help on the charts

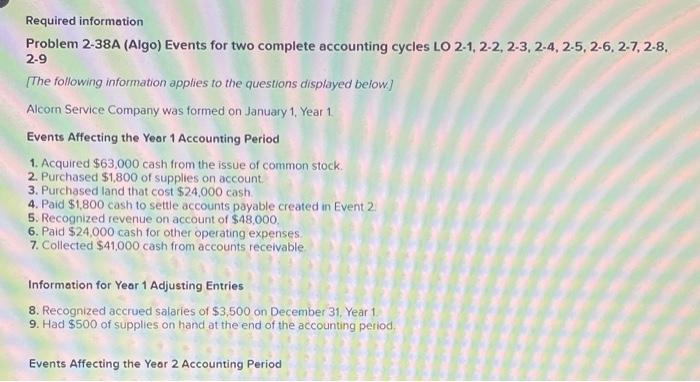

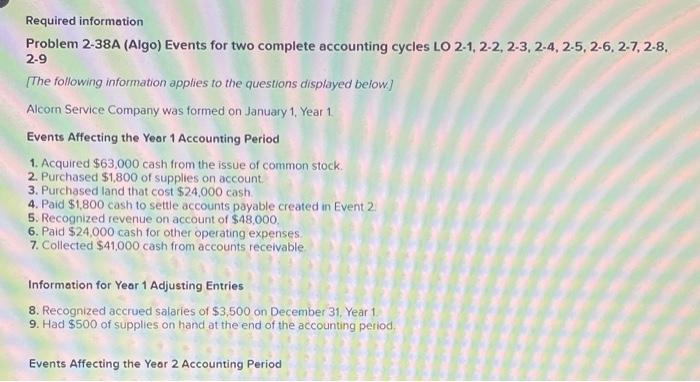

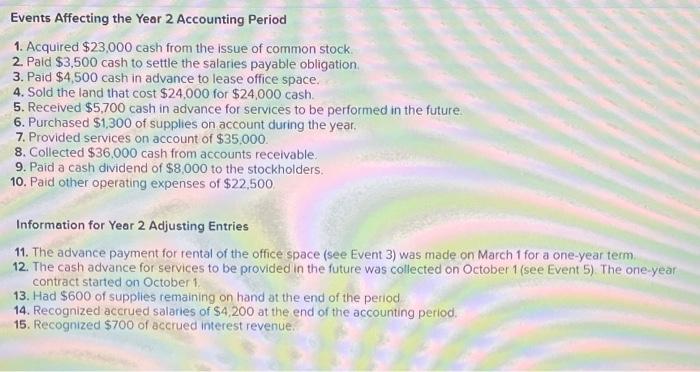

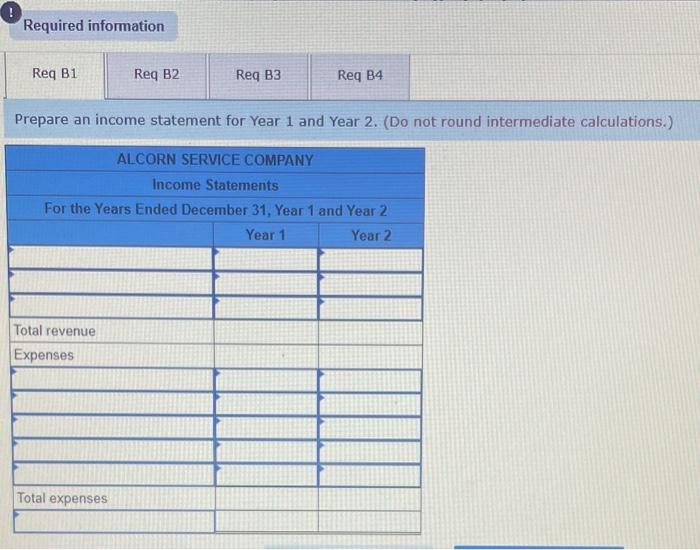

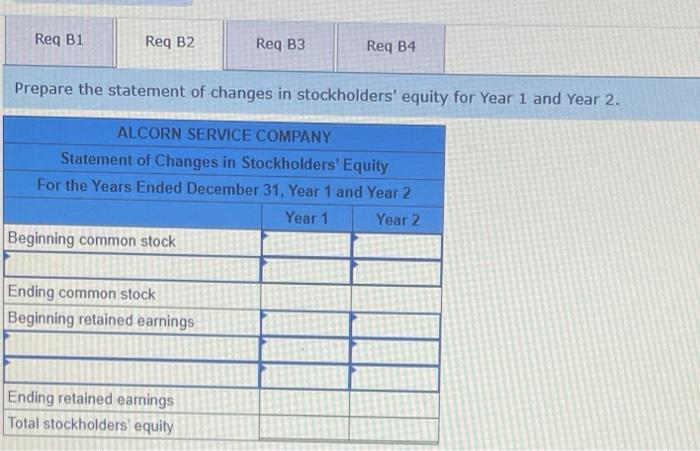

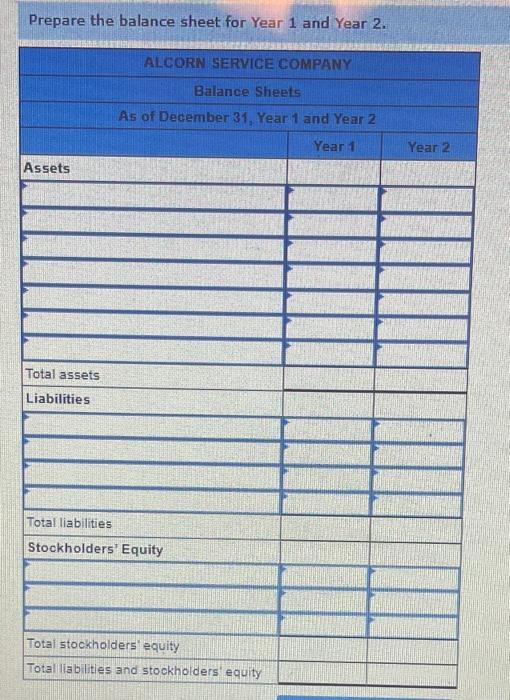

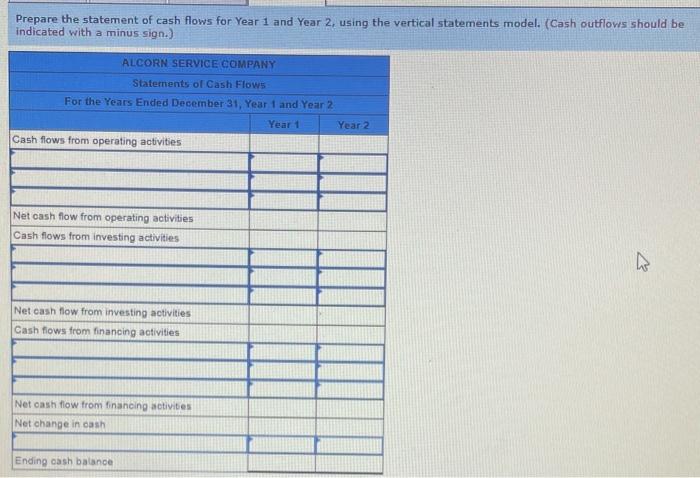

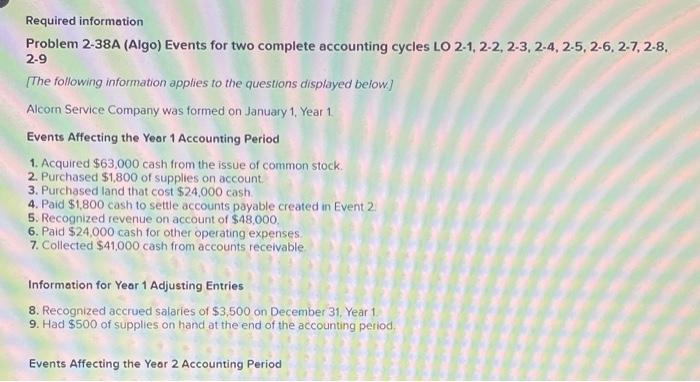

Required information Problem 2-38A (Algo) Events for two complete accounting cycles LO 2-1, 2-2, 2-3,2-4,2-5, 2-6, 2-7, 2-8. 2-9 [The following information applies to the questions displayed below) Alcor Service Company was formed on January 1, Year 1 Events Affecting the Year 1 Accounting Period 1. Acquired $63,000 cash from the issue of common stock. 2. Purchased $1,800 of supplies on account 3. Purchased land that cost $24,000 cash 4. Paid $1,800 cash to settle accounts payable created in Event 2 5. Recognized revenue on account of $48,000, 6. Paid $24,000 cash for other operating expenses 7. Collected $41,000 cash from accounts receivable Information for Year 1 Adjusting Entries 8. Recognized accrued salaries of $3,500 on December 31, Year 1 9. Had $500 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Period Events Affecting the Year 2 Accounting Period 1. Acquired $23,000 cash from the issue of common stock. 2. Pald $3,500 cash to settle the salaries payable obligation 3. Paid $4,500 cash in advance to lease office space. 4. Sold the land that cost $24,000 for $24,000 cash. 5. Received $5,700 cash in advance for services to be performed in the future 6. Purchased $1,300 of supplies on account during the year. 7. Provided services on account of $35.000. 