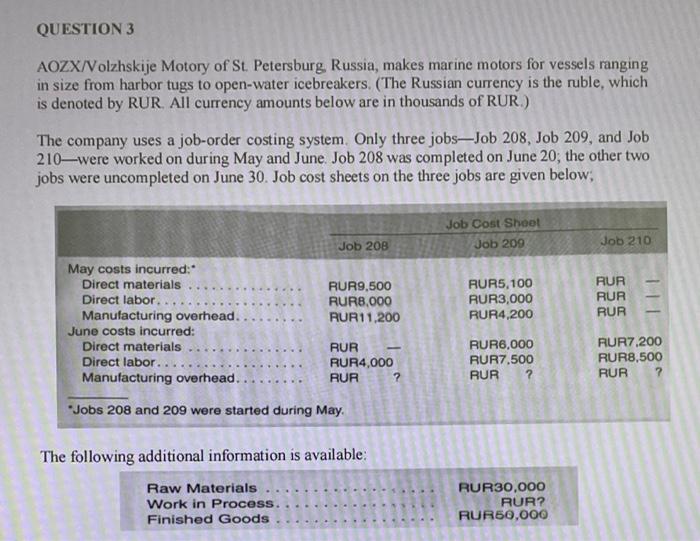

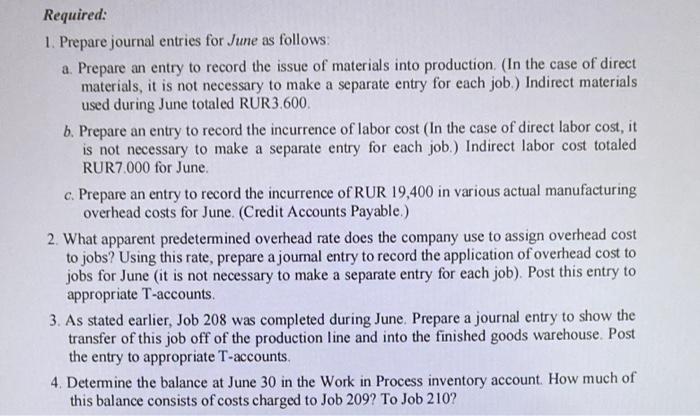

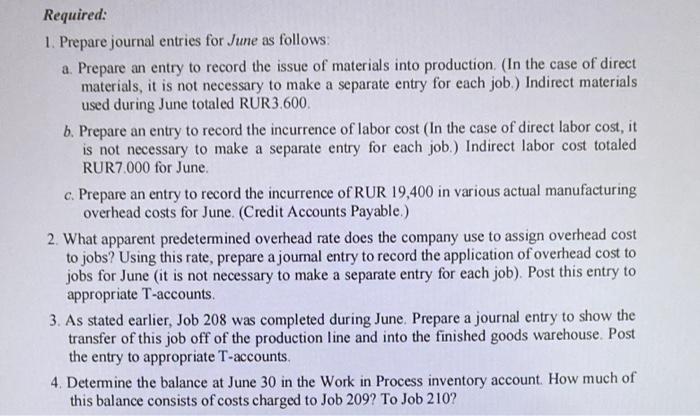

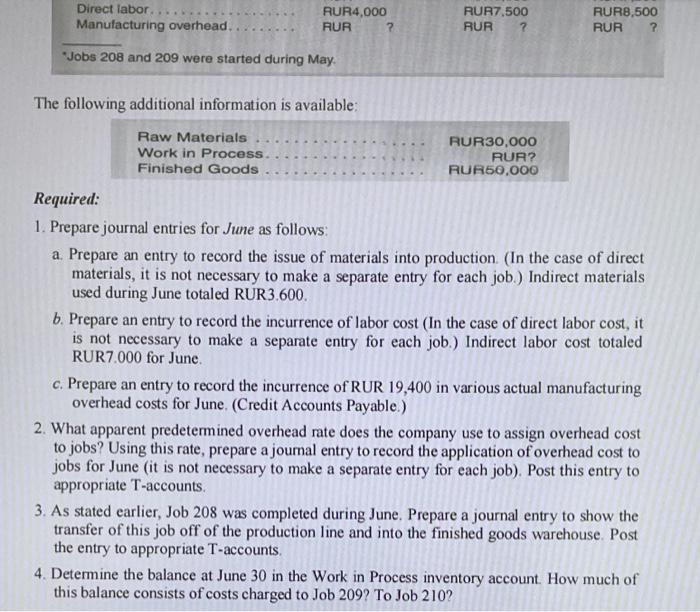

AOZX/Volzhskije Motory of St. Petersburg. Russia, makes marine motors for vessels ranging in size from harbor tugs to open-water icebreakers. (The Russian currency is the ruble, which is denoted by RUR. All currency amounts below are in thousands of RUR.) The company uses a job-order costing system. Only three jobs-Job 208, Job 209, and Job 210 -were worked on during May and June. Job 208 was completed on June 20; the other two jobs were uncompleted on June 30 . Job cost sheets on the three jobs are given below; The following additional information is available: 1. Prepare journal entries for June as follows: a. Prepare an entry to record the issue of materials into production. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during June totaled RUR3.600. b. Prepare an entry to record the incurrence of labor cost (In the case of direct labor cost, it is not necessary to make a separate entry for each job.) Indirect labor cost totaled RUR7.000 for June. c. Prepare an entry to record the incurrence of RUR 19,400 in various actual manufacturing overhead costs for June. (Credit Accounts Payable.) 2. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for June (it is not necessary to make a separate entry for each job). Post this entry to appropriate T-accounts. 3. As stated earlier, Job 208 was completed during June. Prepare a journal entry to show the transfer of this job off of the production line and into the finished goods warehouse. Post the entry to appropriate T-accounts. 4. Determine the balance at June 30 in the Work in Process inventory account. How much of this balance consists of costs charged to Job 209? To Job 210? The following additional information is available: Required: 1. Prepare journal entries for June as follows: a. Prepare an entry to record the issue of materials into production. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during June totaled RUR3.600. b. Prepare an entry to record the incurrence of labor cost (In the case of direct labor cost, it is not necessary to make a separate entry for each job.) Indirect labor cost totaled RUR7.000 for June. c. Prepare an entry to record the incurrence of RUR 19,400 in various actual manufacturing overhead costs for June. (Credit Accounts Payable.) 2. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for June (it is not necessary to make a separate entry for each job). Post this entry to appropriate T-accounts. 3. As stated earlier, Job 208 was completed during June. Prepare a journal entry to show the transfer of this job off of the production line and into the finished goods warehouse. Post the entry to appropriate T-accounts. 