Question

help please !! 3. Prepare an Income Statement, a Statement of Changes in Equity, and a classified Statement of Financial Position for Sandys Services as

help please !!

3. Prepare an Income Statement, a Statement of Changes in Equity, and a classified Statement of Financial Position for Sandys Services as at their year end. Financial statements must be in good form, including correctly identifying the name of the business, the name of the statement and the period covered by the statement. All elements of the statement must be correctly identified, with subtotals and/or totals, where appropriate.

4. Prepare general journal entries to close the temporary accounts (closing entries).

5.. Prepare a Post-Closing Trial Balance in proper format.

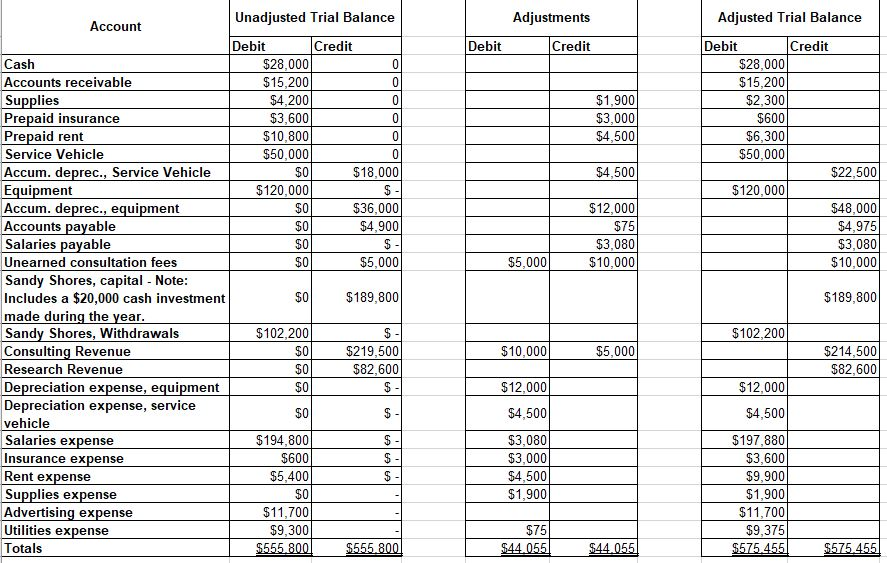

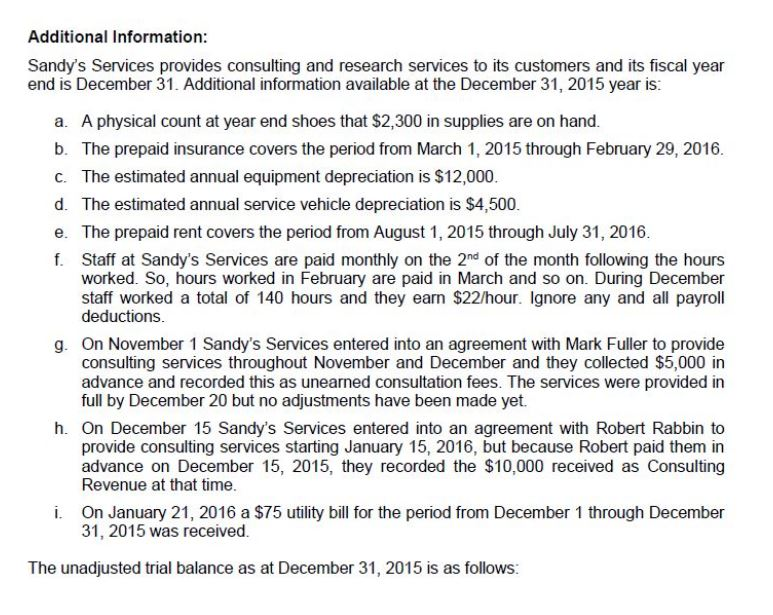

Adjustments Adjusted Trial Balance Debit Credit $1,900 $3,000 $4,500 Debit Credit $28,000 $15,200 $2,300 $600 $6,300 $50,000 $22,500 $120,000 $48,000 $4,975 $3,080 $10,000 $4,500 $12,000 $75 $3,080 $10,000 $ - $5,000 Unadjusted Trial Balance Account Debit Credit Cash $28,000 Accounts receivable $15,200 Supplies $4,200 Prepaid insurance $3,600 Prepaid rent $10.800 Service Vehicle $50,000 Accum. deprec., Service Vehicle $18,000 Equipment $120,000 $- Accum. deprec., equipment $36,000 Accounts payable $4,900 Salaries payable Unearned consultation fees $5,000 Sandy Shores, capital - Note: Includes a $20,000 cash investment $0 $189,800 made during the year. Sandy Shores, Withdrawals Consulting Revenue $0 $219,500 Research Revenue $0 $82,600 Depreciation expense, equipment. $0 Depreciation expense, service vehicle Salaries expense $194.800 Insurance expense $600 Rent expense $5,400 Supplies expense Advertising expense $11,700 Utilities expense $9,300 Totals $555.800 $555.8001 $189,800 $ - $102,200 $10,000 $5,000 $214,500 $82,600 $12.000 $12,000 $4,500 $0 $4,500 $3,080 $3,000 $4,500 $1,900 $0) $197,880 $3,600 $9,900 $1,900 $11,700 $9,375 $575.455 $75 $44.055 $44.055 $575.455 Additional Information: Sandy's Services provides consulting and research services to its customers and its fiscal year end is December 31. Additional information available at the December 31, 2015 year is: a. A physical count at year end shoes that $2,300 in supplies are on hand. b. The prepaid insurance covers the period from March 1, 2015 through February 29, 2016. C. The estimated annual equipment depreciation is $12,000. d. The estimated annual service vehicle depreciation is $4,500 e. The prepaid rent covers the period from August 1, 2015 through July 31, 2016. Staff at Sandy's Services are paid monthly on the 2nd of the month following the hours worked. So, hours worked in February are paid in March and so on. During December staff worked a total of 140 hours and they earn $22/hour. Ignore any and all payroll deductions g. On November 1 Sandy's Services entered into an agreement with Mark Fuller to provide consulting services throughout November and December and they collected $5,000 in advance and recorded this as unearned consultation fees. The services were provided in full by December 20 but no adjustments have been made yet. h. On December 15 Sandy's Services entered into an agreement with Robert Rabbin to provide consulting services starting January 15, 2016, but because Robert paid them in advance on December 15, 2015, they recorded the $10,000 received as Consulting Revenue at that time. i. On January 21, 2016 a $75 utility bill for the period from December 1 through December 31, 2015 was received. The unadjusted trial balance as at December 31, 2015 is as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started