8. Collected $36.000 cash from accounts receivable, 9. Paid a cash dividend of $8,000 to the stockholders 10. Paid other operating expenses of $22,500 Information for Year 2 Adjusting Entries 11. The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5) The one yean contract started on October 1 13. Had $600 of supplies remaining on hand at the end of the period 14. Recognized accrued salaries of $4,200 at the end of the accounting period. 15. Recognized $700 of accrued interest revenue. ! Required information Req B1 Req B2 Req B3 Req B4 Prepare an income statement for Year 1 and Year 2. (Do not round intermediate calculations.) ALCORN SERVICE COMPANY Income Statements For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Total revenue Expenses Total expenses Req B1 Req B2 Req B3 Req B4 Prepare the statement of changes in stockholders' equity for Year 1 and Year 2. ALCORN SERVICE COMPANY Statement of Changes in Stockholders' Equity For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Beginning common stock Ending common stock Beginning retained earnings Ending retained earnings Total stockholders equity Prepare the balance sheet for Year 1 and Year 2. ALCORN SERVICE COMPANY Balance Sheets As of December 31, Year 1 and Year 2 Year 1 Year 2 Assets Total assets Liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders equity Prepare the statement of cash flows for Year 1 and Year 2, using the vertical statements model. (Cash outflows should be indicated with a minus sign.) ALCORN SERVICE COMPANY Statements of Cash Flow5 For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Cash flows from operating activities Net cash flow from operating activities Cash flows from investing activities Net cash flow from investing activities Cash flows from financing activities Net cash flow from financing activities Net change in cash Ending cash balance