Help on part f only thanks

Help on part f only thanks

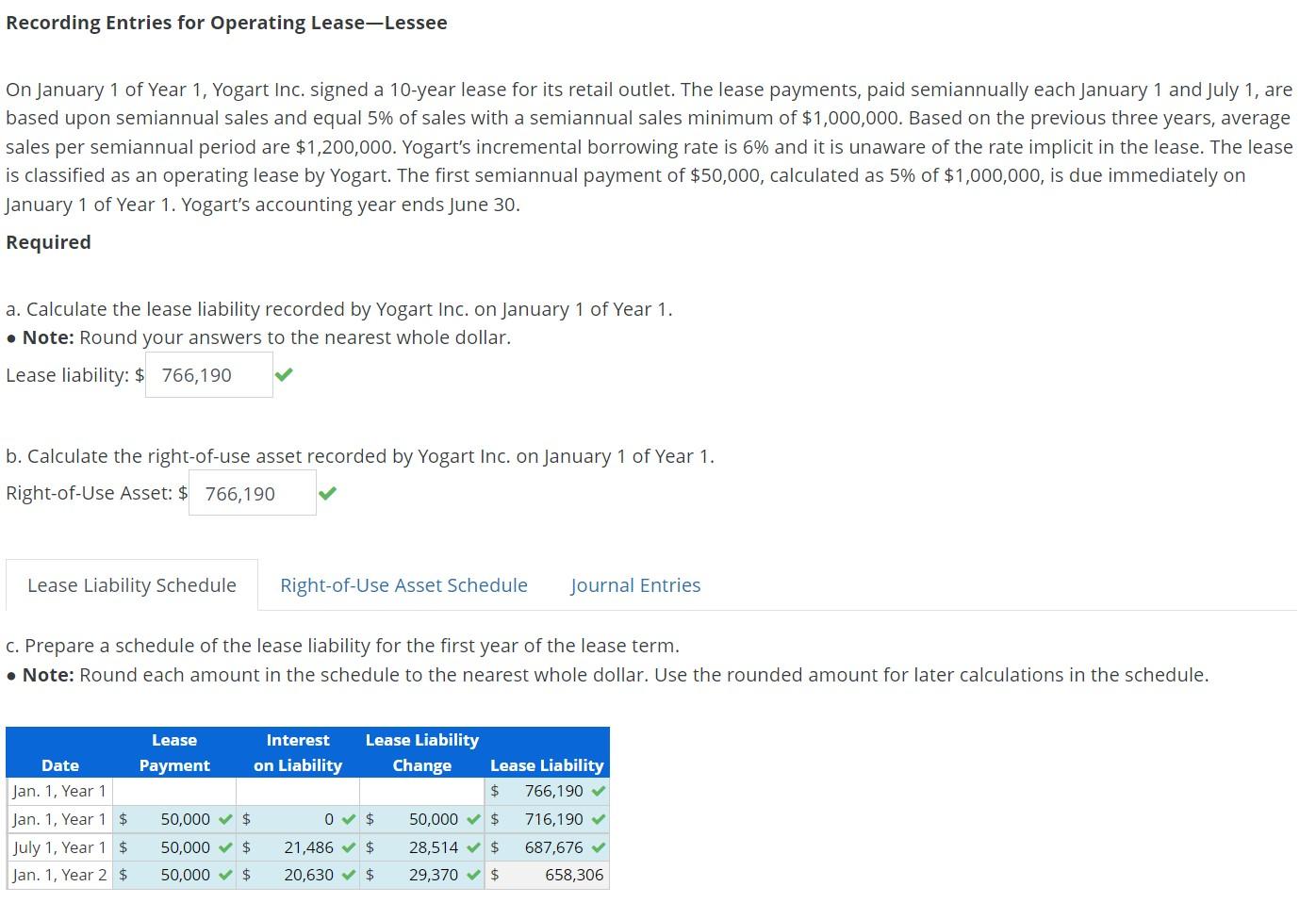

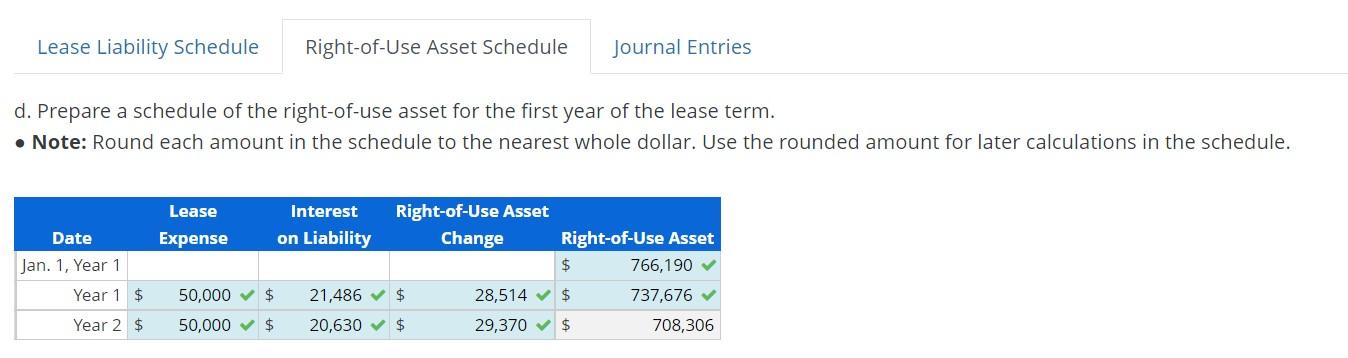

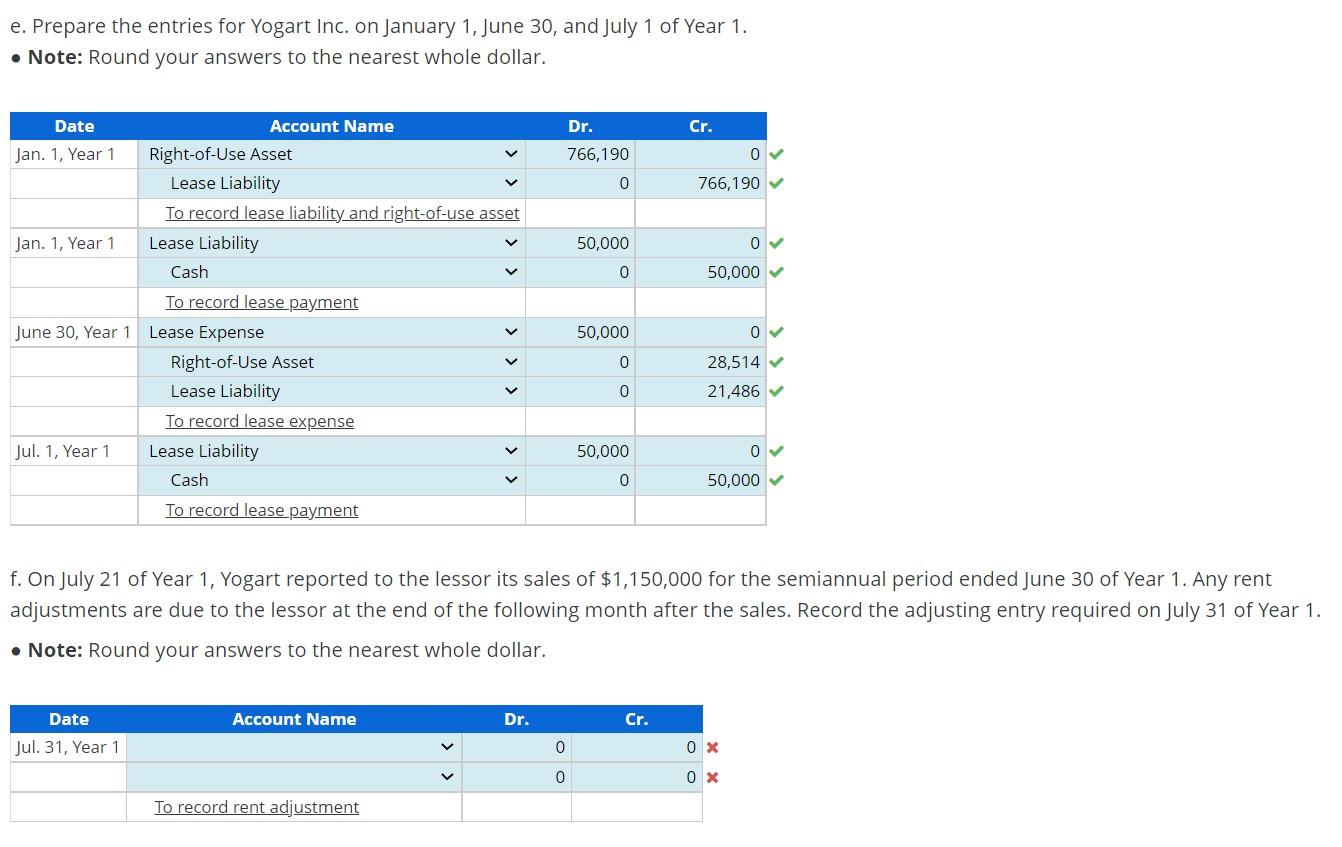

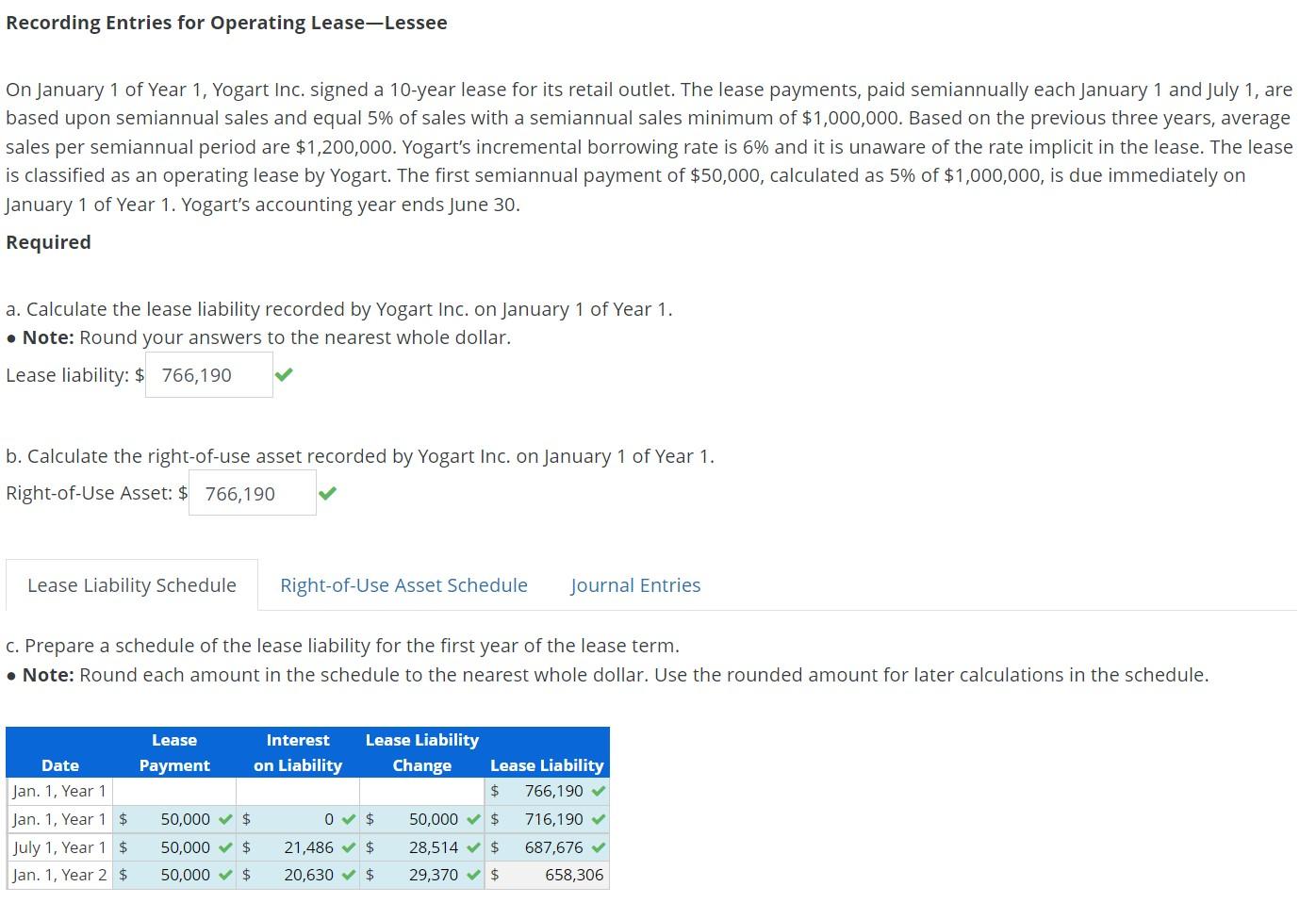

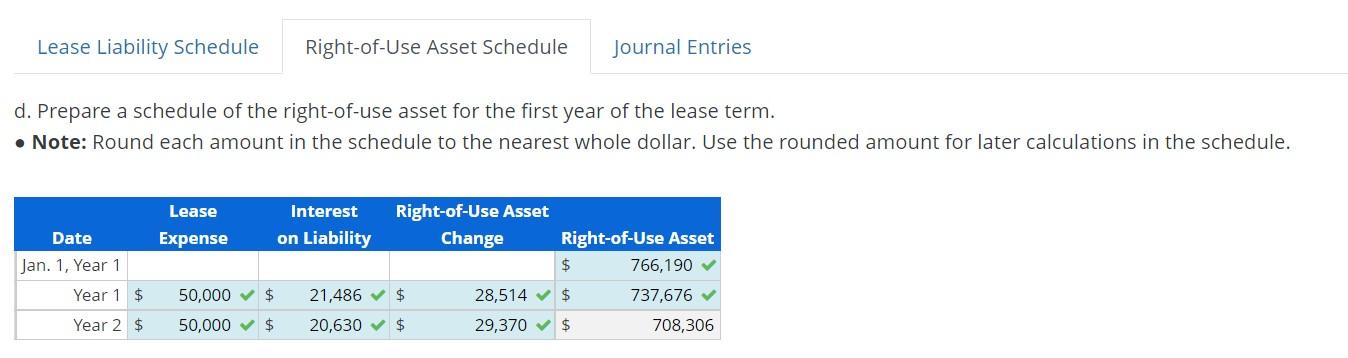

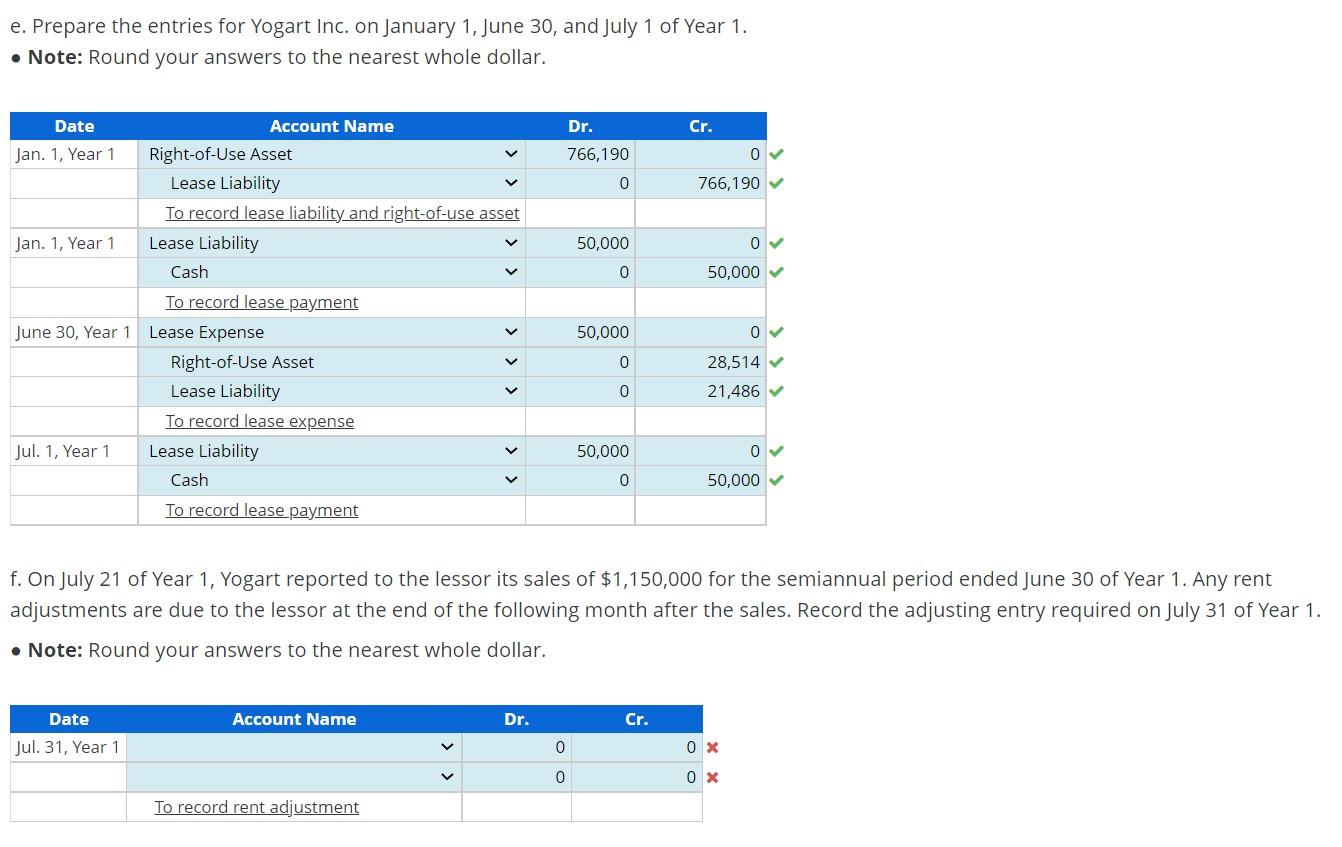

On January 1 of Year 1, Yogart Inc. signed a 10-year lease for its retail outlet. The lease payments, paid semiannually each January 1 and July 1 , are based upon semiannual sales and equal 5% of sales with a semiannual sales minimum of $1,000,000. Based on the previous three years, average sales per semiannual period are $1,200,000. Yogart's incremental borrowing