Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please (Analyzing the quality of earnings and sustainability of capital expenditures) Look up the stafement of cash flows for both Home Depot and Lowes

help please

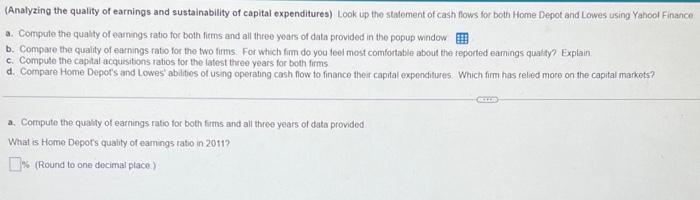

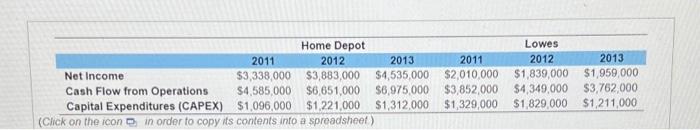

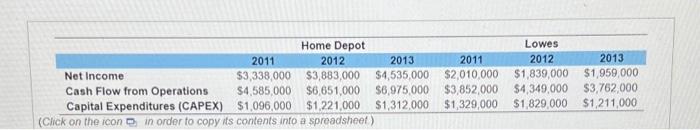

(Analyzing the quality of earnings and sustainability of capital expenditures) Look up the stafement of cash flows for both Home Depot and Lowes using Yahool Finance a. Compute the quality of eamings ratio for both firms and all three yoars of data provided in the popup widow b. Compare the quality of earnings fato for the two firms. For which firm do you feel most comfortable about the reported earnings qualty? Explain. c. Compute the captal acquisibons ratios for the latest three years for both firms d. Compare Home Depor's and Lowes' abilities of using operating cash fow to finance their capifal expenditures. Which firm has reled more on the capital markets? a. Compute the qualify of earnings ratio for both firms and all three years of data provided What is Home Depors quality of earnings ratio in 2011 ? (Round to one decimal placo.) \begin{tabular}{|lcccccc|} \hline & \multicolumn{3}{c}{ Home Depot } & \multicolumn{3}{c|}{ Lowes } \\ \hline & 2011 & 2012 & 2013 & 2011 & 2012 & 2013 \\ \hline Net Income & $3,338,000 & $3,883,000 & $4,535,000 & $2,010,000 & $1,839,000 & $1,959,000 \\ Cash Flow from Operations & $4,585,000 & $6,651,000 & $6,975,000 & $3,852,000 & $4,349,000 & $3,762,000 \\ Capital Expenditures (CAPEX) & $1,096,000 & $1,221,000 & $1,312,000 & $1,329,000 & $1,829,000 & $1,211,000 \\ \hline \end{tabular} (Click on the icon in order to copy its contents into a spreadsheet)

(Analyzing the quality of earnings and sustainability of capital expenditures) Look up the stafement of cash flows for both Home Depot and Lowes using Yahool Finance a. Compute the quality of eamings ratio for both firms and all three yoars of data provided in the popup widow b. Compare the quality of earnings fato for the two firms. For which firm do you feel most comfortable about the reported earnings qualty? Explain. c. Compute the captal acquisibons ratios for the latest three years for both firms d. Compare Home Depor's and Lowes' abilities of using operating cash fow to finance their capifal expenditures. Which firm has reled more on the capital markets? a. Compute the qualify of earnings ratio for both firms and all three years of data provided What is Home Depors quality of earnings ratio in 2011 ? (Round to one decimal placo.) \begin{tabular}{|lcccccc|} \hline & \multicolumn{3}{c}{ Home Depot } & \multicolumn{3}{c|}{ Lowes } \\ \hline & 2011 & 2012 & 2013 & 2011 & 2012 & 2013 \\ \hline Net Income & $3,338,000 & $3,883,000 & $4,535,000 & $2,010,000 & $1,839,000 & $1,959,000 \\ Cash Flow from Operations & $4,585,000 & $6,651,000 & $6,975,000 & $3,852,000 & $4,349,000 & $3,762,000 \\ Capital Expenditures (CAPEX) & $1,096,000 & $1,221,000 & $1,312,000 & $1,329,000 & $1,829,000 & $1,211,000 \\ \hline \end{tabular} (Click on the icon in order to copy its contents into a spreadsheet)

help please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started