4. Determine the balance at June 30 in the Work in Process inventory account. How much of this balance consists of costs charged to Job 209? To Job 210 ? AOZX/Volzhskije Motory of St. Petersburg. Russia, makes marine motors for vessels ranging in size from harbor tugs to open-water icebreakers. (The Russian currency is the ruble, which is denoted by RUR. All currency amounts below are in thousands of RUR.) The company uses a job-order costing system. Only three jobs-Job 208, Job 209, and Job 210 -were worked on during May and June. Job 208 was completed on June 20; the other two jobs were uncompleted on June 30 . Job cost sheets on the three jobs are given below; The following additional information is available: 1. Prepare journal entries for June as follows: a. Prepare an entry to record the issue of materials into production. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during June totaled RUR3.600. b. Prepare an entry to record the incurrence of labor cost (In the case of direct labor cost, it is not necessary to make a separate entry for each job.) Indirect labor cost totaled RUR7.000 for June. c. Prepare an entry to record the incurrence of RUR 19,400 in various actual manufacturing overhead costs for June. (Credit Accounts Payable.) 2. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for June (it is not necessary to make a separate entry for each job). Post this entry to appropriate T-accounts. 3. As stated earlier, Job 208 was completed during June. Prepare a journal entry to show the transfer of this job off of the production line and into the finished goods warehouse. Post the entry to appropriate T-accounts. 4. Determine the balance at June 30 in the Work in Process inventory account. How much of this balance consists of costs charged to Job 209? To Job 210? The following additional information is available: Required: 1. Prepare journal entries for June as follows: a. Prepare an entry to record the issue of materials into production. (In the case of direct materials, it is not necessary to make a separate entry for each job.) Indirect materials used during June totaled RUR3.600. b. Prepare an entry to record the incurrence of labor cost (In the case of direct labor cost, it is not necessary to make a separate entry for each job.) Indirect labor cost totaled RUR7.000 for June. c. Prepare an entry to record the incurrence of RUR 19,400 in various actual manufacturing overhead costs for June. (Credit Accounts Payable.) 2. What apparent predetermined overhead rate does the company use to assign overhead cost to jobs? Using this rate, prepare a journal entry to record the application of overhead cost to jobs for June (it is not necessary to make a separate entry for each job). Post this entry to appropriate T-accounts. 3. As stated earlier, Job 208 was completed during June. Prepare a journal entry to show the transfer of this job off of the production line and into the finished goods warehouse. Post the entry to appropriate T-accounts. 4. Determine the balance at June 30 in the Work in Process inventory account. How much of this balance consists of costs charged to Job 209? To Job 210