help on these plz !

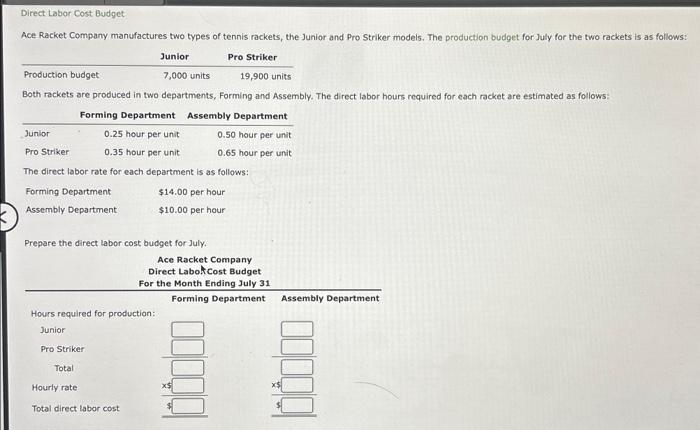

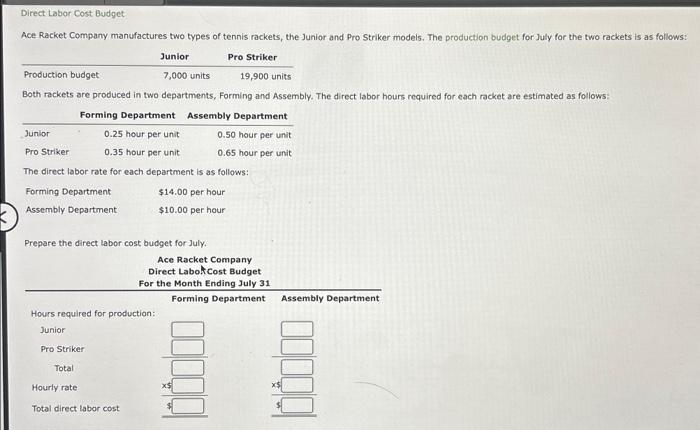

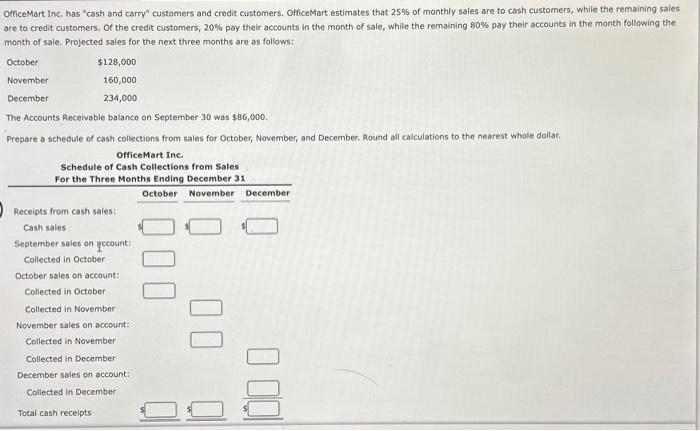

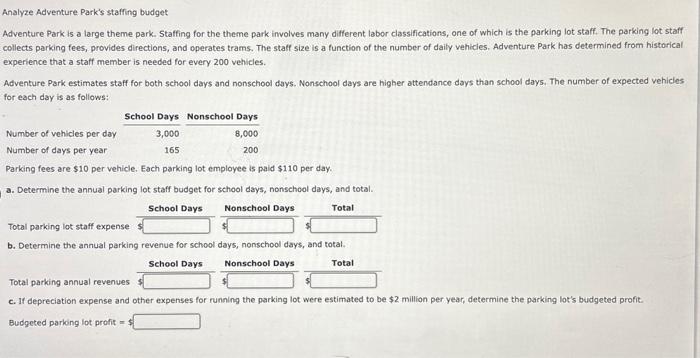

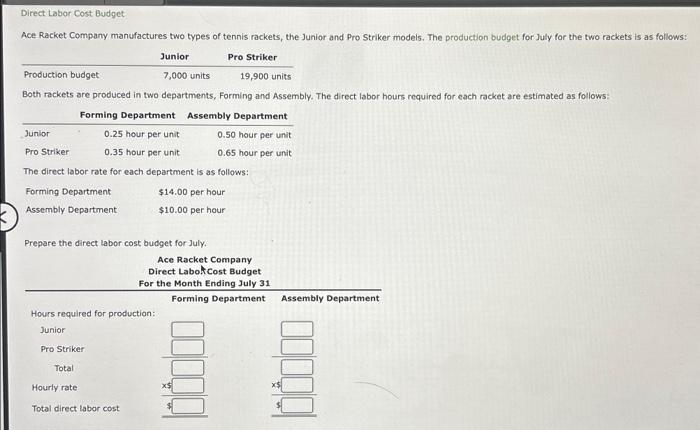

Schedule of cash payments for a service company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: Depreciation, insurance, and property taxes represent $29,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28 , and proper taxes for the year will be paid in June. 64% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be pa in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May. OrficeMart inc. has "cash and carry" customers and credit customers. OfficeMart estimates that 25% of monthly sales are to cosh customers, while the remaining saies are to credit customers. Of the credit customers, 20\% pay their accouints in the month of sale, while the remaining 80% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: The Accounts Recelvable balance on September 30 was $86,000. Prepare a schedule of cash collections from sales for October, November, and December. Round all calculations to the nearest whole dollar, Analyze Adventure Park's staffing budget Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size is a function of the number of daily vehicles, Adventure Park has determined from historical experience that a staff member is needed for every 200 vehicles. Adventure Park estimates staff for both school days and nonschool days. Nonschool days are higher attendance days than school days. The number of expected vehicles for each day is as follows: Parking fees are $10 per vehicle. Each parking lot employee is paid $110 per day. a. Determine the annual parking lot staff budget for school days, nonschool days, and total. b. Determine the annual parking revenue for school days, nonschool days, and total. c. If depreciation expense and other expenses for running the parking lot were estimated to be $2 million per year, determine the parking lot's budgeted profit. Budgeted parking lot profit =$ Direct Labor Cost Budget Ace Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models, The production budget for July for the two rackets is as follows: Both rackets are produced in two departments, Forming and Assembly. The direct labor hours required for each racket are estimated as follows: The direct labor rate for each department is as follows: Prepare the direct labor cost budget for July