Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please 11 points Save Answer American Construction Company has entered into a contract with American University in Cairo beginning January 1, 2017 to construct

help please

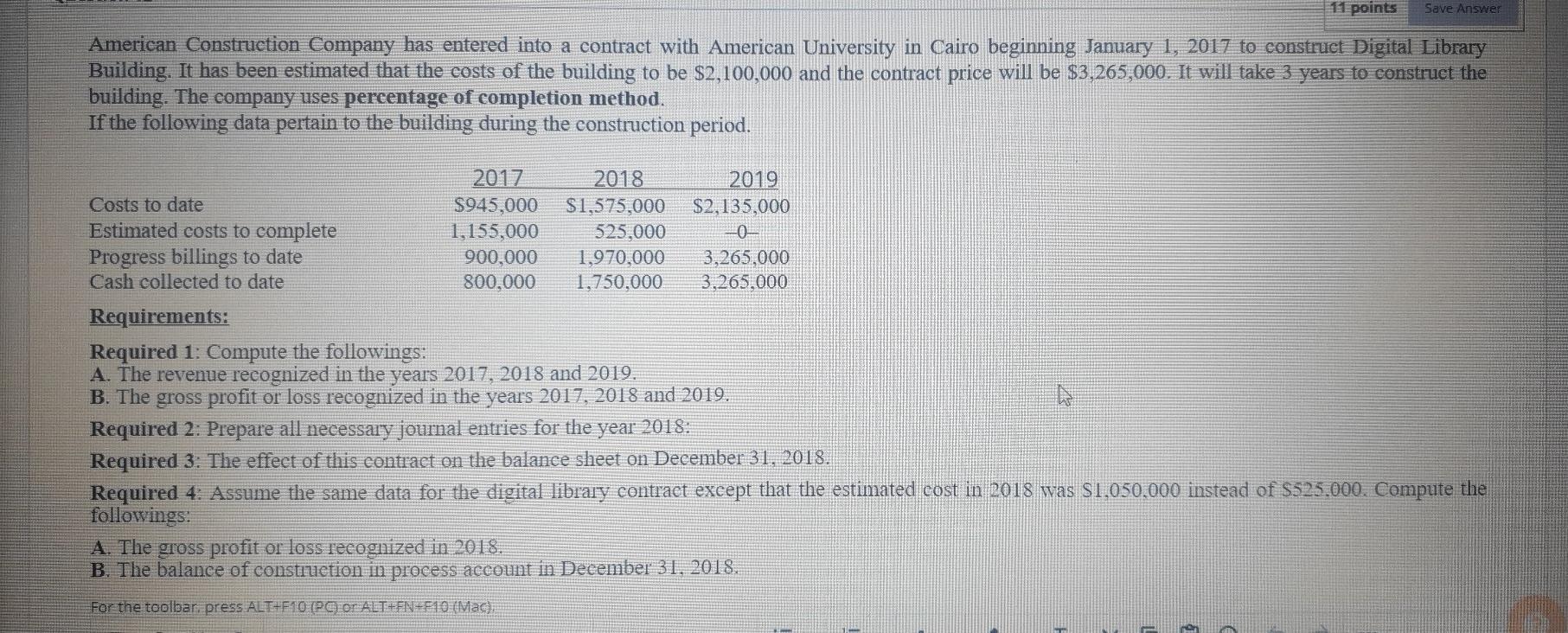

11 points Save Answer American Construction Company has entered into a contract with American University in Cairo beginning January 1, 2017 to construct Digital Library Building. It has been estimated that the costs of the building to be $2,100,000 and the contract price will be $3,265,000. It will take 3 years to construct the building. The company uses percentage of completion method. If the following data pertain to the building during the construction period. 2017 2018 2019 Costs to date $945.000 $1,575,000 $2,135,000 Estimated costs to complete 1,155,000 525,000 0 Progress billings to date 900,000 1,970,000 3,265,000 Cash collected to date 800,000 1,750,000 3,265,000 Requirements: Required 1: Compute the followings: A. The revenue recognized in the years 2017, 2018 and 2019. B. The gross profit or loss recognized in the years 2017, 2018 and 2019. Required 2: Prepare all necessary journal entries for the year 2018: Required 3: The effect of this contract on the balance sheet on December 31, 2018. Required 4: Assume the same data for the digital library contract except that the estimated cost in 2018 was $1.050.000 instead of $525.000. Compute the followings: A. The gross profit or loss recognized in 2018. B. The balance of construetion in process account in December 31, 2018. For the toolbar, press ALT+F10 (PC or ALT+FN=F10 (Mac), 11 points Save Answer American Construction Company has entered into a contract with American University in Cairo beginning January 1, 2017 to construct Digital Library Building. It has been estimated that the costs of the building to be $2,100,000 and the contract price will be $3,265,000. It will take 3 years to construct the building. The company uses percentage of completion method. If the following data pertain to the building during the construction period. 2017 2018 2019 Costs to date $945.000 $1,575,000 $2,135,000 Estimated costs to complete 1,155,000 525,000 0 Progress billings to date 900,000 1,970,000 3,265,000 Cash collected to date 800,000 1,750,000 3,265,000 Requirements: Required 1: Compute the followings: A. The revenue recognized in the years 2017, 2018 and 2019. B. The gross profit or loss recognized in the years 2017, 2018 and 2019. Required 2: Prepare all necessary journal entries for the year 2018: Required 3: The effect of this contract on the balance sheet on December 31, 2018. Required 4: Assume the same data for the digital library contract except that the estimated cost in 2018 was $1.050.000 instead of $525.000. Compute the followings: A. The gross profit or loss recognized in 2018. B. The balance of construetion in process account in December 31, 2018. For the toolbar, press ALT+F10 (PC or ALT+FN=F10 (Mac)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started