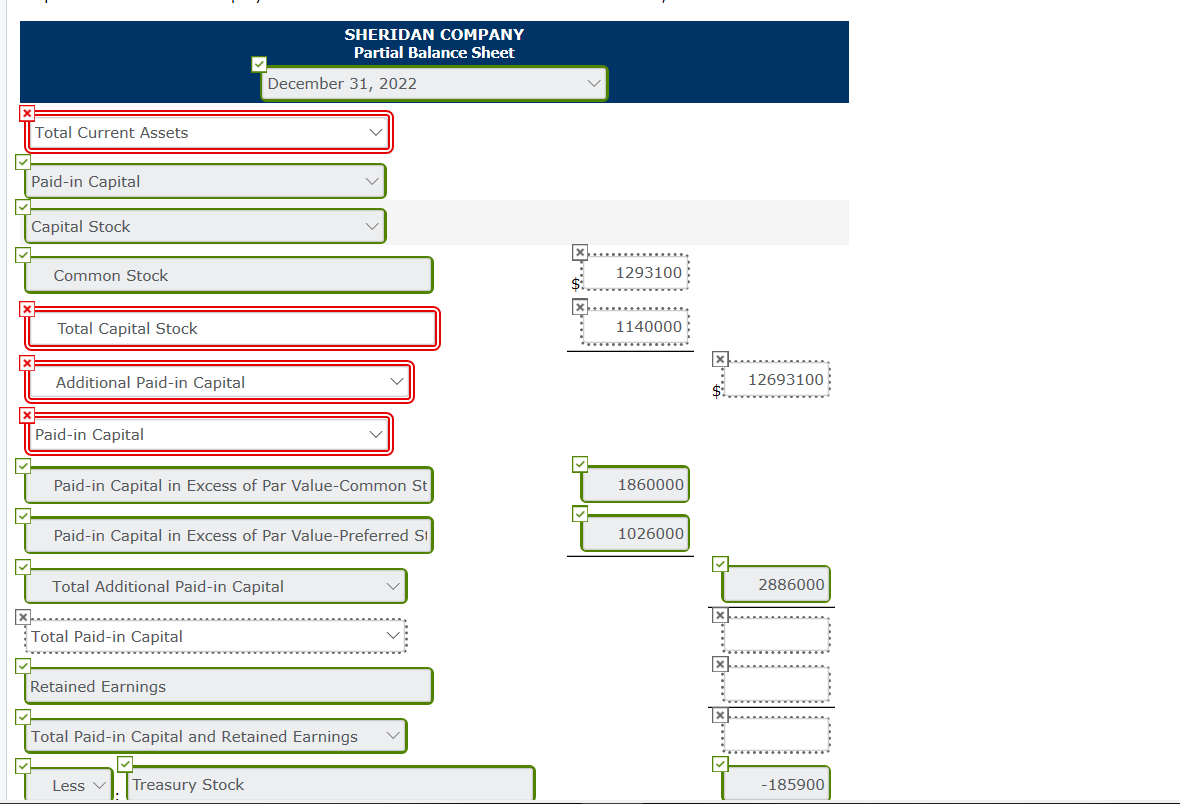

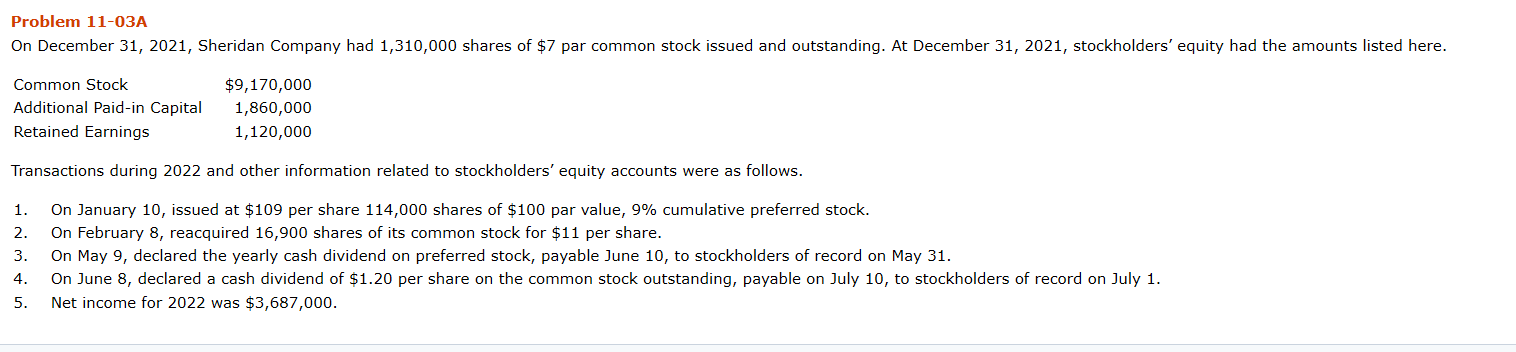

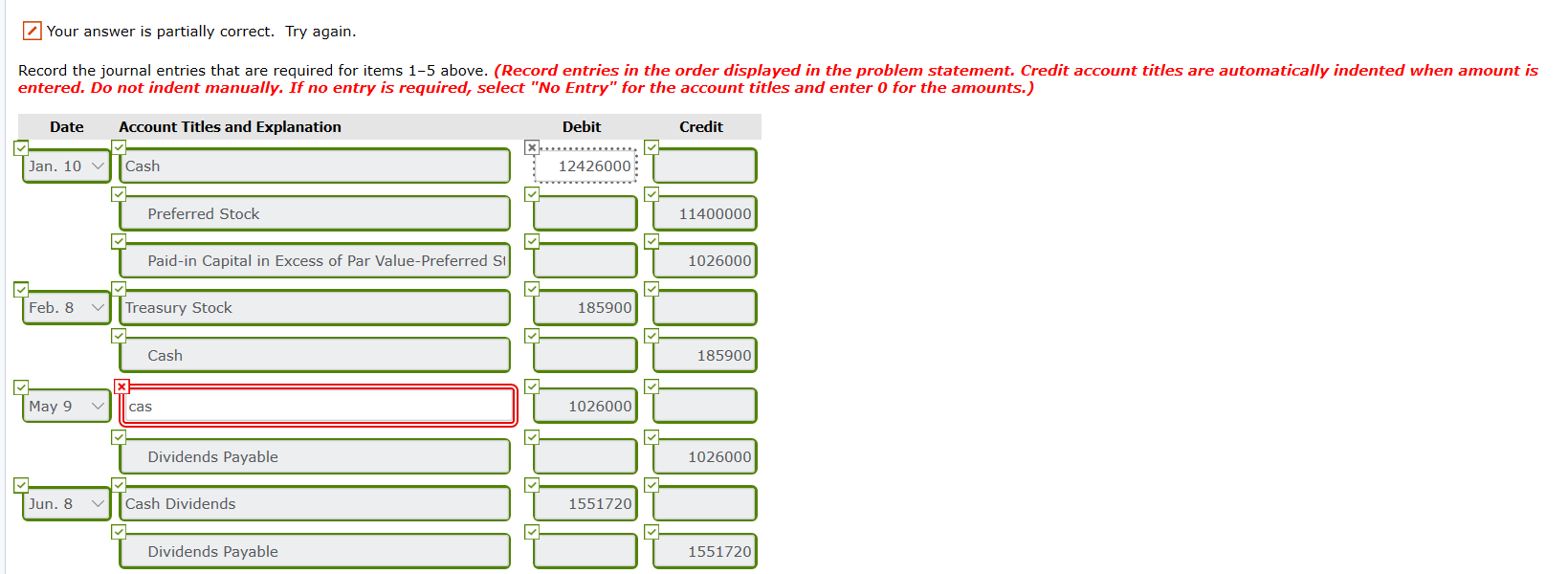

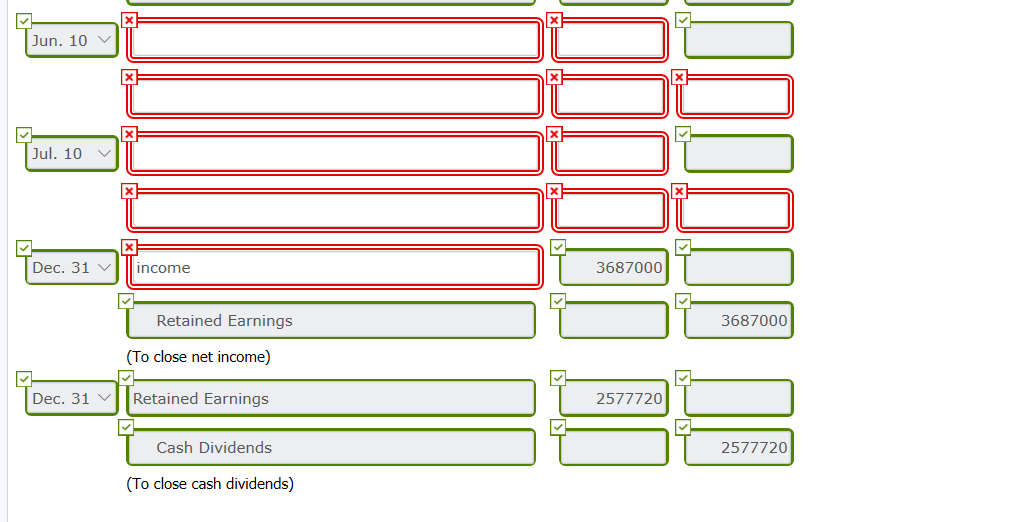

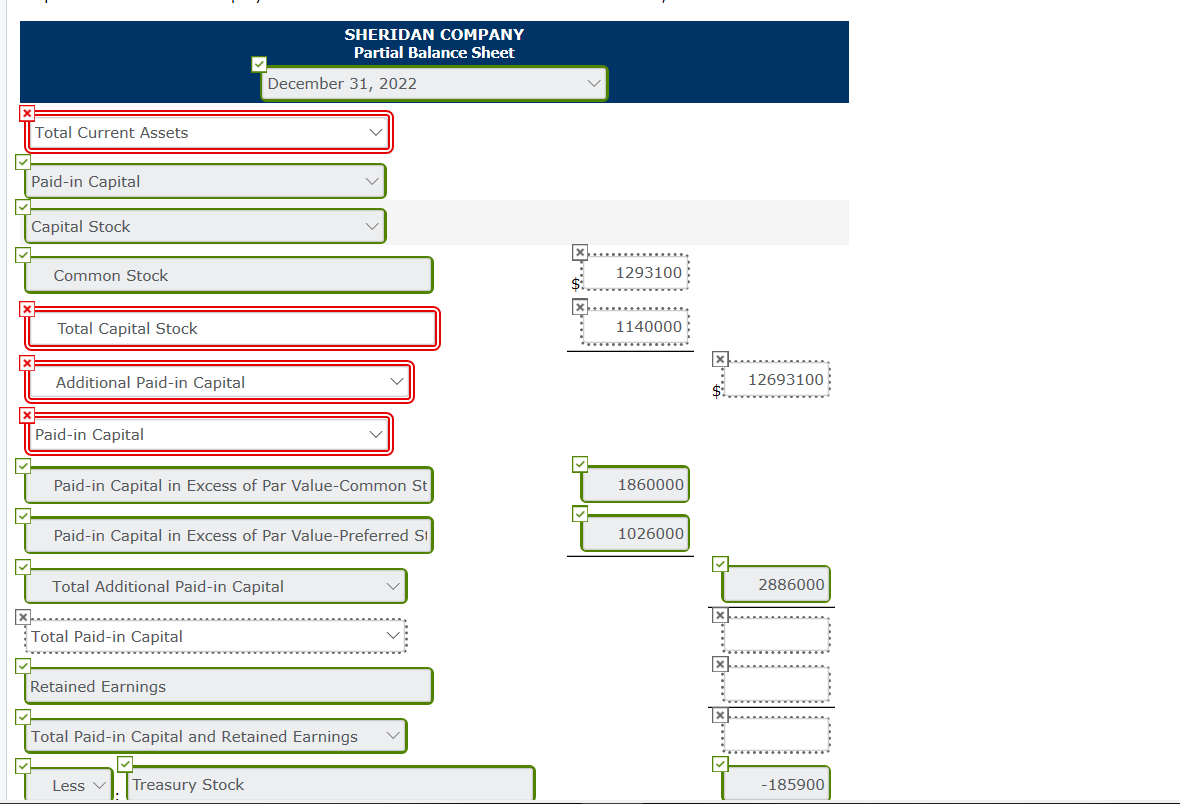

Problem 11-03A On December 31, 2021, Sheridan Company had 1,310,000 shares of $7 par common stock issued and outstanding. At December 31, 2021, stockholders' equity had the amounts listed here. Common Stock Additional Paid-in Capital Retained Earnings $9,170,000 1,860,000 1,120,000 Transactions during 2022 and other information related to stockholders' equity accounts were as follows. 1. 2. 3. 4. 5. On January 10, issued at $109 per share 114,000 shares of $100 par value, 9% cumulative preferred stock. On February 8, reacquired 16,900 shares