Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help needed 5 An investor wants to invest $300,000 in a portfolio of three mutual funds. The annual fund returns are normally distributed with a

help needed 5

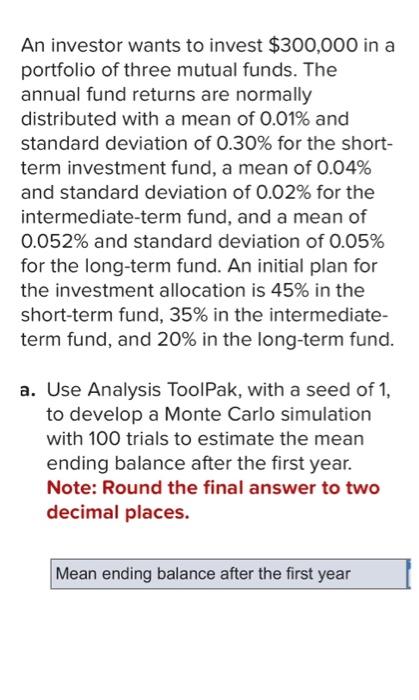

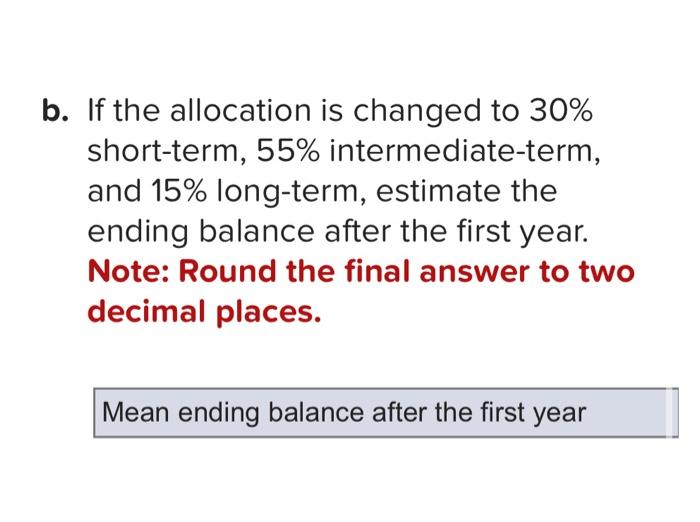

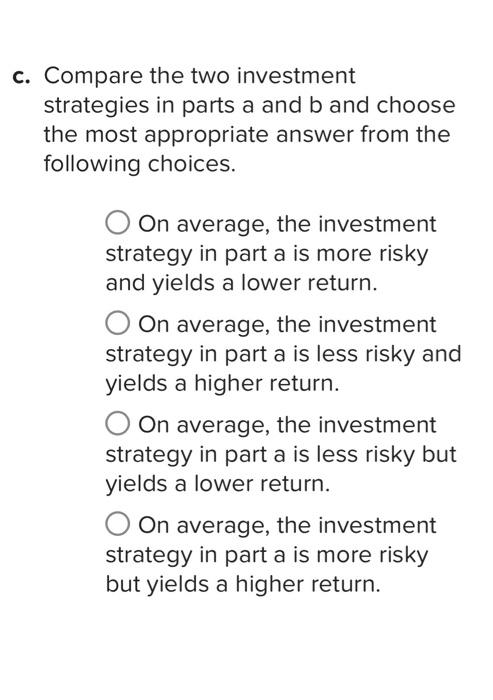

An investor wants to invest $300,000 in a portfolio of three mutual funds. The annual fund returns are normally distributed with a mean of 0.01% and standard deviation of 0.30% for the shortterm investment fund, a mean of 0.04% and standard deviation of 0.02% for the intermediate-term fund, and a mean of 0.052% and standard deviation of 0.05% for the long-term fund. An initial plan for the investment allocation is 45% in the short-term fund, 35% in the intermediateterm fund, and 20% in the long-term fund. a. Use Analysis ToolPak, with a seed of 1 , to develop a Monte Carlo simulation with 100 trials to estimate the mean ending balance after the first year. Note: Round the final answer to two decimal places. b. If the allocation is changed to 30% short-term, 55\% intermediate-term, and 15% long-term, estimate the ending balance after the first year. Note: Round the final answer to two decimal places. c. Compare the two investment strategies in parts a and b and choose the most appropriate answer from the following choices. On average, the investment strategy in part a is more risky and yields a lower return. On average, the investment strategy in part a is less risky and yields a higher return. On average, the investment strategy in part a is less risky but yields a lower return. On average, the investment strategy in part a is more risky but yields a higher return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started