Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE ASAP!! Clark Farms Inc. has the following data, and it follows the residual dividend model. Currently, it finances with 20% debt. Some Clark

HELP PLEASE ASAP!!

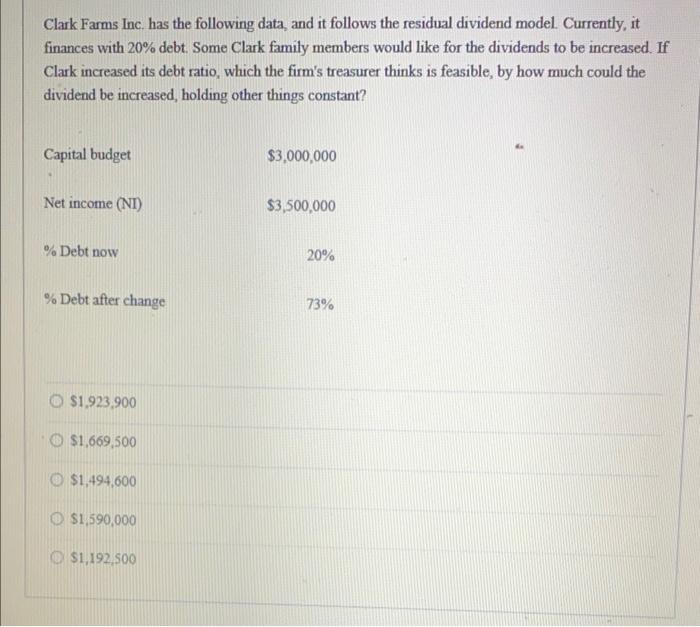

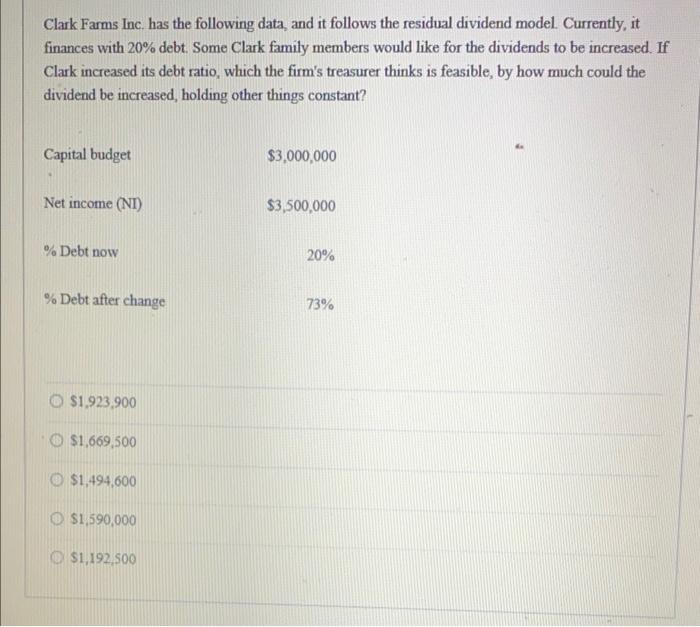

Clark Farms Inc. has the following data, and it follows the residual dividend model. Currently, it finances with 20% debt. Some Clark family members would like for the dividends to be increased. If Clark increased its debt ratio, which the firm's treasurer thinks is feasible, by how much could the dividend be increased, holding other things constant? Capital budget $3,000,000 Net income (NI) $3,500,000 % Debt now 20% % Debt after change 73% O $1.923,900 $1,669,500 $1,494,600 $1,590,000 O $1,192,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started