Answered step by step

Verified Expert Solution

Question

1 Approved Answer

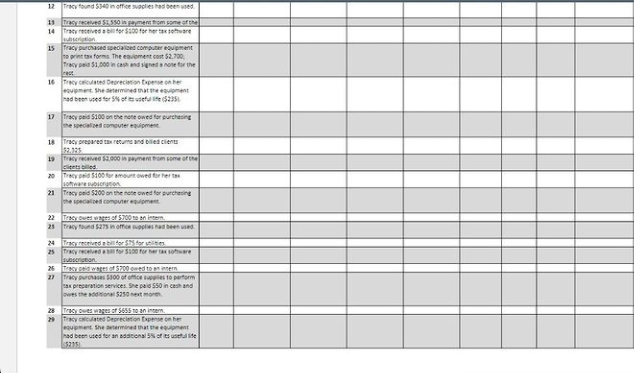

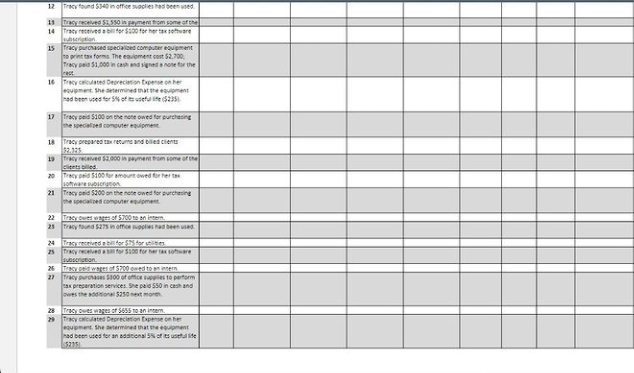

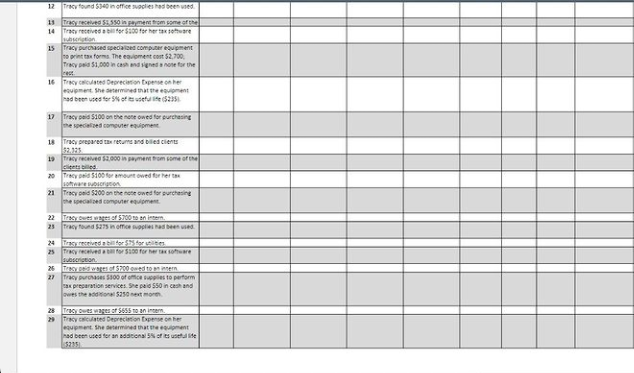

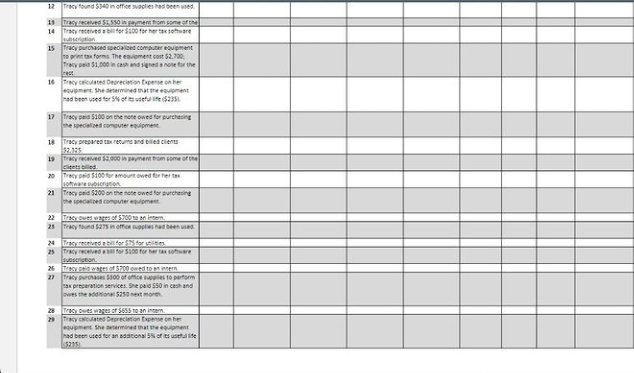

Help please) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy

Help please)

12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235) 12 Tracy found $340 in office supplies had been used 13 Tracy received 5: 550 in payment from some of the 14 Tracy received a bill for $300 for her tax software subscription 15 Tracy purchased specialized computer equipment to print tax forms. The equipment cost $2,700, Tracy paid $1,000 in cash and signed a note for the cest 16 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for 5% of its useful ine (5235) 17 Tracy paid $100 on the note owed for purchasing the specialized computer equipment 18 Tracy prepared tax returns and billed clients 52.325 19 Tracy received $2,000 in payment from some of the clients billed 20 Trey 5100 for amount owed for her tex software subscription 21 Tracy paid $200 on the note owed for purchasing the specialized computer equipment 22 Tracy w wages of $200 to an inte 25 Tracy found $275 in office supplies had been used 24 Trayecived bill for $25 for utilities 25 Tracy received a bill for $300 for her tax software subscription. 26 Tracy i wages of $200 owed to an intern 27 Tracy purchases $300 of office supplies to perform tax preparation services. She paid 550 in cash and owes the additional $250 next more 28 Tracy owes wages of $655 to an intern. 29 Tracy calculated Depreciation Expense on her equipment. She determined that the equipment had been used for an additional 5% of its use 5235)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started