Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please A health club has 3 employees who work on lead generation. Each employee contacts leads 20 hours a week and is paid $24

help please

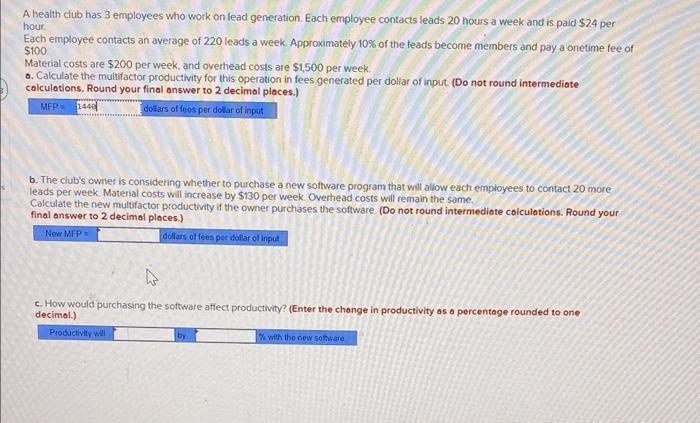

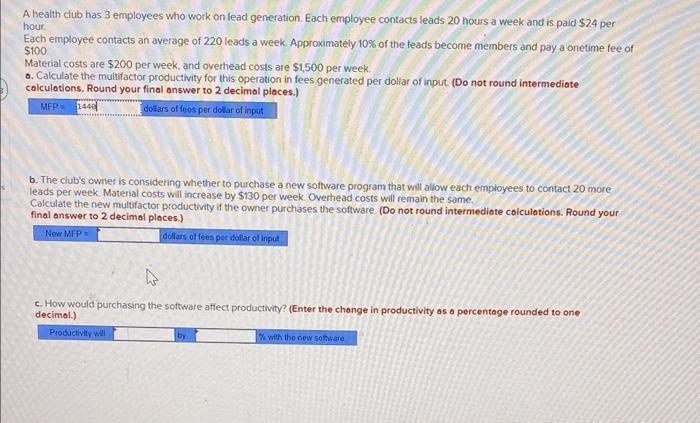

A health club has 3 employees who work on lead generation. Each employee contacts leads 20 hours a week and is paid $24 per hour Each employee contacts an average of 220 leads a week. Approximately 10% of the leads become members and pay a onetime fee of $100 Material costs are $200 per week, and overhead costs are $1,500 per week. 0. Calculate the mulufactor productivity for this operation in fees generated per dollar of input. (Do not round intermediate colculations. Round your final answer to 2 decimal places.) b. The club's owner is considering whether to purchase a new soltware program that will allow each employees to contact 20 more leads per week. Material costs will increase by $130 per week. Overhead costs will remain the same. Calculate the new multifactor producthity if the owner purchases the software. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) c. How would purchasing the software aflect productivity? (Enter the change in productivity as a percentage rounded to one decimal.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started