rate is 6% and it is unaware of the rate implicit in the lease. The lease is classified as an operating lease by Yogart. The first semiannual payment of $50,000, calculated as 5% of $1,000,000, is due immediately on January 1 of Year 1. Yogart's accounting year ends june 30. Required a. Calculate the lease liability recorded by Yogart Inc. on January 1 of Year 1. - Note: Round your answers to the nearest whole dollar. Lease liability: \$ b. Calculate the right-of-use asset recorded by Yogart Inc. on January 1 of Year 1. Right-of-Use Asset: \$ c. Prepare a schedule of the lease liability for the first year of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. d. Prepare a schedule of the right-of-use asset for the first year of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. e. Prepare the entries for Yogart Inc. on January 1 , June 30 , and July 1 of Year 1. - Note: Round your answers to the nearest whole dollar. f. On july 21 of Year 1, Yogart reported to the lessor its sales of $1,150,000 for the semiannual period ended June 30 of Year 1 . Any rent - Note: Round your answers to the nearest whole dollar. On January 1 of Year 1, Yogart Inc. signed a 10-year lease for its retail outlet. The lease payments, paid semiannually each January 1 and July 1 , are based upon semiannual sales and equal 5% of sales with a semiannual sales minimum of $1,000,000. Based on the previous three years, average sales per semiannual period are $1,200,000. Yogart's incremental borrowing rate is 6% and it is unaware of the rate implicit in the lease. The lease is classified as an operating lease by Yogart. The first semiannual payment of $50,000, calculated as 5% of $1,000,000, is due immediately on January 1 of Year 1. Yogart's accounting year ends june 30. Required a. Calculate the lease liability recorded by Yogart Inc. on January 1 of Year 1. - Note: Round your answers to the nearest whole dollar. Lease liability: \$ b. Calculate the right-of-use asset recorded by Yogart Inc. on January 1 of Year 1. Right-of-Use Asset: \$ c. Prepare a schedule of the lease liability for the first year of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. d. Prepare a schedule of the right-of-use asset for the first year of the lease term. - Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. e. Prepare the entries for Yogart Inc. on January 1 , June 30 , and July 1 of Year 1. - Note: Round your answers to the nearest whole dollar. f. On july 21 of Year 1, Yogart reported to the lessor its sales of $1,150,000 for the semiannual period ended June 30 of Year 1 . Any rent - Note: Round your answers to the nearest whole dollar

Help on part f only thanks

Help on part f only thanks