of its common stock for $11 per share. On May 9, declared the yearly cash dividend on preferred stock, payable June 10, to stockholders of record on May 31. On June 8, declared a cash dividend of $1.20 per share on the common stock outstanding, payable on July 10, to stockholders of record on July 1. Net income for 2022 was $3,687,000. Your answer is partially correct. Try again. Record the journal entries that are required for items 1-5 above. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Credit - **** Debit *** *** 12426000 Jan. 10 v Cash Preferred Stock 11400000 Paid-in Capital in Excess of Par Value-Preferred St 1026000 Feb. 8 v Treasury Stock 185900 Cash 185900 May 9V cas Dividends Payable T IT 1026000T T 1026000 1551720) TO 1551720) Jun. 8 Cash Dividends IL Dividends Payable 1551720 Jun. 10 v =X FX Jul. 10 v Dec. 31 v income 3687000 Retained Earnings 3687000 (To close net income) Dec. 31 Retained Earnings 2577720 Cash Dividends 2577720 (To close cash dividends) SHERIDAN COMPANY Partial Balance Sheet December 31, 2022 Total Current Assets Paid-in Capital Capital Stock Common Stock 1293100 XERRER Total Capital Stock : 1140000 Additional Paid-in Capital $ 12693100 Paid-in Capital Paid-in Capital in Excess of Par Value-Common St 1860000 Paid-in Capital in Excess of Par Value-Preferred Si 1026000 Total Additional Paid-in Capital 2886000 x Total Paid-in Capital Retained Earnings Total Paid-in Capital and Retained Earnings v Y Less Treasury Stock -185900 IX . Total Stockholders